Why Haven’t Loan Officers Been Told These Facts?

With the news headlines implicating yet another politician in occupancy fraud, the growing issue of occupancy types warrants clarification.

Most people can identify a primary residence from a secondary residence or an investor transaction. However, not all households can fit into these standard classifications. The agencies responsible for credit policy, such as FNMA and FHA, have a few explicit exceptions for primary residence. Originators must understand the difference between express and implied exceptions and collaborate with the appropriate agency to clarify occupancy in unusual or unique circumstances when necessary.

Applicants may face occupancy problems when their situations do not fit into established occupancy categories. For instance, Florida has no state income tax and offers more favorable personal property taxes compared to many other states. Many individuals who split their time between Florida and other states often designate Florida as their primary residence for federal and state income tax purposes. However, when applying for a mortgage, they frequently list another state as their primary residence because they spend more time there on average. Can you have your cake and eat it too? While many borrowers manage to make specious occupancy claims without issues, problems may arise if tax returns, transcripts, or other documentation reveal another primary residence.

The GSEs and other agencies are always interested in ensuring that lenders perform adequate audits for quality control. Occupancy issues remain a persistent problem.

From FNMA

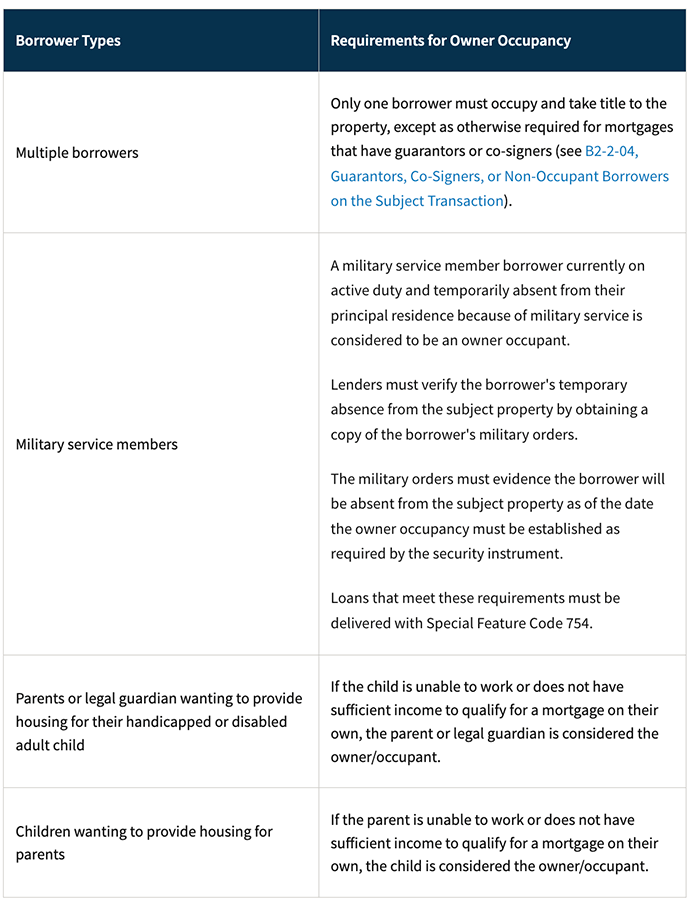

A principal residence is a property that the borrower occupies as their primary residence. The following table describes conditions under which Fannie Mae considers a residence to be a principal residence even though the borrower will not be occupying the property (See Table 2).

Multiple borrowers (Excerpted from FNMA B2-1.1-01, Occupancy Types (10/05/2022)

Only one borrower must occupy and take title to the property, except as otherwise required for mortgages that have guarantors or co-signers.

For a primary residence transaction with a non-occupant borrower, the non-occupant borrower must complete the URLA and not the URLA-Additional Borrower form that is combined with the URLA of an

occupying borrower (Excerpted from “Instructions for Completing the Uniform Residential Loan Application Uniform Residential Loan Application – Instructions Freddie Mac Form 65 • Fannie Mae Form 1003, URLA Effective 1/2021• Instructions Revised 11/2024”).

Example

Consider the case of a couple. One person is commuting for work. Two applicants who are co-borrowing might each have a different primary residence. For example, suppose both persons own the marital home in New London, CT, but one of the applicants works in New York City. In that case, the distance suggests it is reasonable for this individual to purchase a secondary residence in NYC. Only the applicant who works in NYC should indicate on their application that the NYC property will be their primary residence. The applicant working in NYC states their intent to use the NYC property as their primary residence, while the situation is different for financing the New London property. When financing the New London property, the applicant working in NYC indicates that they do not intend to occupy the property as their primary residence. The applicant’s co-borrower does not work in New York City and considers the New London home to be their primary residence. Consequently, when applying for financing for the New London home, the co-borrower designates the New London property as their primary residence. However, when seeking financing for the New York City property, the co-borrower indicates that they do not intend to occupy it.

For More Information

FNMA B2-1.1-01, Occupancy Types (10/05/2022)

FHLMC 4201.11 Mortgages secured by Primary Residences Effective 07/02/2025

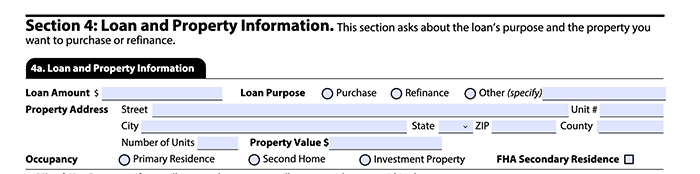

The URLA includes an occupancy type for FHA Secondary Residence, making the FHA occupancy requirement for secondary residence more straightforward (See Figure 1, URLA screenshot).

From FHA 4000.1 (1/10/25)

Exceptions to the One Primary Residence Rule

(A) Principal Residence

A Principal Residence refers to a dwelling where the Borrower maintains or will maintain their permanent place of abode, and which the Borrower typically occupies or will occupy for the majority of the calendar year. A person may have only one Principal Residence at any one time.

At least one Borrower must occupy the Property within 60 Days of signing the security instrument and intend to continue occupancy for at least one year.

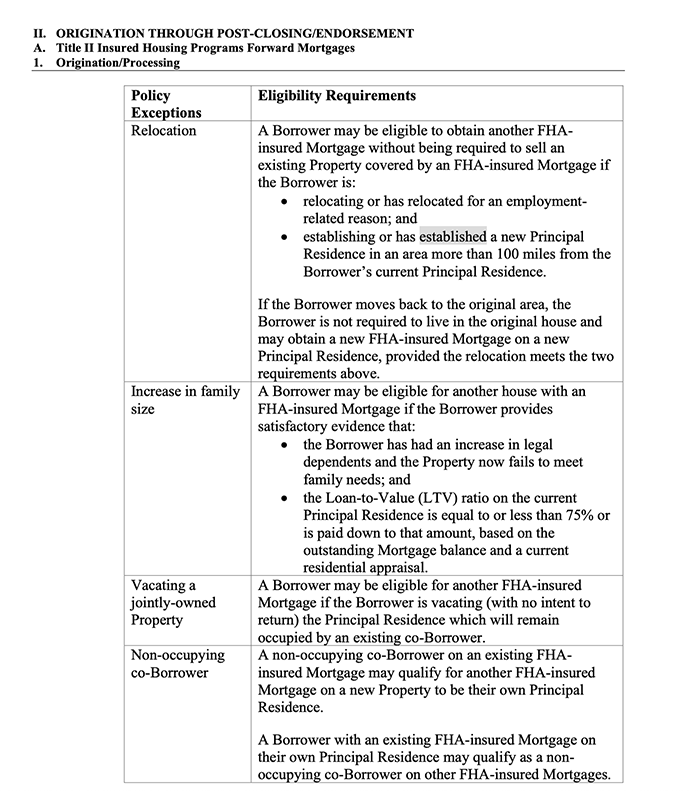

FHA will not insure more than one Property as a Principal Residence for any Borrower, except as noted below (See Table 1). FHA will not insure a Mortgage if it is determined that the transaction was designed to use FHA mortgage insurance as a vehicle for obtaining Investment Properties, even if the Property to be insured will be the only one owned using FHA mortgage insurance.

(c) Exceptions to the FHA Policy Limiting the Number of Mortgages per Borrower (See Table 1). Note the first exception for relocation.

Table 1, FHA Exceptions One Primary Residence Rule

Table 2, FNMA Residency Exceptions

BEHIND THE SCENES: Deregulation Continues to Build Steam, HUD Dismantles PAVE Effort

WASHINGTON – U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner and Acting Administrator of the Office of Information and Regulatory Affairs (OIRA) at the Office of Management and Budget (OMB) Jeffrey Clark announced the termination of burdensome policies introduced under the Biden-era’s Property Appraisal and Valuation Equity (PAVE) task force. As part of the PAVE task force, members were directed to issue guidance on anti-discrimination obligations, review policies and practices, and issue new policies focused on “eliminating bias and advancing equity in home appraisals.”

Eliminating the core policies of the PAVE Task Force upholds President Trump’s Executive Orders, including Ending Radical and Wasteful Government DEI Programs and Preferencing and Delivering Emergency Price Relief for American Families and Defeating the Cost-of-Living Crisis.

The termination of specific policies eliminates unnecessary regulatory hurdles imposed on lenders, appraisers, and other program participants, which will allow HUD’s Federal Housing Administration (FHA) to better serve American homebuyers and homeowners.

“By tearing down these onerous hurdles, we’re freeing professionals from a tangle of red tape that drove up costs, inhibited access to homeownership, and discouraged market participation,” said HUD Secretary Scott Turner. “Under President Trump’s leadership, the Biden-era’s obsession with DEI and overregulation is over. At HUD, we’re restoring common sense and putting the American Dream of homeownership back within reach.”

“The myth is that wokeism is just a social policy. And it surely is corrosive social policy. But, in reality, wokeism at HUD was brass-tacks economic policy that snatched away the American Dream of homeownership from an entire generation. That ends today,” said Acting OMB OIRA Administrator Jeffrey B. Clark.

Established in 2021, the PAVE task force exemplified government overreach by increasing bureaucracy using various tools aimed at addressing so-called systemic biases in the home appraisal process. It asserted that, in part, appraisals often result in systematic undervaluation of properties in black and Hispanic neighborhoods. However, data from the American Enterprise Institute (AEI) concludes that other characteristics unrelated to race – including educational attainment, average credit score, and family formation – are more likely significant drivers in differences between home values and appraisal outcomes.

“We’re encouraged that HUD and other agencies are beginning to roll back certain PAVE-inspired policies adopted by the Biden administration. These actions were driven by claims of race-based disparities in home values, mortgage denial rates, and appraisal under-valuations. These claims ignored AEI Housing Center research that found similar disparities in white communities with similar socioeconomic status, thereby invalidating the argument that the disparities were race based,” said Tobias Peter and Ed Pinto, Co-Directors at the AEI Housing Center.

As a result of pro-growth economic policies under President Trump’s first term, real household income and wages grew at a record pace, including for individuals at all levels of educational attainment and socioeconomic status. President Trump’s One Big Beautiful Bill continues many of these successful policies that create a stronger economy and greater homeownership opportunities for all Americans.

The terminated policies related to Reconsideration of Value and Appraisal Fair Housing Compliance include:

- ML 2024-16, Extension to the Effective Date of Appraisal Review and Reconsideration of Value (ROV) Updates

- ML 2024-07, Appraisal Review and Reconsideration of Value

- ML 2021-27, Appraisal Fair Housing Compliance and Updated General Appraiser Requirements

Current laws, including The Fair Housing Act and Equal Credit Opportunity Act, prohibit discrimination in all housing-related transactions including in the homebuying and lending processes. The Fair Housing Act and Equal Credit Opportunity Act will continue to be enforced.

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE