Why Haven’t Loan Officers Been Told These Facts?

Temporary Buydowns, Fools Gold? Yes and no.

Since last year, there has been a significant buzz regarding temporary buydowns (TBDs). Anyone can pay for a TBD: real estate brokers, employers, and non-profits. Traditionally, TBDs have been valuable tools for developers and stakeholders engaged with builders.

Generally, builders use credits for upgrades and closing costs. For various reasons, with new construction, it is impractical to drop the sales price. TBDs allow builders to reach their target prices while providing necessary negotiating room within the contract. In addition, the generous incentives attract buyers and help builders move inventory in more challenging markets. That can be good for lenders, buyers, the builder’s creditors, and the subdivision residents.

But with the sudden rate increase over the last year, the industry is seeing widespread TBD use on resales—something more novel to the market. Consequently, there is some confusion about proper TRID disclosures. The Journal tackles TBD disclosure in forthcoming issues starting with the article on buyer-paid TBD below.

But did you know, in some cases, the lender may consider the TBD in the borrower’s capacity analysis? For instance, the VA will allow lenders to consider the bought-down rate for qualification purposes if it makes sense. Just remember your underwriting 101. Watch the risk layering.

VA Buydown Qualification

The loan application may be underwritten based on the first year’s payment amount if there are strong indications that the income used to support the application will increase to cover the rising loan payments during the temporary buydown period. However, lenders cannot consider the routine cost of living increases to justify the qualification payment at the bought-down rate.

The VA states, “Increases resulting from confirmed future promotions or wage percentage increases guaranteed by labor contracts (for example, teachers and auto workers) may be given favorable consideration.”

What if the lender cannot provide evidence of future income increases

The lender can still consider the buydown arrangement as a compensating factor. For example, if the buydown period exceeds the duration of debt service.

See “Compensating Factors” in Chapter 4 of the VA Handbook.

For example, Pat and Amare, the applicants in our case study, have $7215 net take-home pay. The applicants appear over-encumbered at present relative to their mortgage request. However, a child support order terminates in 22 months. Additionally, the applicants have relatively reasonable cash reserves, and the numbers line up once the support obligation ends. Can something be done to help this household become homeowners? Oh, hell yeah!

Background

Pat and Amare bought a $500,000 home and applied to their bank for a 30-year fixed-rate mortgage at a note rate of 6.00%.

Housing Costs

- The PI is $3067

- Property tax $727

- Hazard Insurance is $162

- Association dues are $175

- Utilities and Maintenance $210

Debt and Obligations

- The applicants have a $621 monthly car loan with an outstanding balance of $31,500

- The borrower is legally obligated to a $1500 child support order for another 22 months

The Analysis

- The loan amount is $511,500

- 6.00% 30-year fixed rate

- PITIA $4341

Before 2/2 Buydown

- PITIA $4341 + $2121 mo debt = $6462

- Net take-home pay: $7215

- Required residual: $1158

- Calculated residual income: $753

The First Lender’s Credit Decision: Declined, insufficient income.

___________________________________________________

The Second Lender’s Credit Decision with the 2/2 Buydown: Approved Subject to VA waiver (Received): Residual income deficiency

Loan Notes: Seller-paid 2/2 TBD. Seller credits within allowable concessions. 13-month reserve, 762 CS. See current state 26-6393 buydown analysis and future state 26-6393 post-child support, post TBD analysis. 119% residual income during the TBD period. 194% residual income post child support award for the duration of the term. Child support terminates at emancipation. See the attorney’s letter regarding the applicable statutory termination. See support orders. Credit Score and reserves demonstrate the applicant’s ability to maintain high debt service. The applicant’s current rent is $4400.

After the 2/2 buydown (2% subsidy for two years, e.g., 6.00% bought down to 4.00% for two years)

- Gross Income: $10,000

- Net take-home pay: $7215

- $2442 TBD P&I payment

- Total Current and proposed obligations (buydown period): $3716 + $2121 = $5837

- Calculated residual with buydown: $1378

- Residual post-support/post-buydown period: $2253 ($6462 – $1500 = $4962 years 3-30)

Audit result: Because the support order terminates before the end of the buydown, the underwriter correctly considers the residual income at the bought-down payment. As a result, the underwriter adequately justifies the initially high DTI, <120% residual, with a compensating residual in years 3-30. The applicants have reserves, excellent credit, and paid on-time rent history—minimal payment shock.

Go the extra mile for your customers.

BEHIND THE SCENES – Watch those Government Requirements

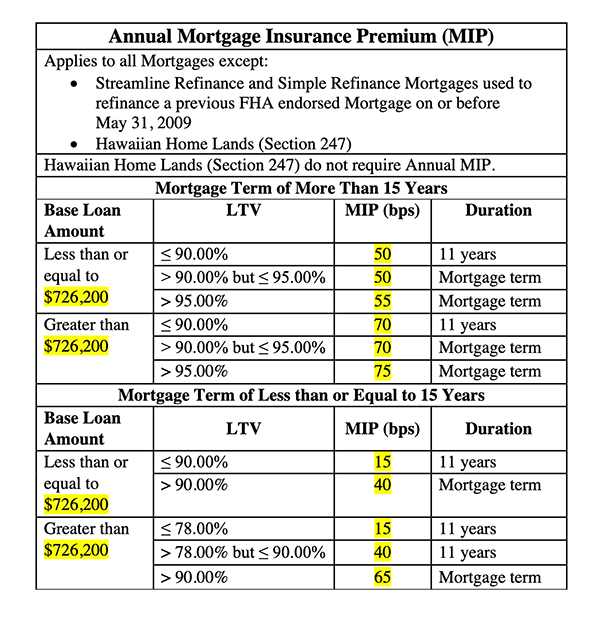

HUD Announcement February 22, 2023

Mortgagee Letter 2023-05

HUD is reducing the annual MI by 30 BPS on forward Title II loans. The effective date of ML provisions is effective for case numbers endorsed on or after March 20, 2023. See the entirety of the changes from the HUD link below.

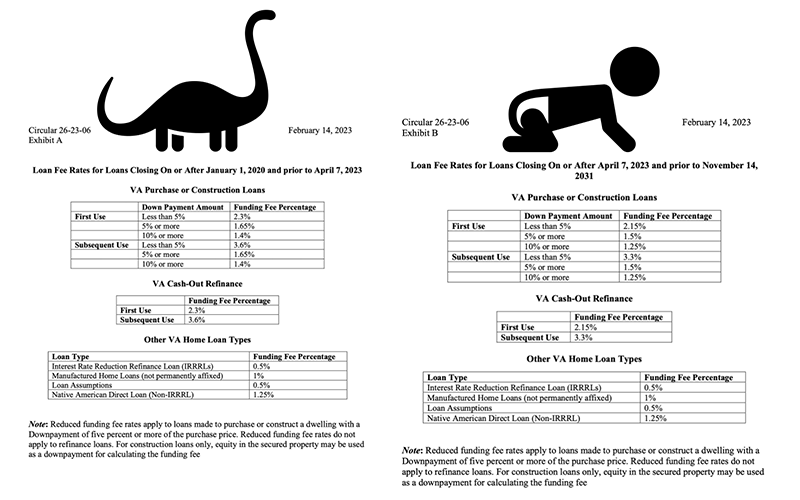

Not to be outdone, VA announced Funding Fee reductions.

Circular 26-23-06

Department of Veterans Affairs February 14, 2023

For loans closed on or after April 7, 2023, lenders must charge non-exempt Veterans the new funding fee percentage from the loan fee table. Exhibit B contains the funding fee rates for loans closing on or after April 7, 2023, and before November 14, 2031.

VA is reducing the funding fee on various transactions from 15-30 BPS.

Mortgagee Letter HUD MIP Changes

Advertise with the LOSJ

Tip of the Week – Disclosure for Borrower Temporary Buydowns (TBD)

There may be instances when a borrower paid temporary buydown is a good and necessary solution. The other 99% of the time, frankly, borrower-paid TBDs are head-scratchers. You may also have noticed that while the borrower-paid TBD is acceptable for all the major programs, lenders have an aversion to the structure. And for a good reason. Disclosure complexity is a good reason to avoid these beasts.

Additionally, why would the borrower do this anyway? “Here is my money. Please return it to me with no interest over the next two years.” The excellent article on buydowns for qualification article above denotes one of those instances when maybe it makes sense for a borrower-paid TBD.

Lender-paid TBDs can also be more complex than traditional third-party or seller-paid TBD. But we will save that for another tip of the week.

Be mindful of the federal disclosure requirements for borrower-paid temporary buydowns. Your LOS may not be programmed to produce a compliant Loan Estimate without some overrides.

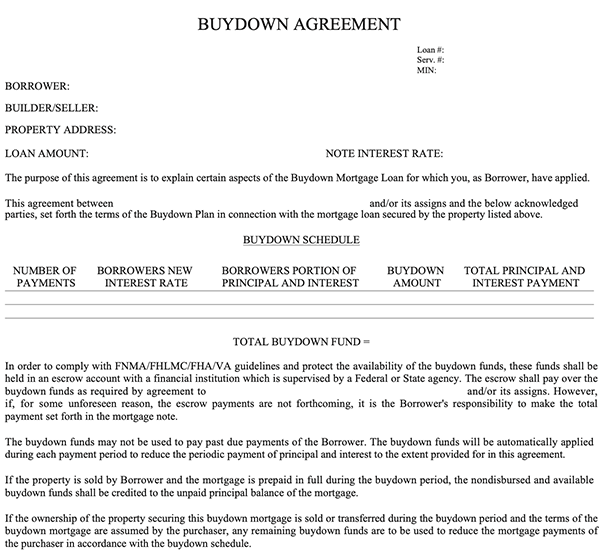

Borrower Paid TBD

The Loan Estimate must reflect borrower-paid buydowns as an amendment to the loan agreement rate terms. However, that does not mean the note needs to reflect the TBD. What it means is found in Regulation Z disclosure requirements. 12 C.F.R. § 1026.17(c)(1) The disclosures shall reflect the terms of the legal obligation between the parties (which means, at the least, the early and final disclosures).

FHLMC and FNMA expressly prohibit altering the note with TBD terms. However, all stakeholders will require a TBD agreement. Additionally, the lender must disclose borrower-paid buydowns as finance charges. Among other disclosures, the Projected Payments disclosure must reflect the bought-down payments.

A composite annual percentage rate must be calculated, considering all interest rates and the effect of the prepaid finance charge (buydown subsidy). Additionally, the TRID disclosures must reflect that the transaction is a step-rate product.

When a third party, such as the seller and the borrower, contributes to the buydown subsidy, the lender must include the portion paid by the borrower in the finance charge and disclose the corresponding multiple payment levels and composite annual percentage rate.

The portion paid by the third party and the corresponding reduction in interest rate is not reflected in the disclosure of the finance charge and other disclosures unless the lender reflects the buydown terms in the loan agreement.

Perhaps you were wondering why your fulfillment partner only allows the seller or third-party buydowns. Disclosing lender-paid TBD is not so bad. Disclosing third-party (including the seller) paid TBD is a breeze.

More on that at another time.