Why Haven’t Loan Officers Been Told These Facts?

Answers from last week’s challenge!

Test Your Knowledge

ECOA

A creditor must notify an applicant of an adverse action within how many days of taking adverse action due to an incomplete application?

- 30 Business days

- 30 Calendar days

- 10 Business days

- 10 Calendar days

12 CFR § 1002.9(a)(1) When notification is required. A creditor shall notify an applicant of action taken within: (ii) 30 days after taking adverse action on an incomplete application.

[Editor’s note: Alternatively, lenders can fulfill Regulation B notice requirements for incomplete applications using the Notice of Incompleteness. See 1002.9(c)(2) below.]

12 CFR§ 1002.9(c)(2) Notice of incompleteness. If additional information is needed from an applicant, the creditor shall send a written notice to the applicant specifying the information needed, designating a reasonable period of time for the applicant to provide the information, and informing the applicant that failure to provide the information requested will result in no further consideration being given to the application. The creditor shall have no further obligation under this section if the applicant fails to respond within the designated time period. If the applicant supplies the requested information within the designated time period, the creditor shall take action on the application and notify the applicant in accordance with paragraph (a) of this section.

TILA

Which transactions are subject to the HPML escrow requirements?

- 1. Primary residence, FHA HECM reverse mortgage, APR two percent over APOR.

- Purchase, primary residence, HPML-Qualified Mortgage.

- Refinance, primary residence, open-end credit, first lien, APR 3.5% over APOR.

- Refinance, primary residence, jumbo first mortgage, condominium, APR 2.00% over APOR.

[Editor’s note: The escrow requirement applies only to first mortgages, not to second mortgages. There are several exceptions to the Higher-Priced Mortgage Loan (HPML) escrow requirement, which include specific types of transactions and loans originated by certain lenders, such as rural lenders and small insured depository institutions. Exempt transactions include cooperative housing (co-ops), construction loans, and reverse mortgages.]

12 CFR § 1026.35(b)(1) Requirement to escrow for property taxes and insurance. Except as provided in paragraph (b)(2) of this section, a creditor may not extend a higher-priced mortgage loan secured by a first lien on a consumer’s principal dwelling unless an escrow account is established before consummation for payment of property taxes and premiums for mortgage-related insurance required by the creditor, such as insurance against loss of or damage to property, or against liability arising out of the ownership or use of the property, or insurance protecting the creditor against the consumer’s default or other credit loss. For purposes of this paragraph (b), the term “escrow account” has the same meaning as under Regulation X.

RESPA

What types of transactions are covered by RESPA?

- 1. A non-convertible construction loan of less than 12 months.

- A Two-unit non-owner occupied purchase.

- A three-unit owner-occupied purchase.

- A refinance transaction for a four-unit property that is owner-occupied.

12 CFR § 1024.5 (b) Exemptions (2) Business purpose loans. An extension of credit primarily for a business, commercial, or agricultural purpose, as defined by 12 CFR 1026.3(a)(1) of Regulation Z. [Editor’s note: Regulation X defers to Regulation Z’s “business purpose” definitions.] Persons may rely on Regulation Z in determining whether the exemption applies. (3) Temporary financing. (4) Vacant land. (5) Assumption without lender approval.(6) Loan conversions. (7) Secondary market transactions.

[Regulation Z business purpose definitions]12 CFR § 1026.3(a) Official Comment 3(a)-5.Owner-occupied rental property. If credit is extended to acquire, improve, or maintain rental property that is or will be owner-occupied within the coming year, different rules apply: i. Credit extended to acquire the rental property is deemed to be for business purposes if it contains more than 2 housing units. [Editor’s note: 3 and 4-unit OO purchases are exempt from Regulations Z and X.]

TILA-TRID Rules

What is the general accuracy requirement for Loan Estimates regarding costs without quantified accuracy guidelines, such as prepaid interest, property insurance premiums, and escrows?

- The aggregate amount of charges paid by or imposed on the consumer does not exceed the aggregate amount of such charges by more than 10 percent.

- If no accuracy requirement is specified, the estimated cost is not subject to any accuracy requirements.

- Regulation Z requires the lender’s best efforts to state the estimate accurately.

- The estimate must be consistent with the best information reasonably available to the creditor when the disclosures are provided.

12 CFR § 1026.19(e)(3)(iii) Variations permitted for certain charges. An estimate of any of the charges specified in this paragraph (e)(3)(iii) is in good faith if it is consistent with the best information reasonably available to the creditor at the time it is disclosed, regardless of whether the amount paid by the consumer exceeds the amount disclosed under paragraph (e)(1)(i) of this section. For purposes of paragraph (e)(1)(i) of this section, good faith is determined under this paragraph (e)(3)(iii) even if such charges are paid to the creditor or affiliates of the creditor, so long as the charges are bona fide:

(A) Prepaid interest;

(B) Property insurance premiums;

(C) Amounts placed into an escrow, impound, reserve, or similar account;

(D) Charges paid to third-party service providers selected by the consumer consistent with paragraph (e)(1)(vi)(A) of this section that are not on the list provided under paragraph (e)(1)(vi)(C) of this section; and

(E) Property taxes and other charges paid for third-party services not required by the creditor.

BEHIND THE SCENES – HUD and FHFA OIG Units Busy Uncovering Everyday Mortgage Fraud

Florida Real Estate Brokers Sentenced

Case 1

United States District Judge Wendy W. Berger has sentenced Maria Del Carmen Montes (48, Kissimmee) to 33 months in federal prison for bank fraud. Montes pleaded guilty on January 4, 2024.

According to court documents, Montes, co-conspirator Carlos Ferrer, and others created and executed a mortgage fraud scheme targeting financial institutions. Montes assisted clients with purchasing homes and, after signing the real estate contract, referred her buyers to a loan officer at a mortgage company. In order to qualify her clients for mortgage loans for which they were unqualified, Montes transferred the personal identifying and financial information of her clients to Ferrer and directed Ferrer to create fictitious paystubs and W-2s showing false earnings and length of employment for her clients, knowing that her clients never worked for the companies on the fictitious employment documents. After Ferrer created the documents, Montes submitted the fictitious paystubs and W-2s to the financial institutions who relied on them when making underwriting decisions.

On August 13, 2024, Ferrer was sentenced to four months’ imprisonment and ordered to serve three years of supervised release for his role in the case.

This case was investigated by the Federal Housing Finance Agency – Office of Inspector General, the U.S. Department of Housing and Urban Development – Office of Inspector General, and the Federal Bureau of Investigation. It was prosecuted by Special Assistant United States Attorney Chris Poor.

Case 2

Tampa, Florida – United States Attorney Gregory W. Kehoe announces that Carlos Calderon (56, Clermont) has pleaded guilty to conspiracy to commit bank fraud. Calderon faces a maximum penalty of 30 years in federal prison. A sentencing date has not yet been set.

According to the plea agreement and court proceedings, Calderon and others conspired to create and execute a mortgage fraud scheme targeting financial institutions. To ensure that otherwise unqualified borrowers obtained mortgage loans from financial institutions, Calderon created fictitious and fraudulent paystubs that falsely indicated the borrowers worked at particular companies for certain periods of time and earned income. Calderon then sent the fraudulent documents to a co-conspirator who submitted them to the financial institutions. Based on Calderon’s and his co-conspirators’ misrepresentations, the financial institutions approved and funded the mortgage loans. The fraudulently obtained mortgages were subsequently purchased and guaranteed by Freddie Mac and the Federal Housing Administration.

This case was investigated by the Federal Housing Finance Agency – Office of Inspector General and the United States Department of Housing and Urban Development – Office of Inspector General. It is being prosecuted by Special Assistant United States Attorney Chris Poor.

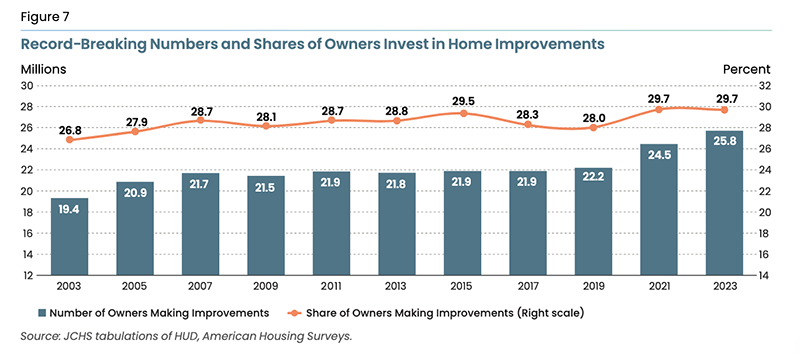

Graphics Courtesy of Harvard University

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability (through rental income).

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

Call Us Today! (866) 314-7586