Why Haven’t Loan Officers Been Told These Facts?

Calculating VA Zero-Down with Partial Remaining Entitlement

The 2019 Vietnam Blue Water Navy act significantly impacted the VA program, notably the maximum financing. When applicants have full entitlement, the VA does not limit the maximum loan amount. However, the VA has an aggregate lender indemnity limit when the applicant has a partial entitlement due to prior use. In these cases, the lender must apply the county loan cap to calculate the maximum loan amount, possibly necessitating a down payment.

The VA does not require a 25% guarantee. The VA limits its maximum guarantee to 25%. It is the secondary market that requires a minimum 25% guarantee.

38 C.F.R. § 36.4302 Computation of Guaranties or Insurance Credits.

When you examine the applicant’s Certificate of Eligibility (COE), the $36,000 entitlement is the VA lender guarantee for loans up to $144,000. For loans exceeding $144,000, the VA covers up to 25% of the loan for potential lender losses. Therefore, loans under $144,000 may have more than a 25% guarantee. For example, 38 CFR 36.4302(a)(4) is the lesser of $36,000 or 40 percent of the original principal loan amount where the loan amount exceeds $56,250.

Do the math:

A $100,000 loan amount has up to $36,000 or 40% entitlement, whichever is less. So in the example, the lender has up to a $36,000 indemnity. That obviously is more than the minimum 25%, which is fine.

For most transactions, the VA’s basic guarantee or promise is to indemnify lenders/investors for actual losses up to 25% of the appraised value or sales price. What constitutes loss is more technical.

When the applicant has a partial entitlement, the lender must calculate the amount of available entitlement to insure the new loan. This calculus is simple. Start with a current COE. The COE makes clear the remaining partial entitlement. Then, to calculate the maximum no-money-down loan with the remaining entitlement, multiply the remaining entitlement by four.

EXAMPLE I

Assume the subject is in a county where the FHFA single-family limit is $726,200. The VA uses the FHFA (the same maximum loan amount used for FNMA and FHLMC) single-family loan limit even when the subject is multi-family.

The subject is a $500,000 purchase.

Locate the subject property county. Take 25% of the FHFA County Limit. For example, $726,200 * .25 = $181,550. When financing a home in this county with partial eligibility, the VA’s total claim exposure is $181,550 for all insured transactions. Let’s say the COE indicates a remaining partial entitlement of $131,550. In our case study, the purchase price is $500,000. The required guarantee is 25% or $125,000. The COE indicates a partial entitlement of $131,550. In this case, the remaining partial entitlement is sufficient to cover the new loan. $131,550 x 4 = $526,200.

EXAMPLE II

Assume the same partial remaining entitlement of $131,550, but in this example, the purchase price is $600,000. How would that square with the GNMA 25% requirement?

From the GNMA MBS Guide (Chp 24 Handbook 5500.3 rev1)

(3) Special requirements for VA-guaranteed loans: For a VA-guaranteed loan to be eligible for pooling, the following additional requirements apply:

The amount of cash down payment and/or equity, plus the amount of available VA guaranty must equal at least 25% of (i) the purchase price of the property or (ii) the Certificate of Reasonable Value (CRV), whichever is less. The funding fee charged by VA must not be included in this calculation.

The cash down payment may not be derived from a second mortgage on the property.

Example II Calculations

The simplest down payment calculation is to determine the difference between the required guaranty and the remaining partial entitlement. The remaining partial entitlement is available from the Certificate of Eligibility. It’s as easy as 1,2,3.

- $150,000 required guaranty

- $131,550 remaining partial entitlement

- $18,550 down payment

$600,000 * .25 = $150,000, $131,550 partial entitlement plus no less than $18,450 downpayment meets the 25% GNMA requirement for a $600,000 purchase, $581,550 base loan (financed funding fee is on top of the base loan). Essentially, any sum exceeding the maximum zero-down loan ceiling (partial entitlement /.25) requires 25% of that excess sum as a down payment from the applicant. For example, $131,550/.25 = $526,200. The difference between $526,200 and $600,000 is $73,800. 25% of $73,800 is $18,450.

VA Pamphlet 26-7, Revised Chapter 9: Legal Instruments, Liens, Escrows, and Related Issues 9-9

Most VA loan manufacture will follow the standard GNMA pool restrictions. But what if the lender allows secondary financing to meet the equity requirement or for another purpose?

“Proceeds of the second mortgage may be used for a variety of purposes, including, but not limited to a downpayment to meet secondary market requirement of the lender. The loan (in conjunction with the first mortgage) may not exceed the NOV.”

Is secondary financing possible? In theory, yes. However, in practice, doubtful.

Secondary borrowing is acceptable as long as “The Veteran is not placed in a substantially worse position than if the entire amount borrowed had been guaranteed by VA.” – But, what does this mean for the lender? Could the VA be any vaguer?

From the University of Chicago Law School: The plain meaning rule says that otherwise-relevant information about statutory meaning is forbidden when the statutory text is plain or unambiguous.

What about regulations and handbooks? Who knows. Most prudent stakeholders approach regulatory ambiguity with a worst-case reading. “The Veteran is not placed in a substantially worse position than if the entire amount borrowed had been guaranteed by VA” sure as hell means the quality of the secondary financing had better equal or exceed the qualities of the VA loan. With VA financing, assumability is no insignificant feature.

The VA does qualify the ambiguity in one area, “The rate on the second mortgage may exceed the rate on the VA-guaranteed first; however, it may not exceed industry standards for second mortgages.” But, again, what does that mean to a lender, “substantially worse” or “industry standards.” Would that industry-standard be for subprime loans or a 780 credit score under 75% CLTV?

Don’t count on any lender trying to figure that out for you. And don’t expect a sympathetic examination from VA.

Remember, where ambiguity increases, subjectivity and risk management should increase. For a lender to systematically risk substantial VA or GNMA noncompliance, let alone for a single loan, is well beyond the risk tolerance of most prudent lenders.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES

FNMA Valuation Modernization – Goodby Appraisal Waiver

From FNMA

Value acceptance is being used in conjunction with the term “appraisal waiver” to better reflect the actual process of using data and technology to accept the lender-provided value. We are moving away from implying that an appraisal is a default requirement. (Note that we are using “value acceptance (appraisal waiver)” for a period of time and will eventually move to “value acceptance” after the market absorbs this change.)

Edited FAQ’s From FNMA

What is Value Acceptance + Property data?

First, the transaction qualifies for what was formerly known as an “Appraisal Waiver,” now known as “Value Acceptance.” In addition to the DU Value Acceptance finding, FNMA requires property data to be collected by a trained and vetted third party (real estate agent, insurance inspector, appraiser, etc.). The lender reviews data and warrants property eligibility.

What is Property Data Collection (PDC)?

PDC consists of a full interior and exterior inspection of the subject property. The data collection can be performed by a trained and vetted third party. (Uber drivers? :))

What is a Hybrid Appraisal?

A hybrid appraisal consists of property data collected by a trained and vetted third party (real estate agent, insurance inspector, appraiser, etc.) which is passed to an appraiser to perform an enhanced version of a desktop appraisal. This is for loans that do not qualify for value acceptance or do not have reliable prior observations of the subject property.

What is a Desktop Appraisal?

An appraiser completes the appraisal without physically inspecting the property, using data from various sources (agents, homeowners, MLS, tax records, etc.). This is best suited for purchase transactions.

What Does This Valuation Modernization Mean? What will Change?

- Lenders can expect to see a reduction in value acceptance (appraisal waiver) offers.

- The percentage of loans receiving value acceptance or value acceptance + property data offers will exceed the original value acceptance percentage for most lenders.

- Desktop Underwriter® (DU®) will begin to issue new messages for value acceptance + property data beginning April 15, 2023.

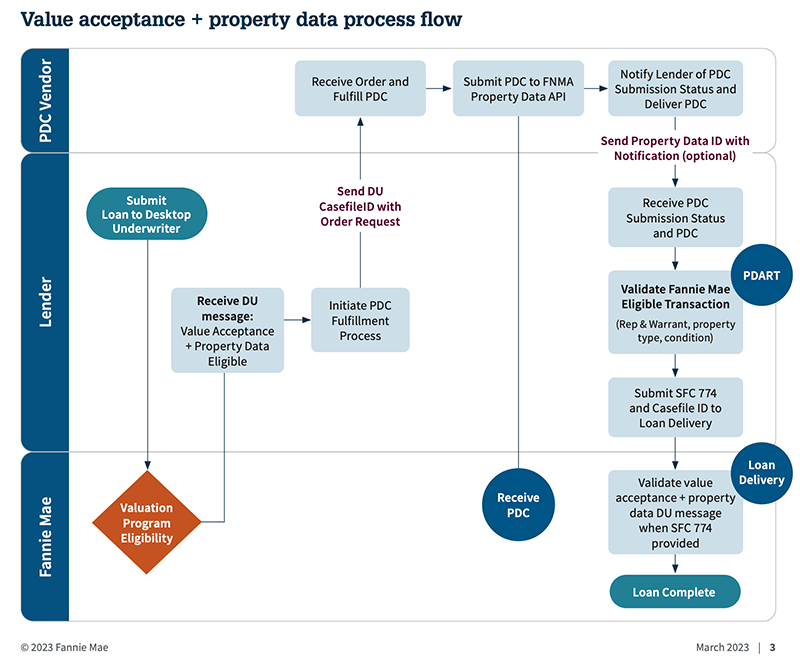

How does the Lender Process Value Acceptance + Property Data?

A lender may only exercise value acceptance + property data when:

- The final submission of the loan casefile to DU resulted in an eligibility message for value acceptance + property data

- Property data collection is obtained after the initial DU offer

- Property data collection is submitted to the Property Data API

- An appraisal is not obtained for the transaction

- The offer is not more than four months old on the date of the note and mortgage.

If the value acceptance + property data offer is lost due to changes in qualifying loan characteristics after the property data was obtained, in some cases, it may be possible for the lender to submit the property data to an appraiser to perform a hybrid appraisal assignment. See Selling Guide B4-1.2-03, Hybrid Appraisals, for specific requirements. Alternatively, the lender may obtain a desktop or traditional appraisal report as specified by DU.

FNMA Valuation Acceptance + Property Data

Tip of the Week – Ethical Concerns

QUESTION: Does doing the right thing increase or decrease productivity?

ANSWER: Does it matter?

Last week, the question was what to do when faced with the all too common predicament; competing against the understated Loan Estimate.

Usually, the prospect is shopping lenders and presents the MLO with the competition’s LE, seeking concessions, comments, or reassurance. Whether the competitor’s LE is intentionally understated or prepared in error, how should the MLO respond?

The Loan Estimate is crucial to the TILA/RESPA consumer mortgage protections. RESPA focuses on keeping down consumer costs by prohibiting kickbacks, increasing competition, and providing timely consumer information. The TILA focuses on the consumer’s informed use of credit through disclosure and fostering increased competition. Therefore, it stands to reason that MLOs and lenders should consider these objectives and articulate the same to the consumer when discussing Loan Estimates.

RESPA §2601. Congressional findings and purpose

(a) The Congress finds that significant reforms in the real estate settlement process are needed to ensure that consumers throughout the Nation are provided with greater and more timely information on the nature and costs of the settlement process and are protected from unnecessarily high settlement charges caused by certain abusive practices that have developed in some areas of the country.

(b) It is the purpose of this chapter to effect certain changes in the settlement process for residential real estate that will result-

(1) in more effective advance disclosure to home buyers and sellers of settlement costs;

(2) in the elimination of kickbacks or referral fees that tend to increase unnecessarily the costs of certain settlement services.

TILA §1601. Congressional findings and declaration of purpose

(a) Informed use of credit

The Congress finds that economic stabilization would be enhanced and the competition among the various financial institutions and other firms engaged in the extension of consumer credit would be strengthened by the informed use of credit. The informed use of credit results from an awareness of the cost thereof by consumers. It is the purpose of this subchapter to assure a meaningful disclosure of credit terms so that the consumer will be able to compare more readily the various credit terms available to him and avoid the uninformed use of credit.

How to Respond to Comparison Shoppers

Firstly, remember that just because the LE appears understated does not mean it is understated. Therefore, accusing the competition of understating the numbers could turn out to be ignorant, misinformed, and slanderous. Furthermore, bad-mouthing competition almost always looks unseemly from the consumer’s perspective. Additionally, the lender could appear to discourage the consumer from shopping and comparing loans, which is a probable UDAAP violation.

Instead, emphasize the preliminary nature of the Loan Estimate. Ask the prospect if they agree it is appropriate to overstate the estimate to ensure the consumer has the full scope of the eventual financing. For example, “Ms. Prospect, many customers have shared some apprehension concerning the estimated cash to close and monthly payment. The specific concern is that the numbers estimated at application might increase at or before closing. As a result, they may close on a loan with unaffordable or uncompetitive terms. Consequently, at ABC Mortgage, we have found the best practice is to overstate the cash to close and the monthly payments preliminarily. In other words, this is a good-faith estimate of the high side final numbers.”

When affirming the value and integrity of your LE, there is no need to besmirch the integrity, competence, or accuracy of the competing lender. For example, “Mr. Prospect, do you have an insurance agent yet? Great, let’s call them and get a more precise estimate for the Homeowners insurance. It appears this LE has an estimated premium of $1,300.00. However, my estimate is $2,200.00. The difference in premiums could indicate differences in coverage. This may be a matter of concern. For example, policies with a $50,000.00 deductible for wind and hail may not meet the lender’s insurance requirements.”

On another note, this isn’t to say that concessions are unnecessary, especially in this market. That said, remember the Regulation Z MLO compensation rules related to concessions. “If you are a loan originator, you generally may not agree with another person to set your compensation at a certain level and then subsequently lower it in selective cases, such as for consumers who find lower rates with other creditors.”