Why Haven’t Loan Officers Been Told These Facts?

Mortgage Loss Mitigation

When borrowers cannot meet their loan agreements, numerous avenues are available to help them survive the financial setbacks common in life.

It is said that a “Friend in need is a friend indeed.” Let your customers know that you have their backs. Most borrowers will never need assistance with loss mitigation or mortgage servicing issues, but many will appreciate your thoughtfulness and offer to help in times of need. Additionally, you become a resource for your customer’s community.

The TILA and RESPA afford borrower’s specific loss mitigations. Additionally, the GSEs and federal agencies have policies intended to assist troubled borrowers in avoiding foreclosure.

A forbearance plan is an agreement between the mortgage servicer and the borrower to pause or reduce monthly mortgage payments for a certain period, allowing borrowers to resolve their short-term hardship. When considering forbearance offers, borrowers should be mindful of the forbearance exit plan before making any agreements with the servicer.

FNMA Provides Options For Borrowers Facing Payment Challenges

The following are forbearance exit options from FNMA.

Option 1 – Reinstatement:

Are you able to resume making your monthly payment and also repay the missed payments right away?

Option 2 – Repayment Plan:

Would you be able to resume your monthly payment while also paying a little more each month to repay the missed payments?

Option 3 – Payment Deferral:

Are you able to continue making the same monthly principal and interest payments you were making before your temporary financial hardship?

Option 4 – Loan Modification:

If your regular monthly payment is no longer affordable and you can’t catch up on your missed payments, there may still be options to help you. Borrowers with long-term hardships may qualify for a loan modification; would you like to learn more about a loan modification?

Encourage Your Customers to Depend on You

When hard times come, folks are sometimes not at their best. Being overwhelmed and highly stressed leads to compounding failures, including neglecting to negotiate mortgage servicing issues successfully. Many will deny or ignore their issues. Consequently, fleeting windows of opportunity may close when they delay attending to time-sensitive servicing issues. When engulfed in trouble, some folks experience shame and may withdraw or isolate themselves, exacerbating their challenges.

Borrowers facing the loss of income, sickness, death, divorce, or work-related trials are dealing with extraordinary hardships. They will profit from a professional, organized, and systematic approach to dealing with mortgage issues. Be that person, or be the person to get your customer to that person. Remember, the time to sow these seeds is always. From the first professional interaction with the person and continuously after that, create a safe environment for your customers. Let people know that if they ever have a problem with the mortgage – you are the first person they can call on for help. Do your best to love the unloved and unlovable.

It is also true that when life throws a curve ball, housing needs and priorities may become fluid. This means a new mortgage is sometimes in the cards.

Get a better picture of agency loss mitigations from the FNMA handout “Financial Hardship Messaging Playbook For Servicers.” Link below.

Financial Hardship Messaging Playbook For Servicers

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Impending Refinance Market? And What is going on with Mortgage Delinquencies?

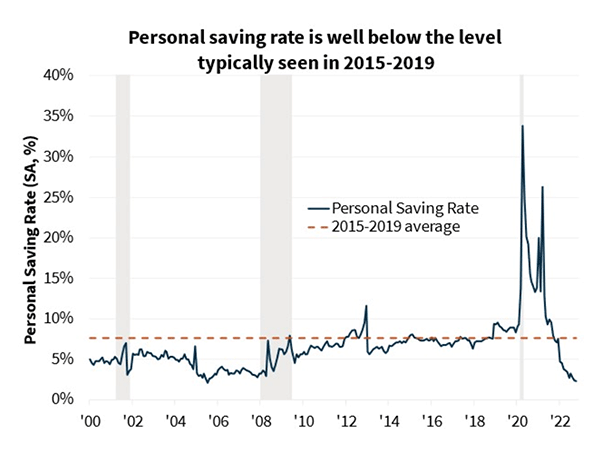

It’s been no secret that rising costs have increasingly stressed Americans with debt—the taste of free federal money wet the consumer appetite for spending, contributing to the profound inflationary pressures that have decimated the housing market. However, now that the free federal money is largely gone, student loans are back in repayment, and the cost of consumer debt is through the roof, how will the cash-strapped consumer continue to indulge their spending appetite for more things? Why more credit, of course.

Yet, eventually, all the federal money and spending from those cash-out refinances over the past few years shall dry up. How many home improvements, luxury cars, trips, and boats can you buy? Perhaps the end is near.

Warp 9

In the Star Trek franchise, whenever Captain Kirk calls upon his Chief Engineer Scotty to give him more speed or more power, Scotty would reply, “I’m giving it all she got, Captain!” One must wonder if the American consumer is pushing Warp 9 – at the limit. At the spending or consumption limit.

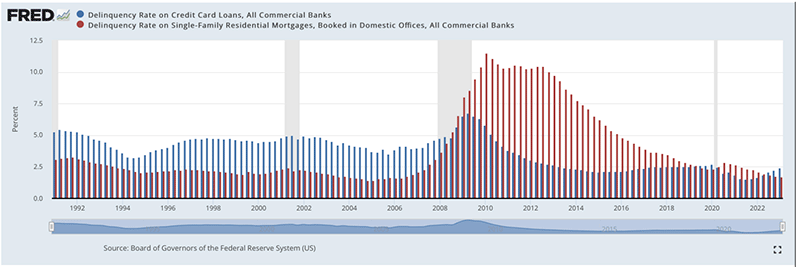

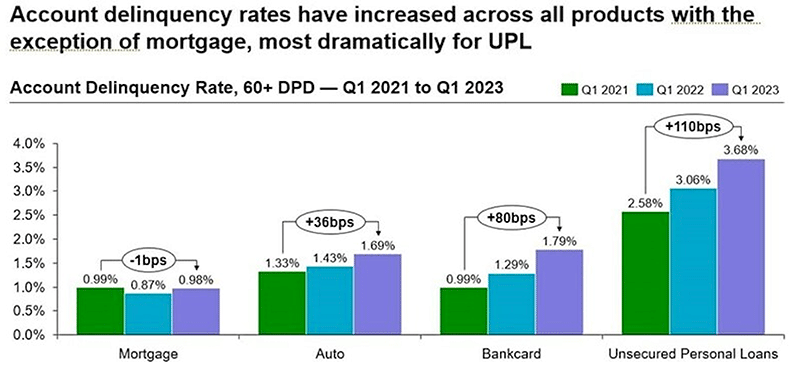

Like Captain Kirk risking engine failure, not surprisingly, reports indicate that American consumers are risking engine failure by spending money that they do not have. Borrowing is at an all-time high. As debt grows, so does the inability to successfully manage the debt both at the household level and in the aggregate. So far, this looming debt crisis has been born out, most visibly in the subprime consumer market. Subprime automobile loan delinquency has exceeded levels not seen during the Great Recession. Also of concern, credit card delinquency is reaching alarming levels.

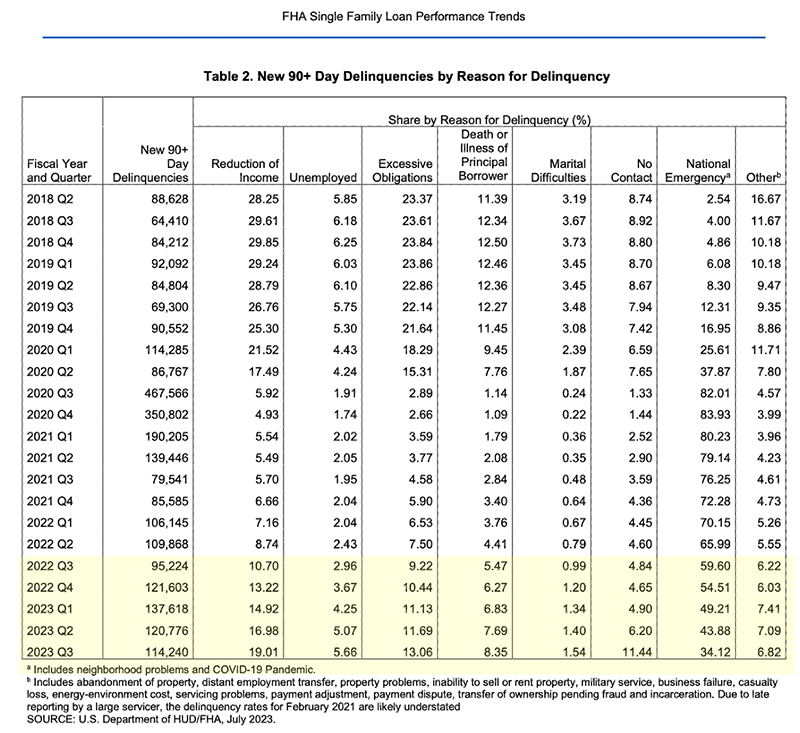

The data reveals that there are slices of serious delinquency throughout the credit spheres. Unsurprisingly, this leading edge of non-performance comprises relatively weaker consumers—those with lesser cash reserves, lower income, lower credit scores, and higher DTI ratios.

Strangely, one credit product is bucking the trend – mortgages. This oddity is probably due to the more stringent underwriting criteria across the mortgage underwriting spectrum. In some subprime loan pools, the average credit score is over 750. The mortgage loss mitigation protections are extensive compared to other consumer credit. Try getting a six-month forbearance on a car loan. Amazingly, lenders still do stated income for many consumer credit products like car loans and bank cards.

The apparent reason delinquencies are down is the vast number of ultra-affordable terms obtained at fixed rates under 5%. Even subprime loans were going for rates better than what prime borrowers obtain today.

What is developing is a further nationwide bifurcation of disposable income, wealth, and affordability. Those homeowners who bought pre-COVID are sitting pretty. For those who bought post-COVID, inflated housing prices, ballistic interest rates, and high DTIs – these homeowners could be doing better. Mortgage performance should begin to decline with the latter group.

Therefore, the mortgage servicing arena is rapidly bifurcating into two distinct spheres – COVID-era terms and post-COVID terms. The post-COVID era involves inflated valuations and higher interest rates which equal less affordable, high DTI, and high LTV transactions, including many underwater mortgages. That could prove to be a dangerous mix.

It is axiomatic that, as a whole, the households enjoying COVID-era loans also have more savings and disposable income. In a way, the COVID-era loans have insulated the economy from recession by inoculating a sizeable percentage of homeowners with low housing costs.

Dickens’ 1859 Novel, A Tale of Two Cities

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.” – A Tale of Two Cities, Charles Dickens

How does this credit drama play out as the United States reaches new heights of indebtedness, corporately as a nation and individually as consumers? The outcome is inevitable – recession. Meaning the spending-spurred growth must wane. But a recession attenuated by the bifurcated homeownership and housing experience. The question is one of timing and magnitude.

The most probable way to fix this issue is for the Fed to unwind what it did to the housing market. However, the Fed will only lower rates in response to significant recessionary pressures.

How Dark will it get Before Dawn? Sunrise on the Horizon.

How this segmented recession plays out and exactly what it looks like is the million-dollar question. But, like the sun rising in the east, certain constants should be expected. When the threat of recession is prominent, that bodes well for mortgage refinancing.

Can you do something to sew the seeds for the next refinance market? It won’t be another 2020/2021, but the refinance market for 2024, 2025, or whenever it happens could be good.

Additionally, should rates edge down to the 5% mark, that should free some of the “locked-in” homeowners who might be willing to part with their 3.00% loan for more bathrooms and a bigger garage.

If so, what might you do shortly to capture this market development? The Journal has a few thoughts. Look for a few suggestions in the coming issues.

Tip of the Week – Do Consumers Throw-Away Money On Permanent Buydowns? Often, They Do.

Cost Benefit Analysis for Mortgages

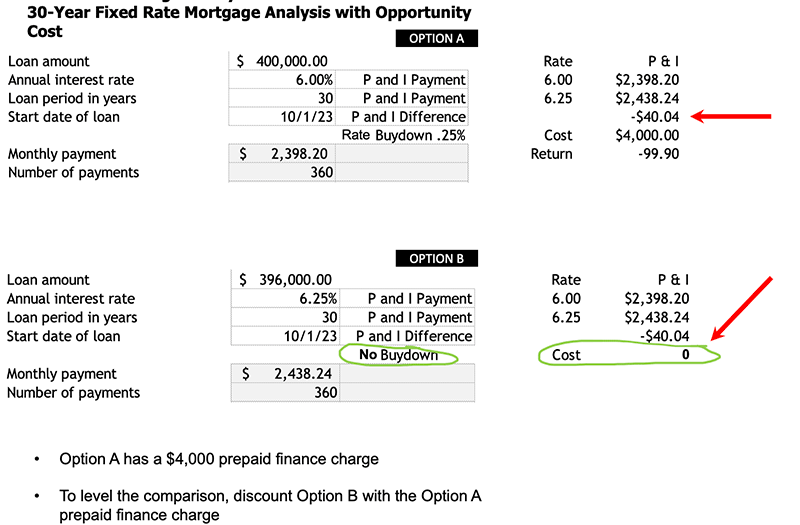

The term “opportunity cost” describes the lost benefits or opportunities that arise when investing or choosing one thing over another. You might say it is similar to a trade-off.

In the case of permanent buydowns, the consumer chooses to invest in a lower interest rate. That choice requires the consumer to pay upfront money to achieve a long-term benefit. The opportunity cost is the benefits the consumer forgoes by spending money on the permanent buydown.

In the mortgage arena, perhaps the simplest way to illustrate opportunity cost is the context of borrowing. For example, instead of the consumer paying to buy down future borrowing costs, the consumer realizes an immediate gain by foregoing the buydown and borrowing less money. The borrower begins their loan with more equity in the property.

The opportunity costs vary depending on the situation and needs of the applicant. Consider an applicant with $4,000 in credit card debt with a current interest rate of 23%. If the borrower makes minimal payments, that debt could cost $5,000 or more in finance charges over the next eight or nine years. Assuming the choice is to either pay down the 23% cards or buy down the 400K mortgage by 25 BPS. If the consumer can do one or the other, which option hurts less to give up?

Another problem with permanent buydowns. The future “savings” are not what they appear to be. The total interest saved at the bought-down rate must assume no inflation to compare apples to apples. Comprehending future value is a bridge too far for many consumers. Still, as a mortgage professional, you might profit from understanding the dollar’s declining value in a cost-benefit analysis.

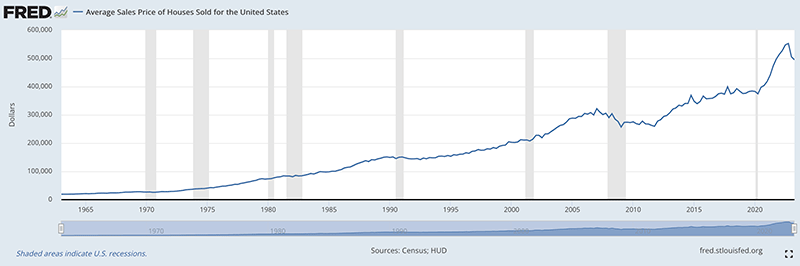

Think about what you would pay to purchase a home 20 years ago. Depending on where you get your housing statistics, nationally, the average price of a home in 2003 was $250,000. In 2023, that average peaked at about $553,000. $4000 bought a lot more house in 2003 than in 2023. That’s inflation. Paying $4000 today to save $4000 of interest twenty years from now may not be the best investment.

The example below demonstrates that the borrower does not recapture the $ 4,000 buy-down for 100 months when nominally factoring in lost opportunity. Other factors influence the actual breakeven, such as amortization and inflation. However, this simplified approach may help consumers recognize the opportunity cost of the buy-downs without muddying the waters.

U.S. Census Bureau and U.S. Department of Housing and Urban Development, Average Sales Price of Houses Sold for the United States [ASPUS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ASPUS, September 2, 2023.