Why Haven’t Loan Officers Been Told These Facts?

Establishing accurate projections of rental income can be challenging, particularly given the fraudulent misrepresentations stakeholders frequently encounter with this type of income.

Rental income fraud is on the rise in declining markets. The number of identified declining markets is increasing each month. Expect lenders to intensify audits for transactions that utilize rental income as effective income.

As an originator, recognizing red flags that lead to increased scrutiny is vital. FNMA offers a valuable handout on best practices for verifying rental income. Check the link below to enhance your skills and streamline your process.

From FNMA: Best practices for rental income verifications

Rental income – common red flag characteristics

- Public records don’t show the departure property was listed for rent.

- Interested party (i.e., lender, broker, real estate agent)sent the lease to alleged tenant or maintains an interest in managing the departure property.

- Lease is electronically signed without other supporting evidence, such as rental listing, receipt showing email sent to alleged tenant, or inability to provide copies of security deposit, rental payments, or rental receipts.

- Borrower will be a first-time landlord in leasing the departure property.

- Rental payment amounts appear inflated compared to market rental rates.

- Monthly rental payments used to offset the PITIA for the departure property.

- Alleged tenant has a pre-existing relationship with the borrower (i.e., same employer, nearby neighbor) or is a relative (non-borrowing spouse, parent, sibling, other).

- Alleged tenant already occupies or owns the departure property prior to the lease date.

- Alleged tenant already owns real estate that they presently occupy.

- Alleged tenant is a gift donor to the borrower.

- Bank statements show alleged tenant is paying both rental and mortgage on departure property.

- Leases provided for multiple rental properties that disclose the same alleged tenant for each lease.

- Rent payment amounts appear to be altered on lease agreement.

- Inability to validate lease terms with the alleged tenant.

- Effective date or occupancy date of the lease agreement is unreasonable when compared to the lease execution date or anticipated closing date of the subject property.

- Excessive Desktop Underwriter® (DU® ) submissions with rental income added or adjusted until Approve / Eligible was obtained.

- Supporting documents for first two rental payments show deposits on the same day or payment by money order.

- Departure property has significant equity, yet source of funds for new purchase money loan is a substantial gift.

- Lender has previously financed mortgage loans for borrower, then sees unreconciled discrepancies on new loan application (occupancy misrepresentation, flags for terms not fulfilled, extenuating circumstances not met).

- Credit reports reflect mortgage loan on a recently acquired property was sold to a GSE; loan terms suggest borrower is obligated to maintain occupancy for 12 months, which means borrower is ineligible for a new primary residence for a period per Guidelines (rate, LTV, MI, withdrawals for down payment, etc.)

What lender due diligence looks like

Use publicly available information (i.e., Zillow/Redfin/Realtor.com/Trulia) to assess the departure property status:

- Is the departure property listed for sale before the Note date of the subject property?

- Does the monthly rental amount appear reasonable for the size/style of home or other nearby rental listings? Do all the relevant dates line up or are some dates illogical?

- Compare the departure property listing date, lease date, occupancy date, closing date, and Note date.

- Did the sales contract for the subject property include a “contingency clause” for sale of the departure property which was removed prior to closing?

- Does occupancy date on the lease for the departure property give the borrower time to move out after closing?

Look at other information in the loan file to see if the transaction makes sense:

- Do bank statements show security deposit checks and rental payment checks were deposited?

- Do amounts and dates on the bank statements align withamounts and dates on the lease agreement?

- Reconcile dates and amounts bank statements, check copies, or receipts to help identify “fake” or altered documents. Look for possible pre-existing relationships with the alleged tenant.

- Does the alleged tenant appear to be an interested party to the transaction or a relative, co-worker or neighbor? Obtain a copy of the Property Insurance policy on the departure property and see if it supports tenant occupancy.

- Has the policy been converted to a landlord policy, or does it include rental or tenant coverage?

- Is the mailing address of the insured (the landlord) different than the departure property?

From FNMA, Solving Rental Income Challenges (Excerpts from FNMA Quality Insider, 8/25/2025):

ISSUE: Including rental income in the underwriting assessment when it is ineligible because the borrower does not have a housing expense, or the housing expense is not supported.

FNMA REQUIREMENT: To include rental income to qualify the borrower, confirm that the borrower owns a principal residence or has a current housing expense. (The loan file must contain documentation of the housing expense.) If the borrower does not have either, then remove the rental income.

ISSUE: Including positive net rental income in the underwriting assessment when it can only be used to offset the housing expenses.

FNMA REQUIREMENT: To use positive rental income to qualify the borrower, confirm that the borrower meets these two conditions:

- Owns a principal residence or has a current housing expense AND has at least one year of receipt of rental income or property management experience.

- Received rental income from the non-subject property for at least one year.

If converting the departure residence to a rental property: the borrower must have a one-year history of receiving rental income from other properties. Otherwise, the rental income can only offset the housing expenses.

The loan file must contain documentation to support the history of property management.

ISSUE: Using a lease, instead of a tax return, to calculate the rental income when the property was owned by the borrower in the previous tax year.

FNMA REQUIREMENT: If the borrower owned the property in the most recent tax year, document rental income with tax returns that include Schedules 1 & E and use this information to calculate the rental income or loss.

Otherwise, document a qualifying exception:

If the property is out of service (significant disruption in rental income) per Schedule E, evidence supporting the exception must include:

-

- Fair Rental Days to confirm the number of days out of service, and

- Repair expenses on Schedule E, Line 14

- Additional documentation may be required to ensure expenses support significant repairs or renovation.

- If another situation applies, it must be explained and justified with documentation in the loan file.

ISSUE: Using a lease on a departure residence when the departure residence was listed for rent or sale after closing.

FNMA REQUIREMENT: The documentation in the loan file must be authentic and support the borrower’s financial picture and the borrower’s intended use or occupancy of the property.

ISSUE: Using rental income on a departure residence and not documenting it properly.

FNMA REQUIREMENT: Rental income from a non-subject property must be documented with either tax returns or a copy of the lease.

When a lease is used to document the rental income, the following are required to support the terms of the lease:

- Form 1007 or Form 1025 or

Evidence the terms of the lease have gone into effect:- Two consecutive months of bank statements or electronic transfers showing rental payments that match the existing lease, or

- For newly executed leases, copies of the security deposit and first month’s rental payment (i.e., check) with proof of deposit in the borrower’s bank account.

ISSUE: Incorrect calculation of Principal, Interest, Taxes, Insurance, and Association fees (PITIA) of the rental property.

FNMA REQUIREMENT: Confirm that all components of the property’s housing expense are current and accurate.

FNMA Best practices for rental income verifications

BEHIND THE SCENES: CFPB Reports Massive Increase in NCRA Complaints

Excerpts from the CFPB Report, “Annual report of credit and consumer reporting complaints.”

More than two decades ago, Congress passed the Fair and Accurate Credit Transactions Act of 2003 (FACT Act). The FACT Act was a legislative response aimed at improving the accuracy of consumers’ credit-related records by creating new rights for consumers and new responsibilities for consumer reporting agencies (CRAs). Among its provisions, the FACT Act amended Section 611 of the Fair Credit Reporting Act (FCRA) by adding subsection (e) (codified at 15 U.S.C. §1681i(e)). This subsection created new obligations for the nationwide consumer reporting agencies (NCRAs) and federal agencies.

Under FCRA Section 611(e), federal agencies—initially the Federal Trade Commission (FTC) and later the Consumer Financial Protection Bureau (CFPB)—must “compile” and “transmit” certain complaints to the NCRAs. Specifically, the CFPB must transmit each complaint it receives in which a consumer (1) indicates that their file maintained by an NCRA contains incomplete or inaccurate information, and (2) appears to have disputed the completeness or accuracy with the NCRA or otherwise utilized the procedures under FCRA Section 611(a). These complaints are referred to as “covered complaints” throughout this report.

In response, the NCRA must review each covered complaint to determine whether all legal obligations under the FCRA (including any obligation imposed by an applicable court or administrative order) have been met with respect to the subject matter of the complaint. The NCRA must also provide reports on a regular basis to the CFPB regarding the determinations of and actions taken by” the NCRA, if any, in connection with its review.

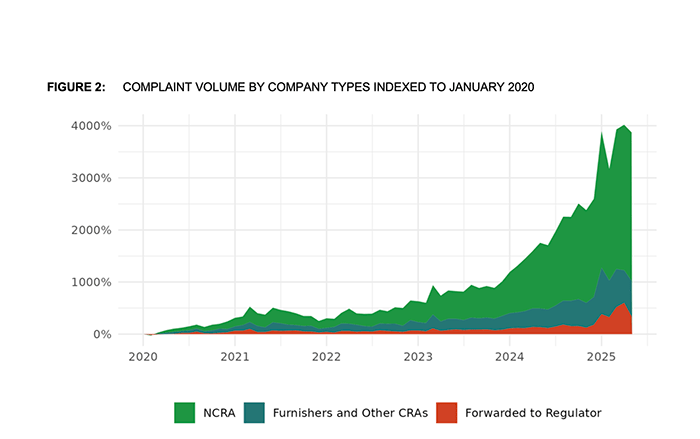

From January 1, 2024, to June 30, 2025, the CFPB received more than 5.6 million complaints. Most of these complaints—almost 4.8 million—were about credit and consumer reporting. And most credit reporting complaints—about 3.9 million—were about the three largest NCRAs (Equifax, Experian, and TransUnion). Complaints to NCRAs dominated the overall growth of credit reporting complaints, with an almost 3,000% increase in NCRA complaints since January 1, 2020.

See the full CFPB report here: Annual report of credit and consumer reporting complaints

Tip of the Week – Successful Elicitation

From Dictionary.com: the act of drawing out or bringing forth emotions, opinions, facts, etc.

Mastering the art of elicitation is crucial for gaining the insights needed to guide potential buyers smoothly through their decision-making process, ultimately leading to successful closings. Consider non-first-time homebuyers; it’s surprising how many mortgage loan officers (MLOs) overlook the valuable insights from these clients’ past mortgage experiences. By harnessing this information, MLOs can uncover what truly matters to their prospects and provide exceptional service, ensuring a seamless and rewarding buying journey. Embracing this approach not only enhances relationships but also drives success in the competitive world of mortgage lending.

An example of elicitation gone wrong: The Mortgage Loan Originator (MLO) says, “I understand this isn’t your first time buying a home. How did the process go the last time you got a mortgage?” The prospect responds, “The last time I got a mortgage was extremely painful. I’m a little worried about the process.” The MLO replies, “I’ve been doing this for ten years, and I have the best team in the business. Don’t worry, we will take care of everything!”

The MLO should take the time to clarify their roles and responsibilities. While returning calls, closing transactions on time, and avoiding last-minute surprises are commendable efforts, it’s also essential to focus on developing clear success criteria. If the MLO focuses solely on what they believe to be important, this could unintentionally come across as presumptuous. Prospects might feel that their concerns are not being adequately addressed, which could affect perceptions of the MLO’s expertise and genuine interest in their needs. Rather than making assumptions, it would be beneficial to engage prospects in dialogue to better understand their priorities.