Why Haven’t Loan Officers Been Told These Facts?

FHA Joins FNMA and FHLMC in Scoring Rental History for First-Time Homebuyers

For TOTAL scoring events on or after 10/30/22

Excerpted from Mortgagee Letter 2022-17

The provisions of Mortgagee Letter 2022-17 apply to Single Family Title II forward purchase programs which are evaluated in the TOTAL Mortgage Scorecard system.

Last year, FNMA introduced the Automated Underwriting (AU) feature allowing the GSE to evaluate timely rental payments in Desktop Underwriter® (DU®). Then, in 2022, FHLMC followed suit. Now, the FHA is also onboard with a positive rent rating scored by TOTAL. However, unlike FNMA and FHLMC, no authorized asset report supplier is necessary, nor does FHA require a 12-month verification of assets (VOA).

In the case of GSEs, the VOA provides the AU input for positive rent history. Essentially, the AU identifies recurring depository account debits from the VOA report, indicating consistent and timely rent payments.

The FHA went another direction, requiring the lender to determine the applicant’s timely rent payment and indicate such as an input to the TOTAL Scorecard.

A few points about the FHA rent analysis:

- Rental payment is considered to be on time when it is paid within the month due.

- The positive rent history option applies to first-time homebuyers. The FHA uses “First Time Homebuyer” more liberally than other programs. For instance, the FHA first-time homebuyer would include an individual who is divorced or legally separated and has had no ownership interest in a principal residence (other than joint ownership interest with a spouse) during the three years before the case number assignment.

This marital provision means that recently divorced parties are not excluded from the first-time buyer status inside the typical three-year homebuyer test. For example, an applicant divorced in June 2020. The applicant co-borrowed with the former spouse for the marital home. The parties then closed on the sale of the marital home that same month. Both are now first-time buyers under the FHA requirement for positive rent history.

From the FHA

Currently, rental verification is not a feature of most Tri-Merged Credit Reports or Residential Mortgage Credit Reports provided for FHA-insured products that require credit data.

When provided, the rental verification generally exists as separate documentation. TOTAL Mortgage Scorecard does not currently evaluate credit data other than that found in the credit report associated with the application.

Several studies have indicated that positive rental history may represent lower credit risk and could improve credit scores if such information were included in credit reporting data.

To recognize such potentially positive credit attributes, FHA is updating its TOTAL Mortgage Scorecard to allow for the utilization of positive rental payment history for the credit risk assessment when delivering credit decisions through the TOTAL Mortgage Scorecard.

Using rental payment history promotes a more complete credit evaluation while appropriately managing risk to the FHA Mutual Mortgage Insurance Fund.

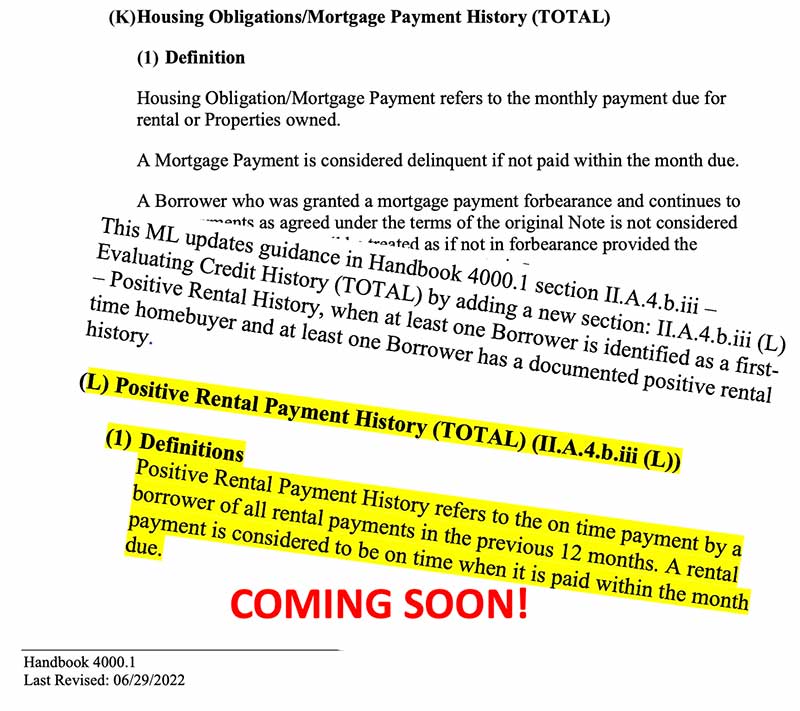

This ML updates guidance in Handbook 4000.1 section II.A.4.b.iii – Evaluating Credit History (TOTAL) by adding a new section: II.A.4.b.iii (L) – Positive Rental History, when at least one Borrower is identified as a first- time homebuyer, and at least one Borrower has a documented positive rental history.

4000.1 Update

(L) Positive Rental Payment History (TOTAL) (II.A.4.b.iii (L))

due.

From time to time, FHA will release new versions of TOTAL Mortgage Scorecard. FHA will announce the date that the new version will be available. All Mortgages being scored for the first time will be scored using the new version. For Mortgages with a case number, the Mortgages will be scored using the version that was effective when the case number was assigned. Existing Mortgages scored without a case number will be scored according to the version number tag that is provided in the TOTAL file by the AUS provider (if none, then the current version will be used). All Mortgages without a case number will be scored using the new version 90 Days after the new version is implemented.

Summary of Changes

Definitions

Positive Rental Payment History refers to the on-time payment by a borrower of all rental payments in the previous 12 months. A rental payment is considered to be on time when it is paid within the month due. (How do you like that definition for timely payment!!!)

A First Time Homebuyer refers to an individual who has not held an ownership interest in another property in the three years prior to the case number assignment. First Time Homebuyer includes an individual who is divorced or legally separated and who has had no ownership interest in a principal residence (other than joint ownership interest with a spouse) during the three years prior to case number assignment.

Standard

A Mortgagee may submit the transaction to TOTAL Mortgage Scorecard indicating a Positive Rental Payment History provided:

- The transaction is a purchase

- At least one Borrower is identified as a First Time Homebuyer

- The Minimum Decision Credit Score (MDCS) is 620 or greater

- At least one Borrower has a documented history of a positive rental payment history with monthly payments of $300 or more for the previous 12 months (similar to the GSEs payment amount floor).

Required Documentation

To verify the Borrower’s rental payment history, the Mortgagee must obtain a copy of the executed rental or lease agreement and one or more of the following:

- Written verification of rent from a landlord with no Identity of Interest with the Borrower

- 12 months of canceled rent checks

- 12 months bank or payment service statements documenting rents paid

- Landlord reference from a rental management company

Borrowers renting from a Family Member must provide a copy of the executed rental or lease agreement and 12 months of canceled checks or bank statements to demonstrate a satisfactory rental payment history.

Unlike the GSE’s positive rental history verification, no particular fintech provider is necessary.

FHA Connection and the TOTAL Mortgage Scorecard have been updated with an indicator that the Mortgagee may use when a positive rental payment history has been documented and submitted for one of the Borrowers.

Read more about beefing-up marginal AU submissions with positive rental histories here.

FHLMC Announces AU Enhancement

LOSJ Article – Positive Rent History In DU

BEHIND THE SCENES

Affordable Housing Requires a Paradigm Shift

Lenders Need New Markets

Accessory Dwelling Units (ADUs) Going Mainstream

In recent Journal issues, we reviewed the GSE’s disposition towards the ADUs. Another key stakeholder featured in the Journal ADU series is the American Association of Retired Persons (AARP) interest group. Affordable housing has become a priority for this powerful and influential advocacy group advocating. For lenders serious about pursuing non-customers (those market segments not currently on their radar), we also wanted to share the perspective of a non-mortgage stakeholder, like the AARP.

Identifying non-customers and key stakeholders in the affordable housing milieu is a good first step in exploiting the burgeoning ADU and manufactured housing market. You might want to brainstorm with prospective partners and internal stakeholders to identify key stakeholders in the affordable housing struggle.

This week, the Journal touches on ADU matters from HUD’s perspective. The 4000.1 is the go-to source for the Title I (renovation and manufactured housing) and Title II programs.

From the Handbook 4000.1 (Provided by the Journal in FAQ format)

Q. What is an Accessory Dwelling Unit (ADU)

A. An Accessory Dwelling Unit (ADU) refers to a habitable living unit added to, created within, or detached from a primary one-unit Single Family dwelling, which together constitute a single interest in real estate. It is a separate additional living unit, including kitchen, sleeping, and bathroom facilities.

Q. Is a one-unit property with an ADU considered a two-unit property?

A. No. A one-unit Property is a Single Family Residential Property with a single Dwelling Unit or with a single Dwelling Unit and a single ADU.

Q. What is the effect of an ADU on the unit count when combined with a Two – Four unit property?

A. For any Property with two or more units, a separate additional Dwelling Unit must be considered as an additional unit.

Q. Must the ADU borrower abide by the HUD 92561 “Borrower’s Contract with Respect to Hotel and Transient Use of Property?”( No portion of the housing shall be used for transient or hotel purposes;The Secretary has defined the term transient or hotel purposes to mean (1) any rental for a period less than 30 days)

A. Yes. The Mortgagee must obtain a completed form HUD-92561, Borrower’s Contract with Respect to Hotel and Transient Use of Property, for each Mortgage secured by a one-unit Single Family dwelling with an Accessory Dwelling Unit (ADU) or a two- to four-unit dwelling.

Q. Can the Mortgagee use the rental income from the subject with an ADU as effective income?

A. It depends. The 4000.1 is not explicit in this area. However, the 4000.1 states, “Rental Income from the subject Property may be considered Effective Income when the Property is a two- to four-unit dwelling or an acceptable one- to four-unit Investment Property.” Generally, investment property is not eligible for FHA insurance, with a few exceptions. Consequently, the lender might consider ADU rental income as boarder income, ignoring boarder income for applicants who fail to meet the boarder income requirements. On the other hand, ignoring ADU boarder income/rental income does not make sense in light of the agency’s 2-4 unit rental income policy. Perhaps clarification from FHA would be helpful.

The 4000.1 refers to a “Boarder” as an individual renting space inside the Borrower’s Dwelling Unit. The 4000.1 states that “Rental Income from Boarders is only acceptable if the Borrower has a two-year history of receiving income from Boarders that is shown on the tax return and the Borrower is currently receiving Boarder income.”

Q. Regarding ADU analysis, do the appraiser and property requirements protocols, analysis, and reporting differ from origination and processing requirements?

A. Yes. As part of the highest and best use analysis, the Appraiser must make the determination to classify the Property as a Single Family dwelling with an ADU, or a two-family dwelling. The conclusion of the highest and best use analysis will then determine the classification of the Property and the analysis and reporting required.

The Appraiser must not include the living area of the ADU in the calculation of the Gross Living Area (GLA) of the primary dwelling.

Q. Will the appraiser consider a manufactured ADU in the value reconciliation and analysis?

A. Yes. The Appraiser may consider a Manufactured Home to be an ADU if it meets the highest and best use and FHA requirements. The Appraiser may value a Manufactured Home on the Property that physically or legally may not be used as a dwelling and does not pose any health and safety issues by its continued presence as a storage unit.

Tip of the Week

It’s a Good Time to Expand Your Geographic Service Area

Could state licensure be holding you back? It is never a good time to reduce costs at the expense of growing your business. But, even more, now is not the time to skimp on your business. Instead, get immediate access to new markets while meeting state education and licensing requirements. The 2018 amendment to the SAFE Act allows the licensing state to grant temporary origination authority to MLOs while seeking licensure. If your company is licensed in the property state – don’t go giving away your business.

Don’t wait until it’s too late. Alternately, determine how to get Temporary Authority before the pressure is on.

The Economic Growth, Regulatory Relief, and Consumer Protection Act (S. 2155 or the amendments), which was signed into law on May 24, 2018, adds a new section to the federal SAFE Act (12 U.S.C. 5101 et seq.) entitled “Employment Transition of Loan Originators.”

Temporary Authority to act as a loan originator permits qualified MLOs who are changing employment from a depository institution to a state-licensed mortgage company and qualified state-licensed MLOs seeking licensure in another state to originate loans while completing state-specific licensure requirements such as education or testing.

MLOs must be employed by a state-licensed mortgage company in the application state and either registered in NMLS as an MLO continuously during the one year preceding the application submission; or be licensed as an MLO continuously during the 30 days preceding the date of application.

The amendments provide that an “application State means a state in which a registered loan originator or a State-licensed loan originator seeks to be licensed.” Based on this language, CSBS believes that “move” does not refer to nor require an MLO seeking Temporary Authority to change their physical address. The CSBS believes that S. 2155 allowed MLOs to expand their authority to originate mortgages from bank to non-bank and state to state. With this understanding, an MLO could simultaneously be eligible for Temporary Authority in any number of states.

See the NMLS Temporary Authority Resources here: