Why Haven’t Loan Officers Been Told These Facts?

Mortgage Application for Non-U.S. Citizens

Unlawful Discrimination Against Non-U.S. Citizen Loan Applicants

Recently, the LOSJ wrote that the CFPB and Justice Department had issued a joint statement cautioning that financial institutions may not use immigration status to discriminate against credit applicants illegally. See the link to the LOS Journal – Volume 3 Issue 45 below.

No lender wants to turn away qualified mortgage applicants. So, how do lenders find themselves non-compliant with ECOA and the Fair Housing Act surrounding credit decisions and processing related to immigration status? Furthermore, in a very tough loan market, who can fail to exploit any lending opportunity?

Lenders must recognize the categories of non-U.S. citizens to comprehend the mortgage opportunities, if any. Additionally, MLOs may misunderstand the necessity of subprime solutions for foreign nationals. Guiding an agency loan-qualified applicant into a subprime loan is an abusive and unfair act. Having a foreign national status itself does not disqualify mortgage applicants from agency loan products.

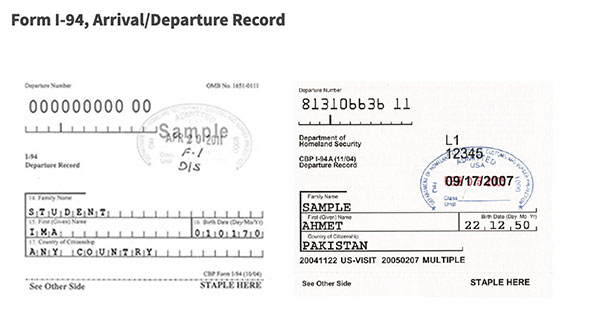

Generally, among other artifacts, non-immigrant foreign nationals (not qualified for or pursuing permanent residence) require the I-766 Employment Authorization Document (EAD) and I-94 Arrival/Departure record to meet the agency’s non-immigrant borrower requirements.

From the U.S. Department of Homeland Security

Nonimmigrants are foreign nationals granted temporary admission into the United States. The major purposes for which nonimmigrant admission may be authorized include temporary visits for business or pleasure, academic or vocational study, temporary employment, or to act as a representative of a foreign government or international organization.

Temporary worker visas are for persons who want to enter the United States for employment lasting a fixed period of time, and are not considered permanent or indefinite. To work in the United States temporarily as a lawful nonimmigrant, temporary workers must qualify for the available visa category based on the planned employment purpose.

Here is a U.S. visa list, including visa types that qualify for an Employment Authorization Document necessary for agency products:

Temporary workers and trainees

CW1 CNMI-only transitional workers

CW2 Spouses and children of CW1

H1B Temporary workers in specialty occupations

H1B1 Chile and Singapore Free Trade Agreement aliens

H1C Registered nurses participating in the Nursing Relief for Disadvantaged Areas

H2A Agricultural workers

H2B Nonagricultural workers

H2R Returning H2B workers

H3 Trainees

H4 Spouses and children of H1, H2, or H3

O1 Workers with extraordinary ability or achievement

O2 Workers accompanying and assisting in performance of O1 workers

O3 Spouses and children of O1 and O2

P1 Internationally recognized athletes or entertainers

P2 Artists or entertainers in reciprocal exchange programs

P3 Artists or entertainers in culturally unique programs

P4 Spouses and children of P1, P2, or P3

Q1 Workers in international cultural exchange programs

R1 Workers in religious occupations

R2 Spouses and children of R1

TN North American Free Trade Agreement (NAFTA) professional workers

TD Spouses and children of TN

Intracompany transferees

L1 Intracompany transferees

L2 Spouses and children of L1

Treaty traders and investors

E1 Treaty traders and their spouses and children

E2 Treaty investors and their spouses and children

E2C Treaty investors and their spouses and children (CNMI only)

E3 Australian Free Trade Agreement principals, spouses and children

E3D Spouse or Child of E3

E3R Returning E3

From the Joint Statement on Fair Lending and Credit Opportunities for Noncitizen Borrowers under the Equal Credit Opportunity Act

“While Regulation B describes certain conditions under which creditors may consider immigration status, creditors should remain cognizant that ECOA and Regulation B expressly forbid discrimination on the basis of certain protected characteristics, including race and national origin.

Immigration status may broadly overlap with or, in certain circumstances, serve as a proxy for these protected characteristics. Creditors should therefore be aware that if their consideration of immigration status is not “necessary to ascertain the creditor’s rights and remedies regarding repayment” and it results in discrimination on a prohibited basis, it violates ECOA and Regulation B.

Accordingly, creditors must ensure that they do not run afoul of ECOA’s nondiscrimination provisions when considering immigration status. As a general matter, creditors should evaluate whether their reliance on immigration status, citizenship status, or “alienage” (i.e., an individual’s status as a non-citizen) is necessary or unnecessary to ascertain their rights or remedies regarding repayment. To the extent that a creditor is relying on immigration status for a reason other than determining its rights or remedies for repayment, and the creditor cannot show that such reliance is necessary to meet other binding legal obligations, such as restrictions on dealings with citizens of particular countries, 12 C.F.R. pt. 1002, Supp I. ¶ 2(z)-2, the creditor may risk engaging in unlawful discrimination, including on the basis of race or national origin, in violation of ECOA and Regulation B.”

Loan Application Requirements for Non-Permanent-Resident Applicants

What is required for the business decision when interacting with persons or communities with non-immigrant status (excludes lawful permanent residents) or facilitating a mortgage application for non-U.S. citizens?

From FNMA:

B2-2-02, Non–U.S. Citizen Borrower Eligibility Requirements (07/28/2015)

Fannie Mae purchases and securitizes mortgages made to non–U.S. citizens who are lawful permanent or non-permanent residents of the United States under the same terms that are available to U.S. citizens. Fannie Mae does not specify the precise documentation the lender must obtain to verify that a non–U.S. citizen borrower is legally present in the United States. The lender must make a determination of the non–U.S. citizen’s status based on the circumstances of the individual case, using documentation it deems appropriate. By delivering the mortgage to Fannie Mae, the lender represents and warrants that the non–U.S. citizen borrower is legally present in this country.

If a borrower is reliant on income for which documentation of continuity is required, the mere fact that a borrower has current, verified status does not impact the continuity of income analysis. For example, if a borrower can provide documentation of 3-year income continuity when required, the fact that their status is renewed only every 2 years is not a factor — the borrower is legally present and has met the continuity of income requirements.

See the entire FNMA non-citizen handout here:

Non-Citizen Borrower Eligibility

From HUD-FHA

4000.1 II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT

A. Title II Insured Housing Programs Forward Mortgages

1. Origination/Processing, Rev 01/18/23

(b) Non-permanent Residents

A Borrower who is a non-permanent resident may be eligible for FHA-insured financing provided:

- The Property will be the Borrower’s Principal Residence;

- The Borrower has a valid SSN, except for those employed by the World Bank, a foreign embassy, or equivalent employer identified by HUD;

The Borrower is eligible to work in the United States provided the Borrower provides either:

- An Employment Authorization Document (USCIS Form I-766) showing that work authorization status is current;

- A USCIS Form I-94 evidencing H-1B status, and evidence of employment by the authorized H-1B employer for a minimum of one year;

- Evidence of being granted refugee or asylee status by the USCIS;

- OR evidence of Form I-94, Arrival/Departure Record

From Homeland Security

Form I-94, Arrival/Departure Record

CBP and USCIS issue Form I-94, Arrival/Departure Record, to nonimmigrants. This document indicates the bearer’s class of admission, date of entry, and date their immigration status expires. Generally, employees download it from cbp.gov. If an employee presents a paper Form I-94, it may show a stamped or handwritten date. They may present Form I-94 with documents that Form I-9 specifies are valid as a combination of documents, such as Form I-94 presented with a foreign passport, and Form DS-2019 or Form I-20.

Form I-766, Employment Authorization Document

USCIS began issuing this design of the Employment Authorization Document (EAD) on January 30, 2023. Some cards issued after that date may still display the previous design because USCIS uses existing card stock until supplies are depleted. Both the current and previous EADs will remain valid until the expiration date shown on the card (unless otherwise noted, such as through an automatic extension of the validity period of the EAD as indicated on a Form I-797, Notice of Action, or in a Federal Register notice).

This version contains the bearer’s photo on the front and back, name, USCIS number, date of birth, and card expiration date along with updated artwork of the Statue of Liberty, holographic images on the front and back of the cards, a new layer-reveal feature with a partial window on the back photo box; and data fields displayed in different places than on previous versions.

From the U.S. Dept of Labor:

The H-1B program allows employers to temporarily employ foreign workers in the U.S. on a nonimmigrant basis in specialty occupations or as fashion models of distinguished merit and ability. A specialty occupation requires the theoretical and practical application of a body of specialized knowledge and a bachelor’s degree or the equivalent in the specific specialty (e.g., sciences, medicine, health care, education, biotechnology, and business specialties, etc.).

Current laws limit the annual number of qualifying foreign workers who may be issued a visa or otherwise be provided H-1B status to 65,000 with an additional 20,000 under the H-1B advanced degree exemption.

See the U.S. Citizenship and Immigration Services document page below:

USCIS 13.1 List A Documents That Establish Identity and Employment Authorization

LOSJ Article on Immigration Discrimination

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – FINCEN On Watch For Money Laundering Residential Real Estate Transactions

October 22, 2023

Financial Crimes Enforcement Network (“FinCEN”) issues a Geographic Targeting Order (“Order”) requiring title insurance companies to collect and report information about the persons involved in certain residential real estate transactions, as further described in this Order.

For purposes of the Order, the “Covered Business” means title insurance companies and any of their subsidiaries and agents. This definition would include closing attorneys and escrow companies.

Transactions must be reported if a purchase in the geographically targeted area is made without a bank loan or other similar form of external financing by a financial institution, as that term is used in corresponding regulation (Applies to virtually all residential lenders, including third-party originators).

The transaction must be reported should a covered transaction use currency or a cashier’s check, a certified check, a traveler’s check, a personal check, a business check, a money order in any form, a funds transfer, or virtual currency.

The Covered Business shall report the Covered Transaction to FinCEN by filing a FinCEN Currency Transaction Report within 30 days of closing the Covered Transaction.

The terms of this Order for purchases of properties within the Texas county of Travis; the Massachusetts counties of Bristol, Essex, Norfolk, and Plymouth; and the Florida counties of Hillsborough, Pasco, Pinellas, Manatee, Sarasota, Charlotte, Lee, and Collier are effective beginning November 21, 2023, and ending on April 18, 2024 (except as otherwise provided in Section III.C).

The terms of this Order for purchases in all other counties covered by this Order are effective beginning October 22, 2023, and ending on April 18, 2024.

The purchase price of the residential real property is in the amount of $50,000 or more in the City or County of Baltimore in Maryland, or in the amount of $300,000 or more in any of the following areas:

- The Texas counties of Bexar, Tarrant, Dallas, Harris, Montgomery, Webb, or Travis;

- The Florida counties of Miami-Dade, Broward, Palm Beach, Hillsborough, Pasco, Pinellas, Manatee, Sarasota, Charlotte, Lee, or Collier;

- The Boroughs of Brooklyn, Queens, Bronx, Staten Island, or Manhattan in New York City, New York;

- The California counties of San Diego, Los Angeles, San Francisco, San Mateo, or Santa Clara;

- The Hawaii counties of Hawaii, Maui, Kauai, or Honolulu, or the City of Honolulu;

- The Nevada county of Clark;

- The Washington County of King;

- The Massachusetts counties of Suffolk, Middlesex, Bristol, Essex, Norfolk, or Plymouth;

- The Illinois county of Cook;

- The Maryland counties of Montgomery, Anne Arundel, Prince George’s, or Howard;

- The Virginia counties of Arlington or Fairfax, or the cities of Alexandria, Falls Church, or Fairfax;

- The Connecticut counties of Fairfield or Litchfield;

- The Colorado counties of Adams, Arapahoe, Clear Creek, Denver, Douglas, Eagle, Elbert, El Paso, Fremont, Jefferson, Mesa, Pitkin,Pueblo, or Summit; or

- The District of Columbia.

About FinCen

The mission of the Financial Crimes Enforcement Network is to safeguard the financial system from illicit use, combat money laundering and its related crimes including terrorism, and promote national security through the strategic use of financial authorities and the collection, analysis, and dissemination of financial intelligence.

The Bank Secrecy Act (BSA) defines the term “financial institution” to include, in part, a loan or finance company. The term, however, can reasonably be construed to extend to any business entity that makes loans to or finances purchases on behalf of consumers and businesses. Non-bank residential mortgage lenders and originators (RMLOs), generally known as “mortgage companies” and “mortgage brokers” in the residential mortgage business sector, are a significant subset of the “loan or finance company” category.

From the Conference of State Bank Supervisors (The NMLS owner), MultiSate Mortgage Committee

Residential mortgage lenders and originators (RMLOs) are in a unique position to assess and identify money laundering risks, fraud, and other forms of potential suspicious activity. As a first line of defense, RMLOs can readily identify suspicious transactions and activities since they work closely with consumers when originating, underwriting, and approving or denying mortgage loans. The Financial Crimes Enforcement Network (FinCEN) expanded the applicability of the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations to include nonbank RMLOs in 2012.

The expansion imposed specific BSA and AML protocols on any RMLO who makes or acquires loans secured by deeds of trust or mortgages on residential properties. Specifically, FinCEN requires each RMLO to create and implement a risk-based BSA/AML compliance program (BSA/AML Program), train their employees on money-laundering and fraud, and file Suspicious Activity Reports (SARs). Under the BSA, financial institutions must maintain an anti-money laundering program. The BSA requires RMLOs to develop and implement a written BSA/AML Program to include policies, procedures, and controls that are designed to prevent, detect, and deter money laundering and terrorist financing. The Program must be approved by senior management or the Board of Directors, depending on the corporate structure of the RMLO.

Tip of the Week – Communicate What You Do For Them

What is the role of the MLO? Do you effectively articulate the benefits you provide to prospects and borrowers? The role has a variety of responsibilities and diverse objectives, and each objective ties with the others to produce customer satisfaction.

SERVICE AND LEADERSHIP

- The referral partner-facing role.

- The prospect-facing role.

- The customer-facing role.

- The team member-facing role.

Your ability to articulate your role as it relates to each person’s interests allows you to establish professional relevance. Additionally, by enumerating your responsibilities in the role, you articulate the specific benefits you shall provide to those you serve. The foundation for the success criteria of the stakeholders you assist becomes more palpable and measurable.

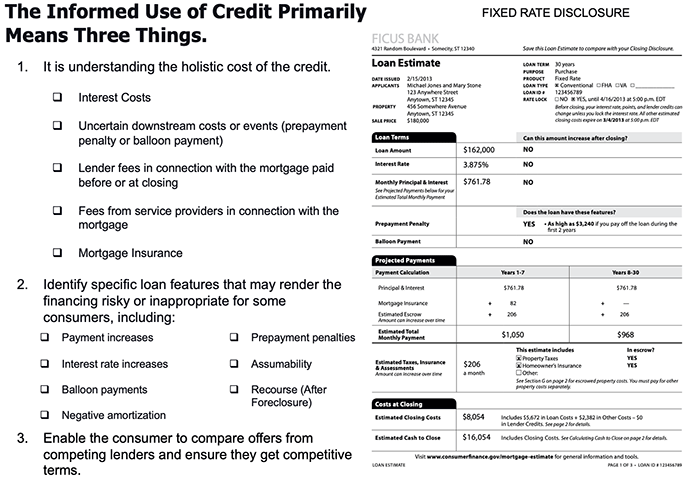

For example, a prospect-facing role requires, among other things, your facilitation of the informed use of credit. The fundamental and overarching premise of the TILA, the foremost consumer protection statute, is the “informed use of credit.”

The prospect-facing role requires certain skills, including leadership, interpersonal, and communication skills, to unpack and facilitate the informed use of credit. With mortgage prospects, the MLO must rapidly build credibility and rapport to promote an informed use of credit successfully.

You gain credibility and rapport with the prospect by fulfilling the established loan manufacture expectations or promised benefits they realize when working with you, including the informed use of credit.

Ensure that this central responsibility is communicated to interested stakeholders.

Disclosure

The MLO prospect-facing role includes disclosure. What is meant by the term disclosure?

- Exposure – the condition of being presented to view or made known.

- Revelation – the act or an instance of making known something previously unknown or concealed.

Disclosure: A lender’s revelation of information to a consumer under the Truth in Lending Act that enables the consumer to make an intelligent decision about the loan.

– Merriam-Webster.com Dictionary

The Informed Use of Credit Centers on Three Primary Concerns

The MLO effectively leads consumer comprehension through effective leadership and interpersonal and communication skills.

Ensure that you communicate your objectives and elicit (bring forth or uncover) the success criteria of the prospect.

For example:

MLO: Mr. Prospect, one of my chief responsibilities is to ensure you have written information about our credit offers so that you can evaluate 1) The suitability of the terms for your needs. Additionally, I’ll provide you with the means 2) To compare mortgage offers. This empowers you to recognize and obtain competitive terms. Lastly, the written disclosure furnishes 3) A holistic picture of the cost of the credit. From the top to the bottom, you will understand the complete cost of the credit. Mr. Prospect, is that what you want from me at this time?

Mr. Prospect: Yes, that sounds good. I heard that there are a lot of hidden costs with a mortgage. I also need to know if I will qualify.

MLO: Noted. We will take care to determine what terms are available to you through the process of pre-approval. Shall we get started?

Mr. Prospect: I’d also like to see a few loan options. I can put 20% down if that makes sense, but I’d prefer to put down as little as possible.

MLO: Of course. An excellent approach to determining the best financing is to evaluate your options comparatively. Let’s get some information together and then look at your options.

Mr. Prospect: What you suggest sounds like what I want. Where do we start?