Why Haven’t Loan Officers Been Told These Facts?

The CFPB Warns Users of Credit Reports

FCRA section 604(f) strictly prohibits a person who uses or obtains a consumer report from doing so without a permissible purpose.

The FCRA’s permissible purpose provisions are thus central to the statute’s consumer privacy protection. Consumers suffer harm when consumer reporting agencies provide consumer reports to persons who are not authorized to receive the information or when recipients of consumer reports obtain or use such reports for purposes other than permissible purposes. These harms include the invasion of consumers’ privacy, as well as reputational, emotional, physical, and economic harms.

In 2020, a mortgage broker settled FTC allegations that it used consumer reports for other than a permissible purpose when, in response to negative reviews on a website, it publicly posted information it had obtained from a consumer report about the reviewer.

What Happens After the MLO Pulls The Credit

The FTC enforcement action against a mortgage broker for improper use of a credit report is a gripping study. When pulling the credit, the broker probably envisioned a different outcome than what he got—a $120,000 fine and the federal government all over his business.

As alleged by the FTC, the broker used data from the consumer’s credit report in an awkward attempt to defend his actions against a negative Yelp review. Aside from the social media thing going over a cliff, it is understandable that when someone assaults your reputation, you are inclined to fight back with all you have.

However, no regulator would condone the posting of consumer credit information on Yelp. That clearly violates a handful of laws, including the Fair Credit Reporting Act, GLBA, and the UDAAP prohibitions.

15 USC §1681(f) (FCRA) Certain use or obtaining of information prohibited

A person shall not use or obtain a consumer report for any purpose unless-

(1) the consumer report is obtained for a purpose for which the consumer report is authorized to be furnished under this section; and

(2) the purpose is certified in accordance with section 1681e of this title by a prospective user of the report through a general or specific certification.

15 USC §1681b. (FCRA) Permissible purposes of consumer reports

Subject to subsection (c), any consumer reporting agency may furnish a consumer report under the following circumstances and no other (2) In accordance with the written instructions of the consumer to whom it relates.

(3) To a person which it has reason to believe intends to use the information in connection with a credit transaction involving the consumer on whom the information is to be furnished and involving the extension of credit . . .

Don’t Misuse Credit Information – What Does It Mean to Misuse?

This permissible purpose restriction precludes divulging credit data outside of narrow uses. MLOs divulging consumer credit data outside written and permissible uses risk running afoul of the law.

The CFPB addressed a corollary issue in its 2022-04 Circular titled “Insufficient data protection or security for sensitive consumer information.” Under Title X, brokers can violate unfairness prohibitions when they fail to protect their customers’ non-public personal information (NPI). No data breach is necessary for unfairness to exist. The threat of a breach in light of substandard safeguards is sufficient to violate the unfairness prohibition.

Additionally, Title X prohibits deception. When a consumer grants access to credit information for legitimate purposes only to find their sensitive financial information posted on Yelp. The consumer is unlikely to have authorized the broker to pull their credit had they known the broker would post their sensitive credit information on Yelp. That is deception.

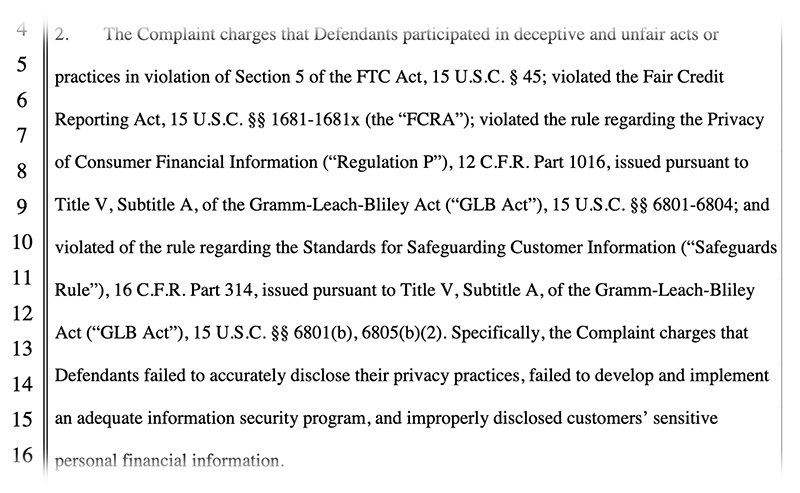

The FTC alleged that the broker violated prohibitions against unfairness and deception under Section 5 of the FTC Act. The Title X UDAAP prohibitions are similar to Section 5 of the FTC Act regarding unfair and deceptive practices.

The SAFE Act

The overarching purpose of the SAFE Act is for lenders and MLOs to act in the consumer’s best interests.

Purposes and methods for establishing a mortgage licensing system and registry

In order to increase uniformity, reduce regulatory burden, enhance consumer protection, and reduce fraud, the States, through the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators, are hereby encouraged to establish a Nationwide Mortgage Licensing System and Registry for the residential mortgage industry that accomplishes all of the following objectives: Establishes a means by which residential mortgage loan originators would, to the greatest extent possible, be required to act in the best interests of the consumer.

And don’t forget Regulation P (Privacy) and the FTC Safeguards Rule, as recently amended.

So the next time you are inclined to reveal NPI from the consumer’s credit report, think twice. Do you have the express written consent of the applicant to divulge such information? Does such consent provide sufficient assent for the disclosure you intend to make?

Users of consumer reports must ensure they do not violate consumer privacy by obtaining consumer reports when they lack a permissible purpose for doing so or by using credit data for other than permissible purposes.

Don’t leave it to chance. Get credit authorizations in writing before accessing a credit report. Don’t violate the applicant’s privacy by using credit data for impermissible purposes.

BEHIND THE SCENES – Bank of America Creates a Stir with the Community Affordable Loan Solution™, announcement

Conversations about Race and Mortgage Lending

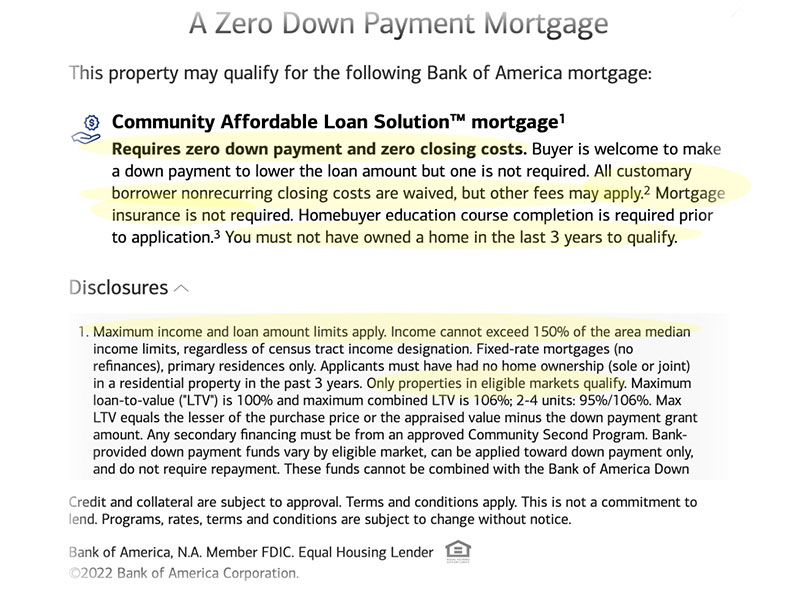

Bank of America recently announced a new program aimed at underbanked communities. The program offers Traditional or Nontraditional credit and 100% financing in limited locales, with no MI, no closing costs, and no minimum credit score. Wow. Too good to be true?

The program is only available in a few locales. The announcement did not exactly describe how Bank of America selected the locations for program availability. From a cursory review of their online collateral, the BOA has identified majority-minority neighborhoods or near majority-minority neighborhoods for program implementation. Why Charlotte and not Chicago? Or Miami but not Phoenix? The announcement mentions plans to expand the offering in 2023.

A few press reports indicated the program was exclusively for Black and Brown borrowers. However, the online collateral indicates no such limitation.

From the Bank of America Press Release on 08/30/22

“Homeownership strengthens our communities and can help individuals and families to build wealth over time,” said AJ Barkley, head of neighborhood and community lending for Bank of America. “Our Community Affordable Loan Solution will help make the dream of sustained homeownership attainable for more Black and Hispanic families, and it is part of our broader commitment to the communities that we serve.”

Bank of America today announced a new zero down payment, zero closing cost mortgage solution for first-time homebuyers, which will be available in designated markets, including certain Black/African American and/or Hispanic-Latino neighborhoods in Charlotte, Dallas, Detroit, Los Angeles and Miami.

The Community Affordable Loan Solution™ aims to help eligible individuals and families obtain an affordable loan to purchase a home.

The program requires no mortgage insurance or minimum credit score. Individual eligibility is based on income and home location. Prospective buyers must complete a homebuyer certification course provided by select Bank of America and HUD-approved housing counseling partners prior to application.

Racial Discrimination Prohibited Under the Fair Housing Act and ECOA

Prohibited Forms of Mortgage Discrimination

The question has come up, isn’t race discrimination in connection with credit administration prohibited under the Fair Housing Act and ECOA? How can or should a lender provide financing along racial lines or limit financing by race? In the case of BOA’s Community Affordable Loan Solution, it does not appear BOA has engaged in unlawful discrimination.

A Significant Problem Requiring Bold Measures

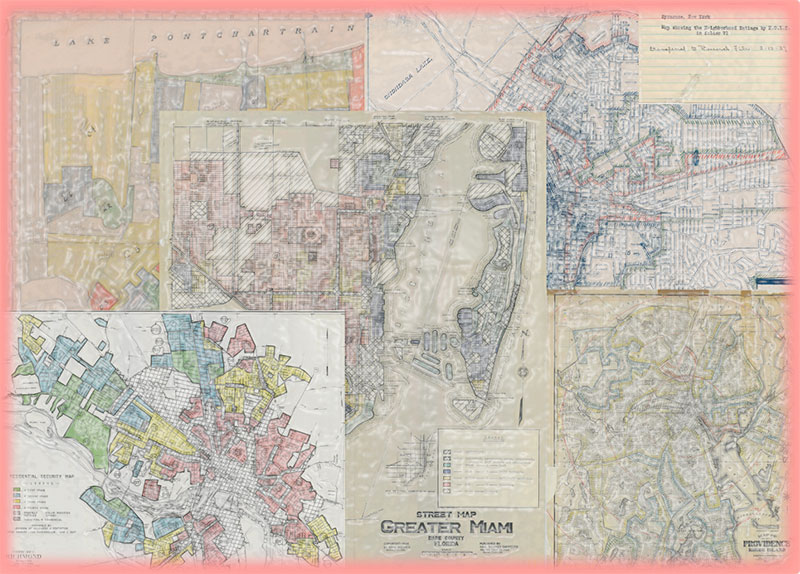

The Federal government took bold measures to alleviate housing and financial insecurity amid the Great Depression. The 1934 National Housing Act established the foundation for the FHA guaranteed loan program. The National Housing Act was part of what is known as the New Deal. The New Deal created substantive relief for people suffering from the Depression. However, some New Deal benefits, notably those from the National Housing Act, were unevenly distributed.

It was a New Deal for some white folks. However, when it came to equal housing opportunities, it was just another Raw Deal for people of color and others experiencing housing discrimination. The Act’s implementation was instrumental, along with other government housing programs, in developing segregated housing markets in many cities. Not just Birmingham and Atlanta, but San Fransisco, NYC, Detroit, Indianapolis, Cleveland, and many places south AND north of the Mason-Dixon line. The housing discrimination of the past reverberates to this day.

Unfortunately, because the federal government accepted rampant racial discrimination in the program implementation, the government-guaranteed loans went primarily to white folks to establish white neighborhoods. That includes program loans to developers, builders, and consumers.

No FHA financing for non-white neighborhoods created discrete disadvantages for people of color and others suffering under discriminatory housing practices. Due to discriminatory FHA program implementation, housing shortages and negative impacts on real estate values were significant. As a result, the non-white segregated neighborhoods were relegated to less desirable forms of financing.

Like the black and brown communities in the first half of the 20th Century, many recent immigrants from Asia and Europe also suffered housing discrimination. These discriminatory housing policies similarly ghettoized Chinese, Jewish, Polish, Irish, and Italian communities.

Despite years of stakeholder handwringing and progressive policies, black homeownership compared to white homeownership rates are not improving.

Consequently, the federal government has identified a need for specialized financing to address and remediate the homeownership and wealth gap.

Special Purpose Credit Programs

Bank of America has carefully labeled its Community Affordable Loan Solution as a Special Purpose Credit Program. What is that? Special Purpose Credit Programs are described and regulated by Regulation B, the implementing regulation for the Equal Credit Opportunity Act.

It does not appear the BOA program is restricted to Hispanic or African American applicants. But the question may arise, what if it were? Is that compliant? Don’t both the Fair Housing Act and Equal Credit Opportunity Act prohibit discrimination on the basis of race? Yes. However, according to the CFPB’s ECOA interpretation under Regulation B, if the program is otherwise compliant, designating the program for consumption along protected class lines is permissible under certain circumstances.

12 CFR §1002.8 the Act (ECOA) and this part (Regulation B) permit a creditor to extend special purpose credit to applicants who meet eligibility requirements under the following types of credit programs

(3) Any special purpose credit program offered by a for-profit organization, or in which such an organization participates to meet special social needs, if:

(i) The program is established and administered pursuant to a written plan that identifies the class of persons that the program is designed to benefit and sets forth the procedures and standards for extending credit pursuant to the program; and

(ii) The program is established and administered to extend credit to a class of persons who, under the organization’s customary standards of creditworthiness, probably would not receive such credit or would receive it on less favorable terms than are ordinarily available to other applicants applying to the organization for a similar type and amount of credit.

More to special purpose credit programs than 12 CFR 1002(8)(a)

Take a look at the CFPB’s effort to clarify the special purpose credit program described in Regulation B. Advisory Opinion published in the Federal Register on January 15, 2021.

The Bureau of Consumer Financial Protection (Bureau) is issuing this Advisory Opinion (AO) to address regulatory uncertainty regarding Regulation B, which implements the Equal Credit Opportunity Act, as it applies to certain aspects of special purpose credit programs designed and implemented by for-profit organizations to meet special social needs. Specifically, this AO clarifies the content that a for-profit organization must include in a written plan that establishes and administers a special purpose credit program under Regulation B. In addition, this AO clarifies the type of research and data that may be appropriate to inform a for-profit organization’s determination that a special purpose credit program is needed to benefit a certain class of persons.

Regulation B is clear that a special purpose credit program qualifies as such only where the program was established and is administered so as not to discriminate against an applicant on any prohibited basis.

All program participants may be required, however, to share one or more common characteristics (for example, race, national origin, or sex) so long as the program is not established and is not administered with the purpose of evading the requirements of the ECOA or Regulation B.

If participants in a special purpose credit program are required to possess one or more common characteristics and if the program otherwise satisfies the applicable requirements of Regulation B, a creditor may request and consider information regarding the common characteristic(s) in determining the applicant’s eligibility for the program.

The Advisory Bulletin may create more questions than it answers.

How will Bank Of America implement and subsidize the program?

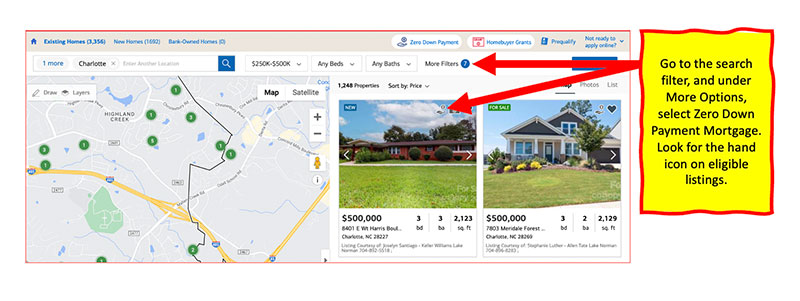

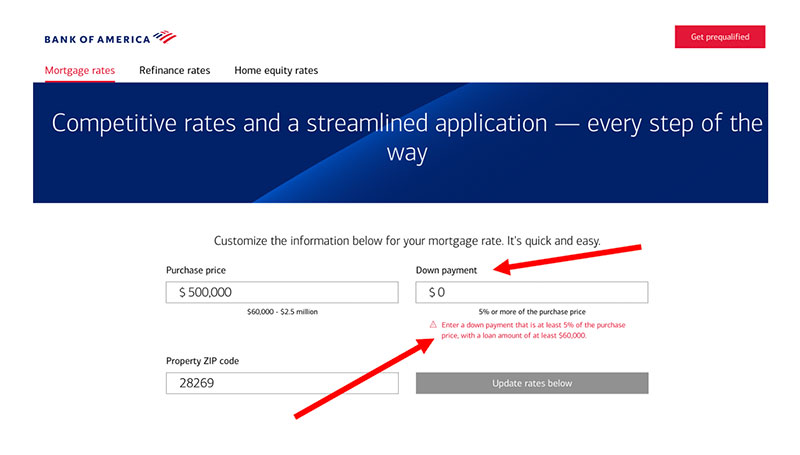

Note the screenshot from Bank Of America’s Mortgage website below. The Program is not promoted on BOA’s primary Retail platform. A query for 100% financing was returned with “put 5% down.” The Journal editor found the BOA consumer facing program presentation somewhat byzantine. It takes real commitment from senior management to make a program like this work. Leadership, accountability, and effective training. Meaningful metrics too.

From the available program collateral, there are no limits on the purchase price or the number of units Bank of America will fund. The disclosures indicate there are loan limits. The property in the screenshot is located in Charlotte, NC, Mecklenburg County, and is listed at $500,000. One other listing popped up under the zero-down filter at $550,000, indicating program availability to $550,000. The FHA limit in the area is $420,680.

The disclosures indicate income limits of 150% of the Area Median Income (AMI). AMI per borrower? The disclosure lacks appropriate specificity. The applicant’s combined income or aggregate household income must be intended. Consumers should not be expected to know that. The advertising disclosure needs work. Promising zero down and no closing costs should be accompanied by additional disclosure. Good old-fashioned disclosure, such as APR, monthly payment, and approximate cash to close should be front and center. Basic financing illustrations might be useful.

Is the Program Realistic? The devil is in the details, as they say. Since there is scant program collateral available, the Journal took a stab at the numbers with a few major assumptions on finance charges.

The Journal used the FNMA AMI tool, which indicates $91,000 for the Charlotte locale. USDA AMI numbers are similar, putting the ceiling income around $136,500. Hats off to BOA for pushing the envelope on moderate-income households.

Estimating $3,684 for PITIA and using the assumed ceiling income, do the numbers square? Assuming a rate near 6% (hey, they said they got 30B to spend) puts the front ratio on a 500K mortgage close to the 32% – 35% range.

As of this writing, 6% fixed, no down, 30-year financing with no MI or pre-paid finance charges is a mighty good deal. The numbers add up based on the assumptions. 100bps over APOR would still be a good deal (35% front ratio). They should have a reserve requirement. Residual income benchmarks would be smart too.

In the years ahead, the program may afford many households an opportunity at sustainable homeownership they might not otherwise gain. Heck, BOA is doing something for moderate-income households, unlike the GSEs with their apparent duty to underserve the moderate-income people in this country. Black, White, or Brown. (Hey guys – read the statute again, its not “duty to underserve” it is “duty to the underserved.”)

As far as underwriting, one would assume manual underwriting with the stated emphasis on non-traditional credit. One can imagine that the program’s underwriting heuristic should be well benchmarked for compliance purposes. The FHA 4000.1 for manually underwriting non-traditional credit is as good bet.

The Journal is all for 100% financing. Equity has a far lesser effect on mortgage sustainability than reserves. 100% financing enables the consumer to retain needed reserves. Chase did an excellent study on the relationship between reserves with early delinquencies. See that here: JP Morgan Chase Institute

So, what level of subsidy is BoA going to swing? Hey, they claim to have already pledged $30 billion to “offer affordable mortgages, industry leading grants and educational opportunities to help 60,000 individuals and families purchase affordable homes by 2025. Through this commitment, Bank of America has already helped more than 36,000 people and families become homeowners, having provided more than $9.5 billion in low down payment loans and over $350 million in non-repayable down payment and/or closing cost grants. To date, two-thirds of the loans and grants made through the Community Homeownership Commitment has helped multicultural clients to achieve homeownership. Bank of America also has a 26-year relationship with the Neighborhood Assistance Corporation of America (NACA), through which the Bank has committed to providing an additional $15 billion in mortgages to low-to-moderate income homebuyers through May 2027.”

Dang, they must be making some serious coin over at the Bank of America! Didn’t they just pay a $225M fine for withholding poor folk’s unemployment benefits during the worst of the COVID pandemic? $125M of that fine goes to those that endured hardships due to BOA’s ham-handed practices.

(Bank of America must pay back the money that they wrongly denied to consumers across the country because of the faulty fraud filter. The bank must also provide each affected consumer with a lump sum consequential harm payment, to be determined through a methodology of financial harm consumers suffered due to the time their accounts remained frozen or blocked. Finally, affected consumers will have the opportunity to receive additional redress through an individualized review process. See that story here: Faulty Fraud Detection = UDAAP!)

Bank of America, please don’t screw this initiative up like the state unemployment benefits. Remember the 1992 Houston Oilers? In the playoffs, they had a 35-3 third-quarter lead over the Buffalo Bills and ended up losing 41-38 in overtime. Remember the Falcons in the 2017 Super Bowl? No choking, please.

How cool would that be to see Chase and Wells Fargo develop similar programs?

Checkout the BoA program here:

Search for Homes In Eligible Cities

Tip of the Week – Easy Communication

Your customers want to know that you understand and respect their concerns. Gaining a shared vision of success with key stakeholders is essential to your success. Anytime you are laying the foundation for this shared vision, do what you can to quantify the measure of success. Vague terms such as ASAP, better, more, faster, when you get a chance, the best, and cheaper are terms leading to misunderstandings.

These vague and unhelpful terms should be discarded or avoided when managing your customer’s expectations. Instead, use quantified language such as “no later than 5:00 PM, no more than $1500, at least $26 monthly, within 14 days.” The specificity promotes clarity and understanding and leads to necessary and appropriate negotiations. Quantified refers to measurements or metrics. Objective expressions.

Rather than ” a tiny bit more,” say, ” Mr. Stakeholder, by a tiny bit more, do you mean between $50 to $100 more?

Saying No

Generally, it is best to avoid telling people no. Communicating things like “I can’t do that, that will never happen, you won’t get that, or that’s nuts” make the conversation about judgment (yours) rather than need (theirs). Instead, focus on their need, and determine how you can realistically meet the stated or underlying need. Easier said than done, but good things start with a goal.

Determine what you can commit to using nonjudgmental language. Instead of “do I look like Santa Claus to you” try, “I cannot commit to that. Here is what I can do for you. Or I can’t right now, but I want to discuss it after my 3:00 meeting. Would 4:20 work for you?” Too often, our response to demands is swift pushback.

In some cases, you want to get yourself some breathing room. It’s the end of the day. You’re beat, you’re late, and you’re not in the best frame of mind. That is not the time you may be equipped to address the needs of others effectively. Without being disingenuous, get some air. Instead of, “Back off and leave me the hell alone!” Try something like, “Hey, I’m beat, and I’m late. But I want to help. Can we take this up at 8:00 AM tomorrow morning? I’ll call you?”

If unable to meet the stakeholder requirement, always provide an alternative solution or goal. Don’t put yourself in a spot. Don’t push back. Stakeholders may attempt to corner you and entice or coerce you to make commitments you will regret. Never say, “I will do my best.” That is a given! And when you fail to produce what they want when they want it, then what? You pledged your best, and it turns out your best is not good enough. You stand there like a chump at the end of the buffet line, with your hands in your pockets. Hoping they’re bringing out more crab legs for your date. Or maybe you did not try hard enough. With some people, I will do my best, is like throwing a steak at a hyena and asking it to wait for the dinner bell. Disappointment and shame are coming your way. Be assertive.

Assertive does not mean combative, aggressive, or disrespectful. Assert in this context is to declare and often to repeat the declaration – that’s all. When folks try to corner you, punt or gain space by asking, “Great question, allow me to confer with my team, and I’ll get back to you before 5:00 PM tonight.”

If the other party ignores your needs or wants, just restate what you can or can’t commit to. Restate what you need and when you need it.

2022 CE – Sneak Preview

Time is running out. Sign up for the best CE in the industry.

LoanOfficerSchool.com is excited to provide a sneak peek into our 2022 CE offering. See the past LOSJ issues on subprime financing and servicing underserved markets that borrow heavily from the 2022 CE 2-Hour nontraditional mortgage product market segment.

We will cover key knowledge points necessary to implement a subprime program from soup to nuts. In addition, the course covers subprime underwriting requirements, how to prove that the subprime loan is in the consumer’s best interest, best efforts requirements, steering safe harbor, residual income calculation, recognizing loan risk, and the competencies necessary to shop your loan and get your customer the best price.

Dodd-Frank and the implementation of Regulation Z have had some negative and unintended consequences for American consumers. Coupled with the Fed’s monetary policies, runaway housing costs, and the management of the GSEs, we have an ugly housing storm brewing. As a result, the growing subprime industry may be well-situated to address the needs of many consumers falling into the remnants of the 2008 housing cracks.