Why Haven’t Loan Officers Been Told These Facts?

Regulation Z Steering Safe Harbor

Regulation Z 12 CFR §1026.36(e)(2-4)

(Paraphrased) A transaction does not violate the steering prohibition if the lender presents the consumer with appropriate loan options for each type of financing in which the consumer expresses an interest.

The loan originator must obtain loan options from a significant number of the creditors with which the originator regularly does business and, for each type of transaction in which the consumer expressed an interest . . .

Regulation Z compliant loan presentations protect the originator from steering violations. Additionally, the compliant presentation establishes a roadmap for pricing and promotes effective salesmanship.

A frequent complaint against the mortgage industry is that MLOs provide scanty options relative to the high-stakes mortgage transaction. This complaint, echoed by various stakeholders, accuses MLOs of behaving like order takers. That’s appropriate at Taco Bell, but not when the consumer makes a significant financial decision. Consequently, Regulation Z and the TILA require that MLOs inform and enable the consumer to make an educated decision to use the best available credit.

Regulation Z provides express guidance regarding the lender’s role in informing the consumer regarding their loan options. Lenders must provide consumers with sufficient information so that they can make informed use of credit.

Shame on the consumer for making an unwise mortgage choice from a reasonable array of viable and cogent options. Shame on the lender when the consumer unwisely accepts an inappropriate single solution.

Unless the industry seeks to invite further use of automated mortgage solutions, bots, and third-party homeownership counselors, it’s time to get with the program. Presenting options is MLO 101 (see the link to the Meatball article in The LoanOfficerSchool.com Journal Volume 2 Issue 4).

Loan options are so central to the MLO’s responsibility that some origination organizations require evidence of an appropriate loan presentation in the loan file. Requiring the MLOs to provide an applicant initialed comparative fee sheet or checklist in every file could help reduce exposure to steering allegations.

In addition to compliance requirements, a cogent presentation of loan options is salesmanship 101. It is far more difficult for the prospect to decide to move forward when the loan officer presents a solitary solution. When empowered with choices, it is easier on the prospect’s emotions to move forward. By considering two or more options, the prospect gains confidence that they have sufficiently searched out their best options through due diligence. The prospect needs to gain a sense that they have put adequate efforts into selecting the loan and lender. The comparative analysis provides the activities necessary for the loan exploration and analysis objectives.

An Informed Use of Credit – Choosing the Best Mortgage

Using precise quantified values (dollars and cents) to articulate the differences between loans is essential. The degree of applicant buy-in to the process, the originator, and the selected financing highly depends on their comprehension of the differences between the presented options. In addition, comparisons increase the applicant’s appreciation of the relative soundness of a solution. Consequently, a cogent presentation of options often lessens the buyer’s impulse to shop due to misgivings about the lender, the presented options, or the MLO.

The MLO giving the prospect what they need is foundational to establishing credibility and rapport. When buyers associate their ah-ha (comprehension of value) moments with your services, they are more likely to find you safe, credible, and trustworthy.

The “best mortgage” is only identifiable in a comparative analysis. The buying process psychology is nothing new. Consider the classic sales practice; the alternate choice close. First, when properly conducted, the alternate choice close assumes the prospect has sufficient information to choose to buy. Otherwise, premature closing may become purely manipulative, awkward, and offputting.

The MLO can consistently foster a buying decision when presenting two or more options. Remember, the big buying decision is not based on a singular evaluation. Instead, the big buying decision is the sum of more minor buying decisions. For example, “Mr. Prospect, what is your initial read of these options? Is option one preferable to option two? Number one, it is then. Do you think assumability is important in selecting a loan program? If nothing else prevents us from moving forward, can we discuss locking the terms and get you underway!”

The alternate choice is not manipulation if the prospect has considered a reasonable array of options. The alternate choice close is then iterated as necessary to winnow further the possible solutions leading to the prospect’s final choice.

Focal Features and Quantified Benefits

The most consistent way to express the differences between the options is by dollars and cents. However, focal feature attributes may yield the most powerful comparisons. A focal feature is a substantively significant feature. The feature may be positive or negative from the prospect’s perspective. The MLO can shape the contours and import of focal features through comparisons. Not quantitatively, but more nebulously. Typical focal features include a fixed-rate, adjustable-rate, prepayment penalty, balloon payment, and assumability.

Focal features are challenging or impossible to quantify plus they present opportunities or threats to the prospect. However, focal features may carry significant benefits or liabilities in the prospect’s way of thinking.

Always make quantified presentations but season the presentation with focal features. For example:

A) Quantified benefit: “Mr. Prospect, the FHA payment is $45 lower than the conventional loan.”

B) Focal feature: “Mr. Prospect, the FHA loan is fully assumable to a qualified buyer. Fully assumable financing can be a significant benefit. Assumability enables you to transfer your loan benefits to a buyer with the same interest rate and terms. For example, suppose rates are significantly higher when you sell. In that case, the attractiveness of taking over a below-market rate may make your home easier and more profitable to sell. You cannot transfer below-market financing with a conventional fixed-rate loan.”

Both options A and B present loan features defined only through comparison. Option A provides a quantified benefit, and option B provides a focal feature.

When you present the options, get excited, and share your enthusiasm over the preponderance of quantified and focal feature benefits. The prospect evaluates the comparison data logically but decides through an emotional prism, and emotions are contagious. Your positive vibe reinforces the buying decisions. It’s hard to get excited over $45, but assumability, though a nebulous benefit, is more exciting.

On the other hand, how does the presentation impact the prospect if you make a disorganized and incoherent presentation? For example, if delivered with an Eeyore (“All good things come to an end… “) disposition, the same A and B presentation may elicit a hesitant or more skeptical prospect response.

The applicant needs options to determine the best mortgage solutions. No options will lead to more second thoughts, insecurity, and doubt about the selected financing, lender, and loan officer.

Next week will further unpack the Regulation Z safe harbor from steering violations.

It’s baseball season! Learn about improving your prospect conversions by throwing the Meatball pitch here: https://www.loanofficerschool.com/los-journal-volume-2-issue-4/

Behind the Scenes

Window Dressing or Substance?

Is FNMA’s efforts to attack the challenge of underserved communities substance or merely hype? Under the HERA Duty to Serve obligation, federal law requires the way-ward GSEs to promote better housing opportunities for all communities. Not just those that make them the most money.

Our plan review excludes FNMA’s multi-family business, though a substantive element of FNMA’s efforts to serve underserved people in rural areas. Rather, our assessment is on residential single family mortgages. Is there anything for rural homebuyers?

Let’s see what the FNMA is doing to help underserved communities get their slice of the American Dream, homeownership!

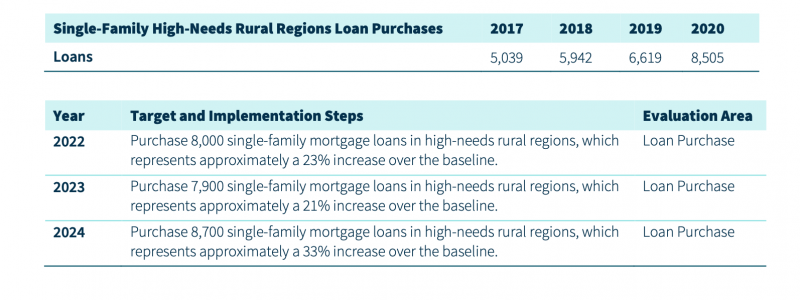

From FNMA’s 2022 Duty to Serve Report

Borrowers in high-needs rural regions experience challenges in securing financing for home purchases. The number of lenders serving high-needs rural regions has declined significantly in recent decades. As described above, lenders that do operate in high-needs rural regions often retain the loans they originate in their portfolio instead of selling them into the secondary market, thereby limiting liquidity and availability of mortgage financing. There is an opportunity to increase liquidity by increasing loan purchases in high-needs rural regions.

Unlike in the prior Plan cycle, we have excluded refinance loans from our loan purchase targets, focusing exclusively on PMM loans. Fannie Mae will continue to support refinance loans for LMI borrowers in this market. However, these loans will not be included in our three-year Plan because of the inherent volatility of the refinance business in a shifting interest rate environment, which may place more weight on market forces beyond our control.

We believe that continued growth over the next three years is reasonable, even amid shifting market conditions. As with the baseline, we considered the circumstances within each market to select appropriate growth targets.

In high-needs rural regions, recent average annual growth has been 19%, and each year of the first Duty to Serve Plan resulted in higher loan purchases than the year prior. Moving into this plan cycle, macroeconomic trends such as increasing housing prices and interest rates suggest that sustained growth in these markets may prove difficult to achieve. However, we recognize that Duty to Serve consumers are likely to be impacted greatly by these broader economic challenges. As a result, we have made what we believe to be a meaningful commitment to this market in the form of an enhanced loan purchase target in Year One, which is 23% higher than the baseline. While we do not have the data to feel confident in making annual increases of this size to later years in the Plan, we will commit to working with FHFA to responsibly adjust our targets should market conditions change.

Baseline: The 6,526-loan baseline represents the four-year average of the number of loans purchased by Fannie Mae from 2017 – 2020. Fannie Mae has set the below targets for 2022 – 2024. Similar to our approach when setting a baseline in the prior iteration of the Duty to Serve Plan, we reference actual loan purchases from a recent period.

Discouraging Objectives

A little context is in order. FNMA had a record year in 2021. But the numbers fail to add up for those in high-need rural communities. The planning comes up short for rural America.

FNMA bought 3.3 million refinance and 1.5 million purchase money loans last year.

4.8 million total mortgage units in 2021. However, FNMA is using its 2017-2020 rural production as a benchmark for future unit objectives. That is what is called sandbagging. In other words, for the entire United States, over the next three years, FNMA plans to purchase a total of 24,600 purchase money loans in high-needs rural regions. This is in addition to the 26,105 purchased loans over the last four years. 50,705 purchased loans over seven years?

It is unclear if the objectives are total units or just purchase money. Regardless, either way, the objectives appear paltry. FNMA’s numbers appear to correlate with whether to contribute one or two pennies to the collection plate.

We will end the review here. Next week we shall see if FHLMC has anything better to offer.

Due to available stock and rising prices, the brewing housing crisis demands innovation and leadership. If you want a picture of what Government-run management does to excellence and initiative, look no further than the FNMA. Homeownership, manufactured housing, and a decent place to call home are matters of national interest. If it were easier for third-party originators to finance manufactured homes, it could go a long way in improving housing opportunities in rural communities.

Understand that the FNMA has a legal obligation to promote homeownership, not just narrowly for the most profitable loans, but also widely, including less profitable loans. Because of the unique nature of the GSEs, they tend to suck the air out of any room they enter. In 2021, the US Supreme Court granted greater powers to the executive branch in the administration of the FHFA. Stakeholders must hold these political hacks accountable for advancing the lawful GSE mission before the federal government further ruins American homeownership opportunities.

Background From FNMA Report on Manufactured Housing

Manufactured housing refers to housing built in a factory after June 15, 1976 and constructed in accordance with the U.S. Department of Housing and Urban Development’s Manufactured Home Construction and Safety Standards code (HUD Code), which sets minimum standards for size and quality of construction. Factory-built manufactured homes that meet these standards post a HUD label and are subject to federal regulations that supersede local building regulations. Homes built before this date are considered mobile homes and are typically of a lesser quality construction.

Manufactured housing represents 6.3% of the nation’s housing stock but is a higher share of housing stock in rural areas. While site-built single-family homes represent about 80% of housing stock in rural areas, manufactured housing represents about 14% of stock. Apartments trail a distant third, representing only about 6% of the stock in rural areas.

An estimated 18 million Americans live in manufactured homes. While most manufactured homes are owned, with 4.8 million homes occupied by owner households, there are also 1.9 million units occupied by renter households.

Tip of the Week – Language Helps

Last week the Journal suggested that awareness of federal regulator guidance surrounding Limited English Proficiency (LEP) in the loan manufacture is essential. However, ham-handed translations or implementations of translation aids may also introduce compliance risks. As a result, originators increasingly find themselves between a rock and a hard place.

LEP loan applicants must be fully aware that the loan manufacture occurs primarily in English at the earliest possible time. The translations are enablements for understanding the loan manufacture. However, the available translations are not exhaustive and may or may not be available throughout the entire loan lifecycle.

Generally, lenders must refrain from implying that the settlement or servicing of the loan occurs in anything but English. Why risk it then? Because not using LEP collateral may also increase compliance risk and disadvantage the consumer. In addition, limiting the marketing efforts to only English might be discriminatory and fail to exploit the market appropriately.

One of the most straightforward translation implementations includes distributing the FHFA Disclosure (pictured above) with any LEP collateral. The FHFA Language Disclosure is available in six languages; English, Español (Spanish), 中文 (Chinese), Tiếng Việt (Vietnamese), 한국어 (Korean), and Tagalog (Filipino). In addition, lenders, servicers, housing counseling agencies, and other parties may customize the disclosure with their logo and formatting.

The FHFA Disclosure is well written and clarifies to the applicant that the LEP translations are not what they will sign at closing. Furthermore, applicants could assume that the settlement agent and loan servicer may have different translation practices absent the Disclosure.

LEP is an edgy compliance area. UDAAP, the MAP Act, and Regulation Z may all come into play.

The FHFA Language Translation Disclosure: https://www.fhfa.gov/MortgageTranslations/Pages/disclosure.aspx

Many loan artifacts in Spanish: https://www.consumerfinance.gov/about-us/blog/support-spanish-speaking-customers-with-spanish-language-disclosures/