Why Haven’t Loan Officers Been Told These Facts?

Preparing for Increasing Volume

A Return to 5.00% rates? Analysis From JP Morgan

Following the administration’s directive for Fannie Mae and Freddie Mac to buy $200bn of agency mortgage-backed securities (MBS), the average interest rate for a 30-year fixed mortgage slid to 6.06%, its lowest level since late 2022. While the announcement is being sold as a way to pressure mortgage rates lower, its likely mortgage rates continue to hover in the low-6% range given the potential for sticky long-term interest rates and continued tight spreads.

As we highlight in our recent piece, fundamental drivers of the nominal U.S. 10-year Treasury yield, the key building block for the 30-year mortgage rate, signal limited scope for base rates to decline. As such, agency MBS purchases could help lower mortgage rates by helping narrow the mortgage spread. However, the mortgage spread—the spread between the 30-year fixed mortgage rate and the U.S. 10 Year Treasury yield—has already tightened and further compression appears limited.

The mortgage spread can be broken down into two components: the primary/secondary mortgage spread, and secondary mortgage spread.

- The primary/secondary mortgage spread is the difference between the mortgage rate offered to borrowers (primary rate) and the yield on mortgage-backed securities (MBS) in the secondary market. It’s the compensation earned by mortgage originators and reflects lender costs (origination, servicing and fees) and profit, as well as market demand.

- The secondary mortgage spread is the difference between the yield on MBS and the yield on the benchmark 10-year Treasury note, representing investor compensation for prepayment risk and credit risk for owning MBS over Treasuries.

The primary/secondary mortgage spread are largely driven by mortgage originations and refinancings. If more people are refinancing and/or taking out new mortgages that typically leads to greater capacity constraints and pressures spreads wider. Early signs of the housing market thawing could contribute to widening spreads, though current homebuilding data still appear tepid. The secondary mortgage spread is driven by perceived credit risk which is currently very low and helping keep spreads tight, and prepayment risk which could widen spreads if interest rate volatility picks up. Altogether, conflicting forces impacting the spread likely keep the mortgage spread rangebound.

Separate from the mechanics of mortgage spreads, there are lingering items investors should consider:

- If the FHFA is mandating GSE purchases, it raises questions about risk limits, capital usage, hedging capacity and earnings volatility, at a time when the administration is openly weighing next steps on taking these agencies public.

- The Fed is still shrinking its MBS holdings at a pace of roughly $15bn per month, essentially equally offsetting Fannie/Freddie purchases. Thus, the net technical boost to the market could be smaller than the headline suggests.

- Additional housing initiatives may be forthcoming including restricting institutional buyers of single-family homes, longer-dated mortgage structures and down-payment flexibility, but feasibility and execution matter most.

All things considered, this action may compress MBS spreads at the margin, but it’s unlikely to deliver a step-change lower in mortgage rates. In our view, the bigger driver of mortgage rates is still the broader interest rate environment and potential further policy announcements that impact the primary market, not directed purchases from already major holders of MBS.

BEHIND THE SCENES: The Nation’s Housing Health, A Mixed Bag

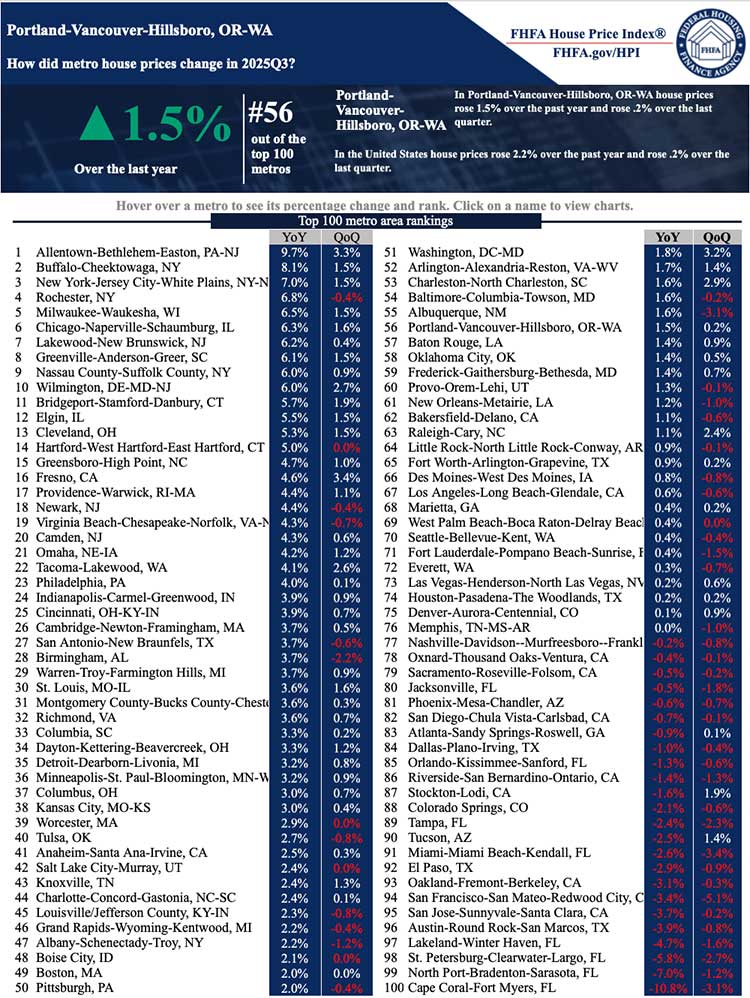

Despite significant headwinds to homeownership, housing prices continue to rise in most US markets.

According to Harvard’s Joint Center for Housing Studies, the prognosis for any return to a more affordable housing market is not in the cards.

Excerpted from Harvard’s State of the Nation’s Housing 2025

In 2025, households and housing markets face an ever-more challenging environment. High home prices and elevated interest rates reduced homebuying to its lowest level since the mid-1990s. Increases in both insurance premiums and property taxes have heightened financial stress on homeowners and landlords. And, despite an abundance of new apartments, high rents have left more people than ever cost burdened, and have contributed to a sharp rise in homelessness. Meanwhile, unprecedented destruction from wildfires has further highlighted the growing threat to the housing stock from climate-related disasters.

At the same time, federal housing support is lessening, creating uncertainty regarding the availability

of crucial assistance programs. The looming possibility of an economic downturn is exacerbating the

nation’s already-enormous housing challenges.

Recent home price appreciation is partly a response to an inventory shortage. Though the for-sale stock grew last year, it remains far below pre-pandemic levels. The number of existing homes available for sale rose 20 percent annually in March 2025 to 1.33 million, according to NAR (Figure 7). Despite these gains, this is 27 percent below the 1.82 million homes for sale averaged the same month each year between 2015 and 2019. Meanwhile, the months of supply—how long it would take to sell all available homes at the current sales rate—was 4.0, up from 3.2 the previous year but still down considerably from the 6 months characteristic of a healthy market.

Loan Performance Issues Appearing in Many Markets

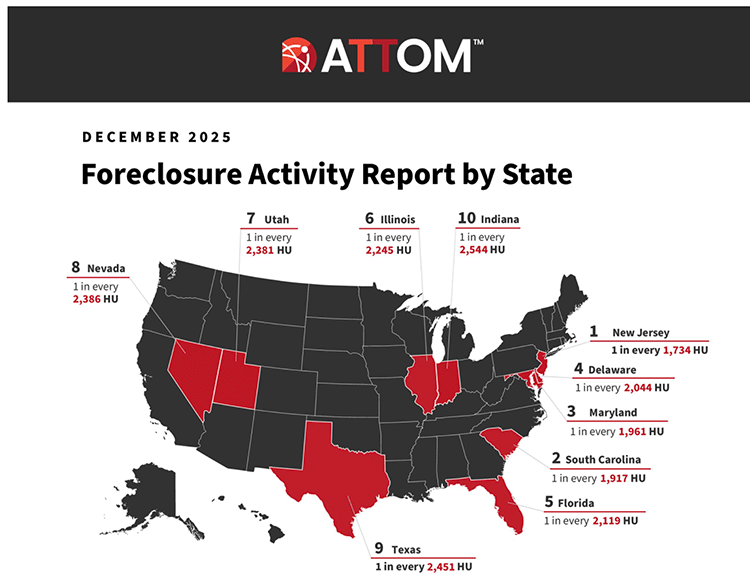

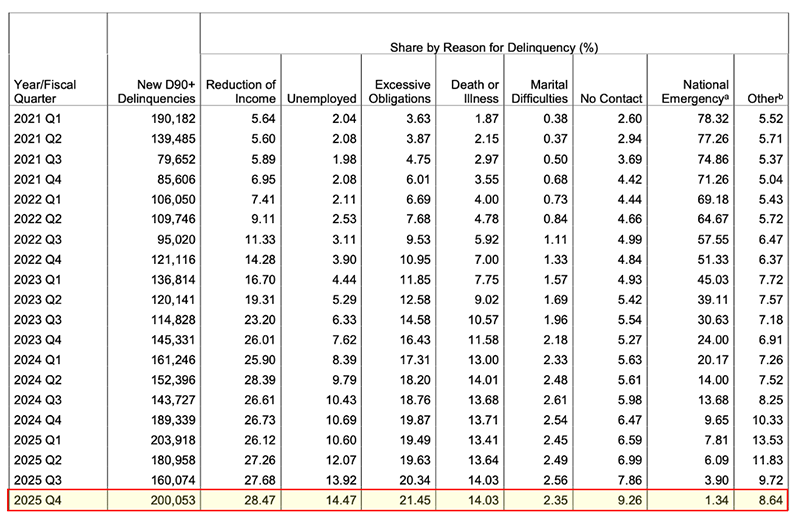

Recent foreclosure data indicates that many markets are experiencing significant increases in foreclosure activity. This trend is partly due to the expiration of COVID-era servicing relief in 2025. As always, the FHA Single Family program serves as an early warning sign of potentially larger issues.

It is important to note that the methodologies used to generate these statistics do not provide the complete picture.

Note the number of newly 90-day delinquent mortgagors. Reports indicate that reduced income and excessive obligations are increasingly the primary causes of performance issues. Local or national recessions will be the true stress test for the current market.

Harvard JCHS 2025 State of the Nation’s Housing

ATTOM: U.S. Foreclosure Rates by State – December 2025

New 90+ Day Delinquencies by Reason for Delinquency

Tip of the Week – Email Your Questions to the Loan Officer School Journal

As the new year begins, the LOSJ has decided it’s time to shake things up a bit and try something different. How about starting a new Dear Abby-like section specifically for mortgage originators?

We invite LOSJ readers to email their questions on any topic to the LOSJ editor. This could include anything related to compliance, sales, marketing, implementation, or other topics that would be beneficial to lenders. Please send your questions to: losjmailbag@gmail.com.

Necessary Mailbag Disclosure: The LOSJ is a periodic publication from LoanOfficerSchool.com designed to educate and inform our readers. It is important to note that we do not provide legal advice, and nothing in the LOSJ should be taken as a legal opinion on specific facts or circumstances. The content serves strictly for informational purposes. We strongly advise readers to consult legal counsel for any legal matters or specific questions they may have.