Why Haven’t Loan Officers Been Told These Facts? When Does an Application Occur?

Most loan officers are familiar with the six or seven elements that make up a mortgage application as outlined under Regulations Z and X. It’s important to note that there is a key distinction between how these two regulations define an application. Regulation X includes a seventh ambiguous element stating, “and any other information deemed necessary by the loan originator.” In this context, a loan originator refers to either a lender or a mortgage broker, as defined by Regulation X, rather than an individual loan officer.

Mitigating Borrower Threat Risks

Regulations X and Z once shared the exact definition of an application. However, during the TRID implementation, the Bureau sought to tighten the Regulation Z definition and omitted the seventh “catch-all” element of the definition found in Regulation X, that is, “any other information deemed necessary by the loan originator.”

In the 2013 TILA-RESPA Integrated Disclosure Rule (TRID) proposal, the Bureau proposed revising the then-current Regulation Z definition of the term “application” as it applies to the Good Faith Estimate (GFE) and early Truth in Lending (TIL Statement) disclosures (Regulation Z contains the TRID rules). Under the final rule, receipt of an “application” triggers a creditor’s obligation to provide the Loan Estimate within three business days. Specifically, the Bureau revised the definition of application to remove the seventh “catch-all” element of the Regulation X definition, namely, “any other information deemed necessary by the loan originator.” The Bureau believed that deleting this element from the definition would enable consumers to receive the Loan Estimate earlier. The new definition would help ensure that consumers have access to information on the cost of credit, allowing them to negotiate better terms and compare other financing options with the time and bargaining power to do so.

As noted, the Bureau believed that one primary purpose of the Loan Estimate is to inform consumers of the cost of credit when they have bargaining power to negotiate better terms and time to compare other financing options. While the Bureau believed that creditors should be able to collect information in addition to the six specific items of information set forth in the current definition of application, the Bureau was concerned that the catch-all item in the Regulation X definition may permit creditors to delay providing consumers with the Loan Estimate, at a point when the consumer has much less opportunity to negotiate or compare other options. The Bureau stated that it did not believe that this principle conflicted with the creditor’s critical need to be able to collect the information necessary to originate loans in a safe and sound manner, and that the definition of application would not define or limit underwriting; it instead would establish a point in time at which disclosure obligations would begin.

Application Definitions for Regulations Z, X, and B

12 CFR 1026 Comment 2(a)(3)-1 (Regulations Z) An application means the submission of a consumer’s financial information for purposes of obtaining an extension of credit. For transactions subject to [TRID disclosure], the term consists of the consumer’s name, the consumer’s income, the consumer’s social security number to obtain a credit report, the property address, an estimate of the value of the property, and the mortgage loan amount sought.

12 CFR § 1024.2(b) (Regulation X) Application means the submission of a borrower’s financial information in anticipation of a credit decision relating to a federally related mortgage loan, which shall include the borrower’s name, the borrower’s monthly income, the borrower’s social security number to obtain a credit report, the property address, an estimate of the value of the property, the mortgage loan amount sought, and any other information deemed necessary by the loan originator [lender]. An application may either be in writing or electronically submitted, including a written record of an oral application.

12 CFR § 1002.2(f) (Regulation B) Application means an oral or written request for an extension of credit that is made in accordance with procedures used by a creditor for the type of credit requested. Comment 2(f)-2. Procedures used. The term “procedures” refers to the actual practices followed by a creditor for making credit decisions as well as its stated application procedures.

The focus of this article is to comparatively evaluate the term “application” as defined by Regulations Z and B, and reserve discussions about Regulation X and any other information deemed necessary by the loan originator for another time. Largely, the Regulation X application definition affects reverse mortgages.

Why So Many Application Definitions?

Regulation B, the implementing regulation of the ECOA, is a fair lending law. RESPA, TILA, and the implementing Regulations X and Z, respectively, are consumer financial protection laws. The objectives, or protections of these laws, approach the risk of harm from two different perspectives.

Regulations X and Z only require risk mitigations, such as disclosures, to be implemented when there is a potential for consumer harm. Lenders cannot finalize a mortgage without meeting the six or seven specific requirements outlined in these two laws. Therefore, there is no immediate risk of a consumer entering into a mortgage with costs they do not understand until the lender has identified a property to secure the mortgage.

Regulation B and Unlawful Discrimination

12 CFR § 1002.2(n) Discriminate against an applicant means to treat an applicant less favorably than other applicants.

12 CFR § 1002.6(b)(1) Except as provided in the Act and this part, a creditor shall not take a prohibited basis into account in any system of evaluating the creditworthiness of applicants.

12 CFR § 1002.4(b) Discouragement. A creditor shall not make any oral or written statement, in advertising or otherwise, to applicants or prospective applicants that would discourage on a prohibited basis a reasonable person from making or pursuing an application.

Comment 4(b)-1 Prospective applicants. Generally, the regulation’s protections apply only to persons who have requested or received an extension of credit. In keeping with the purpose of the Act – to promote the availability of credit on a nondiscriminatory basis – § 1002.4(b) covers acts or practices directed at prospective applicants that could discourage a reasonable person, on a prohibited basis, from applying for credit.

Note that in last year’s CFPB v. Townstone appeal from the United States District Court for the Northern District of Illinois, Eastern Division, the United States Court of Appeals for the Seventh Circuit upheld longstanding ECOA administrative interpretations regarding the contours of unlawful discrimination. Despite the “applicant” language from the ECOA, these interpretations state that unlawful discrimination extends to “prospective applicants”, not just applicants. Therefore, stakeholders must not take a woodenly literal interpretation of ECOA discrimination prohibitions but should pay close attention to relevant case law and regulation. From the appellate court ruling:

“For the reasons set forth in the following opinion, we take a different view. When the text of the ECOA is read as a whole, it is clear that Congress authorized the imposition of liability for the discouragement of prospective applicants. Regulation B’s prohibition on discouraging prospective applicants is therefore consistent with the ECOA’s text and purpose. We accordingly reverse the decision of the district court and remand for proceedings consistent with this opinion.”

Regulation B Unlawful Discrimination Mitigation

Regulation B mitigates the risk of lenders engaging in unlawful discriminatory treatment of applicants or prospective applicants in many ways. As such, what triggers specific lender requirements under Regulation B may have little in common with the consumer risk mitigations under Regulations Z and X.

Unlike Regulations X and Z, an application under Regulation B does not require any property. This is an important distinction. One key aspect of mitigating discrimination under Regulation B is the requirement for lenders to provide a formal written response when an application is submitted. This response must include specific reasons for any adverse actions taken. In addition to addressing discrimination, these notice requirements provide essential information that applicants can use to improve their credit opportunities.

Credit decisions should be handled formally to ensure proper management of both the transaction and the applicant.

12 CFR § 1002.9(a)(1) When notification is required. A creditor shall notify an applicant of action taken within (i) 30 days after receiving a completed application concerning the creditor’s approval of, counteroffer to, or adverse action on the application. A completed application means an application in connection with which a creditor has received all the information that the creditor regularly obtains and considers in evaluating applications for the amount and type of credit requested.

Whether an application occurs may also depend on whether the lender engages in a “prequalification,” which is not considered an application under Regulation B. However, if in evaluating a prospective borrower’s information, the lender declines to advance the prospect’s application for credit, an application has occurred and necessitates an adverse action notice. This is a good thing. No lender wants to tell a qualified applicant that they don’t qualify. If the process is working, the adverse action notice serves as a safety net to prevent such an outcome.

12 CFR 1002 Comment 9(_)-5 Prequalification requests. Whether a creditor must provide a notice of action taken for a prequalification request depends on the creditor’s response to the request, as discussed in comment 2(f)-3. For instance, a creditor may treat the request as an inquiry if the creditor evaluates specific information about the consumer and tells the consumer the loan amount, rate, and other terms of credit the consumer could qualify for under various loan programs, explaining the process the consumer must follow to submit a mortgage application and the information the creditor will analyze in reaching a credit decision. On the other hand, a creditor has treated a request as an application, and is subject to the adverse action notice requirements of § 1002.9 if, after evaluating information, the creditor decides that it will not approve the request and communicates that decision to the consumer. For example, if the creditor tells the consumer that it would not approve an application for a mortgage because of a bankruptcy in the consumer’s record, the creditor has denied an application for credit.

The problem is that MLOs and lenders often have a vague comprehension of these protections. The MLO fails to recognize that an application has occurred. Consequently, the lender is unaware of its credit decisions. That is detrimental to the business objectives and compliance.

Instead of telling the prospect they don’t qualify or will only qualify for a lesser amount, MLOs could be trained and supported to escalate situations in which they see no way to favorably respond to a prospect’s credit inquiry.

This ensures that no applicant is denied because the MLO did not know how to facilitate the transaction or determined it was not worth pursuing otherwise. Lenders must ensure that when MLOs remove a prospect from the path of assistance, no stone is left unturned. Therefore, application visibility is essential.

Other Concerns

Things like the Regulation B notice requirements and the appraisal notice are triggered when the Regulation B application occurs, not when an application occurs under Regulations X and Z.

Safety Nets

Application visibility serves as a crucial checkpoint in the manufacturing process, indicating that an application has been initiated or is about to be initiated. While pulling credit does not guarantee that the application will take place, it represents a significant waypoint where the likelihood of an application occurring increases. Lenders can easily monitor credit requests. Secondly, seeking a second opinion is usually a good idea. The process of getting a second opinion does not require complete transparency. When a mortgage loan originator (MLO) encounters a challenge, they may defer. For example, they might say, “Mr. Prospect, I need some time to explore options. I’ll follow up with you by the end of the day.”

Few things are worse than your reputation getting torched because your MLO told someone no, and the lender around the corner slams dunks the transaction. Even worse is when law enforcement intervenes due to an ECOA complaint, and the lender is completely unaware of the applicant or the transaction involved.

BEHIND THE SCENES – HUD OIG Fraud Bulletin

Ruthless Reverse Mortgage Scam

For Crooks With an Extensive History, It’s Time to Pay the Piper

Two MLOs Plead, Licenses Revoked, 17 Years in Prison Awaits

Phony MLO Ringleader

From the HUD Office of Inspector General

Unfortunately, fraudsters can take advantage of older adults by pressuring or helping them obtain funding for home repairs by applying for a reverse mortgage and then stealing the funds from the reverse mortgage. Fraudsters target the elderly, hoping that they have higher home equity to draw on and are not familiar with reverse mortgages. Fraudsters often prey upon their victim’s trust and use high-pressure tactics to coerce elderly victims into obtaining the reverse mortgage which they may not fully understand or want.

This type of reverse mortgage scam often involves an unsolicited contractor approaching a homeowner about “urgently needed” repairs, who then provides an inflated repair estimate to the homeowner. The fraudster pressures vulnerable seniors into applying for loans without fully explaining the commitment these victims are making. Victims are often told the reverse mortgage is free money that can be used for their home repairs, omitting the loans come with fees, closing costs, and repayment requirements. Unfortunately, the homeowner might not realize they were scammed until well after the fraudster obtains the borrowed funds and the senior’s home-equity has been drained.

From the DOJ Plea Deal With the Ringleader

When it appeared that a homeowner had a significant amount of home equity, DIAMOND visited the home, often accompanied by Wallace. Although the homeowners had specific repairs that they wanted to be made, DIAMOND attempted to convince the homeowner that URS should perform a greater dollar amount of work that was close to the amount of the homeowner’s anticipated equity. DIAMOND made false promises to perform repair work, in that he did not intend to perform, and did

not perform all of the work that he promised. On many occasions, the homeowners, due to age, disability, and/or lack of financial sophistication, did not know or understand how much work they had agreed to or how much equity they had in their respective properties.

See the links for more details.

DOJ Press Release

DOJ Plea Agreement with Ringleader

HUD OIG: Beware of Targeted Reverse Mortgage Schemes

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

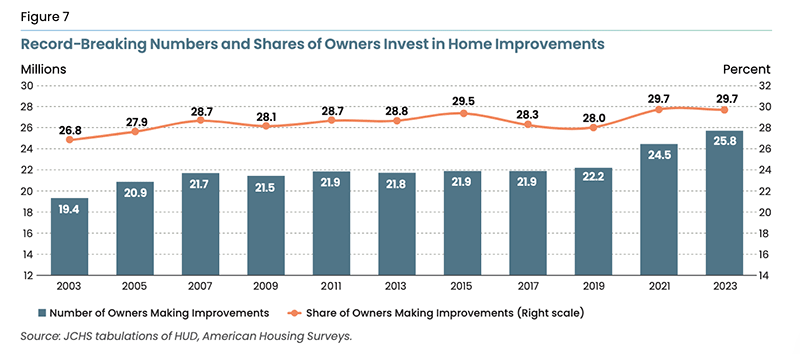

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar