Why Haven’t Loan Officers Been Told These Facts?

Sex Education from the Consumer Financial Protection Bureau and HUD

January 20, 2021, President Biden’s executive order 13988 extends the applicability of sex discrimination to the LGBTQ community.

Last week, in the hopes of clarifying what is meant by the term discrimination as found in the Equal Credit Opportunity Act (ECOA) and Fair Housing Act (FHA), the Journal provided some background on the federal government’s use of the term discrimination. In particular, the nuanced meaning of the term discriminatory effect.

The CFPB, as well as every other federal regulator, adopted the discriminatory effect doctrine from interagency guidance published almost 30 years ago.

In the CFPB’s March 2021 ECOA interpretive rule announcement, there were some terms that will be foreign to many stakeholders. Let’s take a look.

March 9, 2021, From the CFPB:

“Today, the Consumer Financial Protection Bureau (CFPB) issued an interpretive rule clarifying that the prohibition against sex discrimination under the Equal Credit Opportunity Act (ECOA) and Regulation B includes sexual orientation discrimination and gender identity discrimination. This prohibition also covers discrimination based on actual or perceived nonconformity with traditional sex- or gender-based stereotypes, and discrimination based on an applicant’s social or other associations.”

What exactly does the CFPB mean by discrimination based on an applicant’s “social or other associations?” First, take a look at the example provided in the interpretive rule.

“A creditor engages in such associational discrimination if it, for example, requires a person applying for credit who is married to a person of the same sex to provide different documentation of the marriage than a person applying for credit who is married to a person of the opposite sex.”

“The Bureau’s interpretation is consistent with the principle, applied by Federal agencies for decades, that credit discrimination on a prohibited basis includes discrimination against an applicant because of the protected characteristics of individuals with whom they are affiliated or associated (e.g., spouses, domestic partners, dates, friends, coworkers).”

“Moreover, the Bureau has previously established that a creditor may not discriminate against an applicant because of that person’s personal or business dealings with members of a protected class, because of the protected class of any persons associated with the extension of credit, or because of the protected class of other residents in the neighborhood where the property offered as collateral is located.”

“For these reasons, the ECOA and Regulation B prohibition against discrimination on the basis of “sex” includes discrimination or discouragement based on sexual orientation and/or gender identity, including but not limited to discrimination based on actual or perceived nonconformity with sex-based or gender-based stereotypes and discrimination based on an applicant’s associations.”

Association Related to Sex Discrimination

How do the associations of the applicant relate to sex discrimination violations? Arguably, there is no more significant human-to-human association or relationship than with one’s spouse. Association discrimination is readily evident in the context of the marital arrangement. For example, discriminating against a person because they are wed to a person of the same sex treats those persons differently than if they were wed to partners of the opposite sex. The marital context provides a compelling example of discrimination by association: “Man and woman = OK. Man and Man = Not OK.”In this example, discrimination is due to a person’s sex in the context of association or marriage. According to the association doctrine, discrimination against same-sex couples due to their marital association is sex discrimination.

June 26, 2013, What is Marriage in the USA?

The US Supreme Court (SCOTUS) decided that sections of the Defense of Marriage Act (DOMA) were unconstitutional. Specifically, that section of DOMA that prohibited the federal government from recognizing same-sex marriage. However, the Court did not strike down the DOMA provisions that allowed for the states to prohibit same-sex marriage.

Today, many states prohibit same-sex marriage. However, in regards to credit and housing access, the ECOA and FHA supersede any state law related to discriminatory treatment or discriminatory effects along protected class lines. Therefore, there could be some confusion if a loan officer or lender conflates a state’s same-sex marriage prohibition with the federal law prohibiting discrimination and discouragement. Discouragement might very well be the first test of the novel sex discrimination interpretation.

From the CFPB, Regulation B, Discouragement:

“Regulation B 12 CFR 1002.4(b) A creditor shall not make any oral or written statement, in advertising or otherwise, to applicants or prospective applicants that would discourage on a prohibited basis a reasonable person from making or pursuing an application.

Generally, the regulation’s protections apply only to persons who have requested or received an extension of credit. In keeping with the purpose of the Act – to promote the availability of credit on a nondiscriminatory basis – § 1002.4(b) covers acts or practices directed at prospective applicants that could discourage a reasonable person, on a prohibited basis, from applying for credit.”

Regulation B prohibits a creditor from discriminating against an applicant on a prohibited basis (including “sex”) “regarding any aspect of a credit transaction,” and from making “any oral or written statement to applicants or prospective applicants that would discourage on a prohibited basis a reasonable person from making or pursuing an application.”

The CFPB promulgation surrounding Regulation B is significant. First, the CFPB broadcasts its intent to prosecute Regulation B offenders for practices far removed from discrimination against individual applicants or borrowers. In addition to discrimination against individuals, the CFPB plans to attack practices discouraging communities from seeking credit opportunities with specific lenders.

What are the ramifications of the novel sex-discrimination interpretation to loan origination businesses and individual mortgage originators? Next week the Journal addresses a few compliance opportunities.

Behind the Scenes

The Taper Tantrum

Watch Those Refinances, No On and Off Switch for Rate Changes

Leveraging a Blue Ocean Strategy to Grow Your Business

To Explore Strange New Worlds, to Seek Out New Life and New Civilizations, to Boldly go Where no Person has Gone Before :).

Leveraging Adverse Actions and Unqualified Prospects

Rehabilitating failed loan applicants shouldn’t be haphazardly handled. Not only is the failure to remediate the applicant a lost business opportunity, but consider the holistic benefits of an adverse action remediation program. For example, ample evidence shows that people of color experience adverse action at higher rates than white folks. Furthermore, there is evidence that folks belonging to the LGBTQ community experience higher adverse actions than those from non-LGTBQ communities.

Better fair lending compliance may also be at stake.

Stakeholders (e.g., the loan officer, the lender, the real estate agent) can build future business through remediation practices. In the midst of a significant market contraction, why not pursue this business? At the same time the lender captures new markets, the lender demonstrates effective and proactive fair lending practices.

Deliberate remediations for less than perfect applicants ensures that a lender has appropriate safety nets that guarantee a “second look” and also provides a path forward to homeownership when the second look is unfruitful.

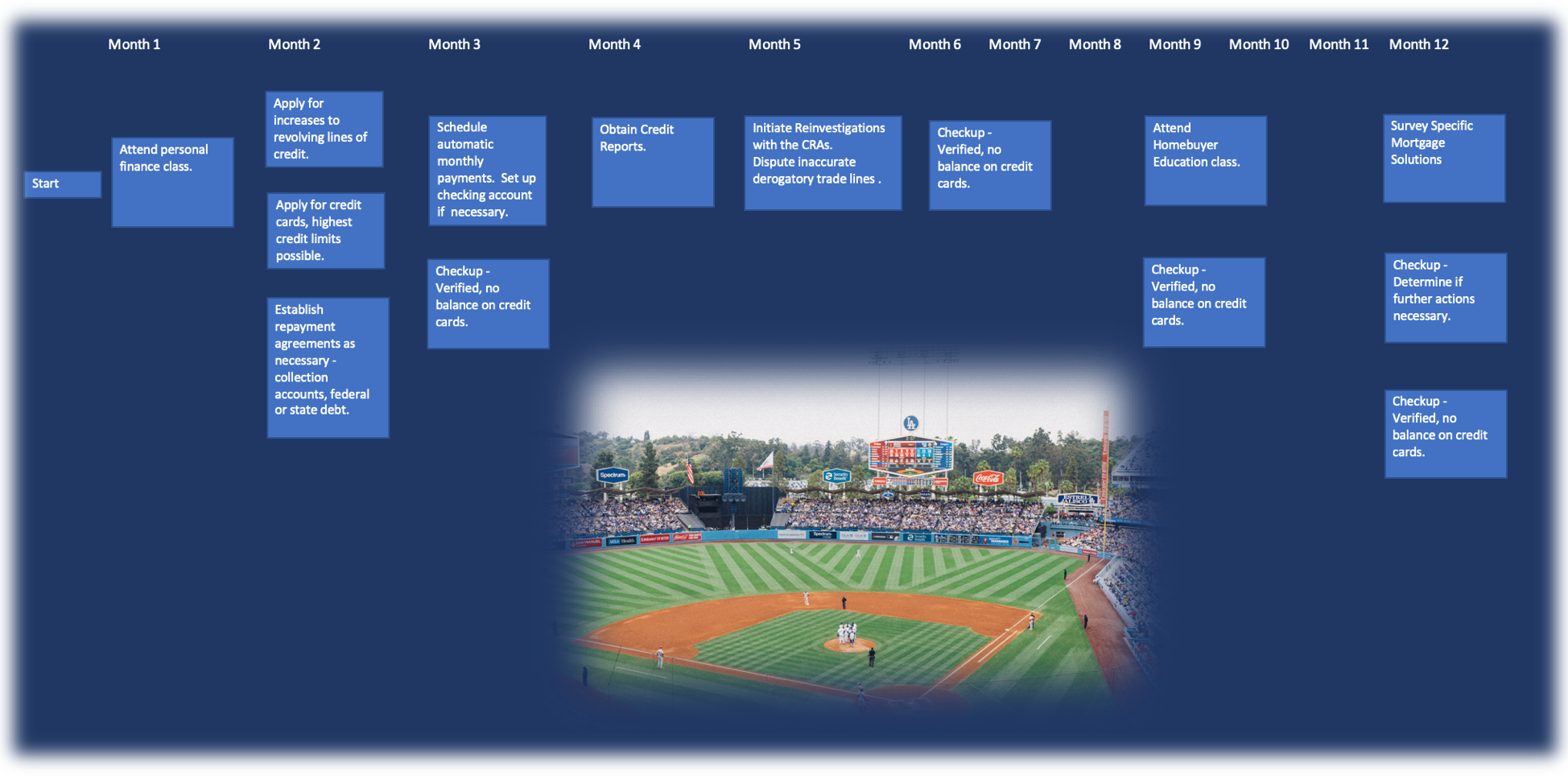

One of the easiest tools to help get your customer back in the saddle is to show them the when and how of homeownership. As they say, a picture is worth a thousand words. Creating a milestone chart is a simple way to help your team members comprehend the stepping stones to mortgage success. Rather than rely exclusively on a written list or oral instructions to help the member stay on track, use a picture.

The workflow diagram maps the specific member activities necessary to reach the goal of homeownership or refinancing.

You can get fancy and use workflow software like SmartSheet. Most of these services are based on subscriptions. You can often get a free version with lesser functionality. Try that first. Or prepare a workflow diagram and milestone chart with Excel or Word.

As the member progresses through the tasks, provide encouragement and celebrations. In addition to the credit remediation, you will add the member to your referral campaign distribution list. Get in the habit of asking the members for referrals to people they know. Every time you contact the member, you give them care and respect, and they are bird-dogging people for you to contact.

See the LOSJ Issues V1 I 23 through V2 I 2:

https://www.loanofficerschool.com/los-journal-volume-1-issue-23/

https://www.loanofficerschool.com/los-journal-volume-2-issue-1/

https://www.loanofficerschool.com/los-journal-volume-2-issue-2/

At the same time you are checking in with the member, you are reporting their progress to their real estate agent. Make sure you have the applicants express permission to share information with the real estate agent Subject to Regulation P. How exciting, that while working with the member, you just might be drumming up buyers for the agent too.

Be mindful of the importance of emotions to the progress of the workflow. Be optimistic, encouraging, and compassionate with the members. You set the tone for the team’s emotional disposition. Your ability to effectively communicate with the team is paramount. Be clear with the expectations.

Ensure whatever solutions you’ve engineered are appropriate to get the job done. Get a second opinion from your boss or solid subject matter expert.

Aside from character and credit concerns (paid as agreed), there could be other financing obstacles. So put on your thinking cap, be creative and leverage your resources. Is the challenge income stability or excessive ratios? What about co-signers/borrowers, Section 8 assistance? Does a second job or gig-work make sense? Is the challenge assets? What about DPA, grants, or faith-based organizations? Leave no stone unturned.

Developing the remediation and workflow planning might be best accomplished in a brainstorming meeting: subject matter expert, processor, and loan officer.

Break down the problems into discrete elements and tackle each as you can. Then, make it fun, keep the prize in sight and show some hutzpa!

Tip of the Week, The Do-Over

Years ago, a friend gave me some very sage words of advice. He said, “CJ, words are like toothpaste. Words, like toothpaste, come out easily. But like putting toothpaste back in the tube, you can’t put spoken words back in your mouth.”

No matter how hard you try, words will leave your lips that would have been better left unsaid. It is inevitable. However, there are better ways to clean up a mess.

Conflict management is one of the more difficult stakeholder management skills to master. Conflict occurs at the organizational, vendor, and interpersonal levels and you need an arsenal of tools and techniques to resolve conflict. There is no one size fits all solution. However “smoothing-over” the conflict is appropriate at times and is one of the most efficient ways to get the exchange back on track.

Keep in mind, smoothing conflict is not always appropriate and at times might be counter-productive to your ultimate goals.

Smoothing could be a go-to technique when there is a more minor disagreement or misunderstanding. Through the process of escalation, stakeholders will go ape over something that started off as a low-level threat or misunderstanding. The conflict can rapidly spiral out of control. People will dig themselves in deeper with hapless exclamations, “Oh, I didn’t mean that!” Or the foul, “I’m sorry you took it that way.”

If you say something regrettable, it is usually in good form to apologize and ask for forgiveness. However, that does not necessarily power the “pivot” you need to get the interaction or conversation back on track.

While an appropriate apology is always in good form, you also need to transition the discussion back to the matter at hand.

One of the easiest and most effective techniques to drive the pivot and get the conversation back on track is a “do-over.” If you are a golfer, this is known as a mulligan. In golf, the idea of keeping the game friendly and fun is often a primary concern. Rather than waste time crawling through the trees to play the ball, just take the shot again.

First, as already described, it is appropriate to apologize right away. Apologies can be powerful in diffusing the tension and upset. It does not matter if you feel the other party is at fault. Lose the judgment and apologize.

Think of the dust-up as one lousy swing in an otherwise good game. You or the other party can get stuck in the trees, possibly derailing an otherwise lovely outing. Affording the do-over provides a gracious escape for you and them. People can usually be better at almost all things. At the least, you can recognize your failure to communicate more effectively. The apology rarely hurts, but the apology is not necessarily essential to the efficient do-over.

Like a mulligan, note that the do-over enlists the cooperation and grace of the other party. Generally, most folks are ready to extend the olive branch and exercise grace towards those that demonstrate appropriate humility. You demonstrate humility by granting or acknowledging the power of the other party when asking for the do-over. The other party feels empowered and respected. Your humble act of requesting a do-over is both graceful and powerful.

However, acknowledging the dust-up is always essential. For example, don’t do this: “Tom, it’s obvious you woke up on the wrong side of the bed today. Why take your misery out on me?”

Of course, that example is wrong on many levels, but that often happens! Our natural inclination is to repay evil with evil.

Instead, try this, “Tom, I’m struggling here. Would you grant me a do-over on this?” Or, “Tom, please forgive me. I bungled that question/comment/task (fill in the blank). Would you let me try that again?”

Hot damn, how easy is that to do! Of course, smoothing is not the end-all to conflict management, but the do-over is an effective way to get your wayward conversation back on track in a pinch.

Bypass all the excuses and equivocations, get back on track. Ask for a do-over.