Why Haven’t Loan Officers Been Told These Facts?

The GSE’s Provide Handy FAQs Regarding COVID Era Originations

FHLMC – Employed Applicants

Q1: [REVISED 09.01.21] Given the continued impacts of the pandemic, is updated income documentation required before closing?

A1: It is recommended that additional due diligence continues to be practiced which may include actions such as obtaining YTD paystubs from the pay period that immediately precedes the note date even if the age of documentation requirements are met.

Q1: [REVISED 09.01.21] What additional analysis or documentation is needed to support the determination of stable and consistent monthly income in scenarios where the borrower has returned to work, but the employed income level has declined over 10% from 2019 due to economic conditions created by the pandemic (e.g., mandated employer shut-downs or business restrictions)?

A1: If the seller determines that the income interruption (e.g., reduced, discontinued) occurred solely due to the economic conditions created by the pandemic, and it is documented that the borrower is back at work, no additional analysis, documentation or requirements to determine the current level of income has stabilized are required. The seller’s written analysis should include this determination.

Q3: [07.01.20] Is there a minimum length of time the borrower must be back at work and earning a certain level of earnings to support that the current income has stabilized when the borrower’s employed income was interrupted (e.g., reduced, discontinued) due to COVID-19 pandemic?

A3: If the seller determines that the income interruption occurred solely due to the pandemic and it is documented that the borrower is once again actively employed, and the income meets all other applicable Guide requirements (e.g., history, documentation), the borrower is not required to be back at work for a minimum specified period of time and the seller is not expected to request additional documentation from the borrower.

Q5: [07.01.20] When the income trend is declining (i.e. the borrower’s YTD income is lower than the prior year W-2 income), is it acceptable to calculate the income by averaging YTD income and income from the prior year(s)?

A5: No; when the income trend is declining, the seller must use the YTD income and must not include the previous higher level unless there is documentation of a one-time occurrence (e.g., injury) that prevented the borrower from working or earning full income for a period of time and evidence that the borrower is back to the income amount that was previously earned. As the COVID-19 pandemic is ongoing, the income interruption/gap is not yet considered a one-time occurrence, such as an isolated injury may be.

Q6: [REVISED 03.11.21] When fluctuating income is used to qualify the borrower, is it acceptable to exclude the period(s) of unpaid time due to COVID-19 (e.g., temporary layoff, furlough, reduced hours) when calculating the qualifying income?

A6: No. For fluctuating employment earnings (e.g., fluctuating hourly employment earnings, overtime, bonus, commission, tips), and regardless of the earnings trend, all 2020 and 2021 YTD income must be included in the calculation, in accordance with the requirements in Guide Section 5303.4(b). Employed income calculation guidance and requirements. As the pandemic is ongoing, the income interruption/gap is not yet considered a one-time occurrence, such as an isolated injury may be; therefore, the period of income interruption must be considered in the overall YTD calculation.

Q1: [06.04.20] When a borrower refinances after a payment deferral, is the new mortgage considered a cash-out refinance loan or a “no cash-out” refinance?

A1: When a borrower refinances a mortgage that with a payment deferral and the amount of the deferred payments is included in the new mortgage, the new mortgage is eligible for sale to Freddie Mac as a “no cash-out” refinance if it otherwise meets all of the requirements for an “no cash-out” refinance in the Single-Family Seller/Servicer Guide. Funds applied to paying off the deferred portion are not considered cash out.

From FNMA

Q4. If the borrower is furloughed but continues receiving income for a specified period of time, such as four weeks, can the income be used for qualifying?

A4. No. This income is not stable, predictable, or likely to continue and therefore does not meet the requirements in B3-3.1-01, General Income Information; Continuity of Income.

Q5. How should I treat non-mortgage debt (for example, student loans, auto loans, etc.) currently in forbearance or deferment?

A5. Regardless of whether the forbearance or deferment is related to COVID-19, lenders must consider the monthly debt payment in the borrower’s DTI. For mortgage loans underwritten using DU, DU will provide guidance on the treatment of the debt, and lenders do not need to conduct additional analysis. For mortgage loans that are manually underwritten, lenders must follow B3-5.3-02, Payment History. However, lenders are not required to, and should not, consider payments missed during the time of a COVID-19-related forbearance to be historical delinquencies or derogatory credit.

For student loans, if the monthly payment is provided on the credit report, the lender may use that amount for qualifying purposes. If the credit report does not provide a monthly payment for the student loan, or if the credit report shows $0 as the monthly payment, the lender must either calculate a qualifying payment per B3-6-05, Monthly Debt Obligations, or use the most recent income-driven repayment plan payment (with supporting documentation).

Q10. Is it acceptable to use a business license to verify that the business is open and operating?

A10. No, this does not verify the business is open and operating within the 20-day or less time frame prior to closing.

Good news – FNMA/FHLMC underwriting the self-employed just got easier. Stay tuned as the Journal reviews the current state of self-employment income policy next week.

Behind the Scenes

(Can’t Say We didn’t Warn Ya!;)

Well, you can’t say we didn’t warn you. Last year, the LOSJ examined the matter of undeclared IRS obligations in connection with the loan manufacture.

In 2019, the HUD Inspector General cited the failure of the FHA to curb loans to tax debtors in light of federal requirements to do so. From the origination side, this problem could stem from a misunderstanding of the gist of federal tax debt relative to the URLA.

Loan officers and other stakeholders ignorant of the matter just don’t know any better. For others, ignoring the issue is okay because seemingly everyone else does. Notably, the FHFA, the GSEs, HUD, VA, and USDA don’t appear to be overly concerned.

For many years, Federal agencies have been obligated to determine if applicants for guarantee programs have federal tax debt and resolve the issue before extending any guarantees.

From the Office of Management and Budget OMB Circular A-129

III CREDIT EXTENSION AND MANAGEMENT POLICY, APPLICANT SCREENING

Delinquency on Federal Debt

“Agencies should determine if the applicant is delinquent on any Federal debt, including tax debt. Agencies should include a question on loan application forms asking applicants if they have such delinquencies. In addition, agencies and guaranteed loan lenders shall use credit bureaus as a screening tool. . . . . . . Processing of applications shall be suspended when applicants are delinquent on Federal tax or non-tax debts, including judgment liens against property for a debt to the Federal Government, and are therefore not eligible to receive Federal loans, loan guarantees or insurance. . . . . . . Processing should continue only when the debtor satisfactorily resolves the debts (e.g., pays in full or negotiates a new repayment plan).”

Since the CRAs stopped reporting tax liens, no small number of applicants conveniently excluded their tax debt from the URLA. Since applicants and other stakeholders appear to get away with the omission, it figures that folks might think it does not matter. Similar to so many drivers doing 75 MPH in a 55 MPH zone.

There is plenty of blame to go around. The FHFA, the MBA, and the GSEs have failed to clarify the term federal debt related to the URLA. So why not add a better definition of federal debt to the URLA written instructions? Especially in light of the HUD OIG Report.

But where does that leave the applicants that exclude the federal tax debt from the URLA? Check out this enforcement action announced by the DOJ last month.

From the US Department of Justice Announcement: January 13, 2022

Baltimore City State’s Attorney Marilyn Mosby Facing Perjury and False Mortgage Application Charges Related to Her Purchase of Two Vacation Properties

Baltimore, Maryland – A federal grand jury today returned an indictment charging Marilyn J. Mosby, age 41, of Baltimore, Maryland, on federal charges of perjury and making false mortgage applications, relating to the purchases of two vacation homes in Florida.

The indictment alleges that on July 28, 2020 and September 2, 2020, as well as on January 14, 2021 and February 19, 2021, Mosby made false statements in applications for a $490,500 mortgage to purchase a home in Kissimmee, Florida and for a $428,400 mortgage to purchase a condominium in Long Boat Key, Florida. As part of both applications, Mosby was required to disclose her liabilities. Mosby did not disclose on either application that she had unpaid federal taxes from a number of previous years and that on March 3, 2020, the Internal Revenue Service (IRS) had placed a lien against all property and rights to property belonging to Mosby and her husband in the amount of $45,022, the amount of unpaid taxes Mosby and her husband owed the IRS as of that date.

Excerpted from the LOSJ Volume 1 Issue 3

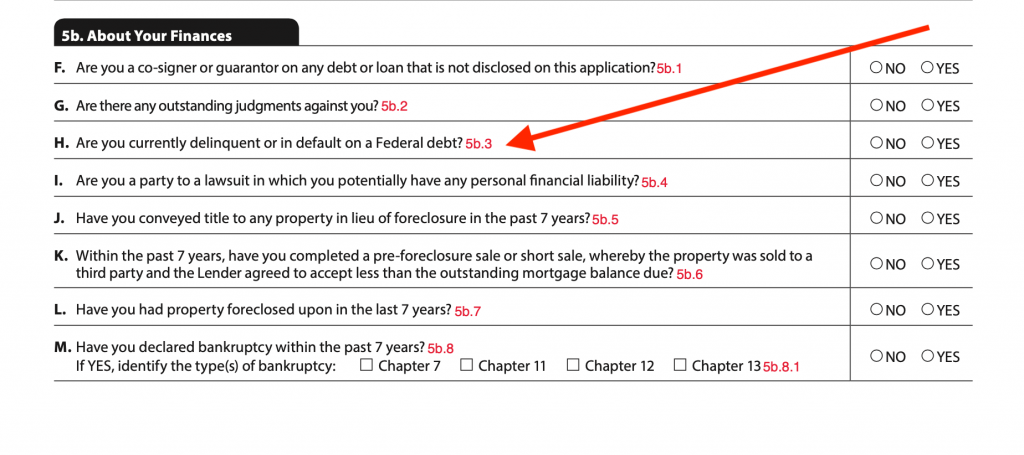

“The URLA Section 5b(H) asks, “Are you currently delinquent or in default on a Federal debt?” The 5b(H) instructions for completing the URLA state, “You must disclose if you are delinquent or in default on any debt owed to the Federal government (for example, a Federally-backed student loan, FHA loan, USDA Rural Development loan, Veterans’ Administration loan).”

The URLA instructions, notably clumsy on the definition of federal debt, exclude delinquent federal tax as an exemplar of federal debt. However, applicable federal law indicates tax and non-tax debt as federal debt or at least a liability.

How can a borrower justify, or how could the MLO dodge the delinquent tax debt omission? Should the applicant have a delinquent federal tax obligation, the applicant must declare that obligation in Sections 5b(H) and 2c (debts not listed on your credit report). Ask yourself, if tax debt doesn’t belong in Section 2c (debts not listed on your credit report) or Section 5b(H) (delinquent federal debt), where on the URLA should the applicant declare federal tax debt?

The matter of liabilities related to applicant repayment capacity is not rocket science. Delinquent federal taxes will impact the applicant’s capacity to repay. As such, the lender must consider delinquent tax obligations in the capacity test.

Concealing the federal tax debt is mortgage fraud. Carefully review the URLA Section 6(1): Acknowledgments and Agreements of the URLA, 18 USC Chapter 47 Fraud and False Statements 1001, 1006, 1010, or 1014. – These are serious mortgage fraud violations. “Any intentional or negligent misrepresentation of information may result in the imposition of:

(a) civil liability on me, including monetary damages, if a person suffers any loss because the person relied on any misrepresentation that I have made on this application, and/or

(b) criminal penalties on me including, but not limited to, fine or imprisonment or both under the provisions of Federal law (18 USC §§ 1001 et seq.).”

From the 01.13.22 DOJ Announcement:

In each application, Mosby also responded “no” in response to the question, “Are you presently delinquent or in default on any Federal debt or any other loan, mortgage, financial obligation, bond, or loan guarantee,” even though she was delinquent in paying federal taxes to the IRS.

If convicted, Mosby faces a maximum sentence of five years in federal prison for each of two counts of perjury and a maximum of 30 years in federal prison for each of two counts of making false mortgage applications. Actual sentences for federal crimes are typically less than the maximum penalties. A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

An indictment is not a finding of guilt. An individual charged by indictment is presumed innocent unless and until proven guilty at some later criminal proceedings.

Recent Appellate Court Opinion (Nonprecedential en banc ruling (not the full court), e.g., may be cited but does not constitute or set a precedent)

In a similar case, back in 2020, a federal appeals court opined on a lower court’s mortgage fraud conviction involving 18 USC 1014 false statements on a loan application. The defendant, a licensed attorney, had IRS problems and made a mortgage application excluding the tax claims. In regards to the tax debt omissions, the appeals court stated:

“Finally, (Appellant) contends the evidence was insufficient to convict him on Count 6 of the superseding indictment—that (Appellant’s) failure to list his outstanding tax obligations as “Federal debt” constituted the making of a false statement in a loan application. ….. Given this evidence, a jury could reasonably conclude that the (Appellant’s) failure to disclose his tax liability when asked whether he was “delinquent or in default on any Federal debt,” when asked to list “all outstanding debts,” constituted the submission of a loan application containing knowingly false statements.”

Do you think these federal agencies communicate with each other? It’s a bad idea to exclude federal tax delinquencies from the URLA period. And a terrible idea to omit tax liability from the URLA amidst a federal tax collection action.

Tip of the Week

Efficiency – Creating a Sense of Urgency

WORDS OF DOOM – AS SOON AS POSSIBLE, A loan officer tale

After getting hit in the head with a figurative file cabinet, I soon realized there had to be a better way. Do you know the 1980 J Geils song, “Love Stinks?” Play that song, and substitute – Loans Stink. Yeah, Yeah. That was my song. Realizing I was coming to hate the job and the feeling was mutual, I thought my days as a loan officer were ending. I half expected to find my desk plant in the parking lot someday.

I consistently miscommunicated with applicants, processors, and my boss. I was utterly ineffective at leading the loan manufacture. I had become part of the legion of the doomed, the walking wounded. When arriving at the office, I thought I could hear, “Dead hack walking!” But God is good. I wasn’t dead yet.

Jerry was an experienced and very successful LO. He was super intimidating to me. At about 5’4″, Jerry was a pit bull. He was a legendary producer. The company used to have him lecture the LO’s on loan manufacture, sales, and marketing. One day, he took me aside. He said, “CJ, I think you need to get more serious about being a loan officer. I have a suggestion that might help. Unless you create a sense of urgency with the applicant, they will deprioritize your demands. Even worse, they will see you as pesky and irrelevant. They will blow you and your requests off or forget about it. They are too busy dealing with important matters. Which are chores they must complete in the next two days. If you want to get your loan application complete without having to chase these people down, make it a priority for them. Give them two days to get you what you need.”

Jerry explained how immediate document reviews were essential to efficient loan manufacture. Often, things that could impact the origination trajectory were detected and addressed early rather late in the loan process. As a result, Jerry and his inside partner were two of California’s most successful origination teams. His partner’s daughter was my lead processor to boot. I imagine she put Jerry up to correcting my wayward practices. He was an impressive individual. People did not mess around with Jerry. He was pleasant, but he had gravity.

But Jerry was a middle-aged man and carried himself like a college hoops coach or a Fortune 500 executive. He commanded respect and projected confidence. I was a skinny 21-year-old. How could I command respect or display the leadership and authority that Jerry conveyed?

Jerry shared some age-old wisdom with me. He said you have to tell people the exact day you need the task completed. And the date should be no more than two or three days from the tasking. Otherwise, he said, the request fails to convey any urgency. If it is not an imposition for the applicant, the task does not register as essential. But, he said, “CJ, you want to impose on the applicant. They need to realize this is serious business. When the applicant agrees to meet your deadline, the applicant responds to your leadership. The applicant expects and needs you to exercise leadership.”

Jerry was right, and I had the ears to hear what he was saying. Years later, a communications expert shared something else with me that put the two-day tasking on steroids. She said that “What you are doing conveys a strong sense of urgency and commands the attention of the persons tasked with the job. However, on a scale of 1 to 10, how would you like to turn the sense of urgency and your command presence up to 11? You need just one minor tweak. Name the time.” She said, “It goes like this – I need all the documents and information on Mr. Borrower’s needs list no later than 2:00 PM Tuesday.” Boom.

Management people sometimes refer to this concept as the “student rule” or “Parkinson’s Law.” The concept is that the applicant will take as much time as you give them to get to you what is needed. Analogous to the student rule, if the homework is due on Tuesday, students focus their energies on work by Monday. Psychologically, the sooner the required task, stakeholders will associate that task with importance.

Fast forward to the 21st Century. Generally, the applicants don’t even ask why it’s essential to have the documents by Tuesday at 2:00 PM. However, if they do, that’s even better. Then you can explain the significance of the TILA ATR standard as it relates to “reasonable” determinations of the applicant’s ability to repay using “reasonably reliable” third part records. Furthermore, you can explain how central the documents are to the efficient loan manufacture, including meeting contract dates and closing as planned.

Important people request essential things. Step up your leadership skills by efficiently communicating the criticality of efficient loan manufacture.