Why Haven’t Loan Officers Been Told These Facts?

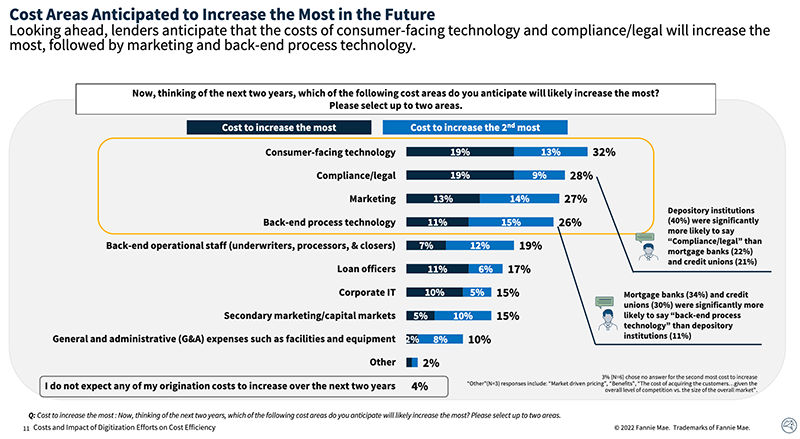

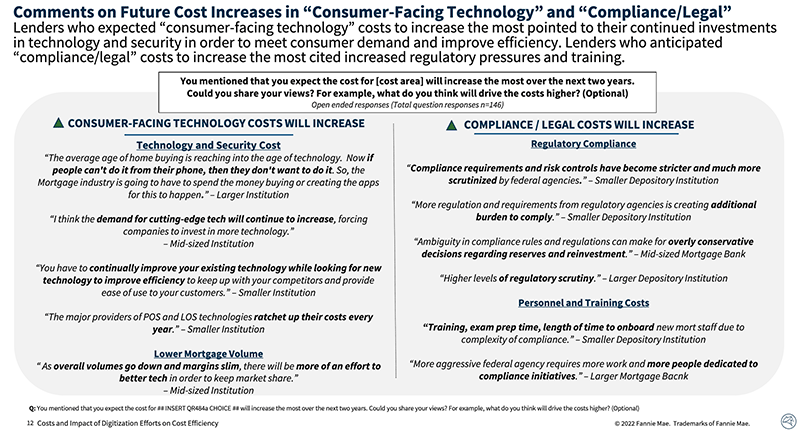

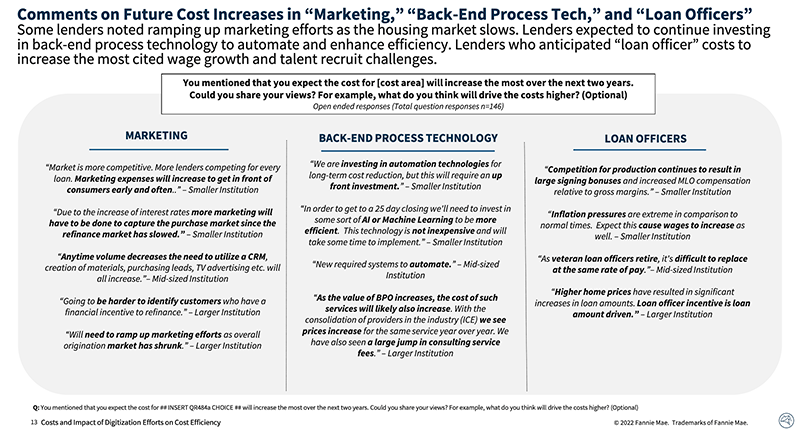

FNMA’s Mortgage Lender Sentiment Survey®

Special Topics Report

How mortgage executives see 21st Century loan origination changes driving production costs. See for yourself.

See the report in its entirety here: FNMA Special Topics Report

BEHIND THE SCENES – The Fair Credit Reporting Act

Is the CFPB on a War Footing with the CRAs?

The CFPB Issues a New Circular Encouraging the States to Open A Fresh Can of Whoop-Ass On Obstinate CRAs

From the CFPB

Washington, D.C.

November 10, 2022

The CFPB Issues Guidance (to regulatory enforcement agencies) to Address Shoddy Investigation Practices by Consumer Reporting Companies

The Consumer Financial Protection Bureau (CFPB) has issued a circular to affirm that neither consumer reporting companies nor information furnishers (those that report consumer credit data to the CRAs) can skirt dispute investigation requirements.

The circular outlines how federal and state consumer protection enforcers, including regulators and attorneys general, can bring claims against companies that fail to investigate and resolve consumer report disputes.

The CFPB has found that consumer reporting companies and some furnishers have failed to conduct reasonable investigations of consumer disputes and spend the time necessary to get to the bottom of inaccuracies. These failures can affect, among other things, people’s eligibility for loans and interest rates, for insurance, and for rental housing and employment.

“One wrong piece of information on a person’s credit report can have destructive consequences that follow a consumer for years,” said CFPB Director Rohit Chopra. “Companies that fail to properly address consumer disputes in accordance with the law may face serious consequences.”

When people identify inaccurate information on their consumer report, they can dispute it with the consumer reporting company. However, that important right is dependent on consumer reporting companies and furnishers conducting complete investigations.

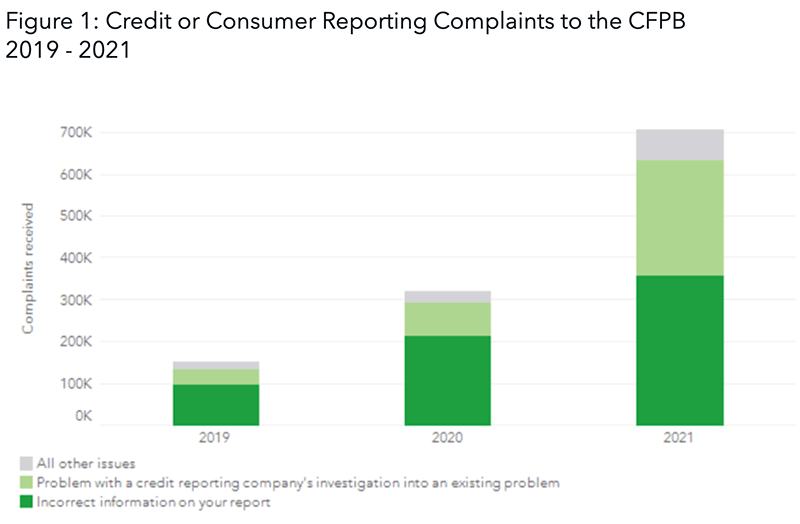

The CFPB’s supervisory exams suggest that consumer reporting companies do not always live up to their investigatory responsibilities. In some cases, the CFPB found consumer reporting companies ignored the results of their investigations and simply deleted disputed tradelines instead of correcting inaccurate information. Consumer complaints received by the CFPB highlight similar problems. In fact, inaccurate information and failures to investigate are the two most common consumer reporting complaints received by the CFPB.

Consumer reporting companies are required to investigate all disputes that are not frivolous or irrelevant. Consumer reporting companies and furnishers may be liable under the Fair Credit Reporting Act if they fail to investigate relevant disputes, and claims can be pursued by both state and federal consumer protection enforcers and regulators. Specific responsibilities for the investigations include:

-

- Consumer reporting companies must promptly provide to the furnisher all relevant information regarding a person’s dispute: After a person disputes the accuracy or completeness of information in their file, the consumer reporting company must notify the entity that originally furnished the information within five business days. In addition, the consumer reporting company must give the furnisher all relevant information provided by the individual.

- Consumer reporting companies and furnishers may not limit a person’s dispute rights: Consumer reporting companies and furnishers must reasonably investigate disputes received directly from individuals. For furnishers, they must reasonably investigate all indirect disputes received from consumer reporting companies. These requirements remain in place even if a person does not include or use the entity’s preferred format, intake forms, or documentation.

Enforcers may bring a claim if a consumer reporting agency fails to promptly provide to the furnisher “all relevant information” regarding the dispute that the consumer reporting agency receives from the consumer.

Through its supervision, the CFPB has found that consumer reporting agencies tend to ingest dispute information from consumers using automated protocols, and they also share dispute information with furnishers electronically. The use of these technologies has reduced the cost and time to transmit relevant information.

When transmitting information about a dispute, a consumer reporting agency may be able to demonstrate that it has transmitted “all relevant information” even if it does not provide original documents in paper form. However, given that primary sources of evidence provided by consumers can be dispositive in determining whether there has been a furnishing error, and given that the character of a primary source of evidence is probative and thus relevant to the investigation, it will be difficult for a consumer reporting agency to prove that it complied with the FCRA if it does not provide electronic images of primary evidence for evaluation by the furnisher.

The consumer reporting agency’s failure to provide the furnisher with all relevant information limits the furnisher’s ability to reasonably investigate the dispute. A furnisher must “review all relevant information” provided by the consumer reporting agency. Accordingly, consumer reporting agency compliance with the obligation to provide all relevant information is crucial to the consumer’s right to have their dispute reasonably investigated.

Editors Note: In addition to a FCRA complaint, violations of the FCRA may also violate 12 USC §5536 of the Consumer Financial Protection Act of 2010 (Title X of Dodd-Frank). – “In general, it shall be unlawful for any covered person or service provider to offer or provide to a consumer any financial product or service not in conformity with Federal consumer financial law or otherwise commit any act or omission in violation of a Federal consumer financial law, or to engage in any unfair, deceptive, or abusive act or practice.” Unfairness under 12 USC 5531 means that the act or practice causes or is likely to cause substantial injury to consumers, which is not reasonably avoidable by consumers.

See the CFPB Circular here: CFPB Circular 2022-07

Tip of the Week – ARM Yourself, Reduce ARM Anxiety

During the loan presentation, and to the prospect’s detriment, MLOs often feel the need to tell loan applicants which loan to take or not to take. Unfortunately, in doing so, the MLO projects their own bias into the prospect’s mortgage solution. This bias may obscure the loan presentation or undermine what is in the consumer’s interest. Alternatively, the better goal is that the applicant makes an informed decision by choosing the loan terms they believe to be in their interest.

Additionally, misguided MLOs seeking deals above all else may be blind to the more immediate and proper prize – rapport, credibility, and influence. For MLOs focusing on their own needs first rather than the needs of the prospect, MLOs may come across as disingenuous, smarmy, and lacking credibility. It shouldn’t be necessary to say as much, but that unholy trio is a fatal mix for effective ARM presentations.

Attempts to help the prospect buy without a central consumer focus are like swinging at a curve ball while blindfolded. You are likelier to nail the prospect in the face than connect with the ball. MLOs must keep their eye on the ball. A helpful exercise to gain the necessary perspective is to start from the premise that you must SHOW applicants what they need to know to make an informed decision. Focusing on showing instead of telling will amplify your loan presentation skills and help keep your eyes focused on the ball.

How do you square the “Keep It Simple” mantra with more complex loan solutions? Coming out of a decade-long fixed rate market, many MLOs have never presented ARMs, temporary buydowns, or balloon payments. Consequently, to the ill-equipped MLO, the more complex loan presentation is almost certain to create unnecessary anxiety. For the MLO and the prospect.

If the prospect benefits from possible ARM solutions and the MLO won’t or can’t effectively deliver the presentation, that will create a loss for the prospect and the MLO. Furthermore, prospect anxiety over ARM payment uncertainty can lead to unease that could sink your credibility and rapport.

The Right Tools for the Job are Essential

ARMs are viable solutions for some and may help borrowers avoid overpaying for mortgage interest. Should rates continue to increase, the spreads between the fixed rate and ARM products will continue to grow. Additionally, fixed rates will suffer should the capital markets continue to be rife with rate risk.

Effective leadership and communications skills are critical when presenting solutions with riskier features. The Journal addressed this subject in a previous Tip of the Week. Yet MLOs can make the mistake of attempting to “overcome objections” as though it was a battle or argument. A skewed view of prospect objections is likely to lead to significant missteps. Arguing with a prospect or dismissing their concerns fails to appropriately build on more minor buying decisions.

Instead, the successful presentation must address prospect objections and honor the intent of the TILA and RESPA, which is the consumer’s informed use of credit. Consequently, MLOs must elicit objections instead of trying to hide behind the elephant in the room – uncertainty. The MLO must take leadership responsibility and address the issue head-on.

Trying to sell an ARM by downplaying risk is a fool’s errand. When unpacking the ARM, refrain from the oft-repeated, ham-handed, and thoroughly incorrect MLO refrain, “You can always refinance!” That statement is untrue, for starters. Hoping for a better mortgage opportunity in the future is a fantasy, not a financial strategy, and is inappropriate when the household finances may be at stake.

Enumerate the prospect’s concerns and tackle those concerns directly, one at a time. For example, “Mr. Prospect, is it the magnitude of possible payment changes that is the primary concern? Or is it more the timing of the possible payment change? Mr. Prospect, is there any apprehension over the thought of a sudden and unexpected payment change creeping up on you?”

For each enumerated concern, the MLO can respond discretely by recognizing the objection and providing a reasonable or viable response. Attenuate the prospect’s discomfort with comparative analysis and trade-offs. For example, “Mr. Prospect, let’s review the 5/1 ARM worst-case payments again. If the timing of the payment change is unacceptable, let’s look at the 7/1 ARM options.”

Stop selling what you think is crucial, and start helping the prospect to get what they need. Ask the prospect what part of the solution works and what elements concern them. Listen to which aspects of the solution are causing the buyer’s concerns.

One possible source of discomfort is the prospect’s sense that they are alone in managing the ARM. Consequently, MLOs might stress their continued support over the loan lifecycle. Address the fact that you are their mortgage professional. For example, the MLO might state, “Ms. Prospect, you’ll hear from me on or near the anniversary of your loan closing – every year. We will discuss the mortgage market and any changing mortgage needs you have. Additionally, I’ll be in touch if something emergent develops in the market that might benefit you.”

Another source of unease might be an apprehension that years pass, and suddenly, they are faced with a new unaffordable payment surprise. Accordingly, that is when you whip out Regulation Z post-consummation ARM disclosure models.

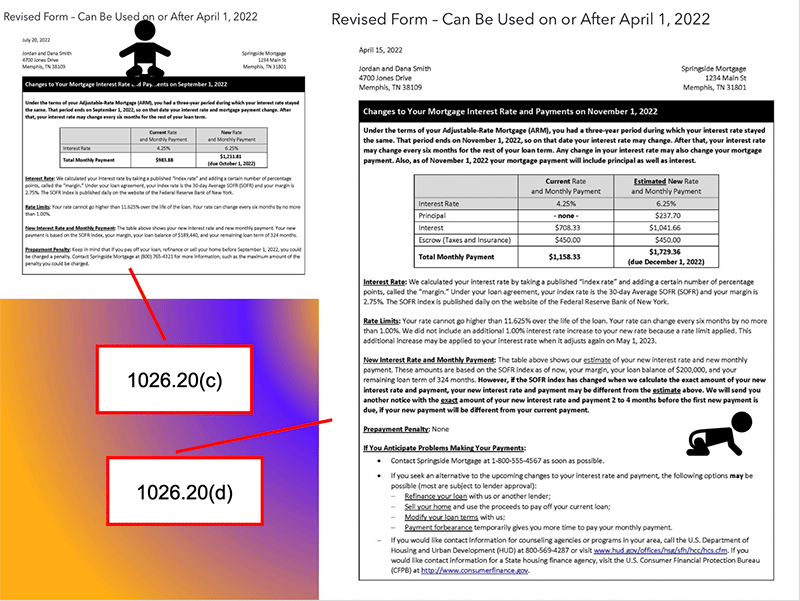

You might say, “Mr. Prospect, federal law prohibits the loan servicer from changing your ARM payment without providing advance notice. For example, the lender must provide 1026.20 (d) disclosure no less than seven months before your first ARM payment change. For any subsequent ARM payment change, the lender must notify you with 1026.20 (c) disclosure no less than 60 days before the new payment is due. No surprises.”

MLOs might echo the intended benefit of Regulation Z post-consummation ARM disclosures. For example, the MLO might add, “Seven months might be sufficient to consider refinancing the loan, selling the home, or seeking relief from the lender. Ms. Prospect, in light of these disclosures from the servicer, does that ease your concern about possible payment changes?”

Remember basic sales techniques. Help the prospect move forward with each part of the solution. Reinforce their agreement with the goodness of each buying decision. For example, place the encouragement in advance of the desired agreement (called tie-downs), “Mr. Borrower, seven months is an adequate time period to make necessary preparations for a payment change, ISN’T IT.” Tie-downs require a buying decision or further objection from the prospect.

Some prospects need space to think. Respect their process. Remember that emotions are contagious. So don’t be a bummer. This endeavor is exciting, buying a home or becoming a homeowner.

Present riskier loan features matter-of-factly. Your dispassionate delivery allows the prospect to experience their feelings in real time and communicate their concerns more frankly.

In the final analysis, the prospect may decline to pursue ARM financing. Help them comprehend the options. After grappling with an excellent loan presentation, suppose the prospect is uncomfortable with changing loan payments. In that case, the best loan for the customer may be a fixed rate, even if it means lesser buying options. Conversely, buying a lesser home than needed has its risks too. Act in the interest of the prospect. They need someone they can trust.

Links to the Interest Rate Adjustment Notices (Initial and Ongoing Rate Changes)

§1026.20(d) and (c)

H-4(D)(4) Adjustable-Rate Mortgage Sample Form (§ 1026.20(d))