Why Haven’t Loan Officers Been Told These Facts?

Asymmetrical Marketing – Marketing to Households

Get there before the herd

It is lamentable that public educators and other stakeholders place such a premium on the necessity for curriculum to solve quadratic equations or promulgate the latest version of sex education to high schoolers yet neglect the perils of personal financial mismanagement.

It should be a national priority to safeguard entire households from personal financial management ignorance. Of particular importance, why not focus on the most vulnerable stakeholders, the little ones, the budding consumer, from getting screwed by insurance companies, banks, and other purveyors of consumer financial services. Prevention is the best medicine.

Few of these high-school kids could tell you how to manufacture and maintain a ballistic credit score or how a low credit score can impact your life. Consumers compete for more than jobs and homes. Making simple mistakes with consumer finance can have severe and long-lasting consequences.

Consider, what if, alongside contemporary sexual pedagogies, some intrepid stakeholders might also champion financial awareness education? The two subjects are even complimentary. While liberating the little ones from ancient stereotypes and cultural bondage, what about freedom from oppressive debt? Financial liberty! End slavery to consumerism!

Maybe it’s an old-fashioned notion, but what about something like living within your means? What are the benefits of savings? How credit scores can reflect financial prudence. How to protect your finances and identity from malicious or predatory attacks. Or the concept of debt’s antithetical impact on wealth accumulation. Maybe even the secret to financial riches? A penny saved is a penny earned.

It is possible that various stakeholders like school administrators, teachers, and parents also wonder when financial literacy will have a seat at the table.

What are the chances of little Leslie or adorable Angel talking to their guardians about credit scoring or down payment assistance? That is zero. But what if the little rascals bring home personal financial management homework? The odds of connecting with that guardian just improved.

Why not lend these resource-restricted school districts a hand? In addition to defraying the costs of implementing and maintaining a personal financial management curriculum for kids, why not have a mortgage professional as a program sponsor and resource for those in the household needing expert financial guidance? Consider the sponsor as a gatekeeper for various financial and professional needs.

What are your chances of getting in front of school administrators, teachers, school boards, and committees? What about the PTA? Now think about the possible connections you might make as the epicenter of a personal financial management for kids initiative. You will make meaningful connections and see loans regardless of whether or not the financial management for kids program sees the classroom. Practice makes perfect. How many school districts are there in your service area?

What about city, state, or county education professionals? How about pursuing something through the legislative channel? Times are tough, but get prepared to open your wallet. Invest wisely.

Remember, it is not just what you know but who you know. Competence does not hurt. However, ensure you understand the order of things.

Who might you partner with that could open the door to an educational video on developing ballistic credit scores while preparing for homeownership? Imagine the parent’s astonishment with the kids bringing their financial literacy collateral home. Or think about parents watching a video with the kids on how recipients of social security disability or supplemental security income and their families can leverage state and federal tax incentives to save for a home without jeopardizing their public benefits. Or a brief presentation on leveraging Health Savings Accounts to protect a home-buying nest egg? Or the impact of time on retirement accounts? Imagine the cross-selling and networking opportunities.

Recently, an MLO remarked, “I tried getting the school board interested in financial literacy, but they were not interested.” I asked, “How many schoolboards did you approach?” “Just the one,” he said. There you go. What kind of effort was that?

It’s like a dinner menu. It would help if you had the right menu, marketing, and cooks to get folks to come in and dine.

There are ample low-risk materials all ready to help you to launch your endeavor. Check out the financial literacy collateral from the CFPB. The CFPB provides hundreds of financial literacy activities for the wee ones. See the links below.

CFPB Bulk Publications.

Get posters for the classroom. Kids love classroom posters.

Order FREE Consumer Financial Protection Bureau Publications.

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive.

You may download publications by clicking on each title. Adobe Acrobat Reader is required to view the publications and is available for download at: http://get.adobe.com/reader

In most cases, you may order up to 200 free copies of each publication. All publications are free from the CFPB. If you need larger quantities, contact aroybal@gpo.gov

For single copies or small quantities, place your order at pueblo.gpo.gov.

Please allow 3-4 weeks for delivery.

CFPB Financial Literacy for Kids Video

CFPB Financial Literacy Activities

Literacy Posters and Collateral

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES

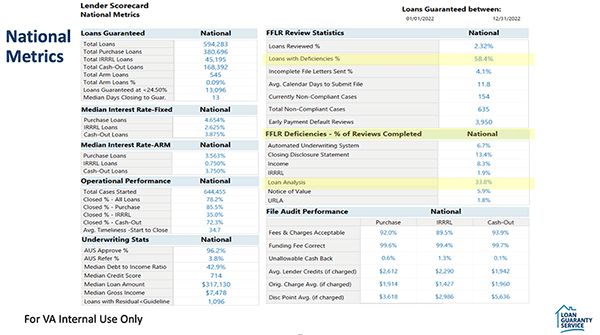

2023 VA National Lender Scorecard Yields Concerning Data, Full File Loan Reviews Reveal Significant Compliance Deficiencies

Time for the VA to toughen up again. The 2023 VA Lender Scorecard gets a D for compliance. Expect lenders to tighten up quality assurance, including underwriting enforcement. VA’s average DTI represents a risk tipping point. See the full scorecard at the link below.

Tip of the Week – How Foreclosure Works

Familiarity with the foreclosure process may help MLOs assist consumers in avoiding foreclosure

The protections under TILA or RESPA surrounding default and foreclosure are for another article. In this week’s article, the focus is on foreclosure mechanics.

After the creditor declares the borrower in default and the applicant fails to answer the demand for payment in full, the lender, to regain its investment, pursues a remedy through a foreclosure action. Most states require the lender to allow for mortgage reinstatement within a specific time from the default. Generally, state reinstatement laws require the borrower to give the lender everything owed under the loan agreements, and only then must the lender cease the foreclosure progress.

Default is an official declaration by the lender that the borrower has materially breached the loan agreements. Consequently, the lender has the right to accelerate the payoff. Since the borrower broke the covenant, the lender is no longer bound to accept the scheduled payments. The lender demands immediate repayment in full.

Foreclosure can take a variety of forms. Lenders only sometimes take back property in foreclosures. Generally, a foreclosure action requires the property to go to an auction (liquidation). This is to be fair to the debtor and the creditor.

The state laws requiring an auction intend to get a fair price for the property and, at the same time, protect the lender’s interest. Therefore, if there is any equity in the property, once the mortgagee’s claim is satisfied and all other claimants are paid (taxes, trustee fees), any proceeds go to the debtor.

Depending on the state, these are called Sheriffs (Judicial foreclosure) or Trustee’s Sales (Non-Judicial foreclosure).

Generally, instead of an auction, a court award of the property title to a lender only happens in a “strict foreclosure.” This foreclosure action occurs when the lender prevails upon the court to determine that the property has no equity and that an auction could cause more harm than good. Few states permit strict foreclosure action.

Like most auctions, a “reserve” protects the lender from having to accept a below-market bid. Lenders get something like the first right of refusal. Suppose the property fails to command a decent bid. In that case, the lender may choose to exercise their right to “bid” the property at the reserve. Then they take the title.

The court enforces the lender’s rights yet allows for any equity beyond the lender’s claim to go to the debtor. As such, “liquidations” are meant to protect the rights of creditors and debtors.

State law determines foreclosure practices. However, state law cannot attenuate federal loss mitigation protections under RESPA, TILA, and the implementing regulations.