Why Haven’t Loan Officers Been Told These Facts?

From UDAP to UDAAP

Ten Years In The Making

The CFPB Unpacks Abusive Acts Or Practices In A Cohesive Policy Statement

Congress built the Consumer Financial Protection Act (Title X of Dodd-Frank) upon the established foundation of the 85-year-old statutory consumer protections found in Section 5 of the FTC Act.

As in many statutory implementations, Congress intentionally leaves room for regulatory discretion and interpretation in administering the act. As such, vagaries allow the statute’s administrator the flexibility to fine-tune compliance requirements. In passing the massive Dodd-Frank legislation, Congress hoped to raise the bar against predatory financial services without creating unnecessarily burdensome requirements.

Elements of the Consumer Financial Protection Act of 2010 are founded on the FTC Act, Section 5, which unequivocally prohibits unfair acts that cause damage to consumers and deceptive acts that involve material misrepresentations or omissions. The Title X definitions of unfair and deceptive practices are similar to those outlined in Section 5 of the FTC Act. However, Congress also introduced a new type of prohibition called “abusive acts or practices” in Title X, which may not be entirely clear.

Unfair Acts or Practices

An act or practice is unfair when it causes or is likely to cause substantial injury to consumers that the consumer cannot reasonably avoid.

Deceptive Acts or Practices

An act or practice is deceptive when a representation, omission, or practice misleads or is likely to mislead the consumer, and the consumer’s interpretation of the representation, omission, or practice is considered reasonable under the circumstances. A misleading representation, omission, or practice implies that had the consumer not been misled; they may have enjoyed better decisions or choices.

Abusive Acts or Practices

12 U.S.C. §5511(b)(2) The Bureau is authorized to exercise its authority under Federal consumer financial law to ensure that, concerning consumer financial products and services that, consumers are protected from unfair, deceptive, or abusive acts and practices and discrimination.

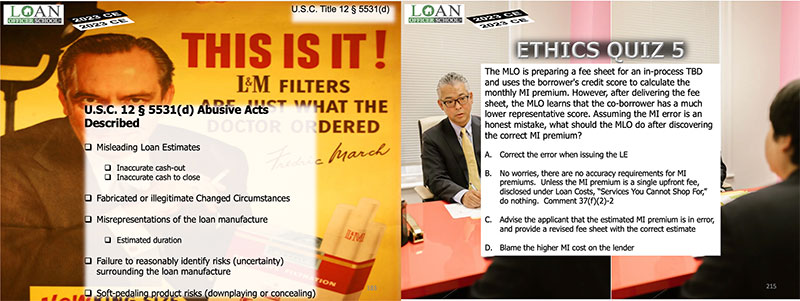

12 U.S.C. § 5531 (a)(d) The Bureau may take any action authorized under part E to prevent a covered person or service provider from committing or engaging in an unfair, deceptive, or abusive act or practice under Federal law in connection with any transaction with a consumer for a consumer financial product or service, or the offering of a consumer financial product or service.

The Bureau shall have authority to declare an act or practice abusive in connection with the provision of a consumer financial product or service if the act or practice:

- Materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service

- Takes unreasonable advantage of a lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service

- Takes unreasonable advantage of the inability of the consumer to protect their interests in selecting or using a consumer financial product or service

- Takes unreasonable advantage of the reasonable reliance by the consumer on a covered person to act in their interests.

There is a common thread. Practices that take “unreasonable advantage” of consumers. The CFPB, jurists, legal scholars, and other stakeholders have wrestled with the scope of Title X abusive acts and practices for years. As is the case for many statutes, stakeholders rely on case law to appropriately clarify legal requirements.

Generally, it may take time to build a sufficient body of case law. Case law, also used interchangeably with the term “common law,” refers to the collection of precedential rulings created by judicial decisions on a particular legal issue or topic. Case law derives from the decisions judges make in the cases before them. As such, case law builds an understanding of the statutory requirements when the court interprets the application and aspects of the law that may be unclear or when the court decides how the law applies to a set of legal facts.

While deception and unfairness have been clarified over time by various agencies and courts, abusive acts or practices have been less defined.

The CFPB’s April policy statement is the most comprehensive and illuminating policy statement on the matter of abusive acts or practices so far.

It just so happens that LoanOfficerSchool.com tackles abusive acts and practices in the upcoming 2023 CE.

Abusive Conduct Concerns The Betrayal Of Trust

From the CFPB’s Policy Statement on Abusive Acts or Practices

Under the CFPA, there are two abusiveness prohibitions. An abusive act or practice: (1) Materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service; or (2) Takes unreasonable advantage of:

-

- A lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service;

- The inability of the consumer to protect the interests of the consumer in selecting or using a consumer financial product or service; or

- The reasonable reliance by the consumer on a covered person to act in the interests of the consumer.

The statutory text of these two prohibitions can be summarized at a high level as: (1) obscuring important features of a product or service, or (2) leveraging certain circumstances to take an unreasonable advantage. The circumstances that Congress set forth, stated generally, concern gaps in understanding, unequal bargaining power, and consumer reliance.

Unlike with unfairness but similar to deception, abusiveness requires no showing of substantial injury to establish liability, but is rather focused on conduct that Congress presumed to be harmful or distortionary to the proper functioning of the market. An act or practice need fall into only one of the categories above in order to be abusive, but an act or practice could fall into more than one category.

Material Interference

Material interference may include actions or omissions that obscure, withhold, de-emphasize, render confusing, or hide information relevant to the ability of a consumer to understand terms and conditions. Interference can take numerous forms, such as buried disclosures, physical or digital interference, overshadowing, and various other means of manipulating consumers’ understanding.

Taking unreasonable advantage

The second form of “abusiveness” under the CFPA prohibits entities from taking unreasonable advantage of certain circumstances. Congress determined that it is an abusive act or practice when an entity takes unreasonable advantage of three particular circumstances. The circumstances are:

-

- A “lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service.” This circumstance concerns gaps in understanding affecting consumer decision-making.

- The “inability of the consumer to protect the interests of the consumer in selecting or using a consumer financial product or service.” This circumstance concerns unequal bargaining power where, for example, consumers lack the practical ability to switch providers, seek more favorable terms, or make other decisions to protect their interests.

- The “reasonable reliance by the consumer on a covered person to act in the interests of the consumer.” This circumstance concerns consumer reliance on an entity, including when consumers reasonably rely on an entity to make a decision for them or advise them on how to make a decision.

Lack of Understanding

The first circumstance, of which entities cannot take “unreasonable advantage,” as defined in the CFPA, concerns “a lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service.”When there are gaps in understanding regarding the material risks, costs, or conditions of the entity’s product or service, entities may not take unreasonable advantage of that gap. Such gaps could include those between an entity and a consumer. Certain types of gaps in understanding can create circumstances where transactions are exploitative.

Gaps in understanding as to “risks” encompass a wide range of potential consumer harms. “Risks” include but are not limited to the consequences or likelihood of default and the loss of future benefits. Gaps in understanding related to “costs” include any monetary charge to a person as well as non-monetary costs such as lost time, loss of use, or reputational harm. And gaps in understanding with respect to “conditions” include any circumstance, context, or attribute of a product or service, whether express or implicit. For example, “conditions” could include the length of time it would take a person to realize the benefits of a financial product or service, the relationship between the entity and the consumer’s creditors, the fact a debt is not legally enforceable, or the processes that determine when fees will be assessed.

Inability of Consumers to Protect their Interests

The second circumstance, of which entities cannot take “unreasonable advantage,” as defined in the CFPA, concerns “the inability of the consumer to protect the interests of the consumer in selecting or using a consumer financial product or service.” When people are unable to protect their interests in selecting or using a consumer financial product or service, they can lack autonomy. In these situations, there is a risk that entities will take unreasonable advantage of the unequal bargaining power. Thus, Congress has outlawed taking unreasonable advantage of circumstances where people lack sufficient bargaining power to protect their interests. Such circumstances may occur at the time of, or prior to, the person selecting the product or service, during their use of the product or service, or both.

Reasonable Reliance

The third circumstance, of which entities cannot take “unreasonable advantage,” as defined in the CFPA, concerns “the reasonable reliance by the consumer on a covered person to act in the interests of the consumer.” This basis for finding abusiveness recognizes that sometimes people are in a position in which they have a reasonable expectation that an entity will act in their interest to make decisions for them, or to advise them on how to make a decision. Where people reasonably expect that a covered entity will make decisions or provide advice in the person’s interest, there is potential for betrayal or exploitation of the person’s trust. Therefore, Congress prohibited taking unreasonable advantage of reasonable consumer reliance. There are a number of ways to establish reasonable reliance, including but not limited to the two described below.

First, reasonable reliance may exist where an entity communicates to a person or the public that it will act in its customers’ best interest, or otherwise holds itself out as acting in the person’s best interest. Where an entity communicates to people that it will act in their best interest, or otherwise holds itself out as doing so, including through statements, advertising, or any other means, it is generally reasonable for people to rely on the entity’s explicit or implicit representations to that effect. People reasonably assume entities are telling the truth. The entity in these situations creates an expectation of trust and the conditions for people to rely on the entity to act in their best interest.

Second, reasonable reliance may also exist where an entity assumes the role of acting on behalf of consumers or helping them to select providers in the market. In certain circumstances entities assume the role of acting on behalf of people as their agents or representatives, and people should be able to rely on those entities to act on their behalf. In other circumstances entities often act as intermediaries to help people navigate marketplaces for consumer financial products or services. In these situations, the entity, acting as an intermediary, can function as a broker or other trusted source that the person uses in selecting, negotiating for, or otherwise facilitating the procurement of consumer financial products or services provided by third parties. Where the entity’s role in the marketplace is to perform these kinds of intermediary functions, people should be able to rely on the entity to do so in a manner that is free of manipulation. In both circumstances, entities that engage in certain forms of steering or self-dealing may be taking unreasonable advantage of the consumers’ reasonable reliance.

For the entire policy statement, see the CFPB Policy Statement on Abusive Acts or Practices

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Goodbye TriMerge, Hello Bi-Merge

FHFA Announces Public Engagement Process for Implementation of Credit Score and Credit Report Requirements

Enterprises to conduct stakeholder outreach and gather feedback

FOR IMMEDIATE RELEASE

3/23/2023

Washington, D.C. – The Federal Housing Finance Agency (FHFA) today announced plans for stakeholder input on proposed milestones as Fannie Mae and Freddie Mac (the Enterprises) work to replace the Classic FICO credit score model with the FICO 10T and the VantageScore 4.0 credit score models, and transition from requiring three credit reports (or “tri-merge”) to requiring two credit reports (or “bi-merge”) for single-family loan acquisitions.

Starting today, the Enterprises will solicit public input on the projected implementation process to inform further refinement of the proposed plans. FHFA and the Enterprises will work with stakeholders to ensure a smooth transition to the new credit scores and the new credit report requirements that minimizes complexity and avoids unnecessary costs.

“Today’s announcement highlights FHFA’s commitment to stakeholder engagement as the Enterprises implement the new credit score models and transition to a bi-merge reporting requirement,” said FHFA Director Sandra L. Thompson. “Obtaining public input in a transparent manner and considering the feedback is critical to a successful transition.”

While FHFA currently estimates that the bi-merge credit report implementation could occur by the first quarter of 2024, implementation of the new credit score models is expected to occur over two phases in 2024 and 2025:

-

- Phase 1, estimated to begin in the third quarter of 2024, will include delivery and disclosure of the additional credit scores.

- Phase 2, estimated to occur in the fourth quarter of 2025, will include incorporation of the new credit score models into pricing, capital, and other processes.

In October 2022, FHFA announced the validation of FICO 10T and VantageScore 4.0 for use by the Enterprises. FHFA and the Enterprises recognize that updates to credit score requirements will necessitate coordination among many stakeholders, and FHFA will continue to promote transparency by providing regular updates. More information, including methods for stakeholders to provide feedback, may be found by visiting the Enterprises’ respective pages below.

Learn more, The Partner Playbook

Tip of the Week – Sign up for 2023 CE

Abusive Acts or Practices

Put simply, as the term is used in Dodd-Frank, abuse involves the betrayal of trust. The loan manufacture is complicated enough that, to a degree, consumers of necessity must trust and depend on MLOs for guidance and advice.

The Journal has suggested that the time to shop for an MLO is before they are needed. Getting professional services during a time of need can be a tall order, similar to when you need a physician, dentist, accountant, or attorney. Yet, that is precisely what the most vulnerable consumers do. What is typical for a first-time home buyer is to meet the MLO when they are house hunting or even after locating a home. Consequently, the consumer is immediately in a highly dependent position once the pressure is on.

Unlike ethically challenged hospitals and auto-repair shops that appear to get a pass on predatory practices, in the highly-regulated mortgage industry, unfairly taking advantage of the consumers’ dependency on those that provide services make this arena an ethical challenge.

Please join us to discuss consumer dependency and trust in the Loan Officer Schools’ 2023 CE.