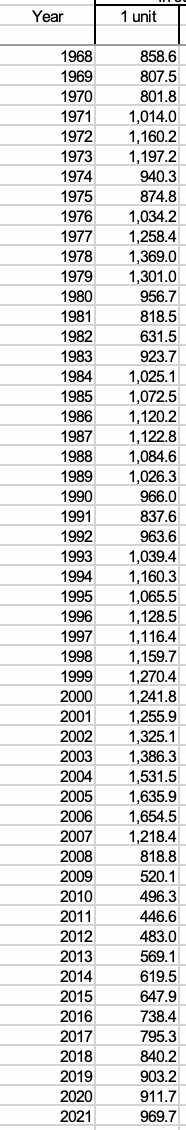

Fig below, new SFR construction (1000s) 1968-2021

Why Haven’t Loan Officers Been Told These Facts?

APPRAISAL SUBJECTIVITY

Market Fluctuations and Industry Instability Increase Appraisal Risks

“The reconciliation is based on the appraiser’s judgment” – FNMA

The 2008 mortgage and homeownership meltdown continues to resonate. For the past 15 years, the construction industry has underproduced new homes unlike any other period in a generation. The residential real estate industry and homebuyers are experiencing the effects of this underproduction.

Like overcorrecting the steering when skidding on a slick road, the housing bus has yet to conclude its wild fishtailing from 2008.

One of the challenges that may soon manifest is increasing appraisal valuation subjectivity. As the residential real estate market morphs, valuations become more challenging. Because of the friction inherent with competing stakeholder requirements and slowing housing sales, one should anticipate greater subjectivity in reconciling value. In the loan manufacture, the lender’s opinion is the one that matters most. Unfortunately, the lender’s opinion is more frequently the most subjective one. And the timing of the lender’s opinion can be difficult to manage.

The nexus between listing prices and values are rapidly changing. Moreover, as the housing market continues to cool, the transition from double-digit housing inflation to market parity will likely change the residential real estate valuation trajectory.

The markets with meteoric appreciation will probably be the first to show signs of fissures. Flat and even declining values may develop in some markets. Expect the risks attendant with subjectivity to increase in those markets. These risks include weak or conflicting data, poor comps, and exacting reviews leading to delays, downgrades, and declines.

The MLO cannot expect to manage every risk successfully but can avoid self-inflicted wounds. For starters, get waivers for the right to the appraisal three business days before consummation. Generally, the appraisal waiver is available up to three business days before consummation.

According to regulation B, the applicant must have a copy of the appraisal used in the credit decision three business days before consummation, absent the waiver. Not infrequently, once the lender reviews the appraisal report, the appraisal report may require changes. Suppose those changes occur within three days of consummation, and you don’t have a waiver. In that case, the lender must delay the closing to meet the Regulation B appraisal delivery requirements.

Regulation B does not define a business day. However, the CFPB states, “you can apply your own reasonable definition, which may include counting Saturdays.” Therefore, the Regulation Z definition § 1026.2(a)(6), every day except Sundays and public holidays is indicated.

An applicant may waive the timing requirement and agree to receive any appraisal copy before consummation, except where otherwise prohibited by law (Reg Z Higher Priced Mortgage Loan/HPML/Subprime loans do not permit appraisal waivers).

Any waiver must be obtained at least three business days before consummation unless the waiver pertains solely to the applicant’s receipt of a copy of an appraisal that contains only clerical changes from a previous appraisal version.

What constitutes a “clerical” change versus a material change to the appraisal can be highly subjective. Don’t expect lenders to err in your favor. If within three days of consummation there are last-minute appraisal changes, more likely than not, the lender should delay your closing to meet the three-day timing requirement.

Suppose you get the appraisal subject to or anything involving a 442. In that case, the lender must delay your closing to meet the delivery requirements if the issue is not resolved within three business days of consummation. Should the transaction require a review or second appraisal, your odds of a closing delay are more than double.

Improve the odds of timely closings, and get the waiver at application.

Recall that on HPML, Regulation Z prohibits appraisal waivers. Plan accordingly. Ensure that all stakeholders are bought into the financing solution and are onboard for what can be a bumpy ride, especially in a changing market.

When a second appraisal is required on HPML because of a covered seller flip, one of the two required appraisals must include the following subjective analysis from the appraiser. The lender must then evaluate the analysis:

- An analysis of the difference between the price at which the seller acquired the property and the sales price.

- Changes in market conditions between the date the seller acquired the property and the date of the sales agreement.

- Any improvements made to the property between the date the seller acquired the property and the date of the sales agreement.

Some hotter markets have had an unusually high number of seller flips. Under Regulation Z HPML rules, covered seller flips are partially defined by the price the seller paid to acquire the property. That means defining the flip is based on the seller’s purchase price, not the seller’s carrying costs or cost of improvements.

Under Regulation Z HPML rules, if the seller sells within 90 days of taking the title for 10% more than the acquisition price, a second appraisal is required unless the deal meets the QM requirements. Likewise, a second appraisal is required if the seller sells within 91 to 180 days of taking the title for 20% more than the acquisition price. The 90 and 180-day time periods are calculated by counting the days after the seller acquired the property, up to and including the date of the consumer’s agreement to acquire the property (HPML only applies to owner-occupied and second homes, not investor deals).

Not everyone is familiar with the intricacies of residential real estate valuation. However, even a first-time home buyer understands that what other buyers are willing to pay for something is essentially the measure of its value. However, some of the forces that shape a market may have little to do with any particular intrinsic value. For instance, a herd mentality is a driving force in rising home prices. Location, location, location begins in the space between the ears as much as the property’s locale.

The fear of getting locked out of affordable homeownership has driven many consumers to pay full price and then some for their purchase. But what happens when the herd responds to new fear? Like recession. Like over-bought housing markets. The herd is growing worried about keeping their jobs and ballistic housing payments. Since the herd has little money in the bank, the whopping mortgage payment looks scarier than living in an apartment or keeping the current home.

The psychology of loss is a primary driver for most people. That is how advertisers use sales to drive purchase activity. If the buyer fails to act NOW, they will experience loss. Closely coupled with the fear of loss is the fear of shame. For example, they are considered fools for missing out on buying opportunities.

Lenders have similar but different fears. Getting caught on the wrong side of a possible housing correction is a risk key stakeholders will try to avoid. Consequently, the uncertainty and possible consequences attendant with the magnitude of the developing market changes will push some stakeholders to err on the side of caution.

The term “err on the side of caution” is a euphemism for risk management. When the outcome of something is uncertain, stakeholders will seek to attenuate the threat risks of over-valuations.

The range of stakeholders in the appraisal arena is extensive. Identifying these stakeholders and their specific concerns will help you anticipate uncertainties in the loan manufacture and act to mitigate the impact and probability of specific threats to better outcomes.

Consider the key stakeholders in this domain.

- The Federal Government

- State Government

- FNMA

- FHLMC

- FHFA

- FFIEC (Create appraisal rules for the states to follow)

- Lenders

- Third-Party Originators

- Buyers

- Sellers

- Builders

- Real Estate Brokers

- AMCs

- Individual Appraisers

Investors like FNMA use credit policies to mitigate risks such as property over-valuation. Because of divergent appraisal objectives, stakeholders, like lenders, overlay the risk management of regulators and investors. Know your lender and know the rules.

Your ability to recognize the appraisal concerns of key stakeholders goes a long way in satisfying stakeholders.

See two CFPB’s Appraisal Factsheets here:

https://files.consumerfinance.gov/f/documents/cfpb_ecoa-valuation_transaction-coverage-factsheet.pdf

Manufactured Housing Primer

Five Key Points for Manufactured Housing

Freddie Mac Provides Clarity On Manufactured Homes

Q1. What is manufactured housing?

A manufactured home is built in a factory in accordance with the Manufactured Home Construction and Safety Standards of June 1976 (“the HUD Code”– 24 C.F.R. Part 3280) and secured on a permanent, non-removable steel frame or chassis. The home can be built as one complete section, or in multiple sections, and then transported, assembled and installed at the home site. The towing hitch, wheels, and axles must be removed, and the dwelling must assume the characteristics of site-built housing.

Q2. How is manufactured housing different from a mobile or modular home?

Mobile homes, or trailers, were built on wheels, prior to the 1976 HUD Code, and can be pulled by a vehicle. Mortgages secured by mobile homes are not eligible for sale to Freddie Mac.

Modular homes (or other factory-built dwellings) are not built to compliance with the HUD code. They’re built to conform to state, local or regional building codes and are usually legally classified as real property. Typically, modular or other factory-built homes are eligible as site-built single-family homes for financing, appraisal and construction financing purposes.

Q3. How do I know a home meets the HUD Code?

When newly built, every manufactured home is inspected at the factory by an independent third-party inspector certified by HUD. The manufactured home will have:

A special HUD Certification Label affixed to the exterior of the home indicating it has been designed, constructed and inspected to comply with the HUD Code standards.

A HUD Data Plate/Compliance Certificate, which is a paper label mounted in the home, that contains, among other things, the manufacturer’s name, trade/model name, year manufactured and serial number, and a list of the certification label number(s), etc. The data plate is typically affixed in a readily accessible and visible location (e.g., near the main electrical panel, in a kitchen cabinet, or a bedroom closet).

Q4. Does Freddie Mac require a professional engineering inspection of the anchoring systems and foundation for all manufactured home mortgage transactions?

No. An engineering inspection is not required for all manufactured home transactions. Our Guidelines require the appraiser to perform a complete visual inspection of the interior and exterior areas of the manufactured home. If the appraiser observes conditions that require further investigation, the appraiser must make the appraisal “subject to” an inspection by an appropriately licensed professional or another person trained in the particular field of concern.

Q5. What products and offerings does Freddie Mac currently offer to finance manufactured homes?

Freddie Mac mortgage products for manufactured homes include 15-, 20- and 30-year fixed-rate mortgages; 7/6- and 10/6-month adjustable-rate mortgages (ARMs); integrated construction conversion documentation; Freddie Mac GreenCHOICE Mortgages and Freddie Mac CHOICERenovation Mortgage.

Tip of the Week – Sex and Familial Discrimination

Last week we covered a Fair Housing Act complaint concerning a lender’s alleged discrimination against an applicant on maternity leave. HUD received the Fair Housing Act complaint because of the involvement of an FHA loan. This lender could just as easily have incited a CFPB enforcement action under the ECOA regarding sex or income discrimination. Were that the case, the defendant would more likely have come out of the action with a more serious beatdown.

Regulation B 12 CFR § 1002.6(b)(5) A creditor shall not discount or exclude from consideration the income of an applicant or the spouse of an applicant because of a prohibited basis or because the income is derived from part-time employment or is an annuity, pension, or other retirement benefit; a creditor may consider the amount and probable continuance of any income in evaluating an applicant’s creditworthiness.

After some thought, the Journal recognizes that providing additional guidance on what to do when your customer is expecting or other instances of temporary leave might be in order. In case you missed last week’s article, see the complaint below.

The Complaint

Complainants alleged that (Redacted) and its agent, loan officer (Redacted) (jointly, “Respondents”), discriminated against them on the basis of sex and familial status in violation of subsections 804(a) and 804(b) and Sections 805 and 818 of the Fair Housing Act as amended, 42 U.S.C. 3601 et seq. (“the Act”) by refusing to approve Complainants for a home loan until after Complainant returned to work from maternity leave.

Respondent agrees to maintain its existing policies and procedures under which applicants on temporary leave, including parental leave, may qualify for a home loan without first returning to active work status, assuming they meet all qualifying requirements. Respondent further agrees to maintain its existing policies and procedures prohibiting employees in lending-related roles from discouraging an applicant from applying due to any prohibited basis, including plans for parental leave, or suggesting that applicants return to work from parental leave prior to applying for a home loan. It is understood that Respondent has provided documentation to the Department showing that it already maintains such policies.

Respondents agree to comply with all applicable provisions of the Act and the Department’s regulations set forth at 24 CFR Part 100 et seq. Respondents specifically agree that they will provide full and fair access to all home loan products regardless of an applicant’s race, color, religion, sex, disability, national origin, or familial status. It is understood that familial status includes any person who is pregnant or is in the process of securing legal custody of any individual who has not attained the age of 18 years.

It is understood that Respondent provides fair lending training courses to its newly hired employees in lending-related roles and provides annual training to its current employees in lending-related roles in manners consistent with applicable law, including the Act and the Equal Credit Opportunity Act. Respondent agrees to continue providing fair lending training to To show compliance with paragraph H17, employees in lending-related roles and annual training to its current employees in newly hired

lending-related roles, including training on its policies and procedures under which applicants on temporary leave, including parental leave, may qualify for home loan products without first returning to active work status, assuming they meet all qualifying requirements.

How To Address The Stability of Income For Employees on Temporary Leave

From FNMA B3-3.1-09, Other Sources of Income

Temporary leave from work is generally short in duration and for reasons of maternity or parental leave, short-term medical disability, or other temporary leave types that are acceptable by law or the borrower’s employer. Borrowers on temporary leave may or may not be paid during their absence from work.

If a lender is made aware that a borrower will be on temporary leave at the time of closing of the mortgage loan and that borrower’s income is needed to qualify for the loan, the lender must determine allowable income and confirm employment as described below.

-

- Temporary leave from work is generally short in duration and for reasons of maternity or parental leave, short-term medical disability, or other temporary leave types that are acceptable by law or the borrower’s employer. Borrowers on temporary leave may or may not be paid during their absence from work.

- If a lender is made aware that a borrower will be on temporary leave at the time of closing of the mortgage loan and that borrower’s income is needed to qualify for the loan, the lender must determine allowable income and confirm employment as described below.

- The borrower’s employment and income history must meet standard eligibility requirements as described in Section B3–3.1, Employment and Other Sources of Income.

- The borrower must provide written confirmation of his or her intent to return to work.

- The lender must document the borrower’s agreed-upon date of return by obtaining, either from the borrower or directly from the employer (or a designee of the employer when the employer is using the services of a third party to administer employee leave), documentation evidencing such date that has been produced by the employer or by a designee of the employer.

- Examples of the documentation may include, but are not limited to, previous correspondence from the employer or designee that specifies the duration of leave or expected return date or a computer printout from an employer or designee’s system of record. (This documentation does not have to comply with the Allowable Age of Credit Documents policy.)

- The lender must receive no evidence or information from the borrower’s employer indicating that the borrower does not have the right to return to work after the leave period.

- The lender must obtain a verbal verification of employment in accordance with B3-3.1-07, Verbal Verification of Employment. If the employer confirms the borrower is currently on temporary leave, the lender must consider the borrower employed.

The lender must verify the borrower’s income in accordance with Section B3–3.1, Employment and Other Sources of Income. The lender must obtain:

-

- The amount and duration of the borrower’s “temporary leave income,” which may require multiple documents or sources depending on the type and duration of the leave period; and

- The amount of the “regular employment income” the borrower received prior to the temporary leave. Regular employment income includes, but is not limited to, the income the borrower receives from employment on a regular basis that is eligible for qualifying purposes (for example, base pay, commissions, and bonus).

Next week the Journal unpacks the steps necessary to calculate income for applicants with reduced or no income on temporary leave according to FNMA.