Why Haven’t Loan Officers Been Told These Facts?

With an increasing number of applicants turning to co-borrowers and co-signers, an examination of the FHA non-occupying co-borrowers and co-signer requirements might be helpful. This week, the Journal clears up the 4000.1 and the 203(b) Title II regulations related to non-occupying co-borrowers and co-signers.

First, some clarification surrounding basic FHA requirements. Misunderstanding credit requirements often begins with confusing creditor risk management policies (credit overlays) with FHA program regulations. Accordingly, it pays to distinguish between these two key stakeholders’ requirements. The FHA requirements should be uniform in practice, but the creditors’ policy overlays may vary from deal to deal and lender to lender. Let’s start with a cursory review of FHA occupancy requirements.

Occupancy Types, The Basics

Principal Residence Definition

A Principal Residence refers to a dwelling where the Borrower maintains or will maintain their permanent place of abode, and which the Borrower typically occupies or will occupy for the majority of the calendar year. A person may have only one Principal Residence at any one time.

At least one Borrower must occupy the Property within 60 Days of signing the security instrument and intend to continue occupancy for at least one year.

FHA will not insure more than one Property as a Principal Residence for any Borrower, except as noted below.

Relocation

A Borrower may be eligible to obtain another FHA- insured Mortgage without being required to sell an existing Property covered by an FHA-insured Mortgage if the Borrower is:

- Relocating or has relocated for an employment-related reason.

AND - Establishing or has established a new Principal Residence in an area more than 100 miles from the Borrower’s current Principal Residence.

Increase in family size

A Borrower may be eligible for another house with an FHA-insured Mortgage if the Borrower provides satisfactory evidence that:

- The Borrower has had an increase in legal dependents and the Property now fails to meet family needs.

AND - The Loan-to-Value (LTV) ratio on the current Principal Residence is equal to or less than 75% or is paid down to that amount, based on the outstanding Mortgage balance and a current residential appraisal.

Vacating a jointly-owned Property

A Borrower may be eligible for another FHA-insured Mortgage if the Borrower is vacating (with no intent to return) the Principal Residence which will remain occupied by an existing co-Borrower.

Non-occupying co-Borrower

- A non-occupying co-Borrower on an existing FHA- insured Mortgage may qualify for another FHA-insured Mortgage on a new Property to be their own Principal Residence.

- A Borrower with an existing FHA-insured Mortgage on their own Principal Residence may qualify as a non-occupying co-Borrower on other FHA-insured Mortgages.

Secondary Residence

Secondary Residence refers to a dwelling that a Borrower occupies in addition to their Principal Residence, but less than a majority of the calendar year. A Secondary Residence does not include a Vacation Home.

- The commuting distance to the Borrower’s workplace creates an undue hardship on the Borrower and there is no affordable rental housing meeting the Borrower’s needs within 100 miles of the Borrower’s workplace.

AND - The maximum mortgage amount is 85 percent of the lesser of the appraised value or sales price.

A Few Points to Remember with Non-Occupant Co-Borrowers and Co-Signers

- Non-occupant co-borrowers and co-signers need not be family members. However, there are significant restrictions for unrelated, non-occupying co-borrower or co-signing parties—chiefly lower maximum LTVs.

- The lender cannot use income from a non-occupant co-borrower or co-signer to determine qualifying ratios if the occupants are without credit scores. Lenders must adhere to the manual underwriting ratio matrix.

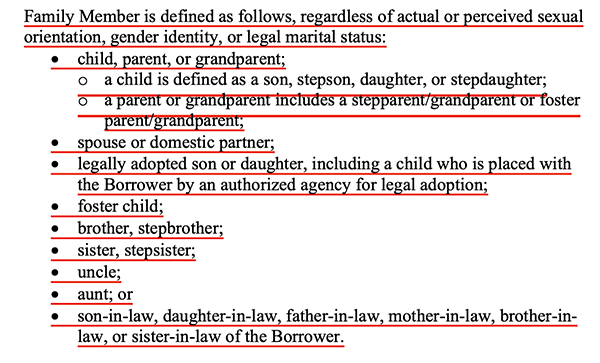

- The term “family member” is central to many FHA requirements, including, in some cases, co-borrowers. The 4000.1 contextually describes family members in relation to the sales contract. The 4000.1 also defines the term “family member” in the 4000.1 glossary.

- The 4000.1 requirements for family members differ from non-family member requirements. Unless HUD provides competing definitions, the 4000.1 glossary definition for “family member” may apply to all instances of family member requirements unless stated or implied otherwise.

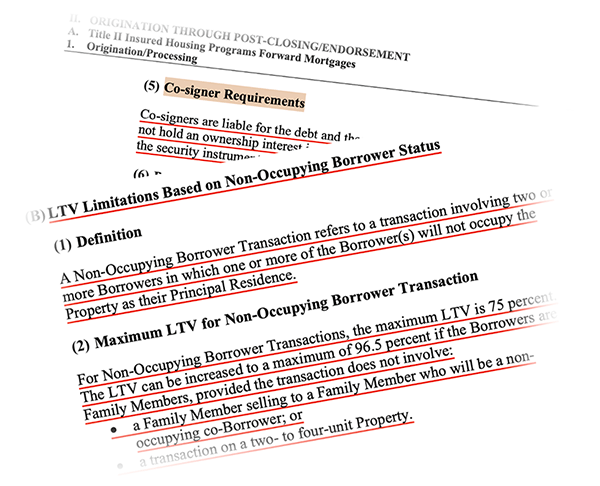

Co-Signers and Non-Occupying Co-Borrowers Differ

- Co-signers are liable for the debt and therefore, must sign the Note. Co-signers do not hold an ownership interest in the subject Property and therefore, do not sign the security instrument.

- Non-occupying co-Borrowers or Co-signers must either be United States (U.S.) citizens or have a Principal Residence in the U.S.

LTV Limitations Based on Non-Occupying Borrower Status

A Non-Occupying Borrower Transaction refers to a transaction involving two or more Borrowers in which one or more of the Borrower(s) will not occupy the Property as their Principal Residence.

For Non-Occupying Borrower Transactions, the maximum LTV is 75 percent. The LTV can be increased to a maximum of 96.5 percent if the Borrowers are Family Members, provided the transaction does not involve:

- A Family Member selling to a Family Member who will be a non-occupying co-Borrower (75% Max LTV)

OR - A transaction on a two – to four-unit Property (75% Max LTV)

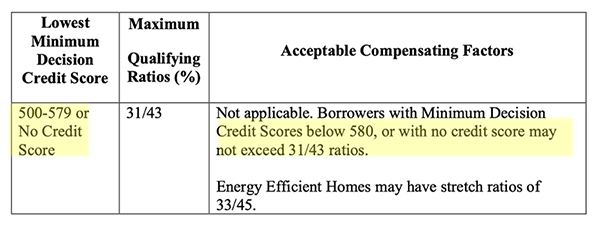

Approvable Ratio Requirements (Manual)

The maximum Total Mortgage Payment to Effective Income Ratio (PTI) and Total Fixed Payments to Effective Income Ratio, or DTI, applicable to manually underwritten Mortgages are summarized in the matrix below.

The qualifying ratios for Borrowers with no credit score are computed using income only from Borrowers occupying the Property and obligated on the Mortgage. Non-occupant co-Borrower income may not be included.

The FHA will insure maximum LTVs with non-traditional credit transactions. However, “the Mortgagee must either obtain a Tri-Merged Credit Report (TRMCR) or a Residential Mortgage Credit Report (RMCR) from an independent consumer reporting agency. If the TRMCR or RMCR generates a credit score, the Mortgagee must utilize traditional credit history.”

4000.1 II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT A. Title II Insured Housing Programs Forward Mortgages, 1. Origination/Processing (E) reference family members, Glossary entry “Family Member.”

See the 4000.1 Glossary here: FHA 4000.1 Glossary

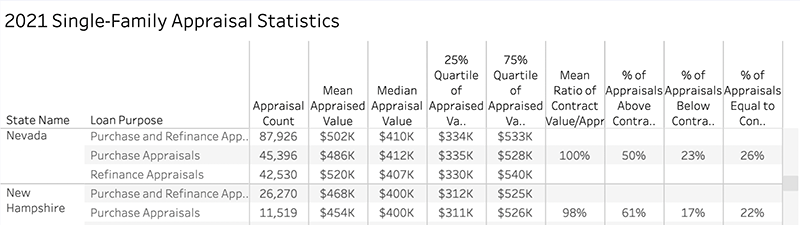

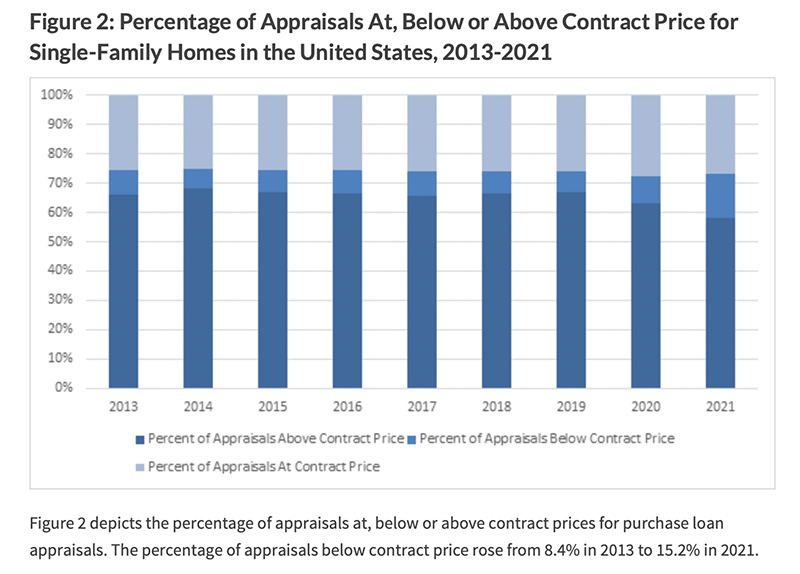

BEHIND THE SCENES – FHFA Makes Extensive Appraisal Data Public

A few key points from the 2021 data.

- Puerto Rico had the highest percentage of appraisals below the contract price at 30%, followed by

- Florida – 24%

- Nevada – 23%

- Arizona – 20%

- Hawaii – 20%

- Iowa had the lowest percentage of appraisals below the contract price at 4%, followed by

- Washington D.C. – 6%

- South Dakota – 7%

- North Dakota – 8%

- Montana – 9%

10/24/22 Washington, D.C. – The Federal Housing Finance Agency (FHFA) today published its new Uniform Appraisal Dataset (UAD) Aggregate Statistics Data File. FHFA also launched UAD Aggregate Statistics Dashboards on its website to provide user-friendly visualizations of the newly available data.

“As home valuations are a vital component of the mortgage process, publishing transparent, aggregate data on appraisals provides useful information to the public while protecting borrowers’ personally identifiable information,” said Director Sandra L. Thompson. “Today’s announcement exemplifies our commitment to the development of a more efficient and equitable valuation system that ultimately reduces appraisal bias.”

The UAD Aggregate Statistics Data File and UAD Aggregate Statistics Dashboards give stakeholders and the public new access to a broad set of data points and trends found in appraisal reports. Additionally, the appraisal statistics may be grouped by neighborhood characteristics and geographic levels (national, state plus the District of Columbia and Puerto Rico, Metropolitan Statistical Areas (MSAs) or Metropolitan Divisions, county, and tract). Of note, the UAD Aggregate Statistics Data File is intended for users capable of using statistical software to extract and analyze data. In contrast, the UAD Aggregate Statistics Dashboards are for users of all types and are designed to provide user-friendly access through customized maps and charts.

FHFA’s Division of Research and Statistics used 47.3 million UAD appraisal records collected from 2013 through the second quarter of 2022 on single-family properties to create a data file of UAD aggregate statistics in a manner that protects borrower privacy. Each UAD appraisal record includes information reported by appraisers on the Uniform Residential Appraisal Report (URAR). The current version of the URAR for single-family homes is Fannie Mae Form 1004 and Freddie Mac Form 70.

Home valuation through the appraisal process is a vital component of the home purchase, mortgage lending, and equity-building processes. The public release of appraisal data may offer a new resource to generate valuable insights. Publicly sharing appraisal data improves market transparency and supports the public in analyzing potential valuation bias and discrimination.

UAD State and County Dashboard

Tip of the Week – Don’t Talk When Listening is Required.

Unnecessary Assumptions Instead of Understanding.

Two maxims to remember. God gave us two ears and one mouth, so we should listen twice as much as we speak. And the second maxim is like the first; Samson slew 1000 with the jawbone of an ass. Likewise, with the same equipment, the salesperson destroys far too many prospects ;).