Why Haven’t Loan Officers Been Told These Facts?

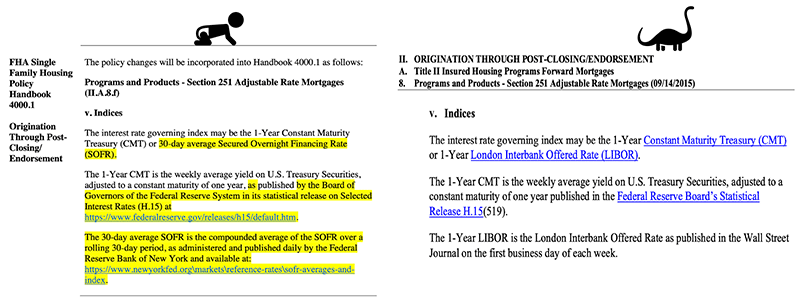

Effective Immediately, FHA ARM’s Now Tied TO SOFR or CMT

A Brief History of the FHA ARM, From HUD

Effective immediately, joining the already implemented SOFR for HECM reverse mortgages, HUD has amended the Code of Federal Regulations to accept SOFR for the Housing Act’s 203(b) provisions. As a result, regular Title II forward mortgages are eligible for insurance with either CMT or SOFR indices.

With this change, the Journal thought it might be interesting to stroll down the FHA memory lane to overview HUD’s implementation of the ARM product for forward loans over the years.

HUD initially provided for mortgage insurance of ARMs for single family forward mortgages under 24 CFR part 203 and for part 234 condominium mortgages in 1984.

As provided in the statute at that time, the interest rate on ARMs had to be adjusted annually, and there was a 1 percent cap on annual adjustments and an overall cap of 5 percent above the initial interest rate over the term of the mortgage. The index originally used by HUD was the U.S. Constant Maturity Treasury (CMT). In 2001 and 2003, statutory changes to Section 251 of the NHA, 12 U.S.C. 1715z-16 allowed HUD to insure ARMs that have fixed interest rates for 3 years or more and are not subject to interest rate caps if the interest rate remains fixed for more than 3 years.

The Modern Era

In 2004, HUD issued a rule (“the 2004 rule”) implementing these statutory changes and providing mortgage insurance for forward ARMs with interest rates first adjustable in 1 year, 3 years, 5 years, 7 years, and 10 years.

Under the 2004 rule, 1, 3, and 5-year ARMs were capped, for each adjustment, in either direction at one percentage point from the interest rate in effect for the period immediately preceding the adjustment. For the life of the mortgage, the overall 5 percent cap in either direction remained. For 7 and 10-year ARMs, HUD raised the per-adjustment cap to 2 percent of the rate in effect for the immediately preceding period, and the life-of-mortgage cap to 6 percent. In all cases, changes that exceeded these amounts could not be carried over for inclusion in an adjustment for the subsequent year. In 2005, HUD revised the regulation to allow for annual adjustments of 2 percent change in either direction, and a life-of-mortgage cap of 6 percent in either direction for 5-year ARMs in 2005, conforming 5-year ARMs to HUD’s 7 and 10-year ARM products.

In 2007 (“the 2007 rule”), HUD added LIBOR, along with the CMT, as an acceptable index for ARM adjustments for its ARM products.

For forward mortgages, the applicability of these indices is codified at 24 CFR 203.49. The cap on 1 and 3-year ARMs (no more than 1 percent in either direction per single adjustment, with a 5 percent from initial contract rate cap over the life of the loan) is codified at § 203.49(f)(1). The caps for the 5, 7 and 10-year ARMs (2 percent in either direction per adjustment, with a 6 percent from initial contract rate cap for the life of the mortgage) are codified at § 203.49(f)(2). HUD also created model note and mortgage documents for forward ARMs and revised those model documents over the years. The 2015 Model ARM Note contains a provision for the substitution of an index by the note holder based on “comparable information,” should the index specified in the note become unavailable.

On March 11, 2021, in Mortgagee Letter 2021-08, HUD removed LIBOR as an approved index and approved the SOFR index for annually adjustable HECM ARMs closed on or after May 3, 2021.

A mortgagee may set rates using CMT or SOFR for annually adjustable HECM ARMs and CMT only for monthly adjustable HECM ARMs. Also, among other changes to the ARM requirements in the Mortgagee Letter, HUD published revised model mortgage documents with “fallback” language intended to address future interest rate index transition events. This language was modeled after the Alternative Reference Rates Committee’s (ARRC) published fallback language for residential ARMs.

10/19/2022 HUD’s Proposed SOFR Rule Change – Effective 05/02/23

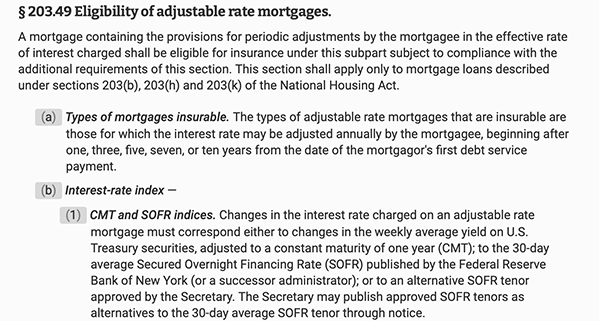

Eligibility of adjustable rate mortgages.

Amend § 203.49 by revising paragraph (b) to read as follows:

(b) Interest-rate index. (1) CMT and SOFR Indices. Changes in the interest rate charged on an adjustable rate mortgage must correspond either to changes in the weekly average yield on U.S. Treasury securities, adjusted to a constant maturity of one year (CMT); to the 30-day average Secured Overnight Financing Rate (SOFR) published by the Federal Reserve Bank of New York (or a successor administrator), adjusted to a constant maturity of one year; or to an alternative SOFR tenor approved by the Secretary. The Secretary may publish approved SOFR tenors as alternatives to the 30-day SOFR tenor through notice.

24 CFR § 203.49

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES –

FHFA Director Thompson Grilled By the House Financial Services Committee

Vice Chairman Hill’s opening remarks

“Generationally high inflation and out of control government spending have made housing affordability worse, with mortgage rates hitting 20-year highs last fall. And the GSEs have somehow become even bigger.

“We have to realize that these outcomes are the result of actions taken in this very room. And it’s hard for me to see it as a very good outcome.

“Enter the FHFA, which has tremendous influence over our housing market and the American economy. Director Thompson has been active on a host of initiatives to revamp and expand the roles that Fannie Mae and Freddie Mac play.”

“These include the questionable—like politically-driven Equitable Housing Finance Plan lending mandates—to the technical, like improving the process for new product approval and continuing to build Enterprise capital.

“Members can decide for themselves if these changes are good or bad, but it’s clear that if you favor a more limited government role in housing markets as I do, then you are probably out of luck. And we’ve been trending in the wrong direction for a while.

“All of that brings us to this hearing and the critical need for Congress to do its job and provide oversight and accountability to the work FHFA is doing.

“In too many instances, it appears that FHFA has allowed safety and soundness to take a back seat to advancing a housing agenda through the GSEs.

“We saw earlier this month when FHFA rescinded its unworkable DTI-based fee and issued a request for input on the opaque process it used to set GSE pricing adjustments.

“The agency’s focus has to be on the safety and soundness of Fannie, Freddie, and the 11 Federal Home Loan Banks.

“Given the tremendous and expanding footprint of the GSEs, homeowners and taxpayers are in need of greater protections from housing instability. With that, I yield back.”

FHFA Director Thompson’s Opening Comments

“Thank you for the invitation to appear at today’s hearing.”

“My testimony includes updates on a number of critical issues advanced by FHFA since I last appeared before this Committee. Among the issues discussed in greater detail below are FHFA’s updates to the Enterprises’ single-family pricing framework, notably including the upfront fees charged by the Enterprises. As Representative Cleaver rightly pointed out at last week’s subcommittee hearing on this topic, housing finance is a complex issue and the pricing grids underpinning this framework are not easily digestible.”

Unfortunately, certain media reports have distorted basic facts by painting an incomplete and misleading picture of these pricing updates. These media reports often make the fundamental mistake of assuming that the pricing grids previously in place were perfectly aligned with the risks faced by the Enterprises. I would like to dispel that myth: in fact, the pricing grids in effect prior to these updates had not been updated in many years and were not fully reflective of the capital framework with which the Enterprises are required to comply.” (In other words, the FHFA has sucked at this for a very long time! Not sure that’s a winning argument, Director Thompson. – LOSJ Editor)

Full Video for Nighttime Sleep Aid

FHFA Testimony Before the House Financial Services Committee

Condensed Version

FHFA House Appearance, Condensed Version

Tip of the Week – Sign up for 2023 CE

Classes Available Now

The silver lining to recessionary pressures is that federal quantitative easing policies will surely follow and give the mortgage industry a shot in the arm. Yes, there may be a small refinance market developing.

The feds must also realize that if the housing industry is to shake off the doldrums, new financing opportunities will necessitate that rates drop about 100 -200 BPS from recent highs. This rate drop would mean a refinance market for many changing payment loans and fixed-rate loans closed over 6.00%. With the national elections on the horizon, keep hope for good things to come.

However, at present, for many consumers, homeownership has become increasingly elusive. The rate hikes have pushed the economy into recession by some accounts (it certainly has for residential real estate) and continue eroding consumer confidence and capacity. The combination of housing scarcity, higher financing costs, and restrictive lending policies contribute to a growing sense of desperation for many households. As the DTIs continue to rise, so will consumers’ willingness to accept riskier financing structures.

Furthermore, with recessionary pressures, credit standards typically tighten. As a result, the economy produces more marginal borrowers than in expanding economic times. Additionally, the capital management squeezes that many lenders are experiencing today will continue to contribute to credit tightening. Expect an uptick in subprime borrowers.

As the industry knows from experience, developments like high rates and housing inflation increasingly put many consumers at risk of taking on inappropriate mortgage debt. This inappropriate debt includes dubious refinances, equity lending, and purchase loans with riskier terms.

While appropriate pricing for risk and reward is not unethical, failing to recognize the vulnerability of relatively weaker applicants and act to protect their interests may put you at greater risk of violating federal laws. The mortgage risks surrounding originating changing payment loans and refinances demand a greater awareness of ethical and legal burdens for mortgage originators. Chiefly, how to document that the lender acted in the consumer’s interest.

There is no law against the consumer taking on foolhardy financing. However, stringent laws prohibit lenders from funding foolish financing when the applicant fails to comprehend the terms. The consumer understanding should include acknowledging the higher costs of subprime offerings and possible pitfalls associated with riskier loan features, including temporary buydowns and ARMs.

Unfortunately, in the years ahead, there is a probability of increased loan flipping, equity stripping, and inappropriate subprime lending in the cards. Accordingly, regulators will be on guard.

Consumers should expect to receive competent, fair, and accurate analysis and disclosure from their MLO. That is what federal and state regulators expect as well.

Please join us to discuss these responsibilities and resultant operational challenges in the Loan Officer School’s 2023 CE classes.