Why Haven’t Loan Officers Been Told These Facts?

Area Median Income

HUD’s Area Median Income (AMI) value has been a credit policy touchstone for many years. With the waiver of credit fees under the duty serve mandate, understanding AMI and its impact is foundational to proper loan selection and competitive pricing. Moreover, lenders cannot successfully compete in today’s mortgage environment without fully leveraging the advantageous pricing discounts for borrowers at, under, or near the AMI.

Every year, HUD calculates estimates for median family income throughout the country. Various stakeholders use these estimates to calculate program income limits, defined as percentages of median family income, which vary by the number of persons in a household. HUD uses income limits to define low-income status and resulting eligibility for many of its housing assistance programs.

Since FY 2011, HUD has based its estimated median family income on the Census Bureau’s American Community Survey (ACS) data. Since FY 2012, there has been a 3-year lag between the ACS estimates and the fiscal year for which the income limits are in effect. For example, the FY 2022 median family incomes and income limits were based on the ACS 2019 data.

Other stakeholders, such as the FHFA, use the AMI for policymaking and targeting disadvantaged consumer groups.

The FHFA and its minions, FNMA and FHLMC, recently announced the cessation of credit fees/loan level pricing adjustments for borrowers at or under the AMI. The credit fee abatement threshold for high-cost areas is 120% of the AMI.

Understanding how various stakeholders target specific geographic areas and demographic groups for credit enhancements is much easier than knowing how to read the tea leaves. Pay close attention to stakeholder initiatives and discover how to leverage the lending winds in your marketing. Note that AMIs thresholds are significantly higher for 2023. The new AMIs went into effect in June 2023.

From FNMA

“Area median income (AMI) estimates are provided to Fannie Mae by our regulator, the Federal Housing Finance Agency. These AMIs are used in determining borrower eligibility for HomeReady®, RefiNowTM, and Duty to Serve. AMI is also used in determining eligibility for certain loan-level price adjustment waivers. The 2023 AMIs will be implemented in Desktop Underwriter® (DU®), Loan Delivery, and the Area Median Income Lookup Tool over the weekend of June 10, 2023, with an effective date of June 12, 2023.

As in past years, we will continue to apply the AMIs in DU based on the casefile creation date. DU will apply the 2023 limits to new DU loan casefiles created on or after June 12. Loan casefiles created before June 12 will continue using the 2022 limits.”

The 2023 area median incomes (AMIs) have been implemented in Desktop Underwriter®(DU®), Loan Delivery, and the Area Median Income Lookup Tool. There was a 7.73% average increase for 2023, meaning more borrowers may meet AMI requirements.

FHLMC

New Area Median Income and Property Eligibility Tool

To help you determine whether a loan may be eligible for a credit fee cap, as detailed in Exhibit 19 and Exhibit 19A, Freddie Mac developed the new, map-based Area Median Income and Property Eligibility Tool*. When you enter a property’s address, the tool will return pertinent information, such as the AMI% for that location and whether your low- to moderate-income borrowers meet the AMI% requirements for certain Freddie Mac mortgage products. The tool’s data elements include:

-

- County Location

- FIPS Code

- 50% AMI

- 80% AMI

- 100% AMI

- 120% AMI

- 140% AMI

- High Needs Rural Tract

- Rural Tract

- High-Cost Area

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES

Representative Andy Barr Throws Down, Equates the CFPB with McCarthyism

Labels Director Chopra, A Political Sycophant acting Like Judge, Jury, and Executioner

Ouch, these guys are rough. The House Financial Services Subcommittee had CFPB Director Rohit Chopra over for lunch. On the menu, Roast Chopra.

On June 14, the House Financial Services Committee held a hearing with Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra. Republicans “discussed” the Director’s role in responding to recent bank failures, the Bureau’s persistent lack of transparency surrounding rulemaking, and its hyper-partisan regulatory agenda. A grilling more accurately describes the engagement. Put another way, Director Chopra fielded the customary “Have you stopped beating your wife” style questions.

From Chairman Andy Barr’s opening remarks (Video at the 14:30 minute mark)

“Thank you, Director Chopra, for being here today. (Interpretation, “Welcome to the jungle, it gets worse here every day. You learn to live like an animal in the jungle where we play.” – Welcome to the Jungle, by Axl Rose.)

“As the Director, you wear a lot of hats.

“You are a member of the Federal Deposit Insurance Corporation and the Financial Stability Oversight Council.

“This committee has spent a lot of time understanding how regulators reacted to the failures of Silicon Valley Bank and Signature Bank. Given that both the FDIC and FSOC played critical roles in those failures, I am looking forward to hearing about your involvement in the decision-making process.

“As we said when FDIC Chair Gruenberg and Fed Vice Chair Barr testified before this Committee, there was and continues to be a lack of transparency surrounding the regulators’ decision making that first weekend in March.

“Was there an ideological lens that impacted your response? Did your views regarding bank consolidation lead to a delayed resolution and greater uncertainty in the financial sector? Let’s spend more time on this when we get to questions.

“Turning to your job today as CFPB Director, your agency is responsible for regulating and enforcing consumer financial laws.

“Unfortunately, under your leadership, the CFPB is doing the exact opposite.

“First, your agency identifies consumer harm in one instance for a specific product.

“From there, you extrapolate that harm occurred everywhere and everyone should be under suspicion. In fact, every act is presumed abusive until the CFPB or a court decides maybe they aren’t.

“You use compliance bulletins, circulars, and advisory opinions to sow doubt and confusion in the marketplace.

“You vilify entire industries simply because they are politically unsavory in your opinion.

“The practice of ‘name and shame’ first, verify later, isn’t consumer protection, it’s McCarthyism.

“This harms consumers and the economy at large, while propping up trial lawyers and consumer activist groups.

“Let me be clear, that is not the mission of the CFPB.

“Finally, I’ll turn to what appears to be your most recent appointment as an appendage of President Biden’s reelection campaign.

“When the President started talking about ‘junk fees,’ the current hyper-partisan CFPB engaged in a campaign about its effort to clamp down on—you guessed it—junk fees.

“Look, it’s an easy target, no one likes fees. And to be clear, some fees should be questioned to ensure people are not getting ripped off.

“But to indiscriminately label fees as abusive is a blatant attempt to pander to Americans who have been hung out to dry in the Biden economy.

“My Democratic colleagues will likely turn to their favorite talking point, ‘corporate greed,’ to explain away the need for fees. But you know who else relies on fees? The government.

“The IRS charges late fees on taxpayers.

“If you want to enter most national parks, you pay a fee.

“Even the CFPB charges fees on Freedom of Information Act requests.

“So why would the CFPB believe the same costs that these fees cover, or the actions they are designed to deter, do not exist in the private sector?

“I’ll finish with this, the current CFPB operates in an opaque, increasingly partisan, and analytically weak manner.

“We experienced this under Richard Cordray, and his legacy lives on with you, Director Chopra.

“The CFPB is directly overstepping its bounds and serving as judge, jury, and executioner in the consumer financial marketplace.”

“That’s why Committee Republicans advanced a package of bills to reform the structure and funding stream of the CFPB to ensure transparency and accountability to the American people.

“And let me just say one thing about the rulemaking on credit cards.

“I want you to talk about this, Director, because we don’t understand how it’s protecting consumers to say to a sub-prime credit card borrower, who’s always on time and never pays late, which is 74% according to your own data—74% of Americans who have credit cards never pay late.

“Why is it consumer protection to force them to pay a higher interest rate by lowering the late fees on borrowers who never pay late?”

Opening Statement of Director Rohit Chopra before the House Committee on Financial Services (Video at the 26-minute mark)

Chairman McHenry, Ranking Member Waters, and Members of the Committee, thank you for holding this hearing on the Consumer Financial Protection Bureau’s (CFPB) submission of its Semiannual Report to Congress.

I am pleased to report that the CFPB continues to deliver tangible results for the public today, ensuring that consumers are protected, while also preparing for the future as tech giants and artificial intelligence reshape the industry. I will share a few observations about the state of the American consumer, as well as some highlights of CFPB’s work.

American families continue to benefit from a resilient labor market. Consumer spending continues to be robust, and borrowing has accelerated. Inflation in key categories, such as vehicles, has contributed to rising levels of household debt. Americans now owe $17 trillion in household debt, including mortgages, student loans, auto loans, and credit cards. Interest rates are substantially higher than they were a few years ago, and some families are paying much more on their credit cards and other loans. Overall, current indicators of distress on consumer credit remain muted, though there are modest signs of increased delinquency. We will continue monitoring the impact of changes in interest rates and home prices closely, as well as other changes that might impact large segments of the population, such as upcoming resumption of federal student loan payments.

The CFPB continues to be on high alert for shocks to the system that might unsettle household financial stability. The failures of Silicon Valley Bank, Signature Bank, and First Republic Bank highlighted significant vulnerabilities in the banking system, and regulators took a series of extraordinary actions that limited the fallout to the broader economy. But it is clear policymakers will need to take steps to avoid the need for emergency measures in the future.

With respect to the CFPB’s mandated objectives, we have made major progress to propose, finalize, or implement required rules on credit reporting for survivors of human trafficking, small business lending data collection, PACE lending, the LIBOR transition, and more. We’re reviewing old rules to find opportunities to simplify and future-proof them. We’ve built on the work of my predecessor to publish more guidance and advisory opinions that especially help small and nascent firms looking to develop new products and services.

We are focusing more heavily on supervision of nonbank financial firms, which have not always been subjected to similar oversight as chartered banks and credit unions. We’ve activated unused authorities to limit regulatory arbitrage by nonbank firms.

We have shifted the focus of our enforcement program away from targeting small businesses and putting more attention on repeat offenders. Since then, we’ve recovered $4.6 billion in refunds and penalties against violators.

We are handling an average of 10,000 consumer complaints each week and obtaining successful resolutions for individuals outside of formal legal proceedings.

Equally important is our work to address how technology is transforming financial services. The United States has a choice: will we harness technology to maintain relationship banking, drive competition, and protect privacy? Or will we continue our lurch toward a system marked by surveillance that is fully automated and controlled by a handful of firms?

The CFPB is working to ensure broad benefits for consumers and businesses alike when it comes to technological advances. One of our most important initiatives is to accelerate the shift in the United States to open banking, allowing consumers to more easily switch and gain access to new products, while protecting personal financial data.

The CFPB has been leading a number of efforts on artificial intelligence, and we’re working to bring on more technical talent inside the agency. We’re taking steps to guard against algorithmic bias across credit markets, and we’re working to ensure that data brokers respect longstanding laws on the books. The work of the CFPB in today’s digital economy is more relevant than ever.

Thank you for the opportunity to appear before you. I look forward to responding to your questions.

Link to the hearing video: The Semi-Annual Report of the Bureau of Consumer Financial Protection

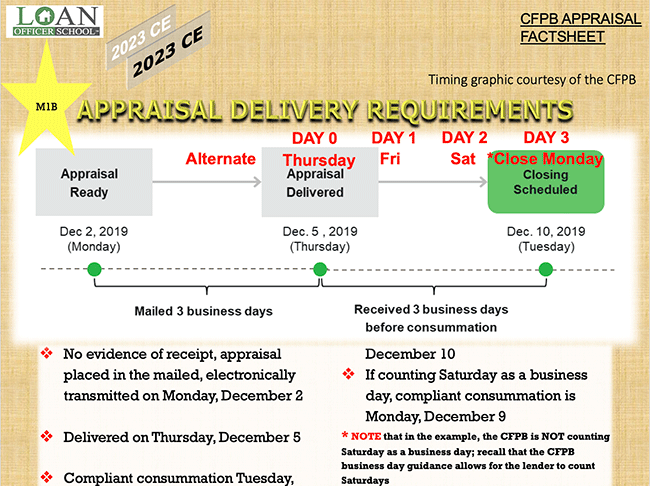

Tip of the Week – Appraisal Delivery – Waiving the Timing Requirements

Regulation B requires that creditors provide an applicant with a copy of all appraisals and other written valuations developed in connection with an application for credit that is to be secured by a first lien on a dwelling.

The term “dwelling” means a residential structure that contains one to four units, whether or not that structure is attached to real property. The term includes but is not limited to, an individual condominium or cooperative unit and a mobile or other manufactured home.

“Completion” occurs when the creditor receives the last appraisal version, or when the creditor has reviewed and accepted the appraisal or other written valuation to include any changes or corrections required, whichever is later.

The reference to “all” appraisals and other written valuations does not refer to all versions of the same appraisal or valuation. If a creditor has received multiple versions of an appraisal or other written valuation, the creditor must provide the applicant with only a copy of the latest version received.

All appraisals mean discrete valuations, which may be understood as the valuation of different appraisers, such as in cases where the lender orders a second appraisal.

The valuations rule covers applications for credit to be secured by a first lien on a dwelling, whether the credit is for a business purpose (for example, an investor refinancing a four-unit dwelling) or a consumer purpose.

Does Regulation B require appraisal waivers to be in writing? Getting the waiver in writing is a good idea, but no. Regulation B does not require waivers in writing, though your lender may freely require you to do so.

Generally, an applicant may waive the timing requirement and agree to receive the appraisal copy at or before consummation, except where otherwise prohibited by law (HPML), at least three business days before consummation.

However, Regulation B does permit waivers within three business days of consummation with some exacting requirements. The applicant may waive the timing requirements if the waiver pertains solely to clerical changes from a previous appraisal version that has been delivered to the applicant and met the delivery timing requirement.

What constitutes a clerical revision is one which has no impact on the estimated value, value calculations, or methodology used to derive the estimated value.

For example, the applicant received an appraisal three business days before consummation. The day before closing, the lender detects an error in the address of one of the appraiser’s comparable sales. The change is only to the address, not the property’s location. That would more likely constitute a clerical change.

Yet, this may involve risks to the lender. Primarily, what is the dividing line between a clerical revision and one that affects the calculations and methodologies inherent in the valuation? In some cases, this may be black and white, and in other cases, less clear.

Before ending up at odds with the lender over waiver requirements within three days of consummation, if the required appraisal revisions might impact the delivery timing, it would help to have a statement from the appraiser that the revisions in question are clerical and are immaterial to the valuation, valuation calculation, or methodologies used to determine the appraised value.

While on the subject of interpretations, did you know that neither Regulation B nor the ECOA defines a business day as related to the appraisal delivery? Yet the valuation rule expressly refers to the delivery timing in business days. No worries, the CFPB has promulgated the meaning of the term business day for the appraisal delivery requirement. You should know it too.

Please join us for 2023 CE Regulation Z and B discussions concerning valuations and valuations relative to HPML (Regulation Z) requirements.