Why Haven’t Loan Officers Been Told These Facts?

Fraud Is in the Air

Rhode Island, The smallest state with the big mortgage fraud issues?

From the Core Logic 2022 Mortgage Fraud Report

• Rhode Island had the largest increase – 60% year-over-year. Its index stands at 170, significantly higher than the national index of 121.

• Rhode Island’s risk increase reflects its larger share of government-backed purchases this year, at the same time risk the FHA/VA segments show higher risk than last year. Lower-volume areas are more susceptible to volatility in these measurements.

• The top five states for increases in risk include: Rhode Island, South Dakota, Kentucky, New York, and Nebraska. As mentioned, several of these are less-populous states where data can be more volatile due to lower levels of lending activity.

• Income and Property fraud types both showed the greatest risk increases, reversing the prior year trend, where they had decreased. This is not surprising given the lending mix moved from rate refinance predominance to purchase loans being the most common transaction.

Purchase transactions have consistently shown higher risk levels, which is still the case. However, the difference in risk has tightened this year because more of the refinance transactions are in the cash-out category. Last year, the Index ranked purchases as 87% riskier than refinances; that figure is now 37%.

See the full report here: CoreLogic 2022 Mortgage Fraud Report

What Can Go Wrong? A Tragic Case Study

Rochester, Illinois, Man Sentenced to 30 Months in Prison for Six Counts of Mortgage-Related Wire Fraud

For Immediate Release

U.S. Attorney’s Office, Central District of Illinois

SPRINGFIELD, Ill. –A Rochester, Illinois, man, REDACTED, 48, of the REDACTED, was sentenced on June 9, 2022 to 30 months in prison, to be followed by three years of supervised release, for six counts of wire fraud resulting from a mortgage fraud scheme.

At the sentencing hearing, the government presented evidence that REDACTED used his extensive knowledge of the mortgage industry and the trust placed in him by his employer, REDACTED, as the manager of its Springfield, Illinois, office, to defraud others and to benefit himself.

Also at the hearing, United States District Judge Sue E. Myerscough found REDACTED was in a position of trust, was acting in a supervisory position, and utilized sophisticated means to conduct the wire fraud. REDACTED was ordered to pay $61,369.36 in restitution and was prohibited from working in a mortgage-related employment position while on supervised release unless given express permission by the Court. Judge Myerscough ordered that $32,811 in restitution be made payable to the Veterans Administration, with the rest owed to REDACTED. Previously, the Illinois Department of Financial and Professional Regulation (IDFPR) had revoked REDACTED mortgage loan originator license and fined him $128,000. In a related matter, IDFPR and REDACTED entered into a consent order where REDACTED agreed to pay $1,275,000 to settle all allegations.

REDACTED was indicted in September 2019 and plead guilty in August 2020. After initially being placed on bond, REDACTED bond was revoked, and he has been in the custody of the U.S. Marshal since June 10, 2021.

The statutory penalties for wire fraud are not more than 20 years in prison, not more than five years of supervised release, and up to a $250,000 fine.

“The significant prison sentence imposed by Judge Myerscough shows that white-collar defendants who harm customers and steal from their employers and entities like the Veterans Administration will pay a stiff penalty for their actions,” said Supervisory Assistant U.S. Attorney Doug Quivey.

“The Federal Bureau of Investigation prioritizes investigating sophisticated white collar crime schemes like the one used by REDACTED” said FBI Springfield Field Office Special Agent in Charge David Nanz. “We are committed to dedicating our investigative resources to target fraud in its many forms to ensure offenders are brought to justice.”

The Federal Bureau of Investigation, U.S. Department of Housing and Urban Development, Illinois Attorney General’s Office, and the Illinois Department of Financial and Professional Regulation investigated the case. Assistant United States Attorneys Tanner Jacobs and Sierra Senor-Moore represented the government in the prosecution.

Updated April 19, 2023

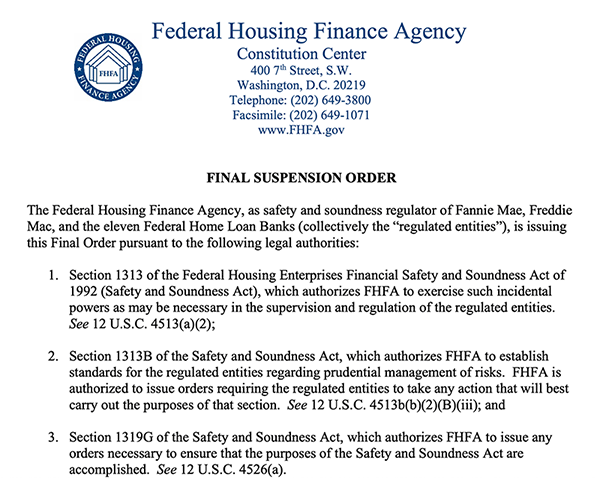

FROM THE FHFA SUSPENSION

Section 1319G of the Safety and Soundness Act, which authorizes FHFA to issue any orders necessary to ensure that the purposes of the Safety and Soundness Act are accomplished. See 12 U.S.C. 4526(a)

Consistent with these authorities, FHFA has determined that any business relationship between REDACTED and the regulated entities would present excessive risk to their safety and soundness.

This determination is based on the following findings:

REDACTED was a loan officer at REDACTED, a loan services company based in Lake Forest, Illinois, with branches in various states throughout the country. One such branch was located in Springfield, Illinois, and was managed by REDACTED.

REDACTED compensation was determined, in part, by the volume of mortgages that customers secured through REDACTED on which REDACTED served as the loan officer. As such, REDACTED had a financial incentive to ensure that mortgage applications of his customers secured approval.

REDACTED routinely committed fraud related to mortgage applications of his customers. He did this in order to improve the appeal of mortgage applicants and increase the likelihood of their applications securing approval, or to assist his applicants in securing external funding for down payments, such that mortgages were more accessible to them.

On June 9, 2022, REDACTED, pursuant to a guilty plea, was convicted by the United States District Court for the Central District of Illinois of wire fraud and was sentenced to imprisonment for a term of thirty (30) months and supervised release for a term of three (3) years.

The conduct underlying the conviction described above occurred in connection with a mortgage business and financial transactions.

With this Final Order, FHFA is directing each regulated entity to cease or refrain from engaging in any business relationship with REDACTED for a term of ten (10) years, beginning on February 28, 2023. This suspension extends to any individual, company, partnership or other group that FHFA determines to be an affiliate of REDACTED.

FROM THE “ILLINOIS TIMES”

REDACTED was once something of a Springfield fixture, with regular appearances on radio and front-page ads in the State Journal-Register touting his mortgage acumen. He boasted that he’d provide housing for homeless vets — it would be just like reality TV, with stunned hard-luck cases handed keys to homes — but didn’t come through.

In pleading guilty to six counts of wire fraud, REDACTED acknowledged fabricating paperwork, including phony W2s and fake canceled checks, to land mortgages for people who didn’t qualify. Prosecutors say that he also doctored paperwork to lower the income of a woman who obtained an Illinois Housing Development Authority grant for a down payment. Depending on the client, he made child-support payments either appear or vanish in paperwork filed to obtain mortgages.

Federal prosecutors filed charges after the Illinois Department of Financial and Professional Regulation revoked REDACTED mortgage loan origination license in 2018, finding that he’d engaged in misconduct ranging from getting a mortgage for a man who made $9 an hour to convincing people they were signing mortgage paperwork when, in fact, they were signing homes over to him in contract-for-deed papers.

In addition to revoking REDACTED license, IDFPR issued a $128,000 fine. REDACTED, which by then had terminated REDACTED as manager of its Springfield branch, agreed in 2018 to establish a $1.27 million fund to make victims whole, with IDFPR finding that the Lake Forest-based company had been negligent in supervising the Springfield branch.

According to state investigators, REDACTED used phony paperwork to obtain at least three loans through the Veterans Administration. After 30 months behind bars, REDACTED, 48, faces three years of probation under Myerscough’s sentence, which also includes a $61,000 restitution order, with nearly $33,000 payable to the Veterans Administration and the balance to REDACTED. He faced as many as 20 years in jail and a maximum $250,000 fine.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

FAQ 1: Do the numbers in the FinCen Insignia spell SATAN in artificial intelligence code?

No. The binary numbers spell out “FinCEN” in binary code and represent the financial data FinCEN uses to keep our country strong and prosperous, our financial system secure, and our communities and families safe from harm.

FAQ 2: If arranged backward, do the numbers in the FinCen insignia spell SATAN in binary code or some form of artificial intelligence language?

Get a life.

Images Courtesy of FinCEN

BEHIND THE SCENES – FinCEN Extends and Expands Geographic Targeting Orders to Combat Illicit Use of Residential Real Estate

Unknown to many third-party mortgage origination entities, the BSA’s anti-money laundering (AML) laws apply to mortgage companies and brokers. If you’ve wondered what you should do when a fraudster or crook seeks your mortgage services, look no further!

The BSA requires financial institutions to maintain an AML implementation, including filing a Suspicious Activity Report (SAR) report when necessary. Part of a compliant BSA implementation typically involves a clear escalation path for employees or agents of the institution to report suspicions about fraud or other criminal activity. That is, whom do you notify when detecting suspicious activities?

A little Orwellian at first glance, the law requires mortgage companies and brokers to inform on their customer’s suspicious activities by filing a suspicious activity report with FinCEN.

FinCen then screens and routes the SARs reports for investigation. FinCEN’s mission is to protect the financial system from illicit use such as money laundering.

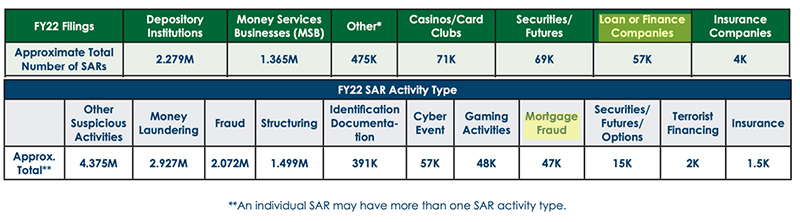

FinCen receives thousands of these SARs every day. Filed mainly by depository institutions. See the 2022 fiscal year (10/1/2021 – 09/30/22) SARs filing data in the screenshot above.

During the 2022 fiscal year, on average, FinCEN received close to 200 mortgage-fraud-related SARs filed every day.

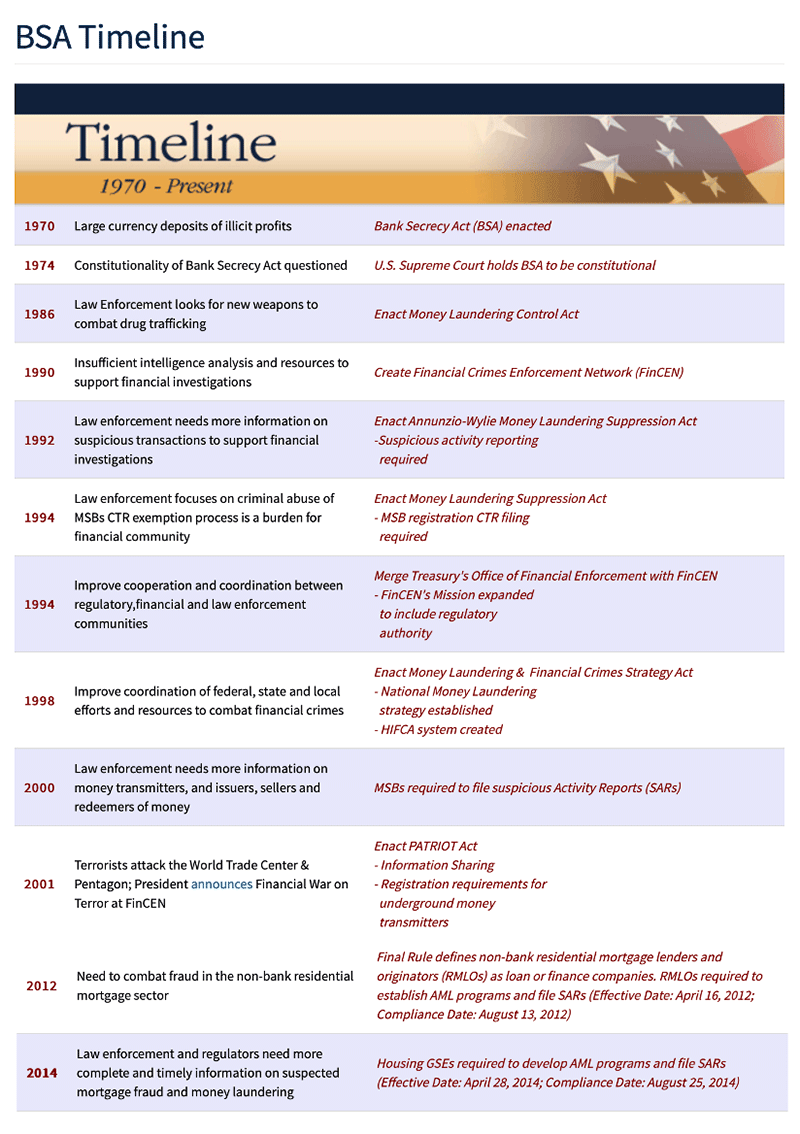

A Brief History of the Bank Secrecy Act and Suspicious Activity Reports

From the Financial Crimes Enforcement Network

1970 Passage of the Currency and Foreign Transactions Reporting Act (now known as the Bank Secrecy Act) 12 U.S.C. 1951(b)

“It is the purpose of this chapter to require the maintenance of appropriate types of records and the making of appropriate reports by such businesses in the United States where such records or reports have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings.”

Third-Party MLOs (Businesses) Required to Report Since 2012

The BSA defines the term “financial institution” to include, in part, a loan or finance company. The term, however, can reasonably be construed to extend to any business entity that makes loans to or finances purchases on behalf of consumers and businesses. Non-bank residential mortgage lenders and originators, generally known as “mortgage companies” and “mortgage brokers” in the residential mortgage business sector, are a significant subset of the “loan or finance company” category.

Every loan or finance company shall file with FinCEN, to the extent and in the manner required, a report of any suspicious transaction relevant to a possible violation of law or regulation. A loan or finance company may also file with FinCEN a report of any suspicious transaction that it believes is relevant to the possible violation of any law or regulation, but whose reporting is not required by this section.

A transaction requires reporting under this section if it is conducted or attempted by, at, or through a loan or finance company, it involves or aggregates funds or other assets of at least $5,000, and the loan or finance company knows, suspects, or has reason to suspect that the transaction

-

- Involves funds derived from illegal activity or is intended or conducted in order to hide or disguise funds or assets derived from illegal activity as part of a plan to violate or evade any Federal law or regulation or to avoid any transaction reporting requirement under Federal law or regulation

- Has no business or apparent lawful purpose or is not the sort in which the particular customer would normally be expected to engage, and the loan or finance company knows of no reasonable explanation for the transaction after examining the available facts, including the background and possible purpose of the transaction

- Involves use of the loan or finance company to facilitate criminal activity

A suspicious transaction shall be reported by completing a Suspicious Activity Report (‘‘SAR’’) and collecting and maintaining supporting documentation. The SAR shall be filed with FinCEN in accordance with the instructions to the SAR.

Geographic Targeting Orders

FinCen also coordinates local and federal agencies efforts to interdict illicit use of the financial system. Law enforcement agencies uncover criminal activity by following the money through these interagency-partnerships.

Law enforcement partners have identified specific geographic areas that constitute a higher incidence of residential real estate use for money laundering. Consequently, title companies must report all cash residential purchase transactions in these locales.

April 21, 2023 Title Companies Must Report Cash Purchases

WASHINGTON—The Financial Crimes Enforcement Network (FinCEN) today announced the renewal and expansion of its Geographic Targeting Orders (GTOs) that require U.S. title insurance companies to identify the natural persons behind shell companies used in non-financed purchases of residential real estate.

The terms of the GTOs are effective beginning April 25, 2023, and ending on October 21, 2023. The GTOs continue to provide valuable data on the purchase of residential real estate by persons possibly involved in various illicit enterprises. Renewing the GTOs will further assist in tracking illicit funds and other criminal or illicit activity, as well as continuing to inform FinCEN’s regulatory efforts in this sector.

FinCEN renewed the GTOs that cover certain counties within the following major U.S. metropolitan areas: Boston; Chicago; Dallas-Fort Worth; Houston; Laredo; Las Vegas; Los Angeles; Miami; New York City; San Antonio; San Diego; San Francisco; Seattle, the District of Columbia, Northern Virginia, and Maryland (DMV) area; as well as the City and County of Baltimore, the County of Fairfield, Connecticut, and the Hawaiian islands of Honolulu, Maui, Hawaii, and Kauai.

FinCEN, working in conjunction with our law enforcement partners, identified additional regions that present greater risks for illicit finance activity through non-financed purchases of residential real estate. Accordingly, today, FinCEN expanded the geographic coverage of the GTOs to Litchfield County in Connecticut and Adams, Arapahoe, Clear Creek, Denver, Douglas, Eagle, Elbert, El Paso, Fremont, Jefferson, Mesa, Pitkin, Pueblo, and Summit counties in Colorado. The effective period of the GTOs for purchases in these newly added areas begins on May 24, 2023. The purchase amount threshold remains $300,000 for each covered metropolitan area, with the exception of the City and County of Baltimore, where the purchase threshold is $50,000.

FinCEN appreciates the continued assistance and cooperation of title insurance companies and the American Land Title Association in protecting real estate markets from abuse by illicit actors.

See the FinCEN GTO here: FinCen 2023 GTO

Tip of the Week – Sign up for 2023 CE

Classes Available Now

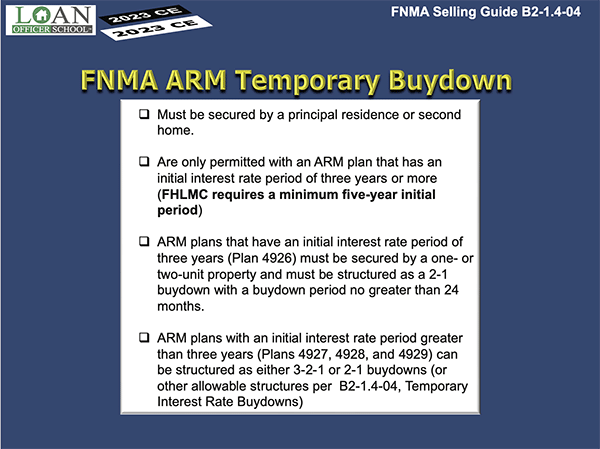

Did you know that FNMA and FHLMC have greater restrictions on using temporary buydowns (TBD) for three and four-unit properties than a one or two-unit property?

The rules for structuring temporary buydowns can get complex. For example, can you use a 3/2/1 TBD for an FNMA 3/6mo ARM? Unfortunately, no. But you can do a 2/1 TBD. However, FHLMC does not allow any TBD on hybrid ARMs with initial discounts of less than five years.

With the increasing demand for ARM financing, you may need to upskill your mortgage payment discounting repertoire because maintaining an acceptable DTI is becoming increasingly challenging.

Did you know that when calculating the applicant’s ability to repay and DTI, Regulation Z QM requirements dictate that the lender consider the worst-case P&I payment in the first five years of the term? Does that mean a 5/1 Hybrid ARM includes or excludes the first payment adjustment in the capacity and DTI test? The first payment change IS included in the DTI and capacity tests.

For a qualified mortgage, the creditor must underwrite the loan using the principal and interest payment based on the maximum interest rate that may apply during the first five years after the date the first payment will be due.

12 CFR § 1026.43(e)(2) a qualified mortgage is a covered transaction for which the creditor underwrites the loan, taking into account the monthly payment for mortgage-related obligations, using the maximum interest rate that may apply during the first five years after the date on which the first regular periodic payment will be due.

For instance, an $850,000 5/6mo ARM with an initial rate of 6.50%. Assume 2/1/5 caps. Such a structure requires the lender to calculate the ratio and residual calculus based on 8.5%, not 6.50%. What about a 7/6mo or 10/6mo ARMs?

QM requires Creditors must use the maximum rate that could apply at any time during the first five years after the date the first payment will be due, regardless of whether the maximum rate is reached at the first or subsequent adjustment during the five-year period.

Consequently, for the 7/6mo and 10/6mo ARMs, the FNMA credit policy requires the lender to use the note rate for the capacity tests but defaults to the standard ATR ARM qualifying requirement, “The fully indexed rate or any introductory interest rate, whichever is greater, B3-6-04,” for HPML.

For the 7/6mo and 10/6mo ARMs, FHLMC also requires the qualifying rate calculated at the note rate for mortgages that are “not Higher-Priced Covered Transactions (HPCTs) or Higher-Priced Mortgage Loans (HPMLs),” 4401.8. For HPML, FHLMC requires the fully indexed rate or any introductory interest rate, whichever is greater calculus on the 7/6mo and 10/6mo ARMs.

For Non-QM loans subject to ATR, the lender must use the fully indexed rate or any introductory interest rate, whichever is greater calculus; however, if the loan contains certain loan features, e.g., interest only, neg am, or balloon payments, underwriting gets more complex.

It is easy to see how a lender or underwriter may conflate and confuse the agency’s requirements.

Consider that a Non-Conforming Jumbo QM loan closed on June 15, 2023. The first payment is due on August 1, 2023. At the end of 60 months on and during the day of August 1, 2028, the worst case rate change is to 8.50% (6.50% initial rate plus the 2% first change rate cap). The lender must use a qualifying payment based on the maximum interest rate that may apply during the first five years after the first payment is due, in this case, 8.50%.

Could that effect reserve requirements? Absolutely. From FNMA B3-4.1-01 – Reserves are measured by the number of months of the qualifying payment amount for the subject mortgage (based on PITIA) that a borrower could pay using their financial assets. For monthly housing expense and qualifying payment requirements, see B3-6-03, Monthly Housing Expense for the Subject Property and B3-6-04, Qualifying Payment Requirements.

From FHLMC 5501.2 – When calculating reserves for the subject property, the principal and interest payment of the monthly payment amount must be based, at a minimum, on the Note Rate. When calculating reserves for other properties, the monthly payment amount for the property must be no less than the current monthly payment amount.

Correctly assessing the qualifying payments has significant underwriting consequences for determining ATR, acceptable cash, housing, and DTI ratio. Noncompliance will get you surprise underwriting decisions or conditions at best. For Creditors, noncompliance with the ATR has dire consequences, including investor sanctions and violations of federal consumer protection federal law.

We can’t promise to untangle all the qualifying requirements, but we can point out a few areas of concern and get you started. For those with ARM experience, you may discover something new.

Please join us for 2023 CE.