Why Haven’t Loan Officers Been Told These Facts?

Pricing Concessions

Price matching occurs when a lender grants a pricing concession based on a competitor’s offer. However, numerous circumstances may give rise to appropriate and compliant concessions well beyond price matching. But the inexpert granting, processing, and documentation of financing concessions can result in TILA, ECOA, and UDAAP violations. How can originators reduce noncompliance risk due to pricing concessions?

The Loan Originator Rule (LOR) is the CFPB slogan for a cluster of Regulation Z rule changes driven by the 2010 Dodd-Frank legislation. Of particular note is the widely impactful mortgage origination compensation rules for closings subject to the LOR after January 1, 2014.

The term “loan originator” applies to loan origination organizations and individual mortgage originators. While the LOR coverage transcends third-party originators (TPOs) and applies to creditors and creditors’ employees, understand that the rule changes stemmed from a Congress focused on creditors’ and mortgage brokers’ relationships and ensuing incentivization of predatory practices.

Over the years, the CFPB has clarified mortgage compensation rules through various promulgations, foremost by Regulation Z section “§ 1026.36 Prohibited acts or practices and certain requirements for credit secured by a dwelling.”

What is a loan originator under Regulation Z

Comment 36(a)-1.i.B states, “The term “loan originator” includes employees, agents, and contractors of a creditor as well as employees, agents, and contractors of a mortgage broker that satisfy this definition.”

Therefore, when unpacking the LOR, one must consider the nuanced application of the term as it relates to two discrete relationships; the creditor-to-mortgage broker compensation and the mortgage broker-to-individual mortgage originator compensation. The LOR applies to compensations paid in both relationships.

The question often arises, is it permissible to pay the individual MLO a lower compensation based on transaction circumstances? The Journal has commented in the past on the atrocious mind-numbing wooden implementations of the LOR, resulting in the nickel and diming of relationships to death.

The answer to whether individual MLOs can accept a pay cut based on pricing concessions is a resounding yes. However, there is compliance peril. Not only for Regulation Z violations but also ECOA violations. Either violation may also lay the foundation for Consumer Protection Act (Dodd-Frank Title X) violations, which of late, is a favorite battle ax of regulators.

The Journal addressed CFPB promulgation on pricing concessions in Volume 2 Issue 16, “Do White Guys Get Better Mortgage Pricing Than Non-White Guys and Women? The CFPB Identifies Patterns of Uneven Pricing Exceptions Along Protected Class Lines.”

Feedback from CFPB Examinations

CONSUMER FINANCIAL PROTECTION BUREAU | DECEMBER 2021

Supervisory Highlights Issue 25, Fall 2021

2.4.1 Pricing Discrimination

“ECOA prohibits a creditor from discriminating against any applicant, with respect to any aspect of a credit transaction, on the basis of race or sex.

Examiners observed that mortgage lenders violated ECOA and Regulation B by discriminating against African American and female borrowers in the granting of pricing exceptions based upon competitive offers from other institutions. The failure of the lenders’ mortgage loan officers to follow the lenders’ policies and procedures with respect to pricing exceptions for competitive offers, the lenders’ lack of oversight and control over their mortgage loan officers’ use of such exceptions, and managements’ failure to take appropriate corrective action surrounding self-identified risks all contributed to the observed pricing disparities.

The examination team observed that lenders maintained policies and procedures that permitted mortgage loan officers to provide pricing exceptions for consumers, including pricing exceptions for competitive offers, but did not specifically address the circumstances when a loan officer could provide pricing exceptions in response to competitive offers. Rather,the lenders relied on managers to promulgate a verbal policy that a consumer must initiate or request a competitor price match exception.

The examination team identified lenders with statistically significant disparities for the incidence of pricing exceptions for African American and female applications compared to similarly situated non-Hispanic white and male borrowers.

Examiners did not identify evidence that explained the disparities observed in the statistical analysis. Instead, examiners identified instances where lenders provided pricing exceptions for a competitive offer to non-Hispanic white and male borrowers with no evidence of customer initiation. Furthermore, examiners noted that lenders failed to retain documentation to support pricing exceptions.

Also, lenders’ fair lending monitoring reports and business line personnel raised fair lending concerns regarding the lack of documentation to support pricing exception decisions. Despite such concerns, lenders did not improve the processes or document customer requests to match competitor pricing during the review period. In response to these findings, lenders plan to undertake remedial and corrective actions regarding these violations, which are under review by the Bureau.”

CONSUMER FINANCIAL PROTECTION BUREAU | NOVEMBER 2022

SUPERVISORY HIGHLIGHTS Issue 28, Fall 2022

“Regulation Z prohibits compensating mortgage loan originators in an amount that is based on the terms of a transaction or a proxy for the terms of a transaction. This means that a “creditor and a loan originator may not agree to set the loan originator’s compensation at a certain level and then subsequently lower it in selective cases.” The rule, however, permits decreasing a loan originator’s compensation due to unforeseen increases in settlement costs. An increase is unforeseen if it occurs even though the estimate provided to the consumer is consistent with the best information reasonably available to the disclosing person at the time of the estimate. Thus, a loan originator may decrease its compensation “to defray the cost, in whole or part, of an unforeseen increase in an actual settlement cost over an estimated settlement cost disclosed to the consumer pursuant to section 5(c) of RESPA or an unforeseen actual settlement cost not disclosed to the consumer pursuant to section 5(c) of RESPA.”

Examiners found that certain entities provided consumers loan estimates based on fee information provided by loan originators. At closing, the entities provided consumers a lender credit when the actual costs of certain fees exceeded the applicable tolerance thresholds. The entities then reduced the amount of compensation to the loan originator after loan consummation by the amount provided to cure the tolerance violation. Examiners determined, however, that the correct fee amounts were known to the loan originators at the time of the initial disclosures, and that the fee information was incorrect as a result of clerical error. Specifically, in each instance, the settlement service had been performed and the loan originator knew the actual costs of those services. The loan originators, however, entered a cost that was completely unrelated to the actual charges that the loan originator knew had been incurred, resulting in information being entered that was not consistent with the best information reasonably available. Accordingly, the unforeseen increase exception did not apply.

CONSUMER FINANCIAL PROTECTION BUREAU | NOVEMBER 2019

Loan Originator Rule Small entity compliance guide

5.7 How may loan originators increase or decrease their compensation in a particular transaction? (Comments 36(d)(1)-5 and -7)

“If you are a loan originator, you generally may not agree with another person to set your compensation at a certain level and then subsequently lower it in selective cases, such as for consumers who find lower rates with other creditors.

When the creditor offers to extend credit with specified terms and conditions (such as rate and points), the amount of your compensation for that transaction may not change (increase or decrease) based on whether different terms are negotiated.

For example, if a creditor agrees to lower the rate it initially offered, the new offer may not reduce your compensation.

While a creditor may change credit terms or pricing to match a competitor, to avoid triggering high-cost mortgage provisions or for other reasons, you may not change your compensation.

There is one provision that allows you to lower your compensation. When there are unforeseen increases in settlement costs, you may lower your compensation to lower the costs to the consumer within certain limitations. (See “Does the rule permit a loan originator to reduce its compensation to cover unexpected costs?” in Section 5.8.)”

5.8 Does the rule permit a loan originator to reduce its compensation to cover unexpected costs? (Comment 36(d)(1)-7)

“Yes. The Loan Originator Rule permits a loan originator to reduce its compensation in narrowly- defined circumstances to lower costs to consumers if there are unforeseen increases in settlement costs.

Specifically, if you are a loan originator, you may decrease your compensation to lower the actual settlement cost for a consumer if there was an unforeseen increase in the actual settlement cost over the estimate disclosed to the consumer under the TILA-RESPA Integrated Disclosure Rule (TRID Rule) or section 5(c) of RESPA (or an unforeseen actual settlement cost not disclosed under the TRID Rule or section 5(c) of RESPA).

An increase in a settlement cost at closing is unforeseen if the increase occurs even when the estimate provided to the consumer is consistent with the best information reasonably available to the disclosing party at the time the disclosure was made.

For example, assume a consumer locks in a rate for a purchase-money transaction. A title issue delays the closing by a week and the rate lock expires. The consumer wants to relock the interest rate. Provided the title issue was unforeseen, you (as a loan originator) may decrease your compensation to pay in whole or in part for the rate-lock extension fee.”

REGULATION Z AND B JEOPARDY

The lack of formality (written policies and procedures, implementation records) and a haphazard process will get you every time. Verbal instructions for something as significant as pricing policy and fair lending compliance? If and when the lender desires to grant pricing exceptions, it should always start with a written exception request. The lender then retains the exception request and evidence of the concession. Email chains are better than nothing.

The lender needs evidence that the exception originated with the applicant. Keep any records for a minimum of 60 months regardless of consummation or not. Regulation B requires 25-month record retention. MLO compensation requires a three-year retention. The LE requires three years of retention. However, the CD requirement is five years. Brokers are not responsible for the CD retention requirements. However, if something comes up regarding the CD, the broker’s record might help. Anything surrounding the CD should be retained for five years.

Have the designated person sign off on any pricing concessions and ensure appropriate comments and documentation relative to the business purpose of the concession are in hand before granting the exception.

Consistency helps. Have a clear written policy on pricing exceptions. Implement procedures to ensure the policy is promulgated and followed.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – The CFPB Survives Another Constitutional Challenge

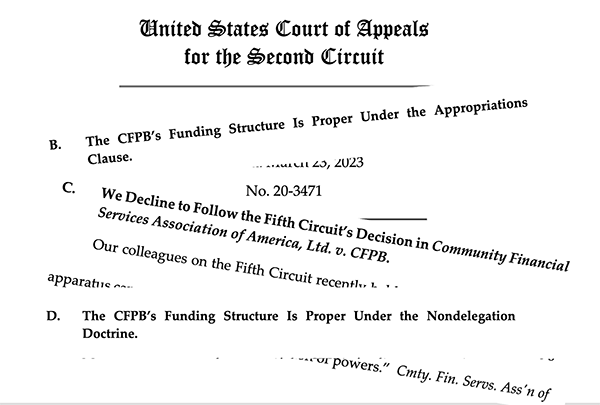

CFPB v. law Offs. No. 20-3471 (2d Cir. 2023)

Debt-Collectors’ defense against the CFPB’s unconstitutional funding structure gets tossed, SCOTUS to decide in the fall

The US Court of Appeals 2nd Circuit Differs from other court rulings; even another US Appeals Court (5th Circuit)

In a nutshell, the Appeals Court stated in the March 23, 2023, ruling

- The CFPBs funding structure is proper under the Appropriations Clause

- The CFPBs funding structure is proper under the Nondelegation Clause

What is all the fuss?

Title X of the Dodd-Frank legislation created the CFPB. The CFPB budget and funding concerns are the legal matter’s heart. These legal challenges to the constitutionality of the CFPB are defendant defense strategies.

It Takes a Licking and Keeps on Ticking

Debt collectors and payday lenders have sought to assail and mitigate the CFPB’s legal complaints by challenging the agency’s authority to pursue enforcement actions. This is not the CFPBs first brush with constitutional death. Another US Appeals Court brushed aside a similar defense years ago. It is a Zombie argument. It just won’t die.

Everyone is entitled to a robust defense, but payday lenders and debt collectors? Why not make an exception for these vultures? Can’t we proceed to the tar and feathering stage already? After all, the practices of these bottom dwellers make big pharma look like Mother Teresa ministering to those in need.

The process is truly the heart of the matter. We are all better off when the law equally protects society’s minor and least popular elements with the most revered and noble. This equal protection precept has applied to individuals and organizations in the courts. Another discussion is whether one agrees with the treatment of blood-sucking corporations receiving rights like other persons under the law. That question is, what is a person under the law?

The lawyer’s legal defense is that the CFPB cannot prosecute the client because the agency does not lawfully exist. Believe it or not, that could be a winning argument. Several courts have agreed.

It all sounds like lawyers at play, but there is reasoning at work beyond pulling down $1000 an hour to dream up these arguments. Besides, let’s not fault the attorneys for making a living—Heck, who wouldn’t argue that hyenas make good house pets for that kind of money? If you enjoy pro wrestling, you must love these cases. Intellects gone wild.

The defense claims the funding structure of the CFPB violates the Appropriations Clause of Article I (The proposition that a legislature should control the disbursement of public funds) of the Constitution and that Congress violated the nondelegation doctrine (A principle in administrative law that Congress cannot delegate its legislative powers to other entities) when it created the CFPB’s funding structure.

From Title X of Dodd-Frank – 12 U.S.C. §5497 Funding; (C) Reviewability

Notwithstanding any other provision in this title, the funds derived from the Federal Reserve System pursuant to this subsection shall not be subject to review by the Committees on Appropriations of the House of Representatives and the Senate.

The CFPB gets its funding as a percentage of the Federal Reserve expenses/budget, “the amount that shall be transferred to the Bureau in each fiscal year shall not exceed a fixed percentage of the total operating expenses of the Federal Reserve System . . .”

When the 111th US Congress passed the bill, the CFPB was structured to limit political tampering with the agency or its mission. Congress may exert power by controlling spending. Telling Congress how they can or can’t spend money is like pouring cold water on a cat. And so the 111th Congress gave the middle finger to typical Congressional budget controls.

The SCOTUS will chime in later this year. Stock up on any CFPB swag you find – it could be a collectors item someday.

Tip of the Week – Sign up for 2023 CE

The CFPB undertook the herculean task of engineering a one-size-fits-all primer on getting a mortgage. As the RESPA and TILA administrator, it falls on the CFPB to publish the Special Information Booklets.

In its mission, the CFPB largely succeeded in updating the Booklet. However, the Booklet comes with strengths and a few weaknesses.

Before heading into these waters, let’s make one thing clear. Lenders and MLOs should uphold the law’s required disclosure, process, and consumer protections. Furthermore, it will likely undermine the consumer’s confidence in the process if the track’s efficacy or stability is questioned. Therefore, always be circumspect when qualifying the required process or disclosure. When augmenting the Toolkit guidance, do so in a complementary fashion, not a critical or contrary manner.

The Journal’s criticism is for the edification of mortgage professionals and is not intended for consumer consumption.

The Special Information Booklet, originally intended to help consumers pay lower settlement costs (including mortgages), is an excellent resource on balance. But some of the guidance needs fine-tuning and qualification. In addition, some of the guidance is downright ugly.

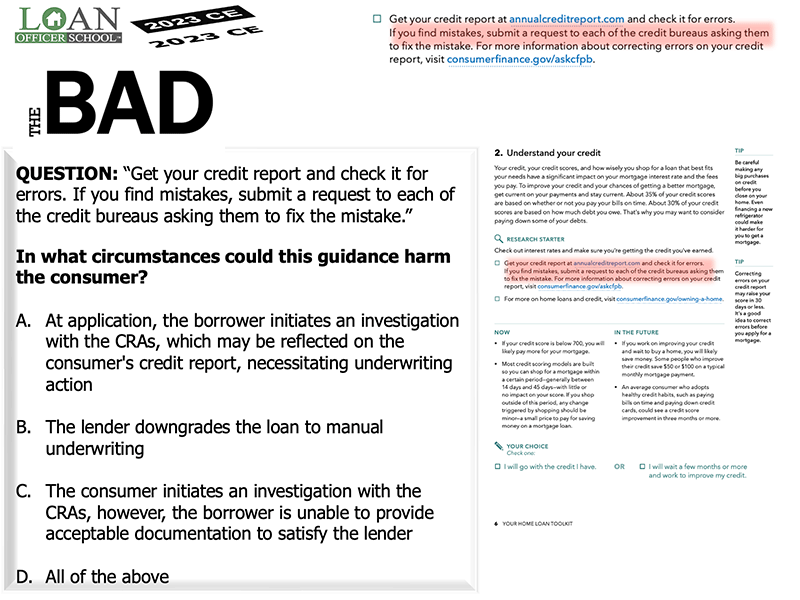

For example, are you aware that on page 6, the Booklet urges, “Get your credit report and check it for errors. If you find mistakes, submit a request to each of the credit bureaus asking them to fix the mistake.” This suggestion is excellent advice. But timing is everything.

The guidance to check your credit report and make disputes during the loan manufacture is generally unnecessary and ill-advised. What could go wrong? As is said, timing is everything.

It is worth noting that, used well, the Toolkit is a valuable tool you can leverage significantly.

Please join us for 2023 continuing education and learn more about building rapport with prospects and customers by leveraging the required disclosure.