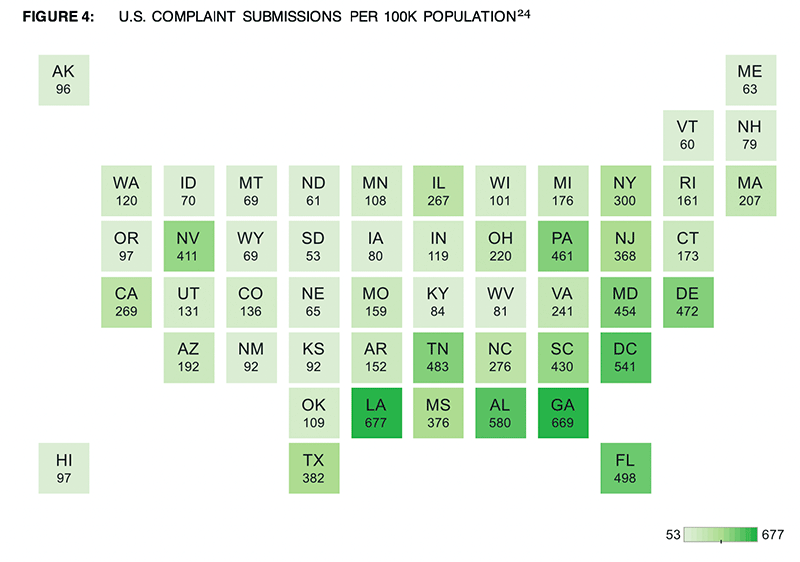

Comparison Of All Consumer Complaints To The CFPB By State

Consumers from all 50 states and the District of Columbia submitted complaints to the CFPB. To understand state and regional trends, the CFPB analyzes the geographic distribution of complaints after accounting for population differences. On a per capita basis, the CFPB received more complaints from consumers from Louisiana than anywhere else in the United States, followed by consumers in Georgia, Alabama, D.C., Florida, and Tennessee. Consumers in South Dakota submitted the fewest complaints of any state per capita.

Why Haven’t Loan Officers Been Told These Facts?

The CFPB Releases 2021 Consumer Complaint Data

Data Reveals Trends That May Portend Trouble for Non-Depository Mortgagees, Servicers, and Consumer Reporting Agencies

Mortgage origination complaint volume was substantially up from the 2019/2020 period.

From the CFPB

- Prospective homebuyers described problems when attempting to purchase or refinance a home. For example, borrowers frequently described lengthy application processing times, as well as unresponsive company representatives. These prospective homebuyers often stated that these delays and poor communication led to closing and settlement delays. Lenders typically responded to these types of complaints by stating that they were experiencing higher-than-normal loan application and processing volume due to high demand resulting from historically low interest rates.

- Homebuyers expressed frustration when their loan applications were denied. Some insisted that they were qualified for the loans and several disagreed with reasons for denial provided by lenders. Lenders typically responded that loan denials were appropriate under their mortgage lending guidelines. Lenders often said loan applications did not meet debt-to-income ratios or credit score requirements.

- Complaints about undisclosed changes to loan terms and costs was another concern raised by homebuyers. They shared concerns about receiving several sets of closing disclosures with terms different than originally discussed or disclosed in their loan estimates. Lenders sometimes responded that they had informed the homebuyer that certain charges could change even after the interest rate was locked if adjustments were within permissible tolerances. Some lenders stated that increases in application volume resulted in loans not closing within expected timeframes. In some instances, lenders responded to these types of complaints by providing monetary concessions due to delays.

Will Recent Complaint Volume Alter CFPB Enforcement Priorities?

§5514. Supervision of nondepository covered persons

1) In general, the Bureau shall

- Conduct examinations of nondepository covered persons to assess compliance with the requirements of Federal consumer financial law

- Obtain information about the activities and compliance systems or procedures of such person

- Detect and assess risks to consumers and markets for consumer financial products and services by nondepository lenders

The Bureau shall exercise its authority in a manner designed to ensure that nondepository lenders comply with federal consumer protection laws. Based on the assessment by the Bureau of the risks posed to consumers in the relevant product markets and geographic markets, and taking into consideration:

- The asset size of the covered person

- The volume of transactions involving consumer financial products or services in which the covered person engages

- The risks to consumers created by the provision of such consumer financial products or services

- The extent to which such institutions are subject to oversight by State authorities for consumer protection

- Any other factors that the Bureau determines to be relevant to a class of covered persons.

To comprehend the threat risk represented by noncompliance data, the CFPB compares the 2021 average monthly complaint data to the monthly average complaints for the prior two years. The much lower 2019 loan volume accounts for a significantly lower number of complaints in the 2019/2020 comparison sampling period. The total number of originated closed-end loans increased by about 5.3 million between 2019 and 2020, or 67.1 percent. 2021 volume was just slightly higher than 2020. However, the epic 2020/2021 loan volume does not quite equate to or explain the degree to which the 2021 complaint numbers increased.

In 2021, there was a 13% complaint increase on Conventional loans and a 17% increase on VA compared to the average number of monthly complaints for the 2019-2020 period. The CFPB does not provide sufficient data to parse the origination complaints along transaction types. Still, based on what is apparent from the CFPB reporting, the statistics suggest that on par with the 2019/2020 period, the expected average number of monthly complaints should increase by about 8% in 2021 due to the loan volume dissimilarities. As the CFPB is counting, the number of origination-related complaints rose by 13% from 2020 to 2021.

Getting a clear picture of what elements comprise these stats is a chore. Furthermore, the origination complaints are not necessarily a corollary to the HMDA data. Remember, HMDA data uses the term “originations” to include credit decisions, not just closed loans. Yet, the implications may be enough, and as the numbers are reported by the CFPB, that may be all that is needed to command the CFPB’s attention.

An Irresistible Corollary?

Is there a connection between recent increases in complaint volume to the changing face of mortgage originations? For instance, the market share of mortgages closed by non-depository, independent mortgage companies has substantially increased over the three-year period in question. For example, in 2021, non-bank lenders originated about 65% percent of covered owner-occupied first mortgages. That is up from 60.7 percent in 2020. There was a similar increase in the prior year-over-year comparison. From 2019 to 2020, the market share of non-depository institutions’ origination of closed loans increased by about 5%. That is not an insignificant shift in how mortgages originate in the USA.

Origination complaints are increasing as non-depository mortgage originators increase their market share. Is there a cause and effect, or are the trends coincidental but nothing more than unrelated and independent variables? The possible corollary is probably too much to ignore. Whatever conclusions can be drawn from the data is yet uncertain. Nevertheless, the trend likely incites the CFPB and other stakeholders to scrutinize non-depository mortgage origination.

The CFPB is continuously scouting the terrain for the next big threat risk to consumers. Lender noncompliance that may diminish competition or cause consumer harm is always teed-up high on their list of priorities. Third-party originators often lack the compliance resources of depository institutions. It stands to reason that as non-depository loan originations increase, so may non-compliance.

From a risk perspective, noncompliance by non-depository institutions is greater in the aggregate than the noncompliance of more resourceful and accountable chartered institutions.

The problem with third-party originator supervision is the sheer number of origination organizations. In the aggregate, the volume is vast. The ability of regulators to detect and correct noncompliance by thousands of smaller origination organizations is unrealistic. Consequently, the CFPB’s focus should fall on third-party origination fulfillment partners. There are not nearly as many of those to police. Creditors working with third-party originators can expect to come under increasing scrutiny and growing pressure to ensure that third-party originations are compliant. UDAAP affords state and federal regulators an excellent tool for this task. See below.

§5536. Prohibited Acts

(a) It shall be unlawful for any person to knowingly or recklessly provide substantial assistance to a covered person or service provider in violation of the provisions of section 5531 of this title (UDAAP §5531. Prohibiting unfair, deceptive, or abusive acts or practices), or any rule or order issued thereunder, and notwithstanding any provision of this title, the provider of such substantial assistance shall be deemed to be in violation of that section to the same extent as the person to whom such assistance is provided.

Therefore, be circumspect when doing business with lenders whose success with compliance is like that of the one-legged man in an ass-kicking contest. From the Examiners Handbook: Noncompliant once. Shame on you. Noncompliant twice. Shame on me. Examiners keep returning until the well runs dry.

Several Concerning Trends Were Identified in the Report

Excerpted From the 2021 CFPB Consumer Response Annual Report

Take a look at the data.

In 2021, the CFPB sent more than 750,000 complaints to approximately 3,400 companies for review and response. Complaints provide consumers the ability to bring their issues to the attention of companies. In turn, consumers—and the CFPB—expect complaint responses that are complete, accurate, and timely. How companies respond to the variety of issues consumers raise provides the CFPB with important information about areas of potential consumer harm.

The CFPB uses this information to monitor risk in financial markets, assess risk at companies, and prioritize agency action. The CFPB makes complaint data and analyses readily available to CFPB staff to support their supervisory, enforcement, and market monitoring activities.

Additionally, the CFPB makes complaint data available to other federal and state agencies, as well as the public.

The CFPB received approximately 32,000 mortgage complaints in 2021. The CFPB sent approximately 26,900 (or 84%) of these complaints to companies for review and response, referred 10% to other regulatory agencies, and found 5% to be not actionable. As of February 1, 2022, 0.2% of mortgage complaints were pending with the consumer and 0.1% were pending with the CFPB.

Companies responded to 98% of mortgage complaints sent to them for review and response. Companies closed 88% of complaints with an explanation, 3% with non-monetary relief, and 4% with monetary relief. Companies provided an administrative response for 1% of complaints. As of February 1, 2022, 1% of complaints were pending review by the company. Companies did not provide a timely response for 2% of complaints.

The remainder of this analysis focuses only on those mortgage complaints for which the company confirmed a commercial relationship with the consumer and responded with an explanation or relief. In 94% of these complaints, consumers reported that they attempted to resolve their issue with the company before submitting a complaint to the CFPB.

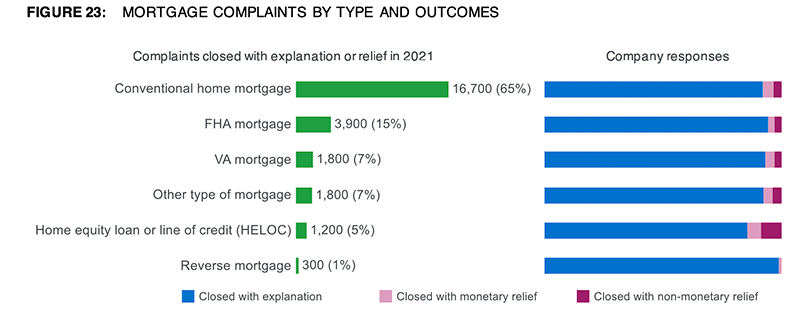

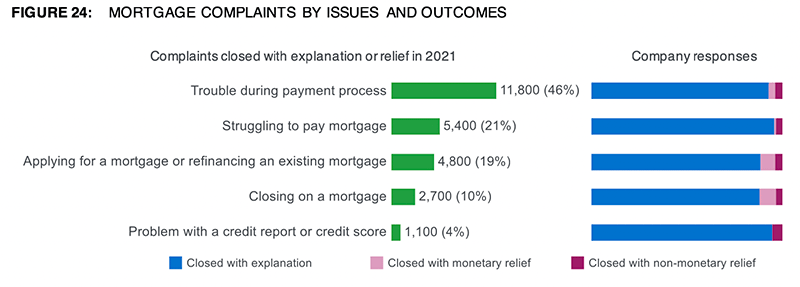

When submitting mortgage complaints, consumers specify the type of mortgage. In 2021, conventional home mortgages were the most complained about mortgage type (Figure 23). Consumers also identify the issue that best describes the problem they experienced. The most common issue was trouble during the payment process (Figure 24).

Mortgage complaint volume increased in 2021. Among the types of mortgages consumers identified in their complaints, the monthly average for conventional home mortgages increased 13% compared to the monthly average for the prior two years. The monthly average for VA mortgage complaints increased 17% compared to the monthly average for the prior two years.

The most common issue in mortgage complaints was about trouble during the payment process. Complaint volume about this issue peaked in early 2021 before generally declining for the remainder of the year (Figure 26). Similarly, complaint volume for the mortgage issue applying for a mortgage or refinancing an existing mortgage peaked in early 2021 before declining for the remainder of the year. Part of this trend may be explained by the increase in origination activity and consumers attempting to take advantage of lower interest rates.

Conversely, complaint volume about struggling to pay a mortgage peaked near the beginning of the pandemic—in early 2020—but then quickly decreased and remained at relatively lower levels for several months. This decrease may be explained in part by relief provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which became effective in March 2020 and provided relief for homeowners with federally backed mortgages. With many borrower protections having expired, complaint volume for this mortgage issue is again increasing to levels observed prior to the pandemic.

In other complaints, borrowers reported issues with escrow accounts, expressing frustration with having to make repeated attempts to resolve issues such as late fees and penalties associated with servicers failing to timely disburse property tax or insurance payments. Servicers typically apologized and paid fees for late tax or insurance payments, frequently attributing delinquencies to loan boarding or prior servicers.

BEHIND THE SCENES

Affordable Housing Requires a Paradigm Shift

Lenders Need New Markets

A Return to Multi-Generational Housing Provides an Answer to the Affordable Housing Crisis

Accessory Dwelling Units (ADUs) Going Mainstream

What if your community makes it tough to implement financing for ADUs due to Covenants, Conditions, and Restrictions, Bylaws, statutes, or zoning limitations?

It could be a chance for you to get involved with other stakeholders in addressing the challenge of affordable housing.

From AARP (American Association of Retired Persons)

ADU legislation has been enacted in California (2016), New Hampshire (2017), Oregon (2017), Rhode Island (2017), and Vermont (2005).

In parallel with local governments’ continuing revisions to their ADU ordinances, California (2019), Oregon (2019) and Vermont (2020) passed many amendments to their initial ADU legislation, chipping away at the various local regulatory barriers to ADU construction. Legislation authorizing or encouraging local governments to authorize ADUs was passed in Florida (allowing ADUs as affordable housing, 2004) and Maine (2019). Hawaii has had legislation allowing counties to permit two dwellings on all single-family lots since 1981.

AARP Produces Model Legislation Reducing Barriers to ADU Success

The continuing demand for affordable housing solutions, and evolving experience with ADU legislation, spurred AARP to provide stakeholders with a blueprint for ADU ordinances and legislation.

Consider AARP’s Guide to ADU legislation as a starting point if you want to get involved in affordable housing solutions while growing your mortgage business.

Find the AARP legislative model law: AARP Guide to ADU Legislation

Find the AARP guide to ADUs: AARP Guide to ADUs

Learn more from AARP about ADUs: AARP – Additional ADU Guidance

Tip of the Week – Gift Giving and Promotion

The Journal editor received the following question from a CE student and thought the LOSJ readers might benefit from the exchange. The Journal edited the student’s question.

STUDENT QUESTION: What if a loan officer rented a nail salon for her top realtors? Would it be okay if the MLO paid to have their nails done and provided wine and snacks? Is that a RESPA violation?

Gifts or promotions directed to a referral source are not prohibited if they are a “normal promotional or educational activity” meeting the conditions in Regulation X, 12 CFR § 1024.14(g)(1)(vi). The CFPB provides some guidance for this sort of thing (MSAs/Promotions/Gifts see FAQ 2 under Gifts and Promotional Activity). The exclusivity of the event in question could be problematic.

12 CFR § 1024.14(g)(1)(iv) Normal promotional and educational activities that are not conditioned on the referral of business and that do not involve the defraying of expenses that otherwise would be incurred by persons in a position to refer settlement services or business incident thereto

FAQ 2 Whether the item or activity is targeted to referral sources. If an item or activity is targeted narrowly towards prior, ongoing, or future referral sources, this could indicate the item or activity is conditioned on referrals of business. For example, if a promotional item is provided only to a limited set of settlement service providers who also happen to be current referral sources or an intentionally targeted group of future referral sources, this may suggest that the recipient is receiving the promotional item because of past or future referrals and, thus, the promotional item may be conditioned on referrals. If, instead, a promotional item is provided to a broader set of recipients, such as the general public or all settlement service providers offering similar services in a given locality, then that may indicate that the promotional item is not conditioned on referral of business.

Compliance might be measured on a continuum of more or less risky (uncertainty surrounding compliance) practices. I’d say what you described is towards the more risky end of the continuum. Perhaps a less risky approach, according to 1024.14(g)(1)(iv), would be a monthly meet-up open to the first 20 real estate agents that sign up (not based on referral activity). Collecting a nominal attendance fee might further reduce the noncompliance risk (not defraying a cost the real estate agents might otherwise incur). Such a practice might also be a more innovative move to grow one’s business. Take care of existing customers but also develop prospective business customers.

See the CFPB Section 8 FAQ here: CFPB RESPA Section 8 FAQ

An Afterthought

After the exchange with the student, it struck the Journal Editor that an MSA with the nail salon might be a good opportunity for enterprising MLOs. How hungry might nail salons, restaurants, or hatchet throwing bars be for new customers and free marketing?

Be compliant, creative, and successful. Educational events afford MLOs an opportunity to develop new markets. See the ADU article above.

Remember, much of the media’s mortgage doom, and gloom is part hogwash. The precipitous 2022 fall in mortgage volume is real. However, note that the fall is from an epic benchmark. The 2020/2021 volume was astounding. No place to go but down from those numbers.

Neither the LOS nor the LOSJ provides legal advice. Nor should anything in this article be construed as a legal opinion on specific facts or circumstances. Readers are encouraged to consult with legal counsel concerning legal matters and specific legal questions.