Why Haven’t Loan Officers Been Told These Facts?

What is the Duty to Serve Mandate, and How Can Lenders Exploit Mortgage Financing Opportunities In These Areas

Section 1129 of the Housing and Economic Recovery Act of 2008 (HERA) amended the Federal Housing Enterprises Financial Safety and Soundness Act of 1992 (Safety and Soundness Act) to establish a duty for Fannie Mae and Freddie Mac to serve three underserved markets.

- Manufactured Housing

- Affordable housing preservation

- Rural areas

Congress requires the GSEs and their handler, the Federal Housing Finance Agency, to increase the liquidity of mortgage investments and improve the distribution of investment capital available for mortgage financing in those markets. The Safety and Soundness Act also provides that the Enterprises “have an affirmative obligation to facilitate the financing of affordable housing for low- and moderate-income families.” The HERA’s emphasis on serving moderate-income households falls under the “Affordable housing preservation” area of the Duty to Serve.

Specifically, the Enterprises must provide leadership to the market in developing loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families concerning manufactured housing, affordable housing preservation, and rural markets.

The duty to serve underserved markets is separate from and additional to the Enterprises’ affordable housing goals. Mortgage purchases that contribute to the affordable housing goals may, under appropriate circumstances, also be considered for the duty to serve underserved markets. The Safety and Soundness Act establishes Affordable Housing Goals separately from the HERA. The single-family housing goals are limited to mortgages on owner-occupied housing with one to four units total. The single-family goals defined under the Safety and Soundness Act include separate categories for home purchase mortgages for low-income families, very low-income families, and families that reside in low-income areas.

In addition, an activity or transaction may count for more than one underserved market. The rules for determining which types of mortgage purchases receive credit for the affordable housing goals could also be used to determine which types of mortgage purchases would satisfy the duty to serve underserved markets.

LENDERS MUST EXPLOIT THE GSE DUTY TO SERVE AND AFFORDABLE HOUSING MANDATE

THE HOUSING AND ECONOMIC RECOVERY ACT OF 2008

12 USC 4501 (HERA) The Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation have an affirmative obligation to facilitate affordable housing financing for low- and moderate-income families consistent with their overall public purposes while maintaining a strong financial condition and a reasonable economic return.

The term ‘‘moderate income’’ means, in the case of owner-occupied units, income not in excess of area median income.

The term ‘‘median income’’ means, with respect to an area, the unadjusted median family income for the area, as determined and published annually by the FHFA Director.

The term ‘‘low-income’’ means, in the case of owner-occupied units, income not in excess of 80 percent of the area median income.

KNOW YOUR PRICING

Unfortunately, in many parts of the country, if the household meets the low-income definition, they have limited to zero sustainable purchase options. However, this is less the case with moderate-income households. In today’s hyper-inflated real estate market, moderate-income households have a better probability of realistically affordable homes.

By segmenting your markets, you can better identify these sliver market segments with sufficient income to afford entry-level housing but still within the AMI limits. Instead of relying exclusively on government-insured products, conventional financing provides additional affordability tools.

All LLPAs (FNMA) and credit fees (FHLMC) will be waived for the following loans HomeReady® loans (FNMA), Home Possible® loans (FHLMC), loans to first-time homebuyers with qualifying income ≤100% area median income (AMI) or 120% AMI in high-cost areas, and loans meeting Duty to Serve requirements.

Updated AMI Limits to Qualify More Borrowers

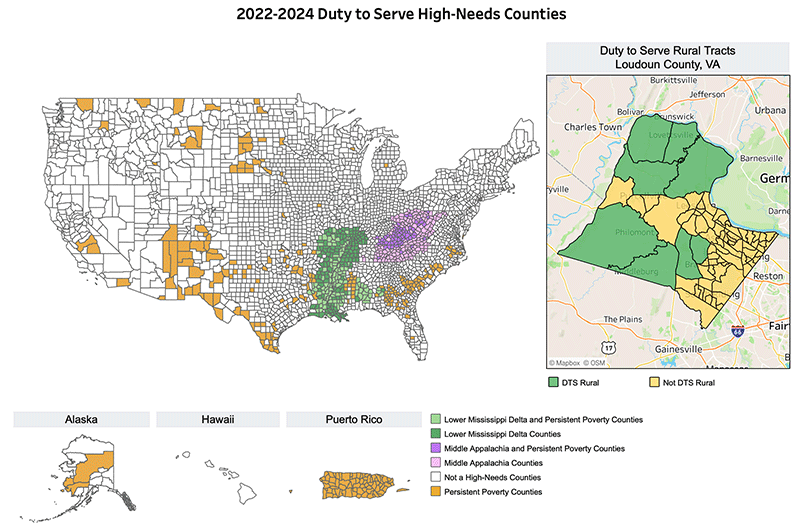

2022-2024 Duty to Serve High-Needs Counties

FHLMC AFFORDABLE SOLUTIONS SPOTLIGHT

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

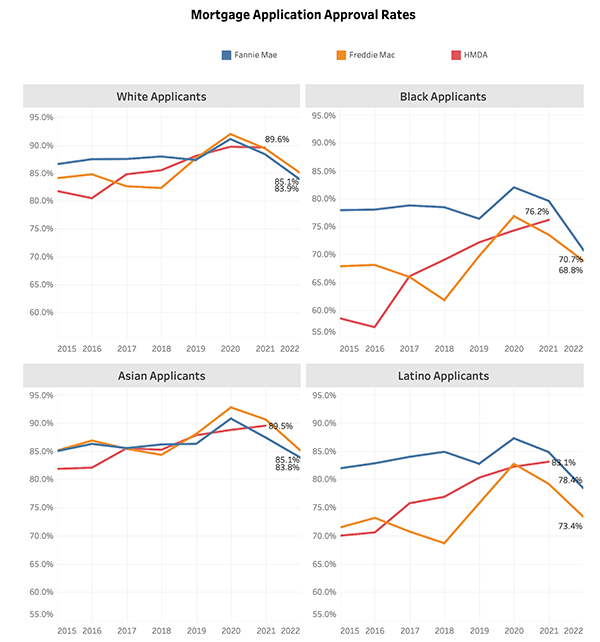

BEHIND THE SCENES – Adverse Actions on the Rise, DTI Increasingly A Limiting Factor

The mortgage industry is approaching a significant tipping point. In a recent Federal Housing Finance Agency paper, the authors cite recent data illustrating the growing impacts of rising home prices and mortgage rates on home purchases and local economies.

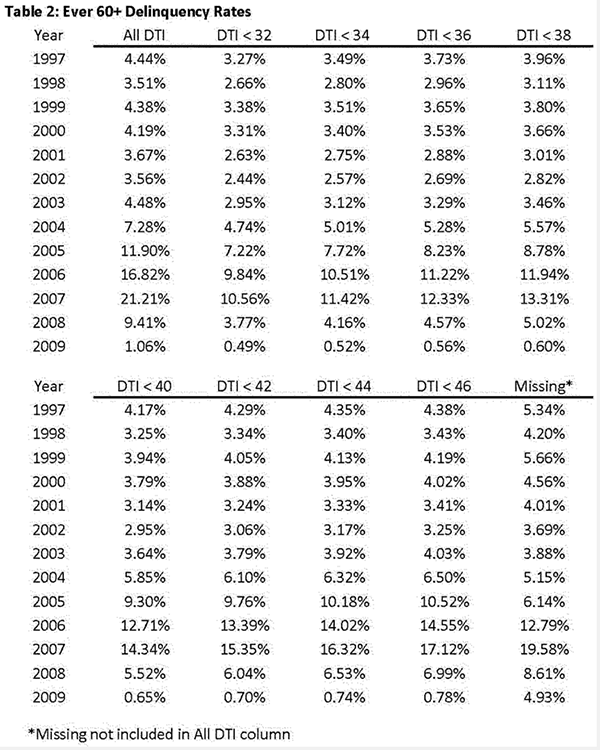

There is a direct line between DTI and serious delinquencies. Consequently, the industry should expect more credit tightening in the coming year.

Agency loan products are becoming riskier for investors despite all the fancy but so far untested FHFA risk management. The current housing market’s soft underbelly is the nexus of high-DTI, lowered savings rates, recessionary pressures, and declining real estate values which could portend a brewing storm and commensurate risk mitigations. Expect credit tightening to get tougher before it gets better.

Excerpted from the FHFA Working Paper Titled “The Credit Supply Channel of Monetary Policy Tightening and its Distributional Impacts”

- First, we find that the reduction in purchase loans during the 2022 mortgage interest rate spike was concentrated around underwriting thresholds in the DTI ratio, consistent with a substantial credit supply channel.

- Second, we find that the reduction in lending was relatively pronounced for middle-income and younger borrowers obtaining small- to medium-sized loans for low- to medium-valued properties. We also find little evidence of a reduction in loan amounts, house values, or non-mortgage debts to accommodate higher interest rates.

- Finally, we find that MSAs with a greater share of the population facing DTI limits upon an increase in interest rates exhibited greater reductions in house prices and spending, suggesting that the DTI-based credit supply channel of the mortgage interest rate spike had implications for local economic outcomes beyond just mortgage originations.

Joshua Bosshardt, Marco Di Maggio, Ali Kakhbod and Amir Kermani

FEDERAL HOUSING FINANCE AGENCY Division of Research and Statistics Office of Research and Analysis

Working Papers prepared by Federal Housing Finance Agency (FHFA) staff are preliminary products circulated to stimulate discussion and critical comment. The analysis and conclusions are those of the authors alone, and should not be represented or interpreted as conveying an official FHFA analysis, opinion, or endorsement. Any errors or omissions are the sole responsibility of the authors.

Understanding the Connection Between Loan Performance and DTI

The Bureau notes that these specific tabulations include first-lien mortgages for first or second homes, that have fully documented income and that are fully amortizing with a maturity that does not exceed 30 years. The FHFA data are comprehensive and cover the entirety of mortgages purchased or guaranteed by the Enterprises.

Tip of the Week

Consider the FHA 203(k) Limited

Unlike the more complex 203(k) “Standard product” that requires the use of a 203(k) consultant, the “Limited” version of the program is less complex and much more forgiving. Just like any new implementation, there are a few things the lender and MLO may learn the hard way.

Think of the 203(k) Limited as useful for anything not requiring a building permit.

II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT

A. Title II Insured Housing Programs Forward Mortgages

8. Programs and Products – 203(k) Rehabilitation Mortgage Insurance Program (04/18/2023)

Limited 203(k)

The Limited 203(k) may only be used for minor remodeling and nonstructural repairs. The Limited 203(k) does not require the use of a 203(k) Consultant, but a Consultant may be used.

The Property must be an existing Property that has been completed for at least one year prior to the case number assignment date. If the Mortgagee is unsure whether the Property has been completed for at least one year, the Mortgagee must request a copy of the Certificate of Occupancy (CO) or equivalent.

The Borrower must submit a Work Plan to the Mortgagee and use one or more contractors to provide the Cost Estimate and complete the required improvements and repairs. The contractors must be licensed and bonded if required by the local jurisdiction. The Borrower must provide the contractors’ credentials and bids to the Mortgagee.

The Mortgagee must review the contractors’ credentials, work experience, and client references and ensure that the contractors meet all jurisdictional licensing and bonding requirements. The Mortgagee must examine the work plan and the contractors’ bids and determine if they fall within the usual and customary range for similar work.

A Contingency Reserve is not mandated; however, at the Mortgagee’s discretion, a Contingency Reserve account may be established and may be financed. The Contingency Reserve account may not exceed 20 percent of the financeable repair and improvement costs.

The Mortgagee must obtain a work plan from the Borrower detailing the proposed repairs or improvements. The Borrower may develop the work plan themselves or engage an outside party, including a Contractor or a 203(k) Consultant, to assist. There is no required format for the work plan.