Why Haven’t Loan Officers Been Told These Facts?

Executing the ABA

It is well said that the devil is in the details. Critically, inattention to detail AND poor execution may be a ticket to Lender Inferno. First, understand that the party making the referral provides the ABA disclosure. However, suppose in the execution of the disclosure, there is a Section 8 violation. In that case, the party receiving the referral could be a counterparty to the violation and may have exposure to RESPA noncompliance consequences.

For example, in the case of a real estate broker, referring the covered loan to a lender, with which it has an affiliate or associate relationship, requires timely disclosure. If the referral violates the disclosure requirements, the party making the referral and the party benefiting from the referral could both violate the RESPA.

RESPA, 12 USC §2607(a) No person shall give and no person shall accept any fee, kickback, or thing of value pursuant to any agreement or understanding, oral or otherwise, that business incident to or a part of a real estate settlement service involving a federally related mortgage loan shall be referred to any person.

Regulation X, 12 CFR §1024.15(b) An affiliated business arrangement is not a violation of section 8 of RESPA IF the conditions set forth in this section (1024.15) are satisfied.

ABA Conditions Which Must Be Satisfied

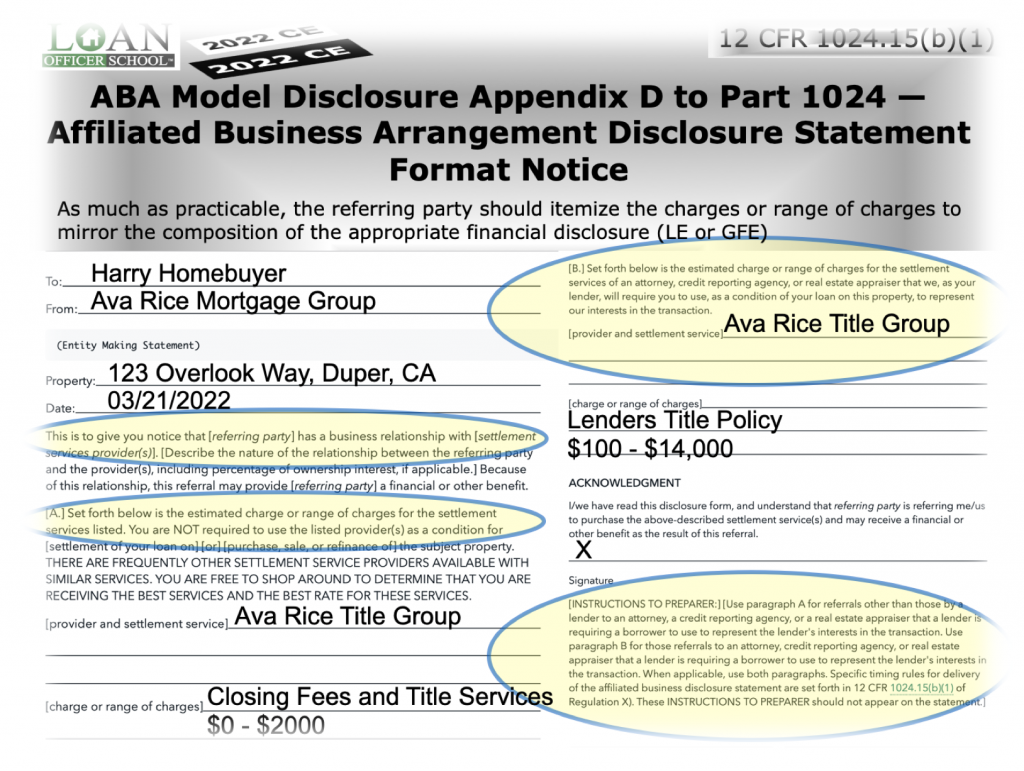

12 CFR §1024.15(b)(1) The person making each referral has provided to each person whose business is referred a written disclosure, in the format of the Affiliated Business Arrangement Disclosure . . .

- The ABA Disclosure shall describe the nature of the relationship between the provider of settlement services and the person making the referral.

- The ABA Disclosure shall provide an estimated charge or range of charges generally made by the provider.

- The ABA Disclosure shall describe the charge using the same terminology, as far as practical, as Page 2, HUD-1 Section (L) or Page 2, “Closing Cost Details” Closing Disclosure).

- The disclosures must be provided on a separate piece of paper no later than the time of each referral.

- No person making a referral has required any person to use any particular settlement services provider (this does not apply to the settlement agent or lender making a referral for required services e.g., appraisers, lenders tile coverage).

The lender cannot presume that the MSA counterparty is doing its job. That starts with a contract in writing with commensurate contract administration. Well-written contracts include key performance indicators and consequences for contract noncompliance. The contract should stipulate disclosure verification, training, and supervision. MSAs should be formal.

Compliance with the law should be a central tenet of any ABA. Contract and regulatory noncompliance can provide excellent evidence for establishing an agreement as a sham ABA and simply a facade for exchanging a thing of value for referrals.

Any pissed-off real estate agent or mortgage broker can report “noncompliance” to one of the enforcement agencies. That is how some of these long painful journeys begin. Most folks want to do the right thing. But again the devil is in the details and execution. They also say the road to hell is paved with good intentions. Why not do the ABA correctly?

The referring party may provide the ABA disclosure anytime before the referral. So why wait until the referral occurs? For example, in the case of the real estate company or builder referring a consumer to an ABA partner-lender, the referring party can easily provide the ABA disclosure with whatever initial handouts, disclosures, or agreements they provide the consumer long before the referral occurs. Management at the referring company must supervise this process. A real estate agent does not have to be obliged to make a referral to the lender-participant unless the terms of the ABA stipulate such. But the real estate company should have every consumer sign the ABA disclosure long before the referral occurs.

The ABA must generate records. Otherwise, how could the counterparty to the referral know the referring party is compliant with the ABA? Yes, that means someone has to monitor the ABA for compliance. Keep in mind that a loan officer does not have to contact the consumer for there to be a referral. The referral is measured 100% from the referring person’s end. The lender would not necessarily know of the referral unless the referring party provided the ABA disclosure.

Again, suppose it looks like the lender is simply handing over money because it is getting adequate numbers of referrals from the builder. In that case, that may appear to be a sham arrangement rather than an ABA.

Compliance also furthers the business objectives. For example, the lender ought to count how many referrals have been made by counting ABA Disclosures. Then, using ABA Disclosures, the lender can better analyze the business opportunity presented and realized by the ABA from that and other data.

A good faith effort on the part of the referring company may count. 12 CFR §1024.15(b)(1)(iii) Failure to comply with the disclosure requirements of this section may be overcome if the person making a referral can prove by a preponderance of the evidence that procedures reasonably adopted to result in compliance with these conditions have been maintained and that any failure to comply with these conditions was unintentional and the result of a bona fide error. An error of legal judgment with respect to a person’s obligations under RESPA is not a bona fide error.

Record retention is five years.

Mortgage lenders are well-advised to retain the services of a competent attorney to tailor appropriate ABA procedures and forms.

Behind the Scenes

FNMA Goes Public With Secret Home Price Index

Excerpted from FNMA Press Release

April 15, 2022

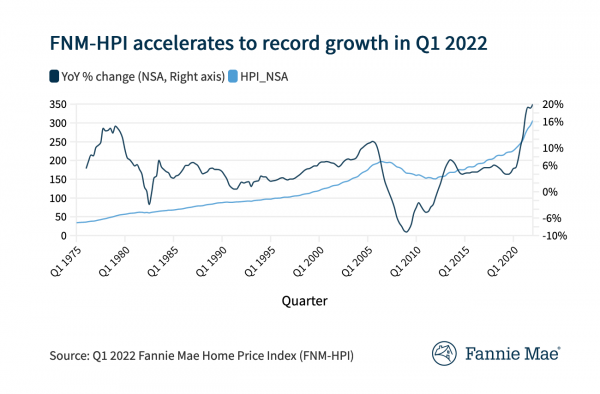

Fannie Mae announced the publication of the Fannie Mae Home Price Index (FNM-HPI), a national, repeat-transaction home price index measuring the average quarterly price change for all single-family properties in the United States, excluding condos.

The FNM-HPI accelerated in Q1 2022 to its fastest annual pace in the 47-year history of the index, measuring 20.0 percent year over year, non-seasonally adjusted, up from the 19.1 percent annual rate recorded in Q4 2021.

On a quarterly basis, home prices rose a seasonally adjusted 4.8 percent in Q1 2022.

Comment from Doug Duncan, Fannie Mae Chief Economist, on Q1 2022 FNM-HPI results:

“We’re pleased to begin sharing the Fannie Mae Home Price Index with external audiences. We have long used this index within the company, including as part of our quarterly financial disclosures, and we believe it will be a highly accurate, timely indicator for measuring home price growth for both economists and housing industry stakeholders alike.”

The FNM-HPI is produced by aggregating county-level data to create both seasonally adjusted and non-seasonally adjusted national indices that are representative of the whole country and designed to serve as indicators of general single-family home price trends.

Beginning April 15, 2022, the FNM-HPI will be publicly available at the national level as a quarterly series with a start date of Q1 1975 and extending to the most recent quarter, Q1 2022.

Fannie Mae plans to publish the FNM-HPI mid-month during the first month of each new quarter.

Tip of the Week – Don’t Piss-Off Your Regulator

Federal Supervisory Agencies on the Watch for Brokered Loans

When the regulator finds evidence of criminal activity such as mortgage fraud, it is generally compelled to refer the matter to law enforcement, including the Department of Justice.

In this tragic case, the mortgage broker engaged in material omissions, either by obfuscating or concealing the applicant’s debt. Brokered loans are subject to scrutiny by the state licensing authority AND state and federal authorities that supervise the entities funding brokered loans, or purchasing brokered loans.

In this case it was a supervisory unit of a prudential regulator that detected the problem. The FDIC Inspector General’s Office discovered the case and made the referral.

Complainee was sentenced to 14 months imprisonment followed by 24 months of home detention and was also ordered to pay $1,004,991.64 in restitution.

Complainee, acting as a mortgage broker, conspired to obtain first and second mortgages on approximately 14 residential properties in the span of approximately 30 days by failing to inform lenders about his co-defendant’s (applicant’s) accurate and complete liabilities. Complainee and his co-defendant prepared fraudulent loan applications in connection with the purchase loans.

The applications contained false statements and representations relating to the co-defendant liabilities, thereby preventing lenders from being able to assess the borrower’s qualifications to borrow money accurately.