Why Haven’t Loan Officers Been Told These Facts?

Risk Identification

The Subprime space should be no different from the agency space when identifying borrower and transaction risks (loan-level risk). But that is not how the subprime market is shaped at present. Moreover, since the subprime space is less developed than the prime space, it is understandable how some clunky credit administration is taking place.

Subprime risk management is similar to prime risk management at the loan level. However, there are likely to be coarser risk mitigations within the underdeveloped residential subprime market. Think of credit score buckets as risk stratification.

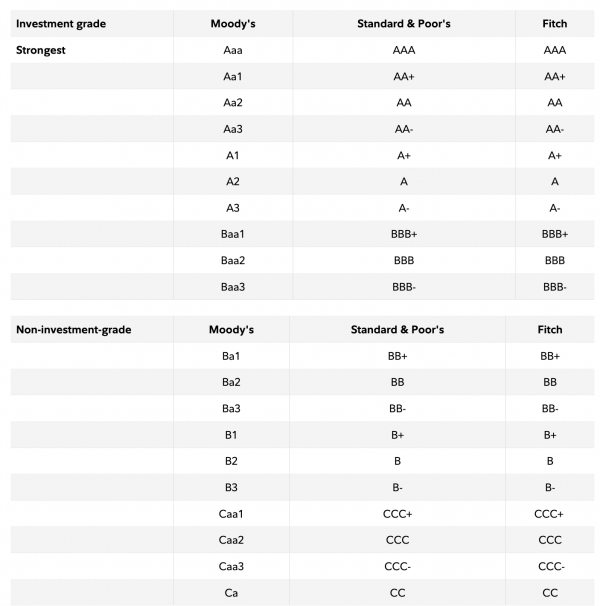

As an illustration, see the bond rating figure at the end of the article. Note the stratification of risk. The refined risk ratings common to bonds are similar to the consumer credit score buckets using different metrics.

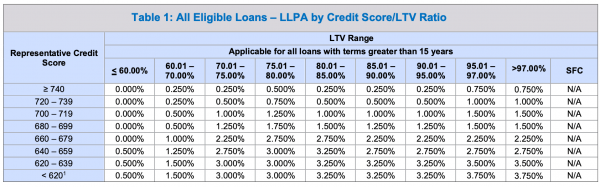

Like in residential lending (e.g., FNMA LLPA, FHLMC Credit Fees), the risk rating directly correlates to the required yield (see the FNMA LLPA Matrix below). In the residential pre-Dodd-Frank subprime market, residential subprime credit grading applied similar grades to residential mortgages as those used in finance. However, the subprime risk is more broadly defined for lenders and investors because the subprime market is less developed today. This coarse risk stratification is not good or efficient for investors or borrowers. The stronger applicant might overpay if grouped into the broader subprime category.

For example, loan-level risks with agency loans are very granular. Manual underwriting, automated underwriting. Minimum property requirements. LTV, CLTV, Owner-occupied or nonowner occupied. Limited cashout or cashout, multifamily or single family. The agencies require extensive transaction risk analysis before the lender even takes a gander at the applicant. Then there is further loan-level risk assessment: credit scores, reserves, and DTI. This type of risk identification and mitigation is studied, data-driven, precise and consistent. Subprime is not. Yet.

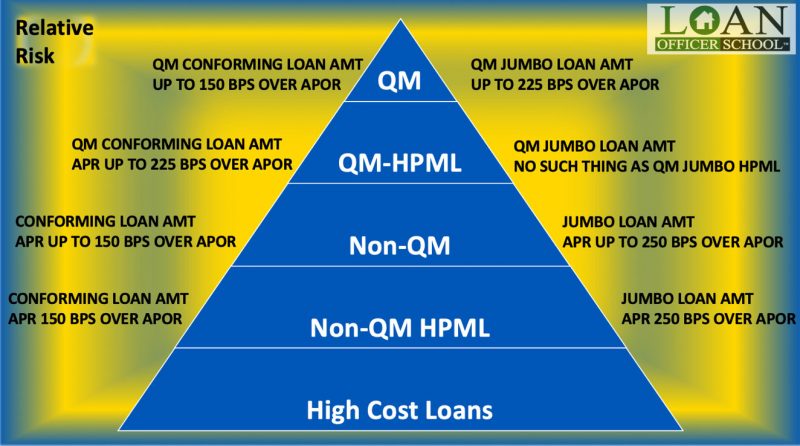

Many practitioners have the mistaken view of the non-government loan universe consisting of QM and Non-QM loans. Because of the failure to identify degrees of risk within each category, originators price prime or subprime quality mortgages too broadly.

What loan originators need instead of a risk “dummy light,” is a risk temperature gauge to better price and place the loans. The Journal’s mortgage risk pyramid is a simple tool to deploy.

At the bottom of the pyramid are the riskiest loans of all. High-Cost mortgages are for the stout of heart and are beyond the risk appetite of most lenders. High-Cost loans create a potentially toxic mix of portfolio and performance risk that few lenders will stomach.

The next riskiest loan category is the Non-QM HPML.

Then, you have the Non-HPML Non-QM loans.

Then we get into HPML QM loans. With this bucket, the portfolio risks drop off significantly. These loans are saleable to the GSEs however, these loans do not have a Regulation Z safe harbor applicable to Non-HPML QM loans. If challenged on its ATR determination, lenders must use a residual income analysis to evidence the capacity determination. Regulation Z permits a complainant to challenge the lender’s ATR determination with evidence. Because one never knows what might happen in an adjudicative proceeding or hearing, many lenders will pass on the ATR uncertainty that exists with HPML. While a QM HPML is exempt from the mandatory second appraisal requirements for some seller flips, the escrow requirement stands.

And at the top of the risk pyramid is the QM loan. The risks that separate the QM from the HPML QM are manifold. Notably, the QM loan has a non-rebuttable presumption of compliance with the ability to repay requirements providing a safe harbor to the lender and any assignees.

The term safe harbor means, (From Black’s law dictionary), “The provision in a law or agreement that will protect from any liability or penalty as long as set conditions have been met.” HPML QM loans carry the risk of a rebut to the lender’s “reasonable” determination of the applicant’s ability to repay.

The HPML-QM law creates a rebuttable presumption of compliance with the ATR requirements. Regulation Z provides step-by-step guidance to complainants that challenge the lender’s ATR determination with evidence (a residual income analysis) that the borrower could not afford the loan at consummation. The rebut evidence stipulated in Regulation Z is why subprime lenders require the originators to use the residual income test (or should!).

STEERING SAFE HARBOR FOR MORTGAGE BROKERS

Numerous federal laws overarch the loan manufacture. Due to the industry’s history of abusive practices, there are granular legal requirements requiring lenders to look out for the consumer’s best interests in the loan selection. Congress enumerated specific requirements to keep lenders from intentionally or negligently putting people into lower grade financing than circumstances require.

The Dodd-Frank Title X UDAAP provisions surrounding unfairness and abuse address the issue of lenders failing to do a reasonably good job for the consumer. As do the SAFE Act and the TILA.

The TILA loan officer compensation rules also attack the problem of incentivizing the MLO or the Loan Origination organization to steer consumers to less desirable financing. Regulation Z even provides mortgage brokers with a safe harbor against steering allegations in the loan selection process.

A mortgage lender must demonstrate that it employed its best efforts to present the consumer with the best viable loan options at the time of consummation. What does a best-effort require? What documentation or evidence is necessary to prove that the lender reasonably looked after the consumer’s interests?

Training is usually a good first step. Lenders must use training that builds on established policies and procedures. Standardized workflows and appropriate supervision are essential to ensure that the lender has done a reasonably good job.

Next week the Journal further examines essential subprime awareness.

Behind the Scenes

Rural Borrowers differ from City Slickers

FHFA and CFPB Release Updated Data from the National Survey of Mortgage Originations

Survey responses reveal some expected and unexpected data

In this series, the Journal hopes to identify several underserved communities with the hope that some enterprising lenders might choose to expand their services to those in need. Some of these underserved communities are definitely more novel, such as gig-workers. Others are better understood and well defined, such as underbanked low and moderate-income households in non-rural communities.

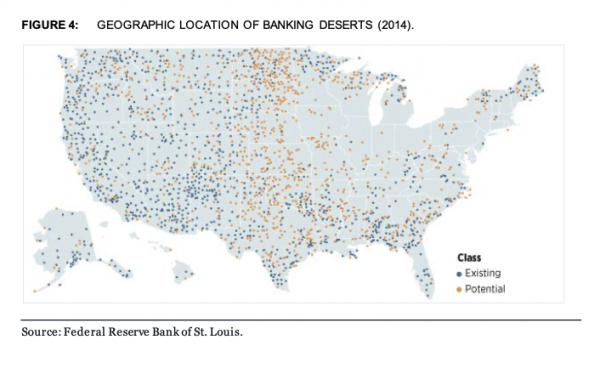

Leveraging the April 2022 CFPB “Challenges in Rural Banking Access” and a report based on the National Survey of Mortgage Originations, the Journal has identified some of the challenges that folks in non-metro locales have in getting to mainstream mortgage providers.

We hope lenders may see an opportunity to broaden their business while doing a good thing by providing much-needed services to underbanked communities.

Will Starlink and other satellite internet providers make a difference?

The Federal Reserve Bank of St. Louis defines bank deserts as census tracts with no branches within a 10-mile radius from the tracts’ centers. As of 2014, the Federal Reserve identified 1,132 existing bank deserts, of which 734 (65 percent) were in rural areas, and 1,055 potential banking deserts, of which 851 (81 percent) were in rural areas. Overall, rural census tracts are ten times more likely to be in a banking desert than urban tracts.

According to the Federal Reserve, the use of online banking in rural areas remains dramatically lower in rural areas, at 56 percent compared to 75 percent in large Metropolitan Statistical Areas and 68 percent in small Metropolitan Statistical Areas.

Excerpts from “Mortgage Experiences of Rural Borrowers in the United States, Critchfield et al., 2019”

The study classifies U.S. counties into three groups based on the USDA’s county-level classification from 2013.

The first group, “metro” counties, consists of 1,167 counties in Metropolitan Statistical Areas.

The second group includes 1,332 counties, not in metropolitan areas but having at least one urban cluster of 2,500 or more people. These counties are referred to as “non-metro” counties.

The last group, “completely rural” counties, comprises 644 counties that are designated under “completely rural or less than 2,500 urban population.”

- 37 percent of counties are metro / 88% of mortgage originations

- 42 percent are non-metro counties / 11% of mortgage originations

- 21 percent are entirely rural / 1% of mortgage originations

Most counties along the coasts are metro counties. Non-Metro counties are spread throughout the country, but the coasts have the lowest share ranging from 33 percent of counties in the Middle Atlantic division to 35 percent in the Pacific division. Entirely rural counties are primarily located in parts of the Midwestern, Mountain, and Southern states.

An interesting point, while 15% of the housing units are in non-metro locales, that market comprises 11% of the mortgage volume. While metro counties hold 83% of the housing units, makeup 88% of the mortgage volume.

Mortgage Experiences of Rural Borrowers in the United States: Insights from the National Survey of Mortgage Originations

Authors: Tim Critchfield – Consumer Financial Protection Bureau, Jaya Dey – Freddie Mac, Nuno Mota – Fannie Mae, Saty Patrabansh – Federal Housing Finance Agency

“The opinions and analyses contained herein are solely of the users/authors of any data analyses or papers, and the FHFA cannot and does not attest to nor vouch for the quality, accuracy, or timeliness of the data, or analyses derived from these data after the data has been retrieved from FHFA.gov.”

The views expressed in this article are those of the authors and are not necessarily those of

the Consumer Financial Protection Bureau, Freddie Mac, Fannie Mae, or the Federal Housing

Finance Agency.

Tip of the Week – Don’t Piss-Off Your Regulator

CFPB Brings the Heat

Title X UDAAP (Consumer Credit Protection Act)

Repeat Offenders

Last week, the Journal described the CFPBs notable enforcement action against TransUnion and a former executive of the company who allegedly violated Dodd-Frank Title X prohibitions against deceptive practices resulting in various consumer harms. According to CFPB Director Chopra “TransUnion is an out-of-control repeat offender that believes it is above the law,” said CFPB Director Rohit Chopra. “I am concerned that TransUnion’s leadership is either unwilling or incapable of operating its businesses lawfully.”

The original enforcement action stemmed from Equifax and TransUnion’s alleged misrepresentation of the value of educational credit scores to consumers.

Most MLOs have encountered a prospective applicant or borrower providing a fallacious credit score based on sometimes hoaky or spurious credit score calculations. Consumers often misunderstand the utility of the educational scores provided by many consumer credit companies. (See the CFPB announcement from the original enforcement action below.)

From the CFPB Announcement on January 3, 2017

The Consumer Financial Protection Bureau (CFPB) today took action against Equifax, Inc., TransUnion, and their subsidiaries for deceiving consumers about the usefulness and actual cost of credit scores they sold to consumers. The companies also lured consumers into costly recurring payments for credit-related products with false promises. The CFPB ordered TransUnion and Equifax to truthfully represent the value of the credit scores they provide and the cost of obtaining those credit scores and other services. Between them, TransUnion and Equifax must pay a total of more than $17.6 million in restitution to consumers, and fines totaling $5.5 million to the CFPB.

“TransUnion and Equifax deceived consumers about the usefulness of the credit scores they marketed, and lured consumers into expensive recurring payments with false promises,” said CFPB Director Richard Cordray. “Credit scores are central to a consumer’s financial life and people deserve honest and accurate information about them.”

Chicago-based TransUnion and Atlanta-based Equifax are two of the nation’s three largest credit reporting agencies. TransUnion and Equifax collect credit information, including a borrower’s payment history, debt load, maximum credit limits, names and addresses of current creditors, and other elements of their credit relationships. These generate credit reports and scores that are provided to businesses. Through their subsidiaries, TransUnion Interactive and Equifax Consumer Services, the companies also market, sell, or provide credit-related products directly to consumers, such as credit scores, credit reports, and credit monitoring.

Credit scores are numerical summaries designed to predict consumer payment behavior in using credit. Many lenders and other commercial users rely in part on these scores when deciding whether to extend credit. No single credit score or credit score model is used by every lender. Lenders use an array of credit scores, which vary by score provider and scoring model. The scores that TransUnion sells to consumers are based on a model from VantageScore Solutions, LLC. Although TransUnion has marketed VantageScores to lenders and other commercial users, VantageScores are not typically used for credit decisions. Scores Equifax sold to consumers were based on Equifax’s proprietary model, the Equifax Credit Score, which is an “educational” credit score that also is typically not used by lenders to make credit decisions.

The order required among other things that the CRAs mend certain practices including:

- Truthfully represent the usefulness of credit scores it sells: TransUnion and Equifax must clearly inform consumers about the nature of the scores they are selling to consumers.

- Obtain the express informed consent of consumers: Before enrolling a consumer in any credit-related product with a negative option feature, TransUnion and Equifax must obtain the consumer’s consent.

- Provide an easy way to cancel products and services: TransUnion and Equifax must give consumers a simple, easy-to-understand way to cancel the purchase of any credit-related product, and stop billing and collecting payments for any recurring charge when a consumer cancels.

The CFPBs discussion of the alleged deception provides a view into practices that lenders would do well to avoid.

The repeat offender angle is interesting. Many stakeholders believe therein lies a special message to the financial services industry. The CFPB calling out individuals by name is not new but rare.

Of significant import are the allegations of deception. Lenders could take a lesson from the specific complaints and required remediation.

Next week, the Journal concludes our focus on this enforcement action by examining CFPB comments about digital dark patterns.