Why Haven’t Loan Officers Been Told These Facts? Is it Time for a Refinance Marketing Blitz?

Timing is crucial in marketing. Although campaigns can be expensive, their overall cost can be significantly reduced when they achieve a high return on investment. During a period of decreasing interest rates, there are optimal moments to emphasize the benefits of refinancing to consumers. Launching a campaign too early, when the advantages of refinancing are limited, could result in high costs and a disappointingly low return. However, if the campaign is timed to coincide with a more precipitous decrease in interest rates, it can benefit from extensive media coverage reporting that rates are low or falling.

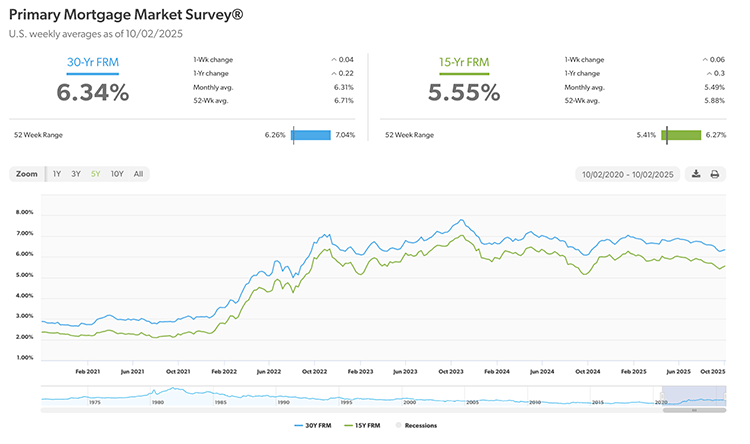

To make the most of your marketing budget, it’s important to anticipate the most significant decline in interest rates. This approach, in conjunction with a sustained refinance campaign, can greatly enhance the chances of achieving higher returns on your marketing investments. However, this strategy relies on one crucial assumption: what is the target interest rate, and when will it become available? Your marketing campaign should commence a week or two before the target rate. If the target is 6.00 on the 30-year par price, that time is at hand.

This strategy carries inherent risks. Predicting when the 30-year rate will drop below 6.00% is merely an educated guess. However, like in roulette, your chances of hitting black improve with more spins. Therefore, don’t rely on perfect timing, which often leads to overspending on a concentrated campaign. Instead, spread your costs over a longer period. A prolonged campaign will significantly increase the likelihood of positioning your marketing efforts in the sweet spot.

Patterns

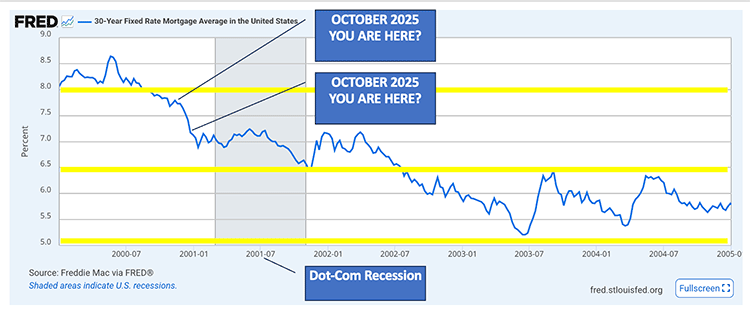

In October 2023, the average 30-year mortgage rate surged to its highest level in recent years at approximately 7.75%. Just two years later, this rate has dropped to around 6.25%, representing a significant decrease of 1.50% from the peak.

The art of prediction may be said to include the art of pattern recognition. For example, the dot-com bubble, similar to how many analyst see the AI driven stock market today, burst in March 2000, triggering a rapid economic downturn that plunged the US and many other countries into a recession. This prompted monetary easing measures, which successfully drove long-term rates lower and spurred a substantial increase in refinancing activity. Might there be an AI bubble in the making? If so, then one must wonder how much higher stock valuations will climb before correcting.

What Are They Saying

The U.S. economy is very close to falling into a damaging contraction — and many states are already experiencing a recession, according to Mark Zandi, chief economist at Moody’s Analytics.

As reported by Fortune, from Moody’s, “According to Moody’s Analytics chief economist Mark Zandi, “Not only is the labor market weakening, but consumer spending is flat while construction and manufacturing are shrinking . . .

As reported by Marketwatch, Zandi estimates that 22 states plus the District of Columbia are now experiencing persistent economic weakness and job losses that are likely to continue. Another 13 states are treading water, he noted. The overall picture is one of a weak U.S. economy that is vulnerable to being pushed into a ditch by a strong wind. “The economy is still not in recession, but the risks are very high. We’re on the precipice,” Zandi said in an interview with MarketWatch.

From UBS, “The UBS analysis of “hard data” reflects the bank’s own proprietary factor model . . . After a brief recovery at the end of 2024, the hard data signal tipped decisively back into negative territory starting in February 2025. The sideways movement since May suggests sustained weakness rather than any new acceleration downward. . . The key message is that the U.S. economy, by these hard data measures, is locked in a prolonged phase of stagnation or slow contraction, warranting caution even as outright collapse has not yet materialized. This aligns with other analysts’ warnings that even if a recession doesn’t materialize, the economy is headed for a bout of 1970s-style “stagflation,” a combination of a stagnating economy and rising inflation.”

What Could Tip the Economy

The AI bubble is 17 times the size of the dot-com frenzy – and four times subprime, Morningstar analysts argue that an AI bubble is here or looming. Morningstar AI Bubble Article

Ready the Refinance Campaign

Loan officers play a crucial role in helping prospective borrowers understand the potential benefits of refinancing, and they need to be well-prepared. Two handy tools can make a significant difference: the blended or average rate calculation, which is ideal for comparing the benefits of a cash-out refinance versus an open- or closed-end equity loan, and the net benefits analysis for limited cash-out or streamline refinances.

Additionally, this is an excellent opportunity to discuss the importance of ethics in loan presentations. Let’s ensure that we always provide the best information reasonably available, in good faith, and with due diligence.

Chart Source: Freddie Mac via FRED®

BEHIND THE SCENES: Foreclosure Fraud, Alive and Well

St. Louis Man Sentenced to Five Years in Prison for Fraudulently Obtaining $1.2 Million in Mortgages

ST. LOUIS – U.S. District Judge Henry E. Autrey on Monday sentenced a man to five years in prison for fraudulently obtaining home mortgages totaling more than $1.2 million.

Judge Autrey also ordered Edward James Mitchell Jr., also known as Musa Muhammad, to repay a total of $482,096 to lenders for their losses due to Mitchell’s scheme.

Mitchell, now 37, of St. Louis, participated in four fraudulent home mortgages from October 2021 through November 2023. Mitchell’s company, Home Team Solutions LLC, purchased three homes in St. Louis and one in Florissant. Mitchell then pretended to be one of his relatives to “buy” two of the homes, submitting fraudulent mortgage loan applications and false employment and financial information and using his relative’s Social Security number and birthdate. He bought another home himself and sold another to his paramour, again submitting false or fraudulent documents.

The total value of the loans was $1,226,550. All the lenders suffered losses due to Mitchell’s fraud. One home was sold at a discount. Another was sold in a foreclosure sale. A third was sold in a short sale.

“The Federal Housing Finance Agency Office of Inspector General (FHFA-OIG) carefully investigates allegations of mortgage fraud involving the government-sponsored enterprises, Fannie Mae and Freddie Mac,” said Korey Brinkman, Special Agent in Charge of FHFA-OIG’s Central Region. “We are proud to work with our partners in this investigation.”

Mitchell pleaded guilty in April in U.S. District Court in St. Louis to one felony count of bank fraud.

In October 2023, Mitchell legally changed his name to Musa Muhammad.

The FBI and the Federal Housing Finance Agency Office of Inspector General investigated the case. Assistant U.S. Attorney Kyle Bateman prosecuted the case.

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]