Why Haven’t Loan Officers Been Told These Facts?

GSEs Are Again Pushing For More Prefunding Audits

If you don’t know what a prefunding audit is, don’t find out the hard way.

Robust prefunding audit execution is necessary for any lender’s quality control verification system. Verification requires internal auditors or vendors to examine the full loan file or elements of the file for conformity with the investor or insurer’s requirements.

The timing of the prefunding audit is critical to sample for defects in the loan manufacture adequately. For example, auditing the loan after the initial underwriting review is less effective because loan file changes frequently occur between the initial review and closing. Consequently, an audit of the completed (prefunding) file is more likely to catch defects before it is too late for rework.

The prefunding audit has two variants: full file and component review. The full file review is just what it sounds like—a top-to-bottom examination. The component review verifies components of the underwriting such as collateral, income, asset, and ratio calculation. In either case, generally, the lender must time the audit near the end of the loan manufacture for greater verification effectiveness. Timing requirements apply to random samples or targeted files. Ideally, the audit should begin only after the clear to close or, even better, after the loan documents are delivered to the settlement agent.

Remember that Operations and Quality Assurance are not necessarily pulling in the same direction as much as they could. The prefunding audit timing requirement risks a delay in the scheduled closing, brand damage to the originator, and damage to borrowers and other stakeholders.

Can anything be done to mitigate prefunding audit adverse impacts on the transaction? Yes. The MLO can start by familiarizing themselves with the risk layers that trigger targeted prefunding audits. Once you identify the risks that trigger more audits, either act to attenuate the audit risk and/or ensure those files lack nothing that may increase the time needed to clear the audit. Like grass through a goose, ensure that the i’s are dotted, and the t’s are crossed to speed up the audit.

Obtaining an appraisal waiver from the applicant is a good start if possible. Tightening the file documentation and speeding the loan manufacture may create some slack in the schedule for loans at higher risk of audit.

Best practices include managing stakeholder expectations. The faster the loan manufacture, the greater the schedule buffer. Encourage the buyer’s agents to tighten up any inspection resolution period. Avoid appraisal delays due to contract resolutions. Don’t allow the applicants to take their time to satisfy the documentary requests. Be demanding. “Mr. Applicant, I’ll need everything on your document checklist by 1:00 PM Friday”— no later than 48 hours from your request. Create a sense of urgency for the applicant.

What are the risk layers that the quality control folks are concerned with? Risk categories are dynamic, meaning many variables may elevate a discrete risk (e.g., incorrect income calculation) to an audit condition. Each file contains discrete and total risk. For example, being self-employed combined with high DTI adds up to significant total risk. If there are two or more discrete risk factors, this increases the probability of a targeted review. Lenders also conduct random sampling. Not much can be done to avoid random audits.

- Loans with characteristics or circumstances related to errors or defects identified in prior prefunding and post-closing review results

- Loans that were impacted by a recent policy change

- Loans with complex income calculations (for example, rental income, self-employed, and short history of receipt of income)

- Loans requiring the use of nonstandard processing or underwriting guidelines (for example, multiple financed properties, assets used as income, or manual reserve calculations)

- Loans originated or processed through various business sources, branch offices, staff persons, contractors, third-party originators, or appraisers

- Loans that require a higher level of documentation

- Loans with greater inherent complexity, such as purchases with secondary financing, grants, and gifts

- High DTI transactions (Greater risk of exceeding DTI maximums when income or liability calculations are in error)

- Collateral issues (Many comps and adjustments)

- Files that trigger fraud flags

From FNMAs 2023 Quality Control Bootcamp

“The industry’s gross and net significant defect rates have risen over the last few years, and the gap between them has widened. To address the increasing trend in the defect rate, Fannie Mae continues to take action and make changes that enhance the industry’s control environment so we have a lens of continuous improvement. Fannie Mae shared recently-implemented actions, such as an action-planning framework and Prefunding QC enhancements. We remain focused on helping the industry move back to generating higher-quality loans.

Prefunding QC (PFQC) is the most important tool in your QC toolbox for identifying risk and remediating it before you own it. Invest in pulling risk forward, i.e., address risk before loans are closed, use strategic discretionary reviews, and mitigate risks before they become problems or financial liabilities. Consider moving efforts from post-closing QC to prefunding QC to do the important work of identifying as many defects as possible before you close the loan and own the risk. Invest in prefunding QC wisely – the requirements in the Selling Guide are a starting point.”

The Selling Guide requires that some portion of a lender’s PFQC contain full-file reviews so that new risks can be identified earlier than post-closing random reviews would reveal, but no minimum requirement is set. This gives lenders the flexibility to use component reviews to target specific risk attributes.

Prefunding reviews must be effective in identifying and preventing ineligible loans from funding. Timing is critical. Selections must be made when the documentation is complete and, at a minimum, when the loan is conditionally approved or cleared to close but not closed. PFQC needs a reasonable amount of time to perform the review and operations needs adequate time to make any corrections identified by PFQC – all while minimizing manufacturing delays.”

Earlier this year, the LOSJ warned about intensified quality control efforts. See that article here:

More Prefunding Audits on the Horizon

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – States Gear Up for Last-Minute License Renewals

Individual states can impose more exacting deadlines than the SAFE Act requirements. And many do. For Example:

Delaware – The deadline to complete CE is December 1

District of Columbia – The deadline to complete CE is November 1

Georgia – The deadline to complete CE is October 31

Idaho – The deadline to complete CE is December 1

Iowa – The deadline to complete CE is December 1

Kansas -The deadline to complete CE is December 1

Kentucky – The deadline to complete CE is November 30

Puerto Rico – The deadline to complete CE is December 1

South Carolina DCA – The deadline to complete CE is November 30

Utah DRE – The deadline to complete both Federal and State CE is December 15

Vermont – The deadline to complete CE is December 1

Washington – The deadline to complete CE is December 15

West Virginia – The deadline to complete CE is November 1

From the NMLS

“The first state deadlines for completing continuing education (CE) are getting close. Review your education record in NMLS to find out what you need to do. Instructions for how to view your record are available here in the NMLS Resource Center.”

If you need to know your state’s deadline, check the handy CSBS website here.

CSBS State Education Requirements

Tip of the Week – Courage and Action, A Case Study

Are You Phobic About Implementing New Services, Programs, or Products? Find Courage in Pat’s Story.

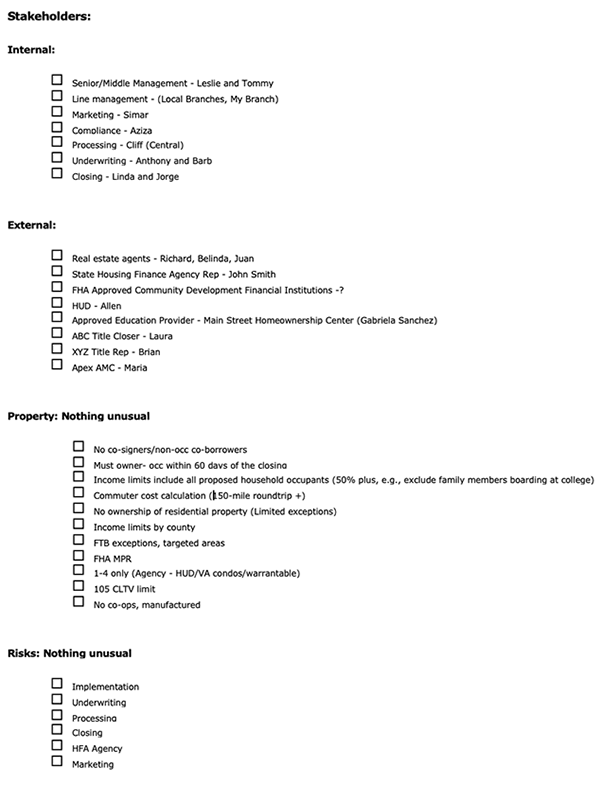

Joe provided Pat with the checklist she uses when launching originations with a new Housing Finance Agency (HFA). She explained to Pat that the first step is identifying the necessary stakeholders to support the implementation. Joe gains the expert judgment from these stakeholders to support the execution. Additionally, Joe made clear to Pat that with the support of these groups and individuals, she would move forward with implementation.

Joe encouraged Pat to try her process to launch his USDA originations.

Joe confided that the trick to successful implementation is knowing when and when not to proceed. Joe said she had delayed her new HFA launch and continues to build support. The plan does not need to be perfect or even great. Good is good enough. However, there is no launching unsupported implementations. If the headwinds are too much, she moves on to the next opportunity.

Pat asked Joe if she was optimistic about the current HFA project being a go, to which Joe replied, “Always hope for the best, but plan for the worst.”

She explained to Pat that you need to capture the success criteria of these critical stakeholders. Without clear success targets, she never proceeds. The success criteria provide for the requisite objectives and metrics to keep the stakeholder’s support.

The HFA already approved Joe’s company to originate their programs. However, the company’s program volume has been lower than hoped.

Joe remarked that she contacted senior management to learn why the state’s HFA originations were not higher. Leslie, the Senior VP of Production, mentioned it was the usual obstacles:

- The local originators were resistant to anything new.

- The MLOs claim they have heard nothing but negative comments about the program and the HFA.

- The branch managers were swamped with other challenges.

- The home sellers won’t accept the contingent offers, and so forth.

- No support from builders or real estate agents.

Leslie said he felt that, in hindsight, he should have surveyed the MLOs before launching in that state. He admitted to Joe he could have taken a more active role in the implementation’s inertia. He was only too pleased to hear from Joe and was all ears.

The Journal further explains Joe’s implementation processes next week.