Why Haven’t Loan Officers Been Told These Facts?

Military Allowances as Effective/Stable Income

Generally, for most servicemembers, Basic Allowance for Housing (BAH) is the most substantial of the military allowances. Servicemembers receive BAH when assigned permanent continental US duty. Generally, when received, BAH in tandem with Basic Allowance for Subsistence (BAS) are the only guaranteed allowances acceptable as effective income for use in calculating residual and DTI. An underwriter can consider temporary income, just not in the residual income or DTI calculus.

BAS is nominal compared to most BAH awards. However, BAS for lower-income enlisted servicemembers can powerfully move the needle for mortgage qualification.

Additionally, both BAS and BAH are tax-free! Therefore, you can gross-up the tax-free income for the DTI test but not for calculating residual income.

The DOD pays a higher BAH with dependents. However, dependency qualification can get complicated. More often than not, the higher BAH with dependents will not break the deal. So don’t get a nosebleed trying to shoehorn immaterial income into the loan manufacture.

The good news is that lenders usually do not need to make this determination. However, when qualifying your servicemembers, ask if they are with or without dependents. Also, ask if they know of any pending changes to their qualified dependent status.

We want to have the servicemember represent their income accurately. For example, the applicant indicates a change to dependent status (e.g., marital status) is probable during the loan manufacture. Consequently, if the applicant overstates the BAH on the application, that could have adverse effects on the servicemember. Understated income would only be an issue if considering program income limits (e.g., USDA, DAP). Document the dependent change if there are changes to the dependent status during the manufacture.

A dependent is a person who has a relationship with the military sponsor and is entitled to certain benefits by that relationship. Certain family members, primarily a spouse, child, stepchild, or legally adopted child, are automatically entitled to dependency status.

Other family members may become military dependents under certain conditions. Eligible dependents may include spouse, parent(s), parent(s)-in-law, step-parent(s), adoptive parent(s), in loco parentis, legitimate child(ren), stepchild(ren), incapacitated child(ren), adopted child(ren), pre-adopted child(ren), child(ren) from the age of 21 to the date of their 23rd birthday who are enrolled in a full-time course of study in an institution of higher education, dependent child(ren), and court-appointed wards. In loco parentis, as the term relates to BAH, it means acting as a guardian without the formality of legal proceedings.

With all that said, avoid complicating things in underwriting. Generally, it’s safe to depend on BAH and BAS as effective income on all transactions when servicemembers are awarded BAH. If you need a certain income to establish the applicant’s ability to repay, bear in mind that the lender must reasonably determine that the income will continue for three years from the application.

This “reasonable” determination that the income will continue for three years can be highly subjective and difficult to ascertain—for example, flight pay. Awarding Aviation Career Incentive Pay as an entitlement pay was discontinued on 1 Oct 2017.

The replacement incentive (allowance) for aviators is Aviation Incentive Pay (AvIP). However, the aviator must fly for an established minimum of hours to maintain eligibility for AvIP. That can get dicey. For example, generally, aviators receive AvIP as long as their duty includes at least 4 hours of monthly flight time (in the air). However, without a Duty Involving Flying (“DIFOPS”) orders to a billet (e.g., 2102 or 2302 (Navy), 75XX or 8042 (Marines)), billet designators generally there is no allowance for AVIP. Additionally, many other military allowances, such as Hostile Fire or Imminent Danger, are temporary and unsuitable for stable monthly gross income.

When in doubt about an allowance or income, determine if it is necessary to meet the financing objectives. If the allowance is unnecessary for mortgage qualification – leave it off the application for credit unless targeting programs with income ceilings.

Military allowance tools:

BEHIND THE SCENES – ARM Yourself

Managing Uncertainty and Risks with Adjustable Rate Mortgages

Fixed-rate mortgages carry a stiff premium in uncertain times. Borrowers risk paying unnecessary finance charges for the certainty of a 30-year fixed-rate loan. Those who end up prepaying the loan within the first seven years of the term are almost guaranteed to overpay on borrowing costs relative to other mortgage options.

More astute applicants may already appreciate the cost-benefit derived from an adjustable-rate mortgage compared to fixed-rate options. As ARM solutions grow in popularity, MLOs who are inexperienced or ineffective in presenting ARMs will see their business suffer.

One of the challenges in presenting ARM solutions is the technical terms and mechanisms involved with periodic rate changes. One such term is “index.” The world of finance has adopted various derivatives of U.S. Treasury Repurchases as the standard for capital costs when indexing consumer loans. The Secured Overnight Financing Rate (SOFR, pronounced “So-Fir”) Index is one of those treasury repo-derived indices. FNMA and FHLMC limit their ARM purchases to loans tied to this capital markets benchmark.

Considering all the hoopla surrounding the recent LIBOR transition, many consumers already have an acquaintance with SOFR . For consumers, a passing familiarity with an obscure finance term is okay when it has little impact on their finances. But when that same financial baseline drives the borrower’s future mortgage payment, it’s another matter. A better understanding is appropriate.

From FHLMC

The Secured Overnight Financing Rate (SOFR) is based on actual transactions in the Treasury repurchase (repo) market, one of the largest markets in the world. This is the market where investors offer borrowers overnight loans backed by their U.S. Treasury bond assets. The Alternative Reference Rates Committee (ARRC) has selected SOFR as the preferred alternate index for U.S. dollar-denominated London Interbank Offered Rate (LIBOR) contracts.

SOFR is based on actual transactions in a market where extensive trading happens daily. In contrast, LIBOR was based on an average of estimates of interbank offered rates in the London market provided by a panel of global banks surveyed by the Intercontinental Exchange. SOFR complies with the governance standards of the International Organization of Securities Commissions (IOSCO).

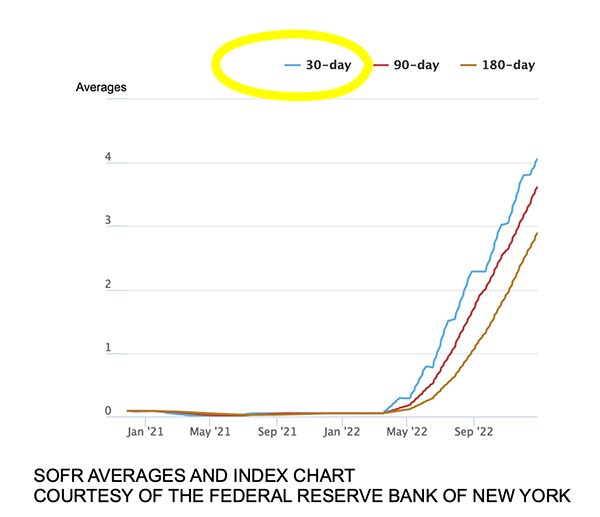

The Federal Reserve Bank of New York (New York Fed) began publishing SOFR in April 2018 as part of the effort to replace LIBOR. The New York Fed, as the administrator of SOFR and in cooperation with the Treasury Department’s Office of Financial Research, began publishing 30-, 90- and 180-day Average SOFR as well as an overnight SOFR index rate.

For their newly originated Single-Family SOFR ARMs, Freddie Mac and Fannie Mae (the GSEs) require the use of the 30-day Average SOFR, which the New York Fed began publishing on March 2, 2020.

Now try explaining that to your prospect!

Next week the Journal provides a few tools you can use to share SOFR comprehension with your customers.

Tip of the Week – Connect With Your Prospects and Customers

Uncovering your customer’s true north can be an elusive task—especially when dealing with home buyers. But, conversely, you might ask, is the prospects’ true north necessary to grasp? Yes, it is necessary to comprehend your prospect. The prospect’s true north is the path to establishing rapport.

For example, is the overarching goal for the mortgage prospect to get a mortgage? Or is the mortgage merely a stepping stone to another goal? Is the buyer’s ultimate goal to buy a house, home ownership, or something else?

Homeownership is more likely a stepping stone to another more important goal. Get to know your customer as more than a home buyer. A true north may underlie the apparent home-buying objective. Consequently, homeownership often differs from what the prospect truly wants.

Home buying or homeownership is the perceived path to their goal. However, isn’t life more than homeownership? Most folks have similar end goals—felicity, peace, security, or contentment. Or the absence of suffering. Therefore, if the goal is happiness, it stands to reason that there is much more we can do to satisfy the prospect beyond the delivery of a mortgage.

Remember, the MLO’s professional goals transcend the closing. Therefore, from the outset, the MLO must envision every customer as a fountain of business. The opportunity to nurture your customer’s desire to reciprocate your love and respect is more probable when you stay relevant to the customer and what they want during and after the loan manufacture.

Develop clear success criteria. Generally, there is much we can do to delight the stakeholders besides the obvious.

A hassle-free process, absent ugly surprises and disappointments may be as critical to your success as the goal of closing the loan. That might get you on base, but respecting your customer’s ambitions and aspirations might be a home run. Consequently, the prospect might find in you someone that respects them and whom they want to trust.

Sadly, most of us don’t have enough loving people around us. Bring some cheer and goodwill to someone in need. Buying a house can be very stressful. Remember, some of these folks are not only buying a house and getting a mortgage but also packing, moving, purchasing floor coverings and window treatments, starting new jobs, getting the kids to new schools, and sometimes leaving friends and family behind. And they have to deal with you. What an opportunity for you to shine.

So be that loving person your customer wants and needs. Don’t just love the lovable. Loving the unlovable ones is what will set you apart from the pack. That’s a win every time. A friend in need is a friend indeed. If you want a friend, be a friend.