Why Haven’t Loan Officers Been Told These Facts?

Borrower Requested PMI Cancellation, Be circumspect with Oral Disclosure

Loan Officer’s sometimes conflate the Homeowners Protection Act PMI cancellation provision with the investor PMI cancellation procedures.

Essentially, applicants may misunderstand the HPA provisions due to the MLO’s assertion that the PMI is cancellable when the loan balance reaches an 80% loan to value (LTV). The applicant then assumes that the market value of the property will govern the 80% LTV determination. Consequently, such a message directly contradicts the HPA and HPA initial disclosure. Accordingly, it may rise to the level of a material misrepresentation of a deceptive and unfair nature. At the least, a material misrepresentation regarding the HPA cancellation violates the prohibited practices enumerated under Title X (UDAAP) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and also the prohibitions found in the Mortgage Acts and Practices Act (Regulation N).

The statute only applies to a “residential mortgage.” The term means a mortgage, loan, or other evidence of a security interest created concerning a single-family dwelling that is the mortgagor’s principal residence (meaning at origination and presently).

The initial HPA disclosure provides the borrower’s a date to request PMI cancellation for fixed-rate loans. However, if the loan is an adjustable-rate mortgage, the servicer will notify the mortgagor when the cancellation date occurs.

Borrowers have the right to request PMI cancellation from the servicer on or after the principal balance is scheduled to fall to 80 percent of the property’s original value (borrowers may request cancellation earlier if they have accelerated the amortization).

For this purpose, “original value” generally means either the contract sales price or the appraised value at the time of purchase, whichever is lower. If the loan in question was a refinance, the borrower may request cancellation at the 80% mark based on the appraised value of the property at the time of the refinance.

The HPA further requires that the servicer must automatically terminate PMI on the date the principal balance is scheduled to reach 78 percent of the original value of the property.

For automatic and borrower requested PMI cancellation, the borrower must be current with payments as of the anticipated termination date. Otherwise, the servicer is not required to terminate PMI until after the borrower brings payments to date. The “current payment” or “good payment history” proviso includes loans in forbearance. Thus, a loan in forbearance would not fall under the rubric of good payment history and would constitute a late payment for the one or two-year clean record timing requirements. If a servicer agrees to a modification, the cancellation date, termination date, or final termination shall be recalculated to reflect the modified terms. However, there is a special consideration for mortgagors impacted by COVID. The Journal will unpack the COVID exceptions later in this series.

So what exactly is a “good payment history?” The term “good payment history” means that the mortgagor has not:

(A) Made a mortgage payment that was 60 days or longer past due during the 12-month period beginning 24 months before the later of (i) the date on which the mortgage reaches the cancellation date, or (ii) the date that the mortgagor submits a request for cancellation

(B) Made a mortgage payment that was 30 days or longer past due during the 12-month period preceding the later of (i) the date on which the mortgage reaches the cancellation date, or (ii) the date that the mortgagor submits a request for cancellation.

12 CFR 4902(a) Furthermore, the statute conditions the following:

1) The borrower submits a request in writing to the servicer that cancellation be initiated.

2) The borrower is current on the payments required by the terms of the residential mortgage transaction.

3) Evidence that the value of the property securing the mortgage has not declined below the property’s original value.

4) Certification that the borrower’s equity in the residence securing the mortgage is unencumbered by a subordinate lien.

Next week, the Journal unpacks the current FNMA and FHLMC PMI cancellation procedures and how they differ from the HPA requirements.

Behind the Scenes

The Taper Tantrum

Watch Those Refinances, No On and Off Switch for Rate Changes

Roundup – Time to Rope in the Finance Cowboys at the Fed

In a previous issue on the gentrification of the mortgage market, the Journal complained about the Fed’s two-fisted approach to managing the credit markets during the pandemic. The truth be told, at the Journal, we don’t claim any real expertise on the credit markets, but the Fed is fast becoming an irresistible institutional pinata. So let take a few whacks at these governors. After all, these are gifted people that can withstand minor criticism. Titans, capable of impressive multi-tasking feats.

Think about it – While tinkering with the biggest financial markets in the world, they are still just one of us, finding ample time to make their own stock trades amid all that busyness, oy vey. https://abcnews.go.com/Business/wireStory/fed-reviews-ethics-polices-prolific-trading-uncovered-80060372

Over the pandemic, the Fed successfully supported demand for bonds and otherwise managed to depress credit yields to keep things humming along when people were scared to buy anything.

I remember being introduced to the easiest money ever when we started doing government streamline refis in the early ’90s. Then, I thought I had died and gone to heaven. However, while not quite as lucrative as that early ’90s refi market, getting this stimulus money is excellent! Free money! It’s a lot easier to give away money when the average cost of borrowing is so cheap! But what will happen to our free money when the rates increase?

The Congressional Budget Office predicts that by 2025, interest on the Federal debt will be the third-largest expenditure in the Federal Budget. Ouch, that really takes the fun of running up the credit cards. Now the Fed is not alone in providing this free money bath. Congress likes to pretend to play hard to get! But there is mistaking, our Congress is fully cooperating, spending like there is no tomorrow.

For me, I feel like I went to sleep and woke up in Norway. I’ve never been to Norway, but from what I hear, it sounds very good. Free money! Money in the mail, money in the bank account, free loans, credits on the taxes, free health care subsidies. Heck, even this Jack Benny-like Journal editor bought a new car for the first time in 20 years.

But now is the hard part. With the Fed spending money like a drunken sailor, here comes the buzz-kill and hangover of a lifetime. Have you ever had to clean up the aftermath of a drunken party? That appears to be where we are now. Just like any crazy party, it looked cool and was lots of fun while doing it. But alas, the waiter is headed to our table with the check. The neighbors are complaining. And still, the kids at Congress are hard at work to keep the party going, but alas, even the hardest partiers appear to be running out of juice. Yet, the actual costs of this spending spree have already become more evident.

Runaway inflation, supply chain issues, and prices are going higher and higher. I am reminded of when I was a kid. I was not the boldest of the tree climbing gang, but to avoid the chicken label, I climbed a few insane trees I’d really rather not have. However, the climb up was usually more manageable than grappling for holds on the way back down.

It’s every parent’s nightmare, imagining the kind of things kids do when out of sight. What I recall as especially treacherous were the climbs when the winds were quiet, going up, but blowing at the top. It’s always much windier at the top of a tree than at ground level.

More than once, the tree climbing gang was lulled into a peaceful and less challenging ascent. Then, no sooner had we got to the top of the tree, the wind started to howl. Swaying trees are lovely to look at from the forest floor. But when you are high up, trees jerk, swing, and rock like a wasted Deadhead bopping around to the last set. And the climb down was very difficult. So here is a tip, no extra charge – climb trees in the morning when the wind is less likely to start blowing.

It’s late afternoon, and the Fed and its bloated portfolio are still high up the tree. The winds are blowing harder. The tree is doing the Deadhead wobble. And the Fed, like the nerdy kid who once tried to climb a tree with his lunch pail in hand, the Fed circles its arms around the tree trunk, holding on for dear life with its goofy lunch pail still in hand. All the while trying to look cool to those of us looking up from the ground. So what are they going to do now?

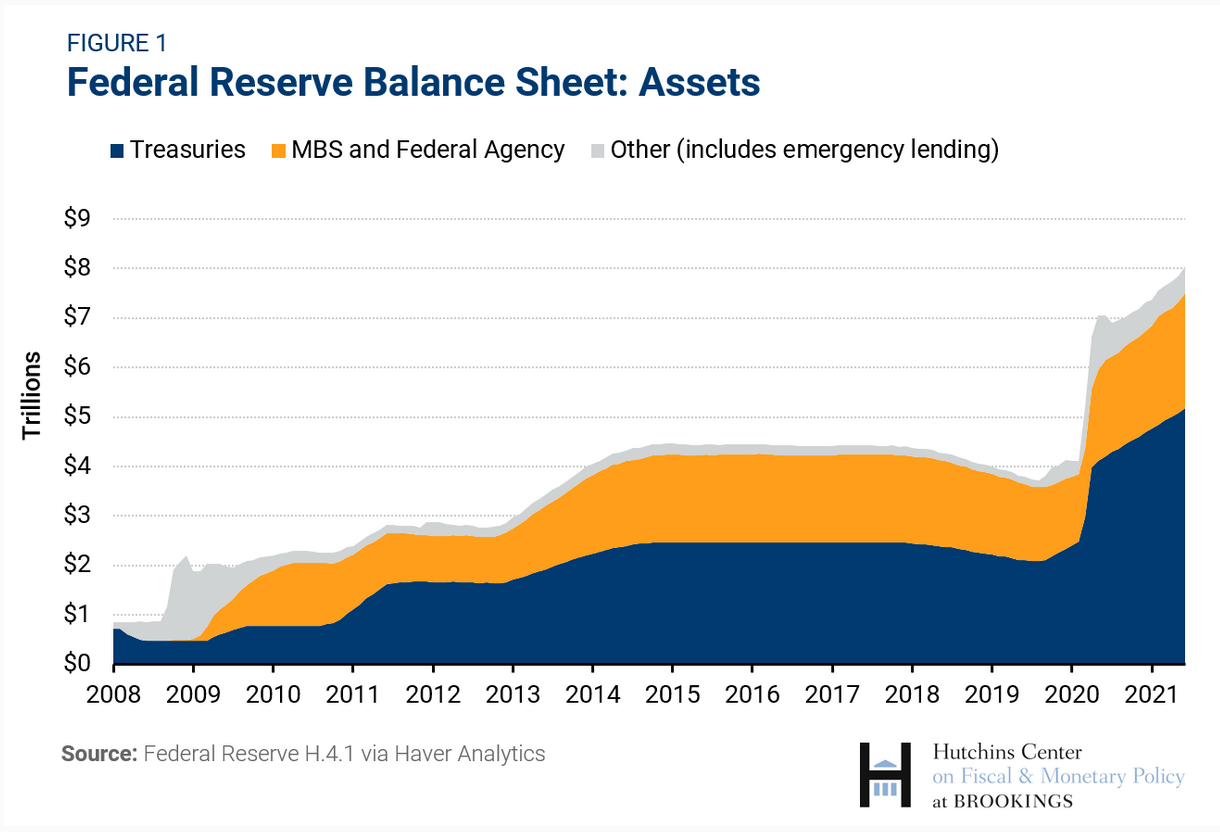

Not only is the Fed trying to cease bond-buying, but they are also having to engineer a soft landing while unloading a remarkable volume of Treasuries, Mortgage-Backed Securities, and Corporate Bonds purchased since the onset of the pandemic. As a result, the Feds portfolio about doubled from what it was before the pandemic buying. Moreover, unlike previous bond-buying sprees of the past, the Fed also bought corporate bonds this go around. That was weird—an end-run around the TARP stigma.

What happened the last time we saw significant Fed tapering? Unfortunately, it wasn’t so good for the mortgage business. Tapering is the term used to describe a gradual easing off the current three-pack-a-day habit—kind of like using Nicorette to lay off the smokes.

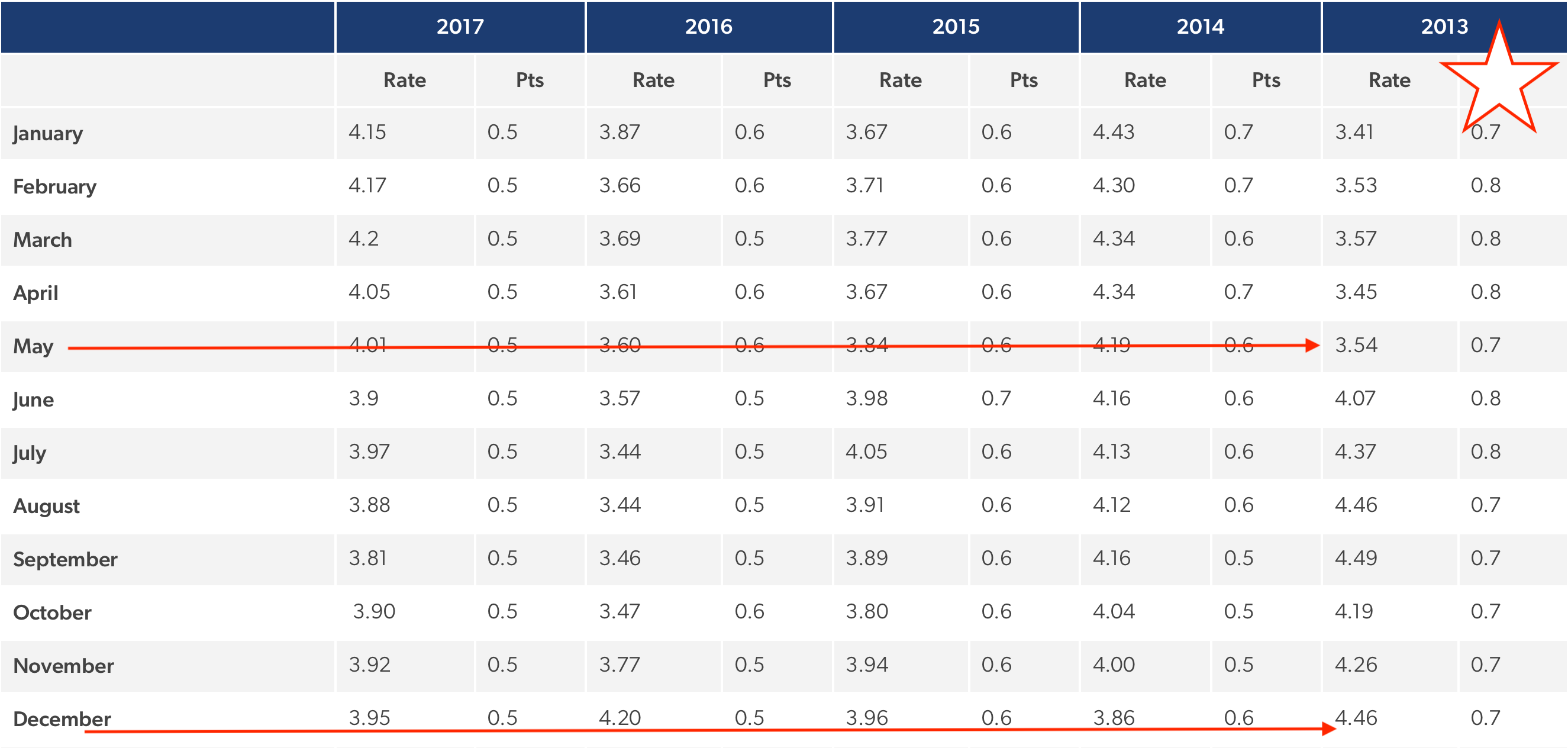

Recent history could foretell how rates might bounce in the coming months despite the reassurances from our market makers and financial gurus.

Market anticipation of Fed tapering in early 2013 moved 30-year mortgage rates up a solid point from May to December 2013 (see chart courtesy of FHLMC). Let’s hope that does not happen. Better than just hoping, why not a little risk management? Rather than hand-wringing, what can lenders do to take advantage of changing winds?

Well, the Federal government threw quite the party, rocking and dancing like there was no tomorrow. It’s all fun until someone drives Dad’s car into a ditch. We sure hope this taper dance works – Best of luck to the Governors. See if you can identify a few Fed officials in the video https://www.youtube.com/watch?v=dOF6zlXDDoI

Next week, the Journal hopes to provide a few suggestions to help MLOs weather the coming winds, should they begin to howl.

Tip of the Week

Project Management Skills for Loan Origination

Communication is the primary element in successful stakeholder management. In recapping last week’s discussion, planning communications is the process of identifying the communication needs of the stakeholders and, most notably, the key stakeholders to ensure the efficient flow of communications.

Communication tools include everything from your customer relationship management tool, email, the Loan Origination System, and the telephone. Planning the communications includes when, how, and who gets what communication.

Some folks want the information pushed to them. Phone calls, reports, and emails are examples of pushed communication.

Pull communication provides repositories for communication needs. These repositories may include loan status portals such as Sharepoint sites or the customer-facing LOS, where the applicant may login to determine how their loan is proceeding.

Understanding the key stakeholder’s communication needs includes their preference for push or pull communications when to use feedback loops (confirms the message is received and understood) and the communication’s frequency and content.

Managing communications is executing the communications according to the plan. For example, sending reports, making calls, and sending updates. Next week, we will look at Monitoring communications, which ensures that our management of the stakeholders’ communications needs is satisfactory.

2021 CE – Sneak Preview

Is now a good time to go long or short on the stock market? Is the residential real estate market overbought? Time to sell? Are you confused about where to invest your hard-earned money? Stop messing around and make the best investment you will ever make – invest in yourself. Yes, that means professional development. Be the best version of yourself that you can be. Expand your horizons. Why not get on one or more of the developing market waves?

Are you interested in Low-Moderate-Household-Income lending? Do you wonder about getting started with loan manufacture requiring alternative credit (nontraditional credit)? Have you heard all the horror stories about collaborations with Housing Finance agencies? Grab the bull by the horns and take some chances. Join us for a primer on getting started with these types of loan programs.

CE should be an opportunity for professional development. That you might expect – but we promise that you will have fun at the same time. So how can you enjoy hours and hours of law, ethics, and regulation? Well, swing on by the LoanOfficerSchool.com 2021 continuing education classes and find out!