Why Haven’t Loan Officers Been Told These Facts?

The Challenge of Moving In New Directions

The mind can form a trap by thinking inside the box. Mortgage originators profit from asymmetrical thinking. A change of circumstance requires a change of plans. The market is ripe for disruption.

The mind identifies patterns or activities that produce value and feelings of success or well-being. Accordingly, the unconscious or conscious mind replays this script, seeking previously enjoyed results.

Scripts play with both organizations and individuals. But the mind may persistently play the dated algorithm when the script no longer works. Consequently, the unproductive script becomes a stumbling block for organizations and individuals. Hence the frequent reliance on outside consultants (coaches).

Shake-ups are often flaccid attempts at disruption, sometimes publicly, such as those occurring in Fortune 500 companies and professional sports teams.

Disruption refers to positive results achieved from outside-the-box thinking. Disruption is frequently observed with new entrants to a space. These entrepreneurial thinkers introduce novel products and services to established markets. Additionally, more nimble organizations or individuals effectively leverage disruption by expanding the market to new customers. For example, in addition to prospecting homebuyers like everyone else, is it possible to target co-signers before the felt need to co-sign arises? Think of Cirque du Soleil® breaking the circus mold.

There is no shortage of wealthy households positioned to aid their loved ones in overcoming obstacles to wealth-building opportunities such as homeownership.

For some parties, co-signing is an unattractive proposition – for both the benefactor and the beneficiary. Are there practical ways to destigmatize mortgage co-signing? Yes, there are, for example, the parties agreeing to share any equity increases in the property instead of the co-signing being just a handout.

More creative arrangements like these might lessen the stigma some parties experience with co-signed loans. Therefore, a financial planner, attorney, or other consultants might be situated to assist MLOs with workable propositions. No harm in building business constellations with other professionals.

Growing trends towards shared living space, multigenerational homes, and other emergent living arrangements afford new marketing opportunities for enterprising loan originators.

Co-Borrowing Trends, From FreddieMac

As home prices remain high amid a competitive market, an increasing percentage of young adult first-time homebuyers are relying on support from older generations, including their parents, to buy a home together.

Saving for a down payment is one of the largest barriers to homeownership, and borrowers source these funds in a variety of ways, including personal savings accounts or gifts or loans from family and friends. A family member or friend can support a homebuyer by co-signing for a mortgage or listing themselves as a co-borrower. Combining income with a co-borrower allows borrowers to qualify for a higher loan amount.

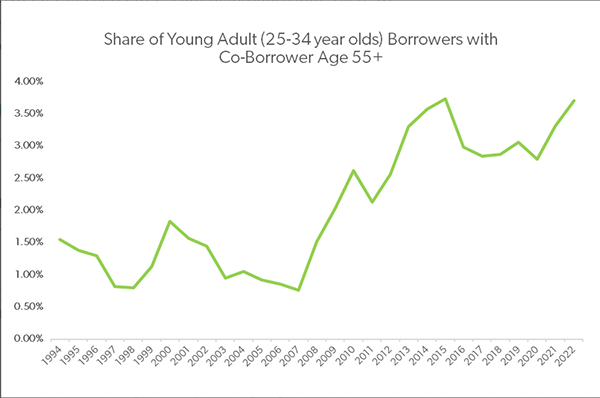

To understand co-borrowing trends overtime, our researchers identified all Freddie Mac purchase loans with a co-borrower between 1994 and 2022, current through April. Then, we analyzed the age profiles of the borrowers and co-borrowers and identified young adult borrowers (defined as age 25-34) who listed an individual age 55 or older as a co-borrower on their application.

Through this analysis, we found that the share of young adult borrowers with a co-borrower age 55 or older has increased since 1994, with the share reaching an all-time high in 2015 before declining. Beginning in 2021, the share of young adult borrowers with a co-borrower spiked.

The chart shows the percentages of young adult first-time homebuyers with a co-borrower age 55 or older since 1994.

In 1994, 1.3% of young adults who were first-time homebuyers listed co-borrowers age 55 or older, and the share has not fallen below 2.5% since 2012. In the past two years, the share has increased one percentage point. More expensive metro areas, such as Los Angeles, San Diego and Miami, tend to have a higher share of young adult first-time homebuyers who receive assistance from older co-borrowers.

The timing of this jump is notable. Since 2020, home prices have increased significantly. Perhaps to help them qualify for higher-cost homes or to make their applications more competitive, these young adult first-time homebuyers have been turning to co-borrowing to make buying a home possible.

BEHIND THE SCENES – Is the CFPB on a War Footing with the CRAs?

Fair Credit Reporting Act

The CFPB Issues New Advisory Opinion

A Fresh Can of Whoop-Ass For Any Obstinate CRA

It appears the CFPB has launched yet another warning shot at the CRAs. In a recent CFPB advisory opinion (an official interpretation), the CFPB has thrown down the gauntlet against the CRA’s failure to correct inaccurate consumer credit data. For some time, the CFPB and the CRAs have been jawing at each other. Yet it has been particularly acrimonious of late.

The Bureau has already voiced displeasure with the CRA’s purported unresponsiveness to consumer disputes but now appears poised to up the ante.

Take a peek at a few excerpts from the advisory opinion.

Excerpted from the CFPB Advisory Opinion Issued 10/20/22

Consumer report accuracy depends on the various parties to the consumer reporting system, including: the three nationwide consumer reporting agencies (Equifax, Experian, and TransUnion); other consumer reporting agencies, such as background screening companies; entities such as creditors who furnish information to consumer reporting agencies (i.e.,furnishers); and public record repositories.

While any of these parties may introduce inaccurate information into the consumer reporting process, a consumer reporting agency is uniquely positioned to identify certain obvious inaccuracies and implement policies, procedures, and systems to keep them off of consumer reports.

In some cases, such as when certain account or other information fields on consumer reports are logically inconsistent with other fields of information (facially false), a consumer reporting agency can detect the logical inconsistencies and prevent the inaccurate information from being included in consumer reports it generates, thereby avoiding the consumer harm to individual consumers that can result from reporting such inaccurate information.

Consumer complaints submitted to the Bureau continue to reflect significant consumer concern about inaccuracies in consumer reports. Complaints about “incorrect information on your report” have represented the largest share of credit or consumer reporting complaints submitted to the Bureau each year for at least the last six years. In 2021 alone, companies responded to more than 157,000 such complaints, representing a majority (53%) of credit or consumer reporting complaint responses that year.

A consumer reporting agency’s policies and procedures should be sufficient to detect tradelines with account statuses or codes that are plainly inconsistent with other information reported for that same account, such that, if included in a consumer report, at least one item of information therein would necessarily be inaccurate. Such inconsistencies may include:

-

- An account whose status is paid in full, and thus has no balance due but nevertheless reflects a balance due

- An account that reflects an “Original Loan Amount” that increases over time, an impossibility by definition

- Derogatory information being reported on an account, although that derogatory information predates an earlier report that did not include the derogatory information

The Bureau is issuing this advisory opinion to remind consumer reporting agencies that the failure to maintain reasonable procedures to screen for and eliminate logical inconsistencies, to prevent the inclusion of facially false (legal term meaning readily apparent) data in consumer reports, is a violation of their FCRA obligation to “follow reasonable procedures to assure maximum possible accuracy” under section 607(b) of the FCRA.

The FCRA provides that “[w]henever a consumer reporting agency prepares a consumer report it shall follow reasonable procedures to assure maximum possible accuracy of the information concerning the individual about whom the report relates.” The Bureau has interpreted this requirement in section 607(b) to include as an integral component that consumer reporting agencies implement and maintain reasonable screening procedures, such as business rules, designed to identify and prevent the inclusion of facially false data, such as logical inconsistencies relating to consumer or account information, in the consumer reports they prepare.

Tip of the Week – FNMA Manual Underwriting

Shoehorn Marginal Applicants Over the FNMA Credit Score Threshold

FNMA Permits Averaging Credit Scores for Manual Underwriting With Two or More Borrowers

From Fannie Mae

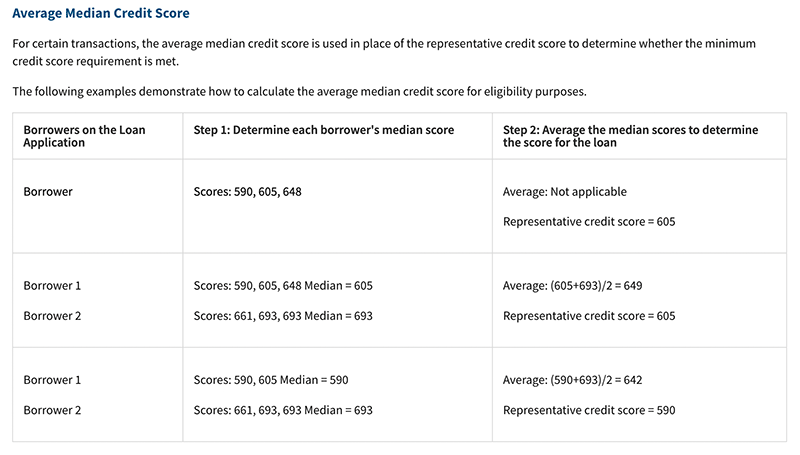

We updated our policy for manually underwritten loans to allow use of the average median credit score to determine compliance with our minimum credit score requirements.

In permitting the use of the average median score when there is more than one borrower on the loan, as opposed to the representative credit score, we are aligning our eligibility requirements for manually underwritten loans with those underwritten using DU.

This change will provide increased access to credit for more borrowers. We are not changing our requirements related to pricing, delivery, or MBS disclosures and will continue to require use of the representative credit score for these purposes. Lenders must continue to deliver a representative credit score for each borrower and Loan Delivery will calculate the loan-level average median credit score to determine if the loan is eligible for purchase.

Manually underwritten loans where the lender has used the average median credit score for eligibility purposes can be sold to FNMA beginning Oct. 28, 2022.