Why Haven’t Loan Officers Been Told These Facts?

A rose by any other name would smell as sweet – Not according to Regulation Z

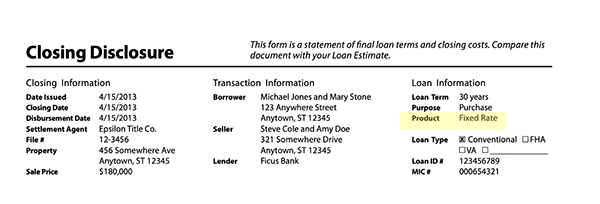

Changing the Loan Product is not what you think. Using the wrong product terminology or naming convention can get you an extra three-day waiting period.

The TRID rules significantly changed Regulation Z. Under TRID, the creditor must give consumers the Closing Disclosure at least three business days before consummation. Should the CD change between delivery and consummation, the lender must provide the consumer with a corrected CD at or before consummation. However, if the creditor makes specific and more significant changes between the time the Closing Disclosure form is delivered and consummation, an additional three-business-day waiting period applies.

Specifically, if the creditor changes the following:

- An increase to the APR above 1/8 of a percent for most loans (and 1/4 of a percent for loans with irregular payments or periods).

- Adds a prepayment penalty to the loan.

- Changes the loan product.

Comparing the CD to the LE reveals if the lender is imposing higher costs or lesser terms on the consumer than the terms promised in the LE. The three-day waiting period affords ample opportunity for the consumer to examine, challenge, and protest any irregularities in the Closing Disclosure.

Regulation Z requires that once the lender delivers the CD, the lender may no longer use the LE to communicate revised loan terms to the applicant. Hence, using CD revisions to communicate updated estimates to the consumer would present a problem if the law required that the lender deliver a perfectly correct CD three business days before consummation. Therefore, Regulation Z requires there always be a three-day waiting period for the INITIAL CD but not for subsequent CD revisions unless the revision is one of the three enumerated changes.

Therefore, subsequent CD versions only require new three-day waiting periods if those changes are deemed material changes to the financing. The CD is often revised repeatedly before consummation. Changes within tolerances or not deemed material, according to Regulation Z, do not necessitate another waiting period. Meaning the consumer could experience “little surprises” at closing.

The APR threshold is precise. Adding a prepayment penalty is clear enough. But what does it mean to change the loan product?

It gets complicated. The CD must correctly describe the product by carefully following the Regulation Z prescription for the Product description found in 1026.37 (LE preparation). An error in the product description violates Regulation Z. If one minuscule error is picked up in a pre-funding audit, a corrected CD is required, and you get another three-day waiting period.

The fact that there are no changes to the actual loan terms, projected payments, cash to close, AIR or AP tables, etc., is immaterial to the product error. A change to the product description gets you a new waiting period.

In other words, should the lender provide an incorrect product description on the delivered CD and subsequently correct the product description, such a change in the product description necessitates another three-day waiting period. Even a change in “name only.”

How precise must the product description be?

§ 1026.19(f)(2)(ii) If one of the following disclosures provided under paragraph (f)(1)(i) (the CD) of this section becomes inaccurate in the following manner before consummation, the creditor shall ensure that the consumer receives corrected disclosures containing all changed terms in accordance with the requirements of paragraph (f)(1)(ii)(A) of this section: (The creditor shall ensure that the consumer receives the CD no later than three business days before consummation.)

The loan product is changed, causing the information disclosed under § 1026.38(a)(5)(iii) (Closing Disclosure “Product” description) to become inaccurate. (iii) Product. The information required to be disclosed under § 1026.37(a)(10), labeled “Product” (the Regulation Z LE requirements).

Example:

In the case of a seller funded 2/1 temporary buydown. The CD must reflect the product as follows. The period of time at the end of which the scheduled payments will change must precede the feature followed by the name of the loan product. Thus, the creditor must disclose a fixed rate mortgage subject to a 2-year step payment plan as a “2 Year Step Payment, Fixed Rate.” Duration, feature, product.

However, in the case study, the creditor prepares the initial CD with the product label error “Step-Rate.” The product is “step-rate” if the borrower or lender pays the buydown subsidy. When disclosing a Step-Rate loan, assuming the loan has no feature like negative amortization, only include the product type (Step-Rate) and introductory and first adjustment periods if applicable.

Step-Rate disclosure works like this, from left to right, Regulation Z requires the lender to disclose the duration of the introductory rate first. The lender then discloses the frequency of the subsequent rate changes.

For example, in the case study, the lender correctly disclosed a Step-Rate loan with a 2/1 buydown as a “1/1 Step-Rate.” The problem was the product should have been labeled “2 Year Step Payment, Fixed Rate” as the subsidy was seller funded.

The lender caught the Product label error and delivered a corrected CD to the applicant at consummation. But mistakenly believing there had been no change to the product (because the loan terms did not change), the lender failed to meet the CD delivery requirements (another waiting period) and is now burning in noncompliance hell.

On the surface, the lender’s actions looked sincere, with no intention to bait-and-switch the applicant. However, the federal government believes accuracy in the product description is essential to the TRID rules.

Here is a sampling of the exacting Regulation Z Product label requirements.

Product (Types)

(10) Product. A description of the loan product, labeled “Product.”

(i) The description of the loan product shall include one of the following terms:

(A) Adjustable rate. If the interest rate may increase after consummation, but the rates that will apply or the periods for which they will apply are not known at consummation, the creditor shall disclose the loan product as an “Adjustable Rate.”

(B) Step rate. If the interest rate will change after consummation, and the rates that will apply and the periods for which they will apply are known at consummation, the creditor shall disclose the loan product as a “Step Rate.”

(C) Fixed rate. If the loan product is not an Adjustable Rate or a Step Rate, as described in paragraphs (a)(10)(i)(A) and (B) of this section, respectively, the creditor shall disclose the loan product as a “Fixed Rate.”

(Loan) Features

The description of the loan product shall include the features that may change the periodic payment using the following terms, subject to paragraph (a)(10)(iii) of this section, as applicable:

(A) Negative amortization. If the principal balance may increase due to the addition of accrued interest to the principal balance, the creditor shall disclose that the loan product has a “Negative Amortization” feature.

(B) Interest only. If one or more regular periodic payments may be applied only to interest accrued and not to the loan principal, the creditor shall disclose that the loan product has an “Interest Only” feature.

(C) Step payment. If scheduled variations in regular periodic payment amounts occur that are not caused by changes to the interest rate during the loan term, the creditor shall disclose that the loan product has a “Step Payment” feature.

(D) Balloon payment. If the terms of the legal obligation include a “balloon payment,” as that term is defined in paragraph (b)(5) of this section, the creditor shall disclose that the loan has a “Balloon Payment” feature.

(E) Seasonal payment. If the terms of the legal obligation expressly provide that regular periodic payments are not scheduled between specified unit-periods on a regular basis, the creditor shall disclose that the loan product has a “Seasonal Payment” feature.

(iii) The disclosure of a loan feature under paragraph (a)(10)(ii) of this section shall precede the disclosure of the loan product under paragraph (a)(10)(i) of this section. If a transaction has more than one of the loan features described in paragraph (a)(10)(ii) of this section, the creditor shall disclose only the first applicable feature in the order the features are listed in paragraph (a)(10)(ii) of this section.

(iv) The disclosures required by paragraphs (a)(10)(i)(A) and (B), and (a)(10)(ii)(A) through (D) of this section must each be preceded by the duration of any introductory rate or payment period, and the first adjustment period, as applicable.

With the preponderance of novel temporary buydowns, noncompliance exceptions in product descriptions are probably more significant than in the predominantly fixed-rate market.

Corrective actions tend to trail the emergent noncompliance, sometimes by years. For many lenders, the magnitude of non-compliant Regulation Z final disclosure accuracy and delivery requirements may be an impending issue.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES

Meet Your New Regulator (Ain’t No Stripes on that Flag)

The CFPB Joins Forces With the EU

THE BELGIANS ARE COMING, THE BELGIANS ARE COMING!

It looks like the EU is making the rounds over here. Maybe you heard about the July U.S. – EU privacy accords inked by the DOJ, the Dept. of Commerce, and EU representative Didier Reynders. The E.U.-U.S. Data Privacy Framework may be the beginning of more complex and invasive international legal collaborations (entanglements). The framework allows Europeans to object when they believe American intelligence agencies collected their personal information improperly. The law creates an independent review body made up of U.S. judges. The Data Protection Review Court will hear appeals from EU member citizens regarding U.S. intelligence collections.

One can only hope our friends across the pond have modest expectations of their privacy rights. Before inking that deal, they should have examined US judicial performance related to section 702 of the Foreign Intelligence Surveillance Act.

Anyway, Commissioner Reynders had a busy July. It likely took countless outings to The Inn at Little Washington and Bourbon on the tax-payer dime to get the job done. To far less fanfare, it appears Reynders prevailed upon CFPB Director Chopra to consider joining an “INTERPOL” type effort. However, in addition to cooperation in hand-cuffing lawbreakers, the collaboration appears to include policy-making.

Ever since the COVID pandemic, the world appears to be accelerating to weirdness. Aside from an alien spaceship landing at the National Mall, the public is numb to surprises anymore. Well, the aliens have landed. Today’s story from the book of weirdness (a.k.a., BOW DOWN) comes from the “You can’t make this stuff up chapter.” The CFPB and the EU have joined hands to protect consumers against intergalactic threats. We are your government, and we are here to help. Translated à la mode de the evil Decepticon, “To Punish and Enslave.”

One must admire the cut of Director Chopra’s jib, but one must also wonder how well Director Chopra knows this guy Reynders and his agenda. Is the CFPB Director suggesting some form of administrative integration with European Union law? “Coordinating on the most pressing policy issues” sounds like instituting a procedural or policy layer to the CFPB administration of U.S. laws.

FROM THE CFPB ANNOUNCEMENT

Consumer Protection of the European Commission, and Rohit Chopra, Director of the United States Consumer Financial Protection Bureau

On July 17, 2023, in Washington, Didier Reynders, Commissioner for Justice and Consumer Protection of the European Commission and Rohit Chopra, Director of the United States

Consumer Financial Protection Bureau announced the start of an informal dialogue between the European Commission and the US CFPB on a range of critical financial consumer protection issues.

Based on their shared priorities and public mandates, Commissioner Reynders and Director Chopra agreed to start a new dialogue on consumer financial protection, focusing primarily on digital developments in the financial sector and the impact on consumers, to improve policy and regulatory cooperation. This cooperation includes sharing insights and experience on issues related to consumer financial products and services, with the aim of exchanging technical expertise and coordinating on the most pressing policy issues.

-

- Automated decision making and processing of data in financial services, including the deployment of AI, and the related opportunities and risks for consumers such as the lack of transparency, misuse of data and violation of financial privacy rights, discrimination, and exclusion.

- New forms of credit such as ‘Buy Now, Pay Later’ products, and the related risks to consumers, including over-consumption and over-indebtedness.

- Strategies to effectively prevent over-indebtedness and to help over-indebted consumers to repay their debt sustainably.

- Digital transformation that ensures fair choice and access to financial services for consumers, including the unbanked, underbanked, and consumers who want to protect their own data.

- Implications for competition, privacy, security and financial stability of Big Tech companies offering financial services, including payment services.

The European Commission and the Director of the CFPB will meet at least once a year. This informal dialogue will involve staff discussions, including bilateral meetings between senior staff and subject matter experts, and roundtables, involving, as appropriate and depending on the topic, stakeholders that include consumer groups, industry representatives, the OECD G20 Task Force on Financial Consumer Protection, and/or others.

Certain subjects may need to be addressed in a non-public format, while other issues may be appropriate for broader stakeholder involvement. The European Commission and the Director of the CFPB expect the cooperation and exchanges within this Informal Dialogue to occur in parallel with other forms of cooperation and exchanges between the European Union and the United States on various digital and financial services policies and regulation.

(Hey, Govenero, how are the international whale hunting and fishing regulations working out?)

What Is Commissioner Reynders’s Agenda?

Marching Orders from Dr. Ursula von der Leyen, President of the European Commission to Didier Reynders upon His Appointment:

- I want you to lead the work on consumer protection, notably for cross-border and online transactions. You should also find new ways of empowering consumers to make informed choices and play an active role in the green and digital transitions.

- I want you to focus on facilitating and improving judicial cooperation between Member States and on developing the justice area. You should also look at how to make the most of new digital technologies to improve the efficiency and functioning of our justice systems.

- I want you to ensure that justice policy has a cross-cutting contribution to the fight against terrorism and extremism, as well as to all aspects of the Security Union. In this context, you should focus on enhancing judicial cooperation and improving information exchange.

- As part of this, you will support the setting-up of the European Public Prosecutor’s Office and work on extending its powers to investigate and prosecute cross-border terrorism.

- You should ensure the full implementation and enforcement of the General Data Protection Regulation and promote the European approach as a global model.

- You should contribute to the legislation on a coordinated approach on the human and ethical implications of artificial intelligence, ensuring that fundamental rights are fully protected in the digital age.

- Citizens’ rights should be at the heart of your role. You should monitor the protection of the rights conferred by European citizenship and be ready to take action when necessary.

- You should ensure that company law contributes to the strategy on small and medium-sized businesses.

Newsflash for you, Commissioner Reynders. The United States does not belong to the EU. We have our own law-making body. International bureaucrats don’t make policy here. We gave that up over 200 years ago! We have enough trouble with our domestic administrators. Perhaps you thought to go right at the Atlantic Ocean, when you should have continued left!

Tip of the Week- Supercharge Your Communications and You Supercharge Your Customer Satisfaction

Gaining a shared vision of success with customers is essential to your success. When laying the foundation for this shared vision or reinforcing the vision, do what you can to quantify the measures of success. For example, vague terms such as ASAP, better, more, faster, when you get a chance, the best, and cheaper lead to misunderstandings.

When managing expectations, these unhelpful terms should be discarded or avoided. Instead, use quantified language such as “no later than 5:00 PM, $1500, $26 monthly, within 14 days.” The specificity of your communication promotes clarity, understanding, and appropriate negotiations. Quantified refers to measurements or metrics.

Be mindful of the power of specificity. To supercharge your communications, quantify objectives if possible. For example, your referral partners will communicate ambiguous requirements to you. “I need fast approvals,” “We need lower payments,” “It would be nice to get more communication from the MLO,” “Better estimates might help,” and “As little cash to close as possible.”

Translating vague requirements into well-understood and agreed-upon deliverables requires appropriate specificity. For example, “If I can limit the cash to close to less than $500, is that what you mean by low down payment?” “Mrs. Applicant, if I can return your phone call the same day before 6:00 PM, would that be responsive communication in your view?” Mr. Applicant, if the cash to close and payments are lower than those on the LE, is that what you mean by no surprises at closing?” “Mr. Real Estate Broker, if we conduct a first-time buyer class once a month for your company, is that what you mean by more support?”

An alternative elicitation technique puts forth a prototype. For example, give the stakeholder a tangible and well-defined model of success rather than giving the customers a blank canvas such as, “What are your communication needs.” Or “How often do you want an update?”

Instead, benchmark the solutions to establish a prototype. “Mr. Applicant, most of my customers prefer I contact them by email at least once a week to update them on the loan status. Would a weekly status email on Friday afternoons between 1:00 and 4:00 PM be good for updates, or would you prefer a quick phone call around that same time?”

Another elicitation technique draws on the experiences of the stakeholder. It is incredible how more MLOs don’t use this technique with non-first-time buyers. For example, the MLO states, “I understand this is not your first time buying a home. How did it go the last time you got a mortgage?” The stakeholder says, “The last time I got a mortgage was excruciatingly painful. Frankly, I’m a little worried about the process.” The MLO says, “I’ve been doing this for ten years, and I’ve got the best team in the business, don’t worry, we are going to take care of everything!” – fail. Take care of what?

The MLO needs to understand how the customer measures success. It could be something unrealistic. It could be straightforward. The point is you need to know the expected measures of success. When an MLO tells the customer the success metrics, that is backward. The MLO may think he has a good idea of success- returns calls, close on time, and avoid last-minute surprises. However, he doesn’t know, and significantly, his customer doesn’t know he knows or cares. Why make unnecessary assumptions? What might be a distant concern in your eyes could be of utmost importance to the customer.

Instead, try this: MLO – “Mr. Stakeholder, that sounds awful. What happened?”

Stakeholder – “Estimates for the cash to close, monthly payment, and escrows increased weekly from the day of application; the final numbers were nowhere near what we’d expected.”

MLO – “Mr. Stakeholder, can I ask you about that?”

Mr. Stakeholder – “Sure, my wife was unnerved. We were moving cross country; she made me promise we would never move again after that disaster. We could never reach the MLO. We had zero confidence in what he said when we did reach him, it always seemed too late!”

MLO – “Mr.Stakeholder, if we give you an estimate, here at application, for closing costs, downpayment, and a monthly payment that is slightly higher than the actual numbers you see at closing, would that be a significant win for you? And another thing, Mr. Stakeholder, can we agree that we will contact you when you reach out to me before 6:00 PM that same day? Would that be another win?”

Meeting the customer’s expectations are as critical to your success as the goal of closing the loan. Be specific – misunderstandings are communications and relationship poison.