Why Haven’t Loan Officers Been Told These Facts?

The CFPB Announces TILA QM 2024 Statutory Threshold Adjustments

For qualified mortgages (QMs) under the General QM loan definition, the thresholds for the spread between the annual percentage rate (APR) and the average prime offer rate (APOR) in 2024 will be 2.25 or more percentage points for a first-lien covered transaction with a loan amount greater than or equal to $130,461

3.5 or more percentage points for a first-lien-covered transaction with a loan amount greater than or equal to $78,277 but less than $130,461

6.5 or more percentage points for a first-lien covered transaction with a loan amount less than $78,277

6.5 or more percentage points for a first-lien-covered transaction secured by a manufactured home with a loan amount of less than $130,461

3.5 or more percentage points for a subordinate-lien-covered transaction with a loan amount greater than or equal to $78,277

6.5 or more percentage points for a subordinate-lien-covered transaction with a loan amount less than $78,277.

For all categories of QMs, the thresholds for total points and fees in 2024 will be 3 percent of the total loan amount for a loan greater than or equal to $130,461

$3,914 for a loan amount greater than or equal to $78,277 but less than $130,461

5 percent of the total loan amount for a loan greater than or equal to $26,092 but less than $78,277

$1,305 for a loan amount greater than or equal to $16,308 but less than $26,092

8 percent of the total loan amount for a loan amount less than $16,308.

2024 HOEPA Fee Thresholds

If the total loan amount for a transaction is $26,092 or more, and the points-and-fees amount exceeds 5 percent of the total loan amount, the transaction is a high-cost mortgage. If the total loan amount for a transaction is less than $26,092, and the points-and-fees amount exceeds the lesser of the adjusted points-and-fees dollar trigger of $1,305 or 8 percent of the total loan amount, the transaction is a high-cost mortgage.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Unlawful Discrimination Enforcement Under UDAAP Suffers Another Setback, U.S. District Court Hands the CFPB Another Stinging Defeat

2023 has been another challenging year for the CFPB as various stakeholders continue to challenge the scope of the agency’s mandate and even its existence. The latest blow surrounds CFPB fair lending examination protocols.

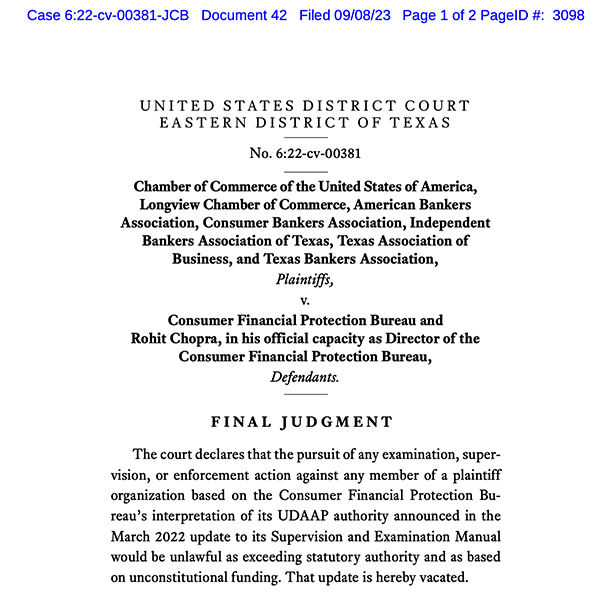

Last year, the U.S. Chamber of Commerce and other trade groups filed suit in a Texas federal district court against the CFPB. The complaint stems from updates to the CFPB’s Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) section of its examination manual, including the detection of unlawful discrimination.

The plaintiffs argue that the exam protocols amount to and institute rules subject to the rule-making process. The court agreed. The agency must propose new rules and follow the rule-making process for the exam protocols to go forward.

And yet, an even more burdensome contention is looming: the District Court ruled against the agency’s standing under the Constitution. The SCOTUS is currently hearing arguments regarding the CFPB structure and funding. What is at stake is the potential invalidation of the CFPB’s administration of the TILA, RESPA, ECOA HMDA, SAFE Act, Fair Credit Reporting Act, and so on.

The SCOTUS hearing could finally settle this CFPB-Appropriations Clause argument. It is hard to imagine that SCOTUS will throw the administration of consumer protection laws into disarray with a blanket ruling against the authority of the CFPB.

The Argument Against the CFPB

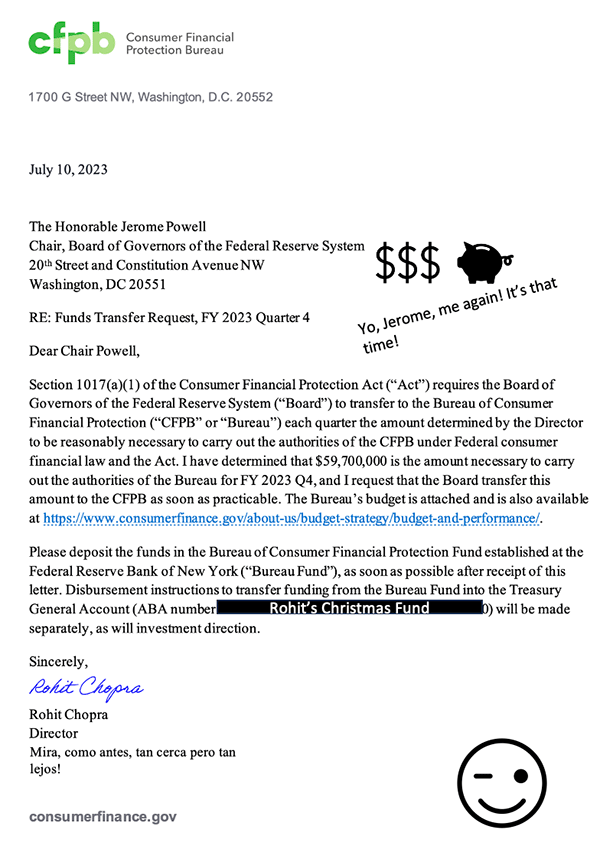

The plaintiff’s argument (a repeated objection and not a novel argument) against the CFPB is that it is unconstitutionally funded. According to Title X of Dodd-Frank (The Consumer Financial Protection Act), the CFPB Director must ask the Fed for budget money every quarter (see letter image above), and the Fed must then fulfill the demand. The CFPB funding requests are limited by law as a percentage of the Federal Reserve budget. There is no Congressional authority to control the Fed’s funding of the CFPB. On the CFPB’s demand, the Fed is legally bound to cough up the dough within the funding caps.

Congress intended the funding mechanism to limit the effectiveness of political attacks against the Bureau by insulating the Bureau’s budget from partisan attacks against the Bureau or its mission. The immensely influential financial concerns in this world have powerful friends in Congress.

Now, while some hold that many in Congress are nothing short of savages, they are our savages in our constitutional jungle. Accordingly, in one reading of the Constitution, Federal agencies must crawl on their bellies to Congress whenever they need money. In this way, Congress controls spending and may duly or unduly influence the agency and its mission.

12 USC §5497. Funding; penalties and fines

(a) Transfer of funds from Board Of Governors

(1) In general

Each year (or quarter of such year), beginning on the designated transfer date, and each quarter thereafter, the Board of Governors shall transfer to the Bureau from the combined earnings of the Federal Reserve System, the amount determined by the Director to be reasonably necessary to carry out the authorities of the Bureau under Federal consumer financial law, taking into account such other sums made available to the Bureau from the preceding year (or quarter of such year).

(2) Funding cap

(A) In general

Notwithstanding paragraph (1), and in accordance with this paragraph, the amount that shall be transferred to the Bureau in each fiscal year shall not exceed a fixed percentage of the total operating expenses of the Federal Reserve System, as reported in the Annual Report, 2009, of the Board of Governors, equal to-

(i) 10 percent of such expenses in fiscal year 2011;

(ii) 11 percent of such expenses in fiscal year 2012; and

(iii) 12 percent of such expenses in fiscal year 2013, and in each year thereafter.

The U.S. Constitution

Article I, Section 9, Clause 7: “No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time.”

The Argument for the CFPB

Another perspective would hold that the 111th Congress lawfully legislated the CFPB funding appropriations within the Constitutional framework. If subsequent Congresses don’t like the work of a former Congress, they are free to make amendments, as is the case with any other legislation. Furthermore, it is disingenuous to single out the CFPB funding mechanism as unconstitutional when other federal agencies also have similar funding. Stakeholders like the banks want to cherry-pick what agencies must grovel before Congress for funds and which do not. You don’t see the banks complaining about Social Security funding.

The Federal Red-Headed Step-Child

The CFPB has functional supervisory responsibilities (It makes the rules for consumer financial protection) for compliance with consumer financial protection laws for banks, thrifts, and credit unions with assets over $10 billion and their affiliates. Additionally, the CFPB exercises similar oversight of nonbank mortgage originators and servicers.

The Consumer Financial Protection Act of 2010 grants the CFPB broad authority to protect consumers from unfair, deceptive, or abusive acts or practices (UDAAP) concerning consumer financial services and products.

In the District Court ruling, the court ruled that not only did the examination protocols exceed the CFPB’s statutory authority but that the CFPB’s interpretation of unfairness under the Act needed to be more clearly defined. Which on the surface is odd. As the term “unfairness” has come to be used, prosecuting unlawful discrimination and discriminatory effects is one of the CFPB objectives under the unfairness precept. The unfairness boundaries have been adjudicated so often (The precept stems from Section 5 of the FTC Act, passed into law 85 years ago) that one has to wonder how much more clarity is gained by further litigation or case law. Unlawful discrimination is unfair (injurious to consumers) to consumers. Period.

§5511. (a) The Bureau shall seek to implement and, where applicable, enforce Federal consumer financial law consistently for the purpose of ensuring that all consumers have access to markets for consumer financial products and services and that markets for consumer financial products and services are fair, transparent, and competitive.

(b)The Bureau is authorized to exercise its authorities under Federal consumer financial law for the purposes of ensuring that, with respect to consumer financial products and services (2) consumers are protected from unfair, deceptive, or abusive acts and practices and from discrimination.

12 USC §5531. The Bureau may take any action authorized under part E to prevent a covered person or service provider from committing or engaging in an unfair, deceptive, or abusive Act or practice under Federal law in connection with any transaction with a consumer for a consumer financial product or service, or the offering of a consumer financial product or service.

Part E of Dodd-Frank refers to the CFPB’s broad enforcement powers.

Last Year’s CFPB UDAAP Announcement

CFPB Targets Unfair Discrimination in Consumer Finance

Discrimination or improper exclusion can trigger liability under ban on unfair acts and practices

MAR 16, 2022

WASHINGTON, D.C. — Today the Consumer Financial Protection Bureau (CFPB) announced changes to its supervisory operations to better protect families and communities from illegal discrimination, including in situations where fair lending laws may not apply. In the course of examining banks’ and other companies’ compliance with consumer protection rules, the CFPB will scrutinize discriminatory conduct that violates the federal prohibition against unfair practices. The CFPB will closely examine financial institutions’ decision-making in advertising, pricing, and other areas to ensure that companies are appropriately testing for and eliminating illegal discrimination.

“When a person is denied access to a bank account because of their religion or race, this is unambiguously unfair,” said CFPB Director Rohit Chopra. “We will be expanding our anti-discrimination efforts to combat discriminatory practices across the board in consumer finance.”

The CFPB enforces several laws that can target discriminatory practices. Government regulators and private plaintiffs have commonly relied on the Equal Credit Opportunity Act (ECOA), a fair lending law which covers extensions of credit. However, certain discriminatory practices may also trigger liability under the Consumer Financial Protection Act (CFPA), which prohibits unfair, deceptive and abusive acts and practices (UDAAPs).

The CFPB published an updated exam manual today for evaluating UDAAPs, which notes that discrimination may meet the criteria for “unfairness” by causing substantial harm to consumers that they cannot reasonably avoid, where that harm is not outweighed by countervailing benefits to consumers or competition. Consumers can be harmed by discrimination regardless of whether it is intentional. Discrimination can be unfair in cases where the conduct may also be covered by ECOA, as well as in instances where ECOA does not apply. For example, denying access to a checking account because the individual is of a particular race could be an unfair practice even in those instances where ECOA may not apply.

The CFPB will examine for discrimination in all consumer finance markets, including credit, servicing, collections, consumer reporting, payments, remittances, and deposits. CFPB examiners will require supervised companies to show their processes for assessing risks and discriminatory outcomes, including documentation of customer demographics and the impact of products and fees on different demographic groups. The CFPB will look at how companies test and monitor their decision-making processes for unfair discrimination, as well as discrimination under ECOA.

Are Banks Arguing Against Fair Lending?

This is all about the money. Ostensibly, we are all on the same team. No sane person promotes unlawful discrimination. However, aggressive fair lending implementations have a cost. Additionally, it is a critical compliance matter that compliance begins with rigorous rule-making. Regulators must play by the rule-making rules.

Admittedly, seeing the SCOTUS spank a few butts for unnecessarily splitting hairs over the UDAAP’s applicability to unlawful discrimination would be delightful. Getting the bum’s rush instead of equal credit opportunities is the apex of unfairness.

When Will CFPB Legitamacy Get Sorted Out?

Sometime between December 2023 and June 2024, look for a SCOTUS ruling.

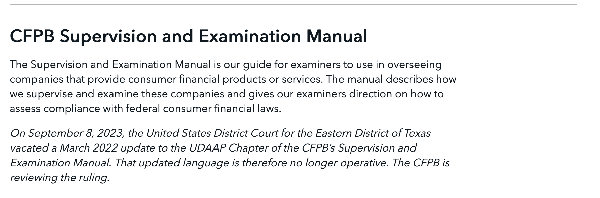

Generally, the CFPB provides examination manuals online. Instead, the image above has, at present, replaced the manuals.

Tip of the Week – Courage and Action, A Case Study

Are You Phobic About Implementing New Services, Programs, or Products? Find Courage in Pat’s Story.

After eight years in the business, Pat had steered away from USDA financing. Pat was employed by a state-chartered community bank whose geographic footprint included USDA-eligible areas. Yet most of the Bank’s USDA Section 502 Guaranteed Loan Program originations went to a handful of MLOs working out of the two branches located in the eligible areas.

Though confident in originating every agency and private label product the Bank offered and having many occasions to originate the USDA loans, Pat found it easy to refer the 502 product to the Bank’s USDA experts. With all the income limits, special provisions, and geographic distances, learning all the ins and outs in the midst of his busy days was just a bridge too far.

Additionally, the Bank encouraged MLOs inexperienced with rural property and the 502 product to refer the prospects to the USDA experts at the branches. Pat earned a reasonable fee for the internal referral.

Until this year, Pat had more volume than he could handle and hadn’t worried about the USDA referrals. Every once in a while, Pat would bring up the USDA originations with his manager. But he repeatedly failed to seize upon Pat’s USDA interests. Pat’s manager insisted that rather than mishandling USDA originations and dealing with a painful learning curve, Pat would be better off focusing on his area of expertise and collecting referral fees.

Bobby, the branch manager at a local mortgage company, was impressed with Pat’s reputation and professionalism and had been recruiting him for a couple of years. Pat enjoyed phone calls and emails from Bobby. He always had something good to say or a few words of encouragement.

On one call, Pat opened up and complained that he was concerned he was “blowing it” by referring USDA prospects to the Bank’s USDA experts. Bobby was surprised and had no idea that Pat wasn’t doing USDA, especially in the area where they worked. Bobby promised to help Pat and scheduled another call.

Over coffee, Bobby asked Pat if he wanted to meet Joe. Joe was one of the mortgage companies’ top USDA producers. Joe was more than just a top USDA producer. Joe did everything. She was the company’s top producer for construction loans, too. Joe was also an acknowledged expert in leveraging accessory dwelling units and renovation loans to improve affordable housing opportunities. Pat agreed to meet Joe.

Bobby set up a Zoom meeting with Joe and Pat. On the call, Pat was immediately impressed by Joe. She knew the ropes and had built the kind of business most MLOs might envy. Joe was also an accomplished recruiter for the mortgage company. Bobby was pumped. As Bobby’s National Sales VP was fond of saying, “If the competition fails to care for their LOs, we will.”

During the call, Joe shared a few highlights of how she tackles new products or services. She talked about her implementation checklist with Pat. Essentially, the same list she used to get started with ADU financing, renovation, and construction loans. Her latest endeavor was setting up a direct billing relationship with a relocation company. She told Pat how the list provided the awareness necessary to execute this new enterprise confidently. The direct billing was also a first for the mortgage company.

The checklist had a handful of components, including sections on:

- Stakeholders

- Property

- Risks

Pat was excited.

Next week, the Journal examines more of Joe’s implementation checklist.