Why Haven’t Loan Officers Been Told These Facts?

VA Discontinues Unnecessarily Burdensome MPR for Private Roads

VA Circular 26-22-17

Effective November 25, 2022

Until last month, the VA regulations mandated road maintenance agreements for a property requiring access by private roads. Generally, road maintenance agreements exist between homeowners or homeowner associations and vendors and provide for routine roadway upkeep. Typically, maintenance agreements require payments from those relying on access to the private road.

When the requirement for a maintenance agreement presented a hardship for the applicant, obtaining waivers from the VA was possible. However, like other waivers, the process can be problematic in many ways. Primarily owing to risk management, some lenders were reluctant to facilitate waivers. For lenders facilitating a waiver request, the approval process could result in delays and hardships for the applicant.

Just in time for Christmas, the VA Repents from Requiring Road Maintenace Agreements – From the VA Circular 26-22-17

1. Purpose. The purpose of this Circular is to announce changes to VA’s procedural requirements related to the acceptability of private roads and shared driveways for VA lending purposes.

2. Background. The VA Lenders Handbook outlines that any private road required to access the property is protected by a recorded permanent easement or recorded right-of-way from the property to a public road. This is to ensure that the Veteran has legal and continued access to the property. Currently, lenders ensure a Veteran’s access through the recorded easement and either an ongoing maintenance agreement through the homeowner’s association or a joint maintenance agreement from the owners of properties accessed by the private road or shared driveway.

Many states have enacted laws that govern the maintenance of private roads and shared driveways, particularly those private roads and shared driveways in which a joint maintenance agreement does not exist. Veterans may also request a waiver from VA in situations where a joint maintenance agreement does not exist. Therefore, requiring the Veteran to obtain such agreement, when this requirement can be met by existing state law or waived at the Veteran’s request, creates an undue burden on the Veteran, disadvantages the Veteran when purchasing a property accessed by a private road or shared driveway, creates additional expense to obtain a maintenance agreement, and extends the time it takes for the Veteran to obtain financing for their transaction.

3. Action. Effective immediately, an ongoing maintenance agreement from a homeowner’s association or a joint maintenance agreement from the owners of properties accessed by the private road or shared driveway is no longer required for properties with private roads and shared driveways. The following actions will be taken on these properties:

a. A recorded permanent easement or recorded right-of-way from the property to a public road is still required to be placed in the loan file.

b. Item 5 of the Notice of Value will no longer be marked as item 5 of the NOV conditions no longer applies.

See the circular here: Circular 26-22-17

BEHIND THE SCENES

Delinquencies Have No Place to Go But Up

AGENCY DELINQUENCY

FHA DELINQUENCY RATES

The CARES ACT is still driving servicing data

The unprecedented low rates and unusually low inventory drove housing prices through the roof in many locations. But, coupled with the Fed’s Frankensteinish monetary policies, the future has many stakeholders wondering if another shoe has yet to drop.

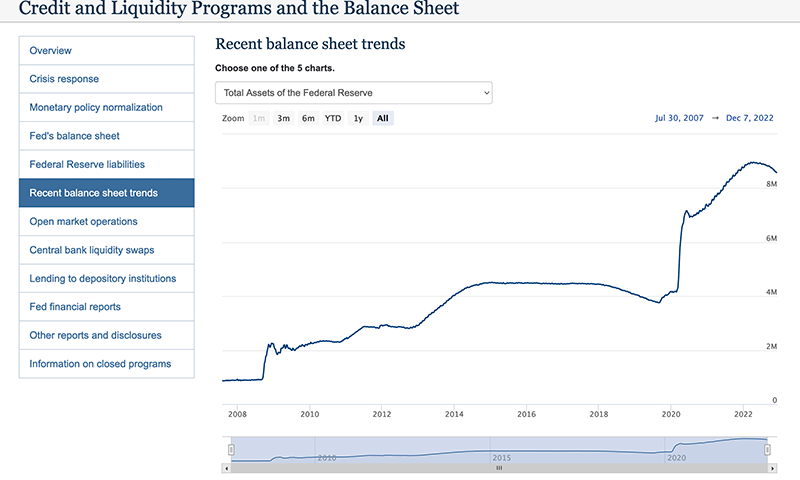

Stakeholders are getting squeamish about debt markets. Presently, the Fed’s quantitative tightening includes unloading 95 billion in treasuries and MBS every thirty days. So the tightening will have an intended ripple effect. But what about unintended effects?

The Fed’s monetary policies, lingering repercussions from the federal CARES Act, the unusually low housing inventory (part of the after-effects of 2008), and concerns of recession leave stakeholders concerned about where we are going next. Add to the mix rising consumer debt and decreasing household savings, and boom! The million-dollar question is, what is the boom in the boom?

Recent CFPB Data

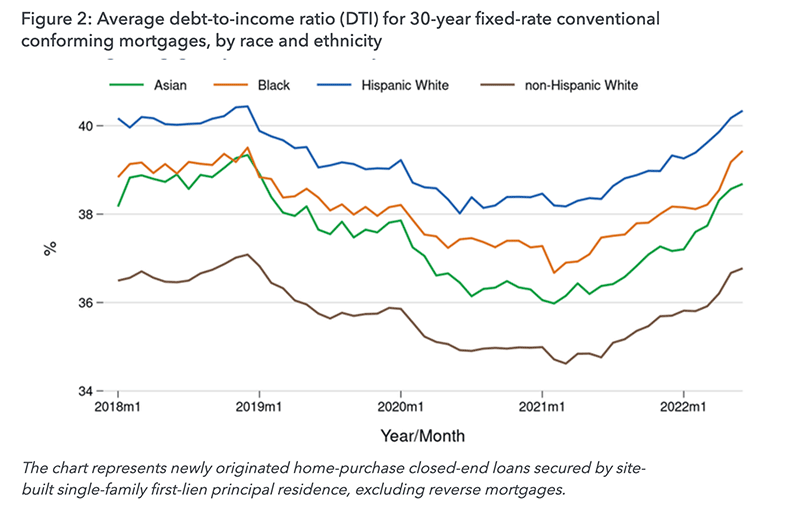

“Consumers taking out new mortgages are likely devoting a higher share of their income towards servicing debts, especially mortgage payments, with the potential that average DTI for borrowers will approach levels not seen since DTI information was first collected in HMDA in 2018.” – CFPB HMDA Analysis

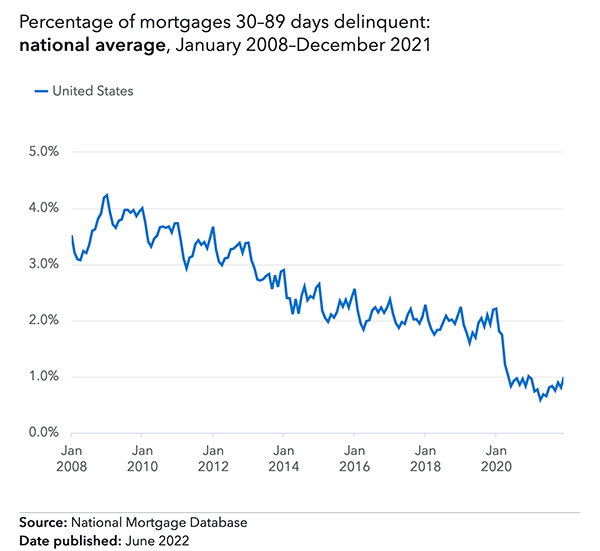

The numbers are difficult to interpret. However, one thing is sure. There is only one direction for mortgage delinquencies to go: up.

The CARES Act temporarily delayed or even halted expected defaults and foreclosures normative for more typical periods. As a result, serious delinquencies were at a low during the pandemic when they should have been close to 2008 levels. But, again, the CARES Act did what was intended and staved off another great recession. But what side effects might the cure bring?

What will the rise in delinquencies mean to the market? First, further credit tightening, increasing rates, and credit restrictions will continue to throttle home-buying opportunities.

The housing inventory must build appreciably to some level where deals are to be had. Buyers will pay higher rates if they perceive they are getting a deal. Buyers want deals in exchange for the high cost of ownership. They need a deal to make the high debt service worthwhile.

However, that incentive does nothing for those that can not afford or qualify for entry-level homes. That requires a more significant housing correction.

If this is the Fed’s plan to build up housing stock, there must be a better way. So here is the plan- Kill off home buyer demand and thus build inventory to produce downward price pressures. Then, get ready for more financial chemotherapy.

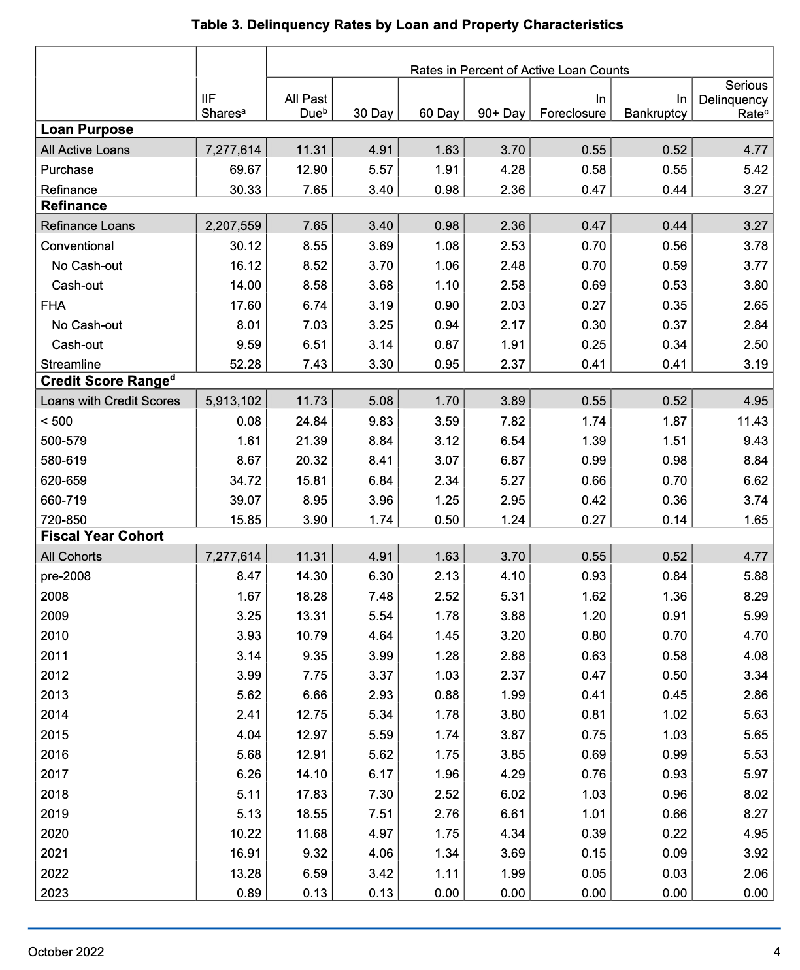

Black Knight is revealing some concerning statistics. What we are seeing is a bifurcation of housing burdens. Particularly for those with conventional financing who bought while rates were low and prices were still headed up. For those buying near the top of the market and paying higher rates – expect fissures in that market segment, particularly in the overbought markets that are now nearing double-digit pricing dips.

- “Of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwater and nearly 40% have less than 10% equity stakes in their home, a situation most concentrated among FHA/VA loans”

- “More than 25% of 2022 FHA/VA purchase mortgage holders have now dipped into negative equity, with 80% having less than 10% equity.”

See the Black Knight data here:

Black Knight’s October 2022 Mortgage Monitor

Tip of the Week – Don’t Be an Alice in Wonderland

Power-Up Your Goals

`Would you tell me, please, which way I ought to go from here?’

`That depends a good deal on where you want to get to,’ said the Cat.

`I don’t much care where–‘ said Alice.

`Then it doesn’t matter which way you go,’ said the Cat.

― Lewis Carroll, Alice in Wonderland

The skill of goal setting can be a powerful technique to help align short-term goals with what is truly important to you. Unfortunately, goal setting too often involves the relatively meaningless exercise of identifying some arbitrary goal and equally arbitrary timebox. Another arbitrary and equally empty goal-setting technique is the stretch goal. Take some equally meaningless standard and add five or ten percent, making the goal just out of the realm of doable.

Sometimes, the goal becomes a futile objective for those without purpose, ostensibly supporting some significant goal but more frequently devoid of any true meaning other than making more money or getting a better job. Even worse, vain goal-setting conditions the person to accept failure as routine.

Alternatively, the strategic goal setter links any short-term goals to a greater purpose and meaning. Purposefully and intentionally set your goals to align with what matters to you. In this goal-setting is power. As part of the goal-setting exercise, this straightforward yet powerful technique requires you to define a vision of success and failure.

Are you ready to get more strategic with your life? Here You Go.

- Step 1

Begin with whatever goal-setting approach you have used before. Once you identify a goal, proceed to step 2. - Step 2

Now ask yourself, “What impact will the failure to achieve the goal have on me or what matters to me?” Proceed to step 3. - Step 3

Suppose you foresee the failure to reach your goal having significantly negative or devastating consequences. In that case, you have yourself a bona fide goal. On the other hand, imagine failure to achieve your goals having little to no adverse effects. In that case, your goal is meaningless and without the power to motivate you. Set only bona fide goals. - Step 4

Repeat Steps 1, 2, and 3 until you set worthwhile and bona fide goals. Try building a portfolio of strategic interests to help identify meaningful goals. See portfolios below.

This goal-setting technique is iterative, which means trial and error is normal. Therefore, you can expect to repeat the goal-setting exercise until you develop a clearer picture of what is important to you and how to get there. Wrestle with your goals.

Use Portfolios to Begin Your Goal Setting

Your short-term goals should connect with and support your long-term goals. A strategy requires a nexus between lesser objectives in support of more significant objectives. Your strategy might consist of several “portfolios.” For example, spiritual goals, physical well-being, professional success, financial security, marital success, paternal success, and retirement success. These portfolios are discrete yet overlap and integrate more or less. Therefore, the apt strategy is better if it is more holistic and integrated instead of myopic and siloed. In other words, portfolios should be balanced.

For example, no person is an island. If your goals are important to key stakeholders in your life, their support and buy-in of your strategy and objectives are critical to successful goal-setting. For example, your long-term goal is to go off-grid and take up a bohemian and nomadic lifestyle of blue-water sailing and travel. However, your spouse can’t swim and prefers to camp at five-star hotels. Your vision of happiness may be a fabulous fantasy, but it will fail as a strategy. You are in jeopardy of getting lost in the Wonderland of a confused and unfocused mind.

A goal unaligned with any actual strategic value and lacking essential purpose has no motivational power. These meaningless or banal goals are without value other than as an example of what not to do. Treat those goals like garbage – get rid of them. Take your goals seriously. After identifying worthless goals, a return to the drawing board is in order.

COHESIVISION (yes, that is a made-up word, try it kō-hēsi-vi-ZHən)

To reiterate, use short-term goals as stepping stones to long-term goals. Disconnects between short and long-term goals reveal potentially flawed strategies, and the vision needs more cohesion to achieve a strategic purpose.

And lastly, don’t attempt to be what you are not. Instead, harness your psychological makeup to achieve your goals. Most people experience a diminished sense of worth and accomplishment when failing to achieve those things that are important to them. Good. Leverage that sense of shame to power your efforts. Tell anyone interested in you about your goals. Be bold. Don’t waste time with feeble goals.

While failure may have significant consequences, you mustn’t fear failure. Through failure lies the path to success. It’s worth repeating – through failure lies the path to success. Yet, an illogical mind reasons that the best way not to fail is not to try. Or worse, to have no aspirations. A person who endeavors never to fail will not attempt to pursue meaningful goals. How can that work for anyone?

Okay, embrace the goal, and don’t fail. Leave your best efforts in the field of play. The determination to achieve your goals is fueled by motivation. You need all the help you can muster to meet your goals. Power is necessary to achieve significant goals.

However, you will occasionally fail if your goals are worth a hoot. Failing hurts less and less when you enjoy the fruits of appropriate goal setting.

What to do in the face of failure? Developing grit is reserved for another discussion. Your resilience in the face of weighty setbacks will set you apart from the pack.