Why Haven’t Loan Officers Been Told These Facts?

New DU Enablement Affords Some Relief From Undisclosed Liabilities

When buying a new home, many people find themselves excited to upgrade their transportation as well. This is particularly true for those moving to the suburbs and planning to commute. However, the loan officer needs to be deliberate in addressing this circumstance—some folks end up buying or leasing a car before closing on their new home.

Loan officers must clearly communicate certain pitfalls to applicants during the origination process. It is crucial to emphasize the importance of disclosing any potential liabilities or significant changes to the application before finalizing those changes. Lenders must clearly inform applicants at the time of origination that they are required to reaffirm the accuracy and truthfulness of their application at the time of closing.

“Mr. and Mrs. Applicant, I’d like to emphasize the importance of open communication regarding your loan application. If you are considering any changes that could impact its accuracy—such as a job change, taking on new liabilities like car loans or credit cards, or co-signing for someone—please reach out to me beforehand. I would be happy to discuss how these changes could affect your financing request and provide guidance to ensure the best possible outcome.”

Of course, storytelling can convey the same meaning more effectively.

“Mr. and Mrs. Applicant, I want to share a story that really highlights how important financial decisions can be, especially when buying a home. A few years back, I assisted a young couple who were eagerly preparing to buy their first home. It was an emotional journey filled with excitement, but shortly after completing their mortgage application, they faced a challenging choice. One of them had a grueling 80-mile round trip to work and felt the need for a more reliable car. Coincidentally, there was an incredible car sale event at a local dealer just a week after they made their mortgage application. Well, you know what happened next!

Unfortunately, this seemingly small decision had significant consequences. When they arrived at the closing, the applicant bravely inquired whether they needed to include the new car loan in their final loan application. Unfortunately, the added loan payment pushed their debt ratio past the lender’s limits. What should have been a joyous and celebratory day quickly turned into one filled with disappointment and heartache. It’s a reminder of how critical it is to consider the bigger picture when making financial decisions, especially during such pivotal moments in life.”

Everyone loves a good story!

FNMA reports that undisclosed liabilities are the top defect in Q1 2025 and have been a top defect in the discretionary loan sampling over the last two years.

Undisclosed non-mortgage liabilities result in a DTI that makes a loan ineligible for purchase. Typically, the liabilities relate to the purchase or lease of an automobile.

Speak with borrowers about taking on financial obligations before the closing date and explain that those obligations may push the DTI out of tolerance. Leveraging targeted questions, typically based on inquiries on the credit report, can help prevent future problems.

FNMA suggests that if you have debt monitoring capabilities in your process, remain vigilant. Monitor data from all three bureaus; debt monitoring tools may only pull data from one credit bureau. Ensure debt monitoring runs on weekends and is reviewed as closely to closing as possible.

From FNMA: Increase certainty for loans with potential undisclosed liabilities

- Undisclosed non-mortgage debt stands as the primary defect driving repurchase requests from lenders since 2021.

- 74% of undisclosed debt is opened more than 14 days before closing which could lead to loan ineligibility.

- Up to half of Fannie Mae loans may have a lower risk of repurchase with this new enhancement.

The excitement of buying a new home can often lead to other large purchases, e.g., furniture or appliances, that require financing. If a borrower takes on new debt before closing on their mortgage loan without telling their lender, it can potentially make the loan ineligible for purchase by Fannie Mae or trigger a post-purchase review.

With the latest enhancement in Desktop Underwriter® (DU®), effective November 15, 2025, lenders will have a clearer picture of exposure to repurchase risk caused by undisclosed debt. This clarity allows lenders to optimize their repurchase risk review and monitoring activities, which can lead to higher confidence in the quality of their loans. This means lenders can focus on what matters most — making informed decisions and minimizing potential risks.

The Selling Guide has been updated to include terms of enforcement relief of representations and warranties related to undisclosed non-mortgage debt for certain loans underwritten through DU. Mortgage-related debt (including HELOCs and second liens) is excluded from eligibility for relief.

When a final DU submission receives an Approve/Eligible recommendation and a DU message indicating that the loan has obtained relief from enforcement of representations and warranties for undisclosed non-mortgage liabilities, Fannie Mae will not enforce representations and warranties related to non-mortgage debt obtained by the borrower(s) prior to or concurrent with the day of closing. All conditions for relief as described in the Selling Guide must be met.

Lender Post-Closing Quality Control Requirements

Lenders must continue to meet all post-closing quality control requirements to verify the accuracy and integrity of the information used to support the underwriting decision. This includes ensuring all data submitted to DU is true, correct, and complete, and conducting a reverification of credit history, as stated in the Guide.

If the reverification credit report reveals non-mortgage debt that was not disclosed by the borrower nor identified by the lender prior to or concurrent with the day of closing, then the lender is not required to re-underwrite the loan to confirm its eligibility for sale to Fannie Mae if enforcement relief was provided and all conditions for relief were met.

Frequently Asked Questions

Q1. What is representation and warranty enforcement relief for undisclosed non-mortgage liabilities?

Representation and warranty enforcement relief (“rep & warrant relief”) for undisclosed non-mortgage liabilities is the confidence that Fannie Mae will not enforce certain representations and warranties for loans with undisclosed non-mortgage debts. When DU issues a message indicating this relief applies, and all other requirements are met, Fannie Mae will not pursue remedies related to these liabilities identified during quality control reviews.

Q2. What types of debt are included in the rep & warrant relief?

Non-mortgage debts obtained by the borrower prior to or concurrent with the day of closing are included in rep & warrant relief. Mortgage debt is excluded from rep & warrant relief. This includes home equity lines of credit (HELOCs), second liens, and any other mortgage-related obligations.

Q3. How will lenders know if a loan is eligible for rep & warrant relief?

DU will issue a specific message in the DU Underwriting Findings report when a loan casefile is eligible for rep & warrant relief related to undisclosed non-mortgage liabilities.

Q4. What is required to get rep & warrant relief for undisclosed liabilities?

The final DU submission must receive an Approve/Eligible recommendation and a DU message indicating that the loan has obtained relief. Relief will apply so long as the lender meets all requirements described in the Selling Guide and complies with applicable DU messages, including closing the loan by the credit report expiration date and delivering the loan with SFC 127 as required for all loans underwritten by DU. See Q7 for more information on requirements during the lender’s prefunding QC review process.

Q5. How do lenders participate?

There is no action required by lenders to participate. Eligible casefiles submitted or resubmitted to DU Version 12.0 on or after November 15, 2025, will receive the DU message providing rep & warrant relief.

FNMA SEL-2025-09: Relief For Undisclosed Liabilities

BEHIND THE SCENES: Consumer Debt, Serious Delinquencies Holding Steady

Household Debt Balances Grow Steadily; Mortgage Originations Tick Up in Third Quarter

Federal Reserve Bank of New York Press Release

November 05, 2025

NEW YORK—The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $197 billion (1%) in Q3 2025, to $18.59 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel. It includes a one-page summary of key takeaways and their supporting data points.

“Household debt balances are growing at a moderate pace, with delinquency rates stabilizing,” said Donghoon Lee, Economic Research Advisor at the New York Fed. “The relatively low mortgage delinquency rates reflect the housing market’s resilience, driven by ample home equity and tight underwriting standards.”

Mortgage balances grew by $137 billion in the third quarter and totaled $13.07 trillion at the end of September 2025. Credit card balances rose by $24 billion from the previous quarter and stood at $1.23 trillion. Auto loan balances held steady at $1.66 trillion. Home equity line of credit (HELOC) balances rose by $11 billion to $422 billion. Student loan balances rose by $15 billion and stood at $1.65 trillion. In total, non-housing balances rose by $49 billion, a 1.0% increase from Q2 2025.

The pace of mortgage originations increased with $512 billion newly originated in Q3 2025. There was $184 billion in new auto loans and leases appearing on credit reports during the third quarter, a small dip from the $188 billion observed in Q2 2025. Aggregate limits on credit card accounts continued to rise by $94 billion, representing a 1.8% increase from the previous quarter. Home equity lines of credit (HELOC) limits rose by $8 billion, continuing the growth in HELOC limits that began in 2022.

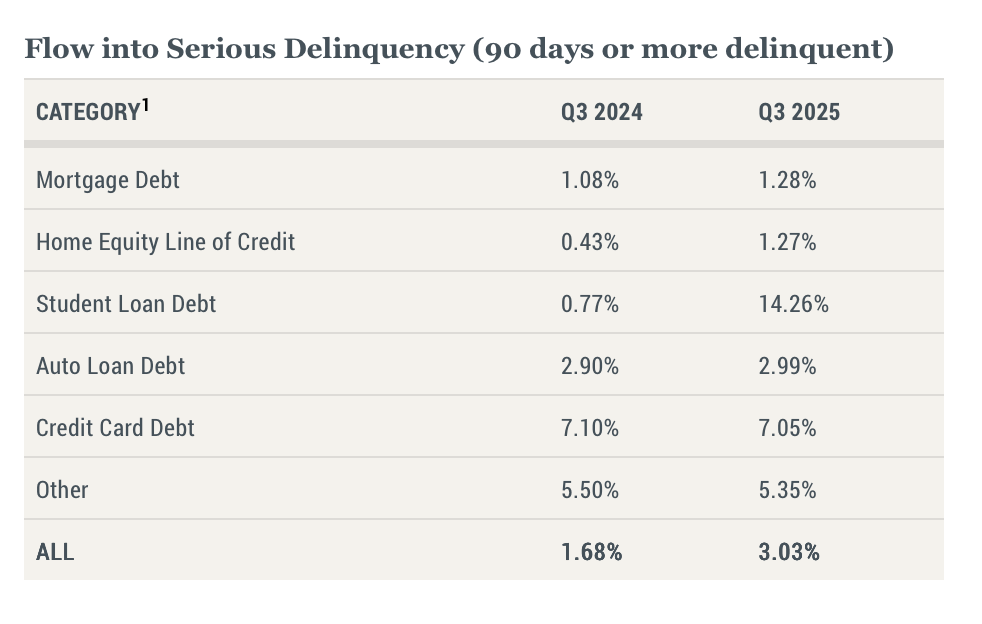

Aggregate delinquency rates remained elevated in Q3 2025, with 4.5% of outstanding debt in some stage of delinquency. Transitions into early delinquency were mixed with credit card debt and student loans increasing, while all other debt types saw decreases. Transitions into serious delinquency mostly increased across debt types, although mortgages saw a slight decrease.

Student Loans

- Outstanding student loan debt totaled $1.65 trillion as of 2025 Q3.

- Missed federal student loan payments that were not previously reported to credit bureaus between 2020Q2 and 2024Q4 are now appearing in credit reports. Consequently, student loan delinquency rates remained elevated after a sharp rise in the first half of 2025. In 2025Q3, 9.4% of aggregate student debt was reported as 90+ days delinquent or in default, as compared to 7.8% in 2025Q1 and 10.2% in 2025Q2.

Tip of the Week – Sign Up for 2025 CE

Expanding your product offerings is an effective way to enhance your business’s vitality. This year, the Loan Officer School is surveying non-government financing options for construction and renovation projects.

The shortage of affordable housing is unlikely to be resolved anytime soon. As affordable, move-in-ready housing solutions remain hard to find, the demand for construction and renovation loans is expected to increase. According to the JCHS, Harvard University, the US remodeling market soared above $600 billion in the wake of the pandemic and, despite recent softening, remains 50 percent above pre-pandemic levels.

Discover how to enhance borrower advantages through construction and renovation financing.

- Enhanced housing affordability.

- Housing options for aging or disabled borrowers.

- Housing solutions for borrowers caring for aging or disabled family members.

- Multi-generational housing solutions.

For any questions or inquiries regarding state education needs, please feel free to call.

Call Us Today! (866) 314-7586

Sign up for a 2025 CE Webinar

Online self-study classes are available.

Sign up for 2025 Online self-study CE