Why Haven’t Loan Officers Been Told These Facts?

VA Lender Guide Change, Minimum Property Requirements

VA Lenders Handbook M26-7, Chapter 12, Topic 33.

Wood Destroying Insects/Fungus/Dry Rot

Effective immediately, VA is authorizing in advance, as a local variance, that Veterans may be charged wood destroying pest inspection fees, where required by the NOV. Veterans may also pay for any repairs required to ensure compliance with MPRs. Veterans are encouraged to negotiate the cost of the wood destroying pest inspection and repairs with the seller.

An itemized invoice identifying the Veteran and the property is required to verify the cost on the Closing Disclosure Statement (CD). Lenders should include the invoice(s) to support the cost of the inspection and any repairs in the loan file if the loan is selected for Full File Loan Review.

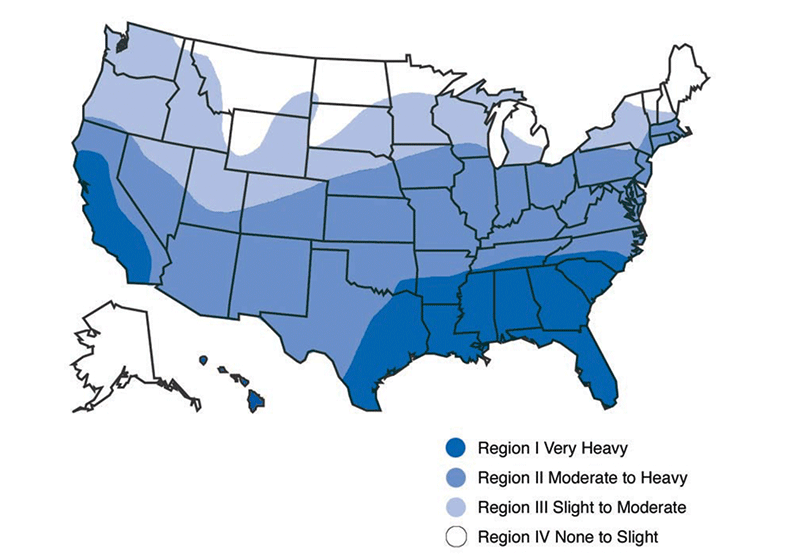

Historically, VA has authorized, as a local variance, that Veterans may be charged for a wood destroying pest inspection report in a limited number of states and territories. Localities susceptible to termites and other wood destroying pests, however, are on the rise. Accordingly, VA requires, as a Minimum Property Requirement, a wood destroying pest inspection report for certain properties located in an area on the Termite Infestation Probability Map where the probability of termite infestation is “very heavy” or “moderate to heavy.” If applicable, the VA Notice of Value (NOV) will be conditioned for this requirement and MPR repairs identified on a wood destroying pest inspection report must be completed prior to guaranty.

Whoops – The VA provided the wrong map with Circular 26-22-11! Sorry Mortgagees! Don’t use that map!

The VA clarifies which map to use when identifying moderate – heavy infestation probabilities related to the June 2022 policy change.

If the property is located in an area on the Termite Infestation Probability Map where the probability of termite infestation is “very heavy” or “moderate to heavy” on origination appraisals, a wood destroying insect inspection report must be required on the NOV.

Image from the Current VA Lender Handbook – USE THIS MAP, Not the one referenced in the June Circular PER THE JULY 28, 2022 CHANGE I

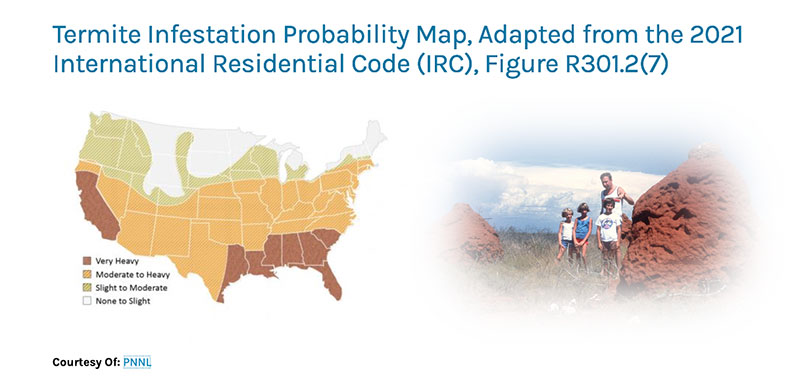

DO NOT USE THIS MAP – Termite Infestation Probability Map, erroneously referred to in the June 15, 2022, Circular 26-22-11

Adapted from the 2021 International Residential Code (IRC), Figure R301.2(7) | Building

America Solution Center (pnnl.gov) is updated to VA Lenders Handbook M26-7

While Supplies Last – ADUs!

BEHIND THE SCENES

Affordable Housing Requires a Paradigm Shift

Lenders Need New Markets/Homeownership Needs a Reboot

A Return to Multi-Generational Housing is Accelerating Solutions for the Affordable Housing Crisis

Accessory Dwelling Units (ADUs) Going Mainstream

Innovative housing solutions like ADUs are becoming more mainstream. Will you be on the sidelines? Is this a golden opportunity for third-party originators?

As the housing crisis intensifies, the demand for innovative solutions may gain more traction. Presently, the housing industry’s response to the housing crisis is like a driver stepping on the gas when stuck in the mud.

What about traditional subdivisions with much smaller homes? Subdivision efficiencies improve with bigger houses, not lots of mini-houses. Much of the infrastructure expenses are the same or higher for lower-margin mini-houses. The mini-house economics don’t square well and, at present, are uninviting for industry participants. Who will build these mini-dwellings? Not an unsubsidized building industry. High-density (stacked) housing projects work better, but people aren’t ready for that outside of urban locations.

The economics surrounding old-fashioned housing solutions centered around suburban subdivisions make less and less sense. Mini-homes in new subdivisions do not seem feasible at present. Accordingly, the time has arrived for diverse and more novel solutions, especially in this market. Necessity is the mother of invention.

It’s been a perfect storm for new construction. The industry has experienced a significant run-up in risks, including waning demand, higher interest rates (which affect the development and building costs), building materials shortages, and higher land, labor, and materials costs.

Instead of building post-WW2-styled suburban housing and reinventing the costly infrastructure attendant to these traditional subdivisions, why not leverage the existing infrastructure to maximize housing opportunities?

Many Problems Require Many Solutions

The affordable housing crisis does not have a silver bullet solution. More likely, sustainable homeownership is incremental and will be achieved by developing numerous solutions. Because of the diverse types of communities needing more affordable housing (e.g., suburban, urban, and rural locales, younger families, older families, extended families, students, retirees, and those requiring close family care), it stands to reason that there is no one-size-fits-all answer. However, the Accessory Dwelling Unit (ADU) is a straightforward solution for many affordable housing problems.

However, the financing of ADU improvements is anything but straightforward. Various financing concerns abound, assuming the state and local ordinances even permit an ADU. ADU financing may include different loan types such as purchase, refinance, take-out, construction, HELOC, and renovation loans. Additionally, loan manufacturing considerations include valuations, compliance, and credit policy. Despite the complexities, there is gold in those hills.

ADUs attenuate the housing crisis in two ways. First, in many communities, ADUs provide rental income for homeowners, thereby making homeownership more affordable for low-moderate income households. Roommates might be agreeable for some homeowners, but other folks prefer their own space. Second, the rental ADU provides housing solutions for renters. Our current housing crisis exists for both homeowners and renters. ADUs can help alleviate the affordable housing shortage on both fronts.

Furthermore, with the aging of America, multi-generational housing makes a lot of sense for many households. Caring for the elderly or disabled without appropriate enablements can have crushing financial and psychological consequences for the elderly, the disabled, and their families.

Could ADUs play a significant role in your community?

Will the GSEs approve properties with ADUs? Can ADU income contribute to stable monthly gross income for the capacity test? Will the appraiser value the ADU as a second unit? Do homes with ADU fall under one or two unit policies? Can the owner live in the ADU and rent the main improvements? Does the ADU’s proposed income count in the capacity test? Is an ADU financeable on the same lot with multi-family dwellings? What about modular or manufactured units? Can you combine a manufactured or modular main home with a manufactured ADU? What about bootlegged ADUs in a no-ADU-zoned locale?

Those are the kind of questions that MLOs must prepare to field. Naturally, the rules are somewhat different for each agency and government-guaranteed loan program.

Take a peak at what the GSEs have to say about ADUs. Could you partner with real estate agents and builders to bundle ADU offerings in your community?

From FNMA

An ADU, commonly referred to as an accessory apartment or secondary suite, is a smaller additional living space on the same lot as a single-family home. It has to include space for living, sleeping, cooking and bathrooms independent of the primary residence. While the ADU may or may not include access to the primary residence, it must be accessible without going through the primary residence and there must be some expectation of privacy from the home.

Examples of ADUs include (but are not limited to):

- A living area over a garage

- A living area in a basement

- A small addition to the primary dwelling

- A manufactured home (legally classified as real property).

Notable Selling Updates From FHLMC Touching on ADUs

FreddieMac Video

What if your community hates the idea of ADUs? What if you or the lender mishandle the transaction because this is all new to you? Next week, the Journal identifies some of the obstacles to successfully financing ADUs, and ADU bundles and what you can do to help.

Tip of the Week – Easy Communication Starts With the Right Questions

The URLA asks, “Have you had an ownership interest in another property in the last three years?” Hopefully, you know the answer to this question long before you get to the borrower’s declarations. Chances are you’d get to the declarations much more frequently on many more loans if you knew the answer to this central question before completing the URLA.

One of the more critical clusters of questions you can ask prospective applicants is about their home-buying experiences. Naturally, that includes their mortgage shopping and loan manufacture experiences.

Your ability to rapidly establish rapport and credibility with the prospect is critical to the sales effort and loan presentation. In addition, the prospect’s mortgage prism and surrounding sentiments impact their interactions with you and how they experience loan shopping and manufacture. Therefore, it makes sense that you must understand their hot buttons, needs, and perspective based on their experiences.

If the prospect felt like they got their lips ripped off the last time they got a mortgage, that might be useful to know. Did the prospect find their MLO responsive? Was the MLO knowledgeable? Did the MLO do what they promised? Did they feel respected by the MLO?

But how to approach the subject? Better to let sleeping dogs lie? No. A better metaphor for the circumstance is the foolishness of ignoring the elephant in the room. Depending on the prospect’s communication style, you might choose to grab the bull by the horns and wrangle the information from them. Or, you may try something more diplomatic. You might say, “Imagine the loan goes without a hitch, and you could not be more satisfied with the mortgage experience. What are the top three things that you might be most grateful for? That might include things that happened or did not happen?”

The prospect might tell you how to help them buy from you. Your interest in the prospect as a person, not just a buyer, and their unique perspective demonstrates respect for them. If the prospect feels respected and believes you are up to the task of helping them across the finish line, you have furthered the rapport and credibility necessary to frame and lead the successful loan manufacture.

2022 CE – Sneak Preview

Time is running out. Sign up for the best CE in the industry.

LoanOfficerSchool.com is excited to provide a sneak peek into our 2022 CE offering. See the past LOSJ issues on subprime financing and servicing underserved markets that borrow heavily from the 2022 CE 2-Hour nontraditional mortgage product market segment.

We will cover key knowledge points necessary to implement a subprime program from soup to nuts. In addition, the course covers subprime underwriting requirements, how to prove that the subprime loan is in the consumer’s best interest, best efforts requirements, steering safe harbor, residual income calculation, recognizing loan risk, and the competencies necessary to shop your loan and get your customer the best price.

Dodd-Frank and the implementation of Regulation Z have had some negative and unintended consequences for American consumers. Coupled with the Fed’s monetary policies, runaway housing costs, and the management of the GSEs, we have an ugly housing storm brewing. As a result, the growing subprime industry may be well-situated to address the needs of many consumers falling into the remnants of the 2008 housing cracks.