Why Haven’t Loan Officers Been Told These Facts?

Significant Credit Enhancements from the GSEs

From FNMA

LTV Enhancement

During the weekend of Nov. 18, 2023, Fannie Mae will update Desktop Underwriter® (DU®) Version 11.1, which will include the changes described below. Unless specified below, the changes in this release will apply to DU Version 11.1 loan casefiles submitted or resubmitted on or after the weekend of Nov. 18, 2023.

To expand access to credit and provide support for affordable rental housing, the maximum allowable LTV, CLTV, and HCLTV ratios for two- to four-unit, principal residence, purchase and limited cash-out transactions will be updated to 95%. This change will not apply to high-balance mortgage loans and loans that are manually underwritten.

Self Employed Changes

Selling Guide Announcement SEL-2023-09 updated the DU policy that permits one year of personal and business tax returns for self-employed borrowers. New self-employed documentation messages supporting this policy change will be issued on DU Version 11.1 loan casefiles created on or after Jan. 1, 2024.

Length of self-employment

Current underwriting requirements emphasize the continuity of a borrower’s stable income to demonstrate the likelihood that a consistent level of income will continue to be received for borrowers. For borrowers using self-employment income to qualify, we require lenders to obtain a two-year history of the borrower’s prior earnings as a means of demonstrating the likelihood that the income will continue to be received, but allows a shorter history in certain circumstances.

We updated the Selling Guide to clarify the requirements for use of self-employment income when the borrower has less than a two-year history of self-employment. These clarifications include a requirement for the signed personal and business federal income tax returns to reflect a minimum of 12 months of self-employment income from the current business.

Effective: Lenders are encouraged to implement these changes immediately but must do so for DU loan casefiles created on or after Jan. 1, 2024, and manually underwritten loans with application dates on or after Jan. 1, 2024.

Tax return requirements for self-employed borrowers

The Selling Guide currently requires that self-employment income be documented with the most recent two years of personal and business tax returns. When a loan is underwritten through DU, DU may determine that only one year of tax returns is required to document self-employed income.

To provide more transparency for this documentation policy, we updated the policy to allow one year of personal and business tax returns when

• All self-employed businesses have been in existence for five years, and

• The borrower has had a 25% or greater ownership interest for the last five consecutive years.

This policy applies to both DU and manually underwritten loans.

Effective: For manually underwritten loans, lenders may implement these changes immediately. DU will apply the updated policy for DU loan casefiles created on or after Jan. 1, 2024.

B3-3.2-01, Underwriting Factors and Documentation for a Self-Employed Borrower (10/04/2023)

Length of Self-Employment

Fannie Mae generally requires lenders to obtain a two-year history of the borrower’s prior earnings as a means of demonstrating the likelihood that the income will continue to be received.

However, the income of a person who has less than a two-year history of self-employment may be considered, as long as the borrower’s most recent signed personal and business federal income tax returns reflect a full year (12 months) of self employment income from the current business. The loan file must also contain documentation to support the history of receipt of prior income at the same (or greater) level and

- In a field that provides the same products or services as the current business, or

- In an occupation in which they had similar responsibilities to those undertaken in connection with the current business.

In such cases, the lender must give careful consideration to the nature of the borrower’s level of experience, and the amount of debt the business has acquired.

FHLMC 5304.1(c)

In certain instances, a Borrower may not have a current two-year history of self-employment; however, the income and employment may still be considered stable if the Seller provides a written analysis justifying the determination of stability, and sufficient supporting documentation is obtained. When making this determination, the Seller must take into consideration the overall layering of risk, including the Borrower’s demonstrated ability to repay obligations. When the Borrower has been self-employed for less than two years, prior to considering the income for qualifying purposes, at a minimum the Seller must:

- Document that the Borrower has a two-year history of receipt of income at the same or greater level in the same or similar occupation

- Consider and evaluate the Borrower’s experience in the business

- Consider and evaluate the acceptance of the company’s service or products in the marketplace

Analysis of current business activity through a review of the year-to-date (YTD) financial statement and/or the most recent three months of business bank statements may provide support to this evaluation.

The Borrower’s federal income tax returns must reflect at least one year of self-employment income.

Analysis

This is not a seachange for the GSEs as, in the past, they have allowed lenders some discretion surrounding the stability and history of business income. FNMA stipulates that one year of self-employment is acceptable with specific provisos. The seller guide section 5304.1(c) now stipulates that the borrowers must have a two-year history of stable income, which includes 12 full months of business income reflected in the current return. This means that in the year preceding the tax return evidencing 12 months of business income, the applicant had income equal to or greater than that income calculated for self-employment. The guide does not specify the exact constitution of the prior income. However, what is implied is that the lender must derive from the prior income some continuity related to the current business and business income.

The Guide continues to leave room for lender discretion in evaluating if the business income is stable or not. The change is a mixed bag of impacts but, on the whole, an improvement for many. Providing increasingly granular requirements for fringey transactions is a plus.

Implementation

Have your ducks lined up. FNMA requires the current return to cover 12 months of self-employment. Expect lenders to demand the requisite documentation to provide evidence reflecting the business’s existence, operations, and cash flow for the 12 months corresponding to the return.

Additionally, anything that provides evidence of the applicant’s acumen, experience, or success in the particular business field will help the lender make the case. A CV or resume and cover letter from the applicant are not evidence but are helpful. Consider certifications, licensure, college transcripts, contracts, awards, commendations, trade journals, news releases, and professional recommendations.

Multiple risk layers are a terrible idea—no other application weaknesses. The applicant must have excellent credit and reserves. A larger down payment won’t hurt.

Marketing

Contact business attorneys, financial planners, bookkeepers, and accountants—additionally, the local Chamber of Commerce, SCORE, and business lenders can bird dog self-employed leads. Check for public filings from the Secretary of State.

Don’t focus exclusively on those people looking for loans. Prospect the newly self-employed.

See the DU Release Notes here:

Desktop Underwriter (DU)/Desktop Originator (DO) Release Notes DU Version 11.1 Nov. Update

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – DOJ Strikes Again, $9,000,000 Remediation

Redlining Complaint Resolved Without Civil Penalty

Justice Department Secures $9 Million Agreement with Washington Trust Company to Resolve Redlining Claims in Rhode Island

Wednesday, September 27, 2023

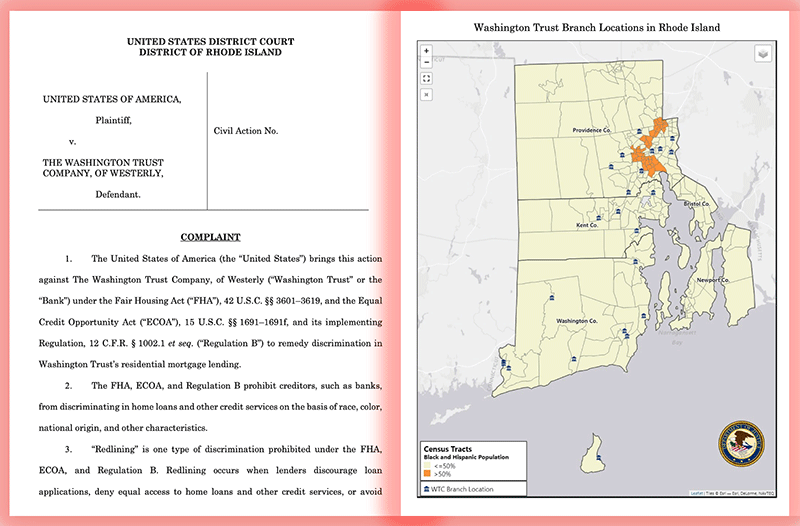

The Justice Department announced today that Washington Trust Company (Washington Trust), the oldest community bank in the nation, has agreed to pay $9 million to resolve allegations that it engaged in a pattern or practice of lending discrimination by redlining majority-Black and Hispanic neighborhoods in Rhode Island.

Redlining is an illegal practice in which lenders avoid providing credit services to individuals living in communities of color because of the race, color or national origin of residents in those communities.

“This settlement should send a strong message to banks regarding the Justice Department’s firm commitment to combat modern-day redlining and ensure that all lenders are providing equal access to home loan opportunities to communities of color,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “This resolution will provide critical relief to impacted Black and Hispanic communities, enabling them to buy a home, keep their home or access the equity in their home. Ending redlining and providing relief to communities of color impacted by this unlawful practice is a necessary step in ongoing efforts to reduce racial wealth and homeownership gaps across our country.”

“Everyone who pursues the American dream has the right to expect to be treated equally and with dignity, regardless of their race, their background, or zip code. When communities are denied access to fair lending, families are denied the opportunity to build stability and financial success,” said U.S. Attorney Zachary A. Cunha for the District of Rhode Island. “I am pleased that, as a result of the hard work of attorneys in my office and the department’s Civil Rights Division, Washington Trust has agreed to take targeted and extensive measures to make meaningful lending services available for all Rhode Islanders, regardless of race or background.”

The complaint alleges, from 2016 through at least 2021, Washington Trust failed to provide mortgage lending services to majority-Black and Hispanic neighborhoods in Rhode Island. The complaint alleges that despite expansion across the state of Rhode Island, Washington Trust has never opened a branch in a majority-Black and Hispanic neighborhood.

The complaint alleges that Washington Trust relied on mortgage loan officers working out of only majority-white areas as the primary source for generating loan applications, and Washington Trust failed to train or incentivize its lending staff or conduct outreach, marketing and advertising of its mortgage services to compensate for its lack of branches and presence in majority-Black and Hispanic areas. The complaint further alleges that, compared to Washington Trust, over the same six-year period, other banks received nearly four times as many loan applications each year in majority-Black and Hispanic neighborhoods in Rhode Island. The complaint also alleges that, even when Washington Trust generated loan applications from majority-Black and Hispanic areas, the applicants themselves were disproportionately white.

Under the proposed consent order, which is subject to court approval, Washington Trust has agreed to do the following:

- Invest at least $7 million in a loan subsidy fund to increase access to home mortgage, home improvement, home refinance and home equity loans and lines of credit for residents of majority-Black and Hispanic neighborhoods in Rhode Island;

- Spend $1 million on community partnerships to provide services that increase residential mortgage credit access for residents of those neighborhoods;

- Spend $1 million for advertising, outreach, consumer financial education and credit counseling focused on majority-Black and Hispanic neighborhoods;

- Open two new branches in majority-Black and Hispanic neighborhoods in Rhode Island; and ensure at least two mortgage loan officers are dedicated to serving these neighborhoods; and

- Employ a Director of Community Lending who will oversee the continued development of lending in communities of color.

Press Release From the Washington Trust Company

The Washington Trust Company (“Washington Trust” or “the Bank”), the wholly owned subsidiary of Washington Trust Bancorp, Inc. (Nasdaq: WASH), today announced that it has entered into a settlement agreement with the U.S. Department of Justice (“DOJ”) that resolves alleged violations of fair lending laws in Rhode Island from 2016 to 2021. The settlement does not include any civil monetary penalties.

Washington Trust vehemently denies the allegations and entered into this agreement solely to avoid the expense and distraction of potential litigation, and to allow the Bank to focus fully on serving the needs of its customers and communities.

“We believe we have been fully compliant with the letter and spirit of fair lending laws, and the agreement will further strengthen our focus on an area that has always been important to us,” stated Edward O. “Ned” Handy III, Washington Trust Chairman and Chief Executive Officer. “Rhode Island has been home to Washington Trust for 223 years and our neighbors count on us to provide affordable loan opportunities no matter where they live.”

“We care about all of our communities across Rhode Island, and we demonstrate our commitment through a number of proactive state-wide and corporate initiatives,” added Handy. “For example, our Washington Trust RI Community Lending Program offers a variety of creative affordable loan opportunities, and our financial literacy and educational programs help potential borrowers prepare for home ownership. In addition, our dedicated team includes multi-lingual and minority community outreach and loan officers. We believe it is as a result of our proactive community efforts that we have steadily increased our lending in Majority-Minority Census Tracts as we’ve expanded our branch network.”

Under the agreement, Washington Trust will provide $7 million in mortgage loan subsidies over a five-year period for mortgage, home improvement, or refinance loans, in specific census tracts in RI. Washington Trust will also commit $2 million for focused community outreach and marketing efforts. Over the past five years, Washington Trust has invested significantly in mortgage loan subsidies, community outreach, and marketing in Majority-Minority Census Tracts, and will continue these efforts to make positive impact in these communities.

“As the oldest community bank in the nation, we were founded to provide people with a trustworthy and local financial partner, and that mission continues to guide us today. We deliver a consistently superior banking experience to each and every member of the community, and that contributes directly to our solid financial foundation and the steady performance that we have achieved for more than two centuries. We look forward to serving our community long into the future,” concluded Handy.

Tip of the Week – Courage and Action, A Case Study

Find Courage in Pat’s Story.

Joe explained to Pat that, in her estimation, the green light to move forward is two or more referral partners on board. Joe said that instead of soliciting business hat in hand, she proposes business solutions to build the team.

Joe asked, “Who can afford to spin their wheels?” Joe also said she doesn’t like looking or feeling like a beggar. When the prospective referral partner understands her proposal, either they are on board or not. Move on to the next prospect with the proposal.

Joe said prospective referral partners should put some skin in the game. She said, “No skin, no commitment.”

In the case of her HFA implementation, Joe proposes that each referral partner commit to six homeownership workshops over 12 months. Joe and the prospect agree to split the workshop sponsorship costs 50/50. In this way, Joe gains the attention, resources, and commitment of the prospective referral partner. Joe also shared that some of the real estate brokers she has aligned with were invaluable in their operational knowledge.

Joe added that without senior management’s backing, it’s a no-go. She must enlist the aid of senior management to authorize the company’s legal and compliance review. Besides, the company always split the sponsorship costs with Joe as well.

Joe explained to Pat that there was another green light. Only with rational hopes of achieving and maintaining key stakeholder buy-in and, at the same time, having reasonable certainty of meeting the agreed-upon success criteria will she then move forward.

Joe also explained to Pat that every implementation was merely a calculated risk. You play the odds and put your bet on the endeavor with the best chance of success. She said two of every three sponsorships fail or are only modestly successful (barely worth the effort). But one out of three is all she needs to reach her origination objectives.

Pat’s Gambit

After he met with Joe, Pat was emboldened. He called his branch manager and stated that “He was at a crossroads” and requested a meeting with the bank’s sales manager. In the meeting, Pat was candid about talking to another mortgage company and unfolded his plan to launch his USDA implementation following Joe’s way. Pat made clear his intentions and identified several prospective referral partners he wanted to approach for sponsorship.

The Bank’s sales manager immediately responded to Pat’s concerns, assuring him that “We would work this out.”

The branch and sales managers liked what Pat proposed. The sales manager scheduled a call with the head of production. After meeting with Pat, the production head insisted Pat spend a day at the main fulfillment center to come up to speed on the USDA manufacture. The production head introduced Pat to the Bank President, who was informed about the plan.

Having long considered the Bank’s flimsy USDA efforts needing improvements, the President was also excited. The President told Pat, “I think we have been shooting ourselves in the foot. I have nothing against the two MLOs that do 80% of our USDA production, but they are fed so much business they have little motivation to expand our presence. The Guaranteed Loan Program could be the leading edge of a larger rural services implementation. Our USDA volume has been flat for years and hardly aligns with our strategic goals. You have my support. If it is agreeable to you, Pat, you will meet with the sales manager weekly until this gets off the ground. The sales manager reports to me.”

Epilogue

In a follow-up call with Joe, Bobby shared he was feeling down. Bobby had been recruiting Pat for over a year and hoped that Pat would join forces with him once Pat got a taste of the organization, especially the chance to work with Joe. Bobby was all for Pat but had to confess his disappointment when Pat shared that he got the green light from the bank to launch a USDA initiative. Bobby was sure the bank would fail to support Pat’s desire to originate USDA, and Pat would be on board with him.

Bobby also mentioned to Joe that Pat and his girlfriend bought him and his wife an outrageous dinner as a thank-you. They all had a great time, and he genuinely hit it off with Pat. Yet, he felt he was no closer to recruiting Pat. Maybe, by helping Pat succeed with the bank, he had put him out of reach.

Joe offered a few words of encouragement to Bobby to stay close to Pat. She also reminded him that if he bats .300 in recruiting, he will need a much bigger office. For now, at least, he won’t have to start packing just yet. Joe said, “Bobby, do the right thing and leave the rest to God. Who you got for me next?”