“The opinions and analyses contained herein are solely of the users/authors of any data analyses or papers, and the FHFA cannot and does not attest to nor vouch for the quality, accuracy, or timeliness of the data, or analyses derived from these data after the data has been retrieved from FHFA.gov.”

Why Haven’t Loan Officers Been Told These Facts?

Think Twice When Providing the Rate Quote

Can a mortgage prospect determine that the presented option is the most suitable absent other options from which to choose? The prospect needs options to determine the best mortgage solutions. A lack of options invites second thoughts, insecurity, and doubt about the selected financing, lender, and loan officer.

Cowboy Mortgage Practices

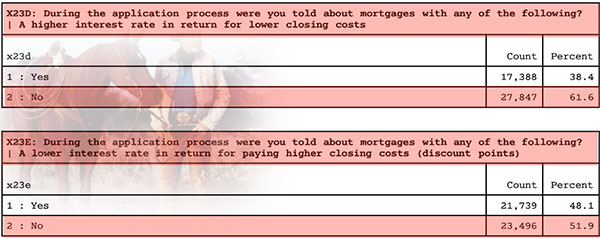

61% of Borrowers State the MLO Failed to Provide a Lower-Cost Tradeoff

The snippet above from the National Survey of Mortgage Originations demonstrates a persistent problem for consumers—an insufficient understanding of everyday mortgage options. Consequently, despite all the mortgage reforms, ongoing consumer ignorance still substantially thwarts the TILA and RESPA objectives. The majority of consumers are still making uninformed credit decisions.

Unfortunately, MLO single-solution presentations are all too common. Every MLO knows the drill. The phone rings. After one degree or other of pleasantries, the prospect says, “What’s your interest rate?” The ill-prepared or poorly trained MLO vomits up some single-rate quote, and the prospect is off to the next lender.

Think Twice

Making a presentation is not always easy. Not just the communication and disclosure mechanics but getting the shopper to slow down enough to listen. Some prospects have no ears to hear, and there is little you can say or do to change that. There will always be folks that don’t need much help or don’t think they need help with mortgage solutions. But for the other 80% of “shoppers,” what you say in the first 15 seconds of the call can make a world of difference.

Conflating a prospect with no interest in a presentation with a prospect who does not know what to say or ask is a big mistake. By default, inexpert shoppers will ask, “What is your rate?”

That’s why MLOs must think twice when the prospect asks for a rate. At the point (however you arrive), you would give a single rate quote to the prospect; instead, give them a 1+0 and 0+0 quote. Suppose the prospect is unfamiliar with premium pricing. In that case, the quote invites a question or two about the quote’s meaning and what option might be best.

Engagement leads to rapport. Instead of giving the customer the third degree before providing a quote, consider integrating the dual pricing into a range-based estimate. Many MLOs use this approach with great success. Use your discounted pricing at the low end of the range and the premium pricing at the other end. Let the prospect ask about the drivers behind the pricing.

The technique is not suited for every interaction but is better than unnecessarily stuttering through the call.

As mentioned, an appropriate loan presentation also furthers Regulations Z and X’s objectives. That is, the consumer makes an informed use of credit. In addition to gaining financing cost clarity, the loan options help inform the consumer about ways to tailor credit offerings, consequently improving the solution’s suitability through lower financing costs (RESPA).

A comparative analysis of the financing options helps engage the consumer. It enhances the likelihood of understanding their options resulting in a better loan selection.

Presenting options is also salesmanship 101. It is far more difficult for the prospect to decide to move forward with only one solution presented. Giving them a selection of solutions is easier on the prospect’s psyche.

The “best mortgage” is only identifiable in a comparative analysis. Comparatively assessing the best options improves consumer satisfaction by fostering a sense of due diligence. Consumers should clearly understand why they select a solution and procure the loan from a given lender.

Remember, every prospect is also a path to the prospect sphere of influence. Love the prospect first. Then they will return the favor when given the opportunity.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – FHFA Outrage

In February, the Journal wrote about the 01/19/23 FHFA announcement about looming loan pricing changes. We even compared the FNMA LLPA matrices before and after versions as of May 01, 2023.

However, while focusing on the obvious, the DTI pricing hit – we missed the fuller magnitude of the planned FHFA pricing changes.

From FHFA Director Sandra L. Thompson – “These changes to upfront fees will strengthen the safety and soundness of the Enterprises by enhancing their ability to improve their capital position over time,” said Director Sandra L. Thompson. “By locking in the upfront fee eliminations announced last October, FHFA is taking another step to ensure that the Enterprises advance their mission of facilitating equitable and sustainable access to homeownership.”

Director Thompson refers to the fee eliminations. These are the abated pricing hits for loans falling under the FHFA “duty-to-serve” program—notably the Low-Moderate-Income loan initiatives, for which the agency should be applauded.

FHFA Announces Targeted Pricing Changes to Enterprise Pricing Framework

FOR IMMEDIATE RELEASE

10/24/2022

“As part of the pricing changes stemming from the Agency’s ongoing review of the Enterprises’ pricing framework announced last year, FHFA is eliminating upfront fees for:

“FHFA is eliminating upfront fees for certain first-time homebuyers, low-income borrowers, and underserved communities to promote sustainable and equitable access to affordable housing,” said Director Sandra L. Thompson. “Today’s announcement will result in savings for approximately 1 in 5 borrowers of the Enterprises’ recent mortgage acquisitions.”

In the October and January announcements, Director Thompson failed to make clear that to pay for these abatements during the present unprecedented housing inflation, the FHFA would commence ripping the lips off a great many other borrowers virtually across the pricing universe.

The pricing increases will be as high as 112 BPS. That is 1.125% to the price. On a $400,000, that works out to $4500 at closing. If rolled into the rate, the finance charges over the term could increase by over $36,000. That is just the DTI and Credit Score/LTV hits. The Journal has yet to evaluate any other changes comprehensively.

Unconscionably Unwise Act – Where the Hell is Congress?

Fair enough, headed into a recession and ever-increasing consumer debt, some risk mitigations are prudent. However painful, pricing adjustments for riskier loans make sense. However, after a closer inspection, Director Thompson’s assertion that “These changes to upfront fees will strengthen the safety and soundness of the Enterprises” boggle the mind. The abatement of pricing hits for the riskiest of loans hardly strengthens the Enterprises’ safety and soundness.

That is why we have government-insured loans. GNMA and the insuring federal agencies are well suited to riskier loans. Part of the risk response spreads out the threat risk when sponsoring lower-grade loans by charging the same price on higher-grade loans. The government-insured loans do, in a sense, penalize better-quality applicants with level pricing. However, everyone pays the same price with government-insured loans. Not so with the FHFA. Instead, Director Thompson imposes significant pricing increases on LESS RISKY transactions to pay for the abatements.

But to balance the risks attendant with the agency’s duty to serve on the backs of the struggling middle-class borrowers further exacerbates the present housing crisis. The FHFA is doing exactly the opposite of what it is supposed to be doing, proving itself unsound and unsafe by worsening all-time high housing insecurity. The agency’s facilitation of capital market liquidity is a tertiary federal mission. First and foremost, the federal sponsorship and supervision are about accessible homeownership, safe housing, and quality of life.

Let’s not lose sight of the forest for the trees, Director Thompson. The purpose of FNMA is not a wooden interpretation of the National Housing Act or Charter Act, “The Congress declares that the purposes of this title are to establish secondary market facilities for residential mortgages, to provide that the operations thereof shall be financed by private capital to the maximum extent feasible.” The question is, why sponsor a secondary market? The answer is to make mortgage financing more accessible and affordable. There must be a better way.

Furthermore, the pricing increases further distances the rate market from the lows of the recent past. These ham-handed pricing manipulations will create even less incentive for those borrowers already locked into sub-three percent fixed rate loans to sell their homes and lose the low rate, worsening the housing stock problem and further pressuring housing costs.

The housing market cannot tolerate any more of Uncle Sam’s fumbles.

We’ve seen enough imprudent federal action. This ill-advised mismanagement of housing opportunities could have gone better last time. Heaven knows when we will recover from the Fed’s intervention. First, the drop in rates, as never before, to get everyone to spend, then to get everyone to stop spending, rates go up into the stratosphere. Now another bungling federal intervention from the FHFA? Write your representatives and senators before these folks run the housing industry into the ground.

The average US credit score is about 715. Note that some of the more burdensome changes will hurt households with above-average scores the most. We’ve highlighted a few more salient changes below.

Tip of the Week – Sign up for 2023 CE

Temporary Buydowns

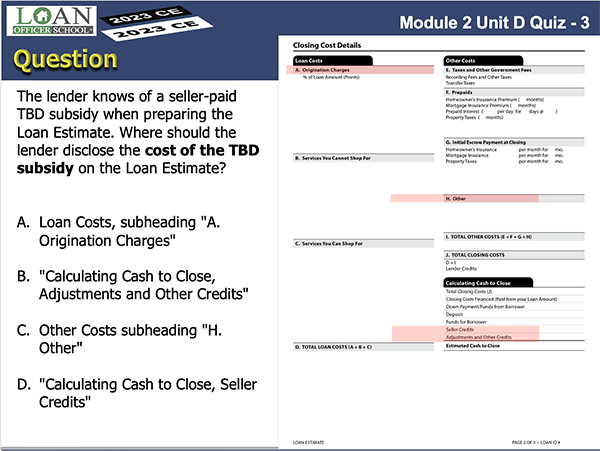

How does the Loan Estimate disclose a seller-paid temporary buydown? Generally, where is the cost of the buydown disclosed?

Take the test.