Why Haven’t Loan Officers Been Told These Facts?

Servicemembers Eligible for a Funding Fee Waiver

Most MLOs know that once the VA rates a veteran as having a 10% or higher service-related disability, certain benefits kick in, including funding fee waivers.

But what about servicemembers with disabilities buying a house before separation from service?

Servicemembers awarded the Purple Heart get the funding fee waiver. But apart from the Purple Heart award, generally, servicemembers are not exempt from the funding fee. Even those with severe service-connected disabilities. But, the VA will waive the funding fee if the servicemember has an adjudicated predischarge claim.

Servicemembers with an illness or injury caused—or worsened by their active duty service can file a claim for disability benefits 180 to 90 days before they leave the military. The predischarge claim should help speed up the claim decision process so the servicemember can get earlier access to needed VA support.

Unlike other instances where the lender incorrectly assesses the funding fee, and subsequently, VA refunds the funding fee, that does not happen with funding fees collected from servicemembers with adjudicated predischarge claims. That money is gone if the lender fails to apply for the funding fee waiver before the loan closes.

In other words, if the lender screws up, the disabled vet gets to pay the bill for the lender’s grave mistake. As is said, adding insult to injury. Don’t let that be you.

MLOs should ask active duty applicants with short ETS (Expiration Term of Service) or ADSO (Active Duty Service Obligation) dates if they have filed a predischarge claim.

The VA states that servicemembers may make a predischarge claim no sooner than six months from separation. But who knows with a bureaucracy? Moreover, VA already requires that lenders need additional documentation if the ETS or ADSO date is within 12 months of the anticipated loan closing. So go the extra mile and ask about predischarge claims.

Servicemembers exiting active duty face numerous adjustments and challenges. The Nation, including the mortgage industry, owe it to those experiencing disablement due to their service to do what we can to help.

From VA

Greetings, We would like to share an important reminder about determining funding fee exemption status for active-duty Service members before a closing takes place.

On July 15, 2021, VA published Circular 26-21-11, Updated Funding Fee Information for Lenders, advising lenders to ask borrowers if they have a pending disability claim with VA and to submit VA Form 26-8937 for active-duty Service members with a predischarge claim pending.

On June 23, 2022, VA published Circular 26-22-12, Certificate of Eligibility Funding Fee Status Update for Active-Duty Service Members with Pending Predischarge Claims, to announce an update to the funding fee status on Certificates of Eligibility (COE) where the lender has submitted VA Form 26-8937, Verification of VA Benefits, for an active-duty Service member who indicates they have a predischarge disability claim pending with VA.

If the active-duty Service member is eligible for the home loan benefit and VA records indicate the Service member has a predischarge claim pending that has not been adjudicated, VA will submit the rating request to the Veteran Service Center (VSC). VA will update the COE funding fee status to Non-Exempt – In Development and issue the COE. The Service member is not exempt at this time. VA will update and reissue the COE as appropriate based on the proposed or memorandum rating received from VSC.

If a proposed or memorandum rating is not obtained, and the loan closing takes place before the Veteran is discharged from service, the funding fee exemption does not apply, and the Service member will not be entitled to a refund.

On January 6, 2022, VA published Circular 26-22-02, VA Form 26-0592 Update, to announce an update to VA Form 26-0592, Counseling Checklist for Military Homebuyers. Lenders are reminded to provide VA Form 26-0952 to active-duty Service members along with the Uniform Residential Loan Application (URLA). This form informs applicants how they can pursue an exemption from the VA funding fee if they have a predischarge claim pending with VA. Thank you for your attention to ensuring that Service members with pending predischarge claims obtain a proposed or memo rating before closing.

Sincerely,

Loan Guaranty Service

BEHIND THE SCENES – The US Justice Department Secures Over $31 Million from City National Bank to Address Lending Discrimination Allegations

Most significant Redlining Settlement Agreement in USDOJ History

The latest enforcement action in the DOJ’s “Combating Redlining Initiative.” Over $75 Million for Neighborhoods of Color to Date

From The United States Department of Justice

January 12, 2023

The Justice Department announced today an agreement to resolve allegations that City National Bank (City National) engaged in a pattern or practice of lending discrimination by “redlining” in Los Angeles County.

City National is the largest bank headquartered in Los Angeles and among the 50 largest banks in the United States. This resolution will include over $31 million in relief to impacted individuals and communities. The agreement, which is part of the Department’s nationwide Combating Redlining Initiative that Attorney General Merrick B. Garland launched in October 2021, represents the largest redlining settlement in its history.

“Fifteen months after I vowed that the Justice Department would be aggressively stepping up our efforts to combat discriminatory practices in the housing market, we have today secured the largest redlining settlement in Department history,” said Attorney General Merrick B. Garland. “So far, the Combating Redlining Initiative has secured over $75 million dollars in relief for communities that have suffered from lending discrimination. The Justice Department will continue to build on our efforts to vigorously enforce federal fair lending laws and work to ensure that financial institutions provide equal opportunity for every American to obtain credit. In advance of what would have been Dr. Martin Luther King Jr.’s 94th birthday, it is a fitting time to reaffirm our commitment to that work, and to the pursuit of justice for all Americans.”

“This settlement is historic, marking the largest settlement ever secured by the Justice Department against a bank engaged in unlawful redlining,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “This settlement embodies Dr. Martin Luther King Jr.’s commitment to fighting economic injustice and ensuring that Black Americans and all communities of color are able to access the American dream and freely access the credit needed to purchase a home. Redlining is a practice from a bygone era, runs contrary to the principles of equity and justice, and has no place in our economy today. This settlement should send a strong message to the financial industry that we expect lenders to serve all members of the community and that they will be held accountable when they fail to do so.”

“In the words of Dr. Martin Luther King Jr., the issue of fair housing is a ‘moral issue.’ Thus, ending redlining is a critical step to closing the widening gaps in homeownership and wealth, especially in a city as large and diverse as Los Angeles,” said U.S. Attorney Martin Estrada for the Central District of California. “It is unacceptable that redlining persists into the 21st century, and this case demonstrates our commitment to combat redlining and hold banks and others accountable when they engage in unlawful discrimination. Through this agreement, we are taking a major step forward by removing unlawful and discriminatory barriers in residential mortgage lending, and meeting the credit needs in Los Angeles.”

“Redlining” is an illegal practice in which lenders avoid providing credit services to individuals living in communities of color because of the race, color, or national origin of the residents in those communities. The complaint filed in federal court today alleges that from 2017 through at least 2020, City National avoided providing mortgage lending services to majority-Black and Hispanic neighborhoods in Los Angeles County and discouraged residents in these neighborhoods from obtaining mortgage loans. The complaint also alleges that during that time period other banks received more than six times as many applications in majority-Black and Hispanic neighborhoods in Los Angeles County than City National each year. In addition, City National only opened one branch in a majority-Black and Hispanic neighborhood in the past 20 years, despite having opened or acquired 11 branches during that time period. And unlike at its branches in majority-white areas, City National did not assign any employee to generate mortgage loan applications at that branch.

Under the proposed consent order, which is subject to court approval and was filed today in the U.S. District Court for the Central District of California along with a complaint, City National Bank has agreed to do the following:

-

- Invest at least $29.5 million in a loan subsidy fund for residents of majority-Black and Hispanic neighborhoods in Los Angeles County; at least $500,000 for advertising and outreach targeted toward the residents of these neighborhoods; at least $500,000 for a consumer financial education program to help increase access to credit for residents; and at least $750,000 for development of community partnerships to provide services that increase access to residential mortgage credit.

- Open one new branch in a majority-Black and Hispanic neighborhood and evaluate future opportunities for expansion within Los Angeles County; ensure at least four mortgage loan officers are dedicated to serving majority-Black and Hispanic neighborhoods; and employ a full-time Community Lending Manager who will oversee the continued development of lending in majority-Black and Hispanic neighborhoods.

- Conduct a Community Credit Needs Assessment, a research-based market study, to help identify the needs for financial services for majority-Black and Hispanic census tracts within Los Angeles County.

City National worked cooperatively with the Department to remedy the redlining allegations. In conjunction with this settlement, City National has announced that it is proactively taking steps to expand its lending services in other markets around the country to provide greater access to credit in communities of color. Specifically, City National is working to facilitate additional homeownership opportunities in underserved communities, including by creating a residential mortgage special purpose credit program to cover geographic areas in various locations throughout the country, including New York, Georgia, Nevada, and Tennessee. Additionally, City National is planning to launch a small business lending program that will be aimed at assisting underserved business owners in operating and growing their business.

Tip of the Week – Explaining SOFR to Prospects and Customers – Understanding the Numbers

Even experienced MLOs get questions that leave them stumped now and then. Expect that with the SOFR transition.

In this age of conspiracy theories and fake news, consumers get barraged with incomplete information and fear-mongering. Therefore, anticipate possible misinformation and apprehension when presenting an ARM solution.

MLOs should have a tiered approach to complexity in loan manufacture. But, more than ever, the KIS (Keep It Simple) principle is profoundly helpful. Especially when unpacking the SOFR index used by the GSEs for consumer mortgage finance.

Rather than merely providing marketing collateral or disclosures, be prepared to give a little more depth for challenging or complex stakeholder questions. At the same time, know when to stay in your lane. It is probably not a good idea to attempt to provide qualitative depth on SOFR to a prospect with an MBA in finance. But KIS will usually work fine for the other 95% of your interactions. A few SOFR Facts.

From the NY Fed:

The Federal Reserve Bank of NY, in cooperation with the Office of Financial Research, began publishing SOFR on April 3, 2018.

SOFR has several characteristics that LIBOR and other similar rates based on wholesale term unsecured funding markets did or do not:

-

- It is a rate produced by the Federal Reserve Bank of New York for the public good (The public includes Wall Street interests, LOSJ editor ;))

- It is derived from an active and well-defined market with sufficient depth to make it extraordinarily difficult to ever manipulate or influence

- It is produced in a transparent, direct manner and is based on observable transactions rather than being dependent on estimates, like LIBOR, or derived through models

- The Alternative Reference Rates Committee (ARRC) is a group of private-market participants convened by the Federal Reserve Board and the New York Fed to help ensure a successful transition from U.S. dollar (USD) LIBOR to a more robust reference rate, its recommended alternative, the Secured Overnight Financing Rate (SOFR)

- It is derived from a market that was able to weather the global financial crisis and that the ARRC credibly believes will remain active enough so that it can reliably be produced in a wide range of market conditions.

SOFR Is Not a Tool of the Anti-Christ

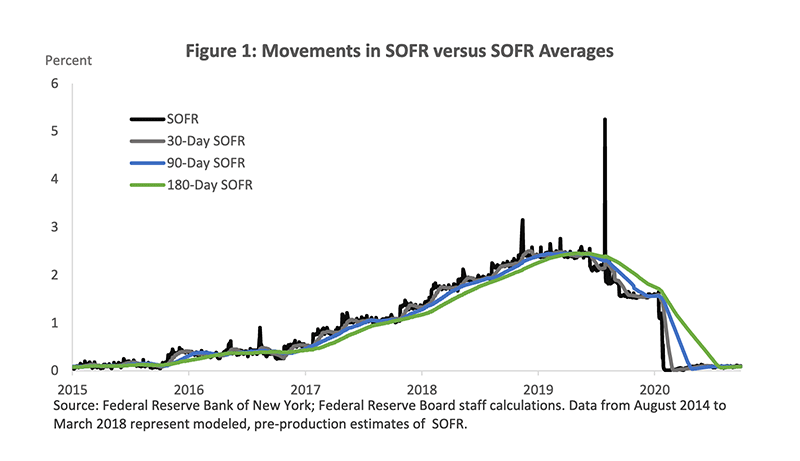

From the Fed – “On a daily basis, SOFR can exhibit some amount of idiosyncratic volatility, reflecting market conditions on any given day, and a number of news articles pointed to the jump in SOFR and other overnight repo rates in the fall of 2019. However, although people often focus on the type of day-to-day movements in overnight rates shown by the black line in the figure below (Fig 1), it is important to keep in mind that the type of averages of SOFR that are referenced in financial contracts (such as mortgages) are much smoother than the movements in overnight SOFR. See Fig 1 below.”

SOFR is Good for Corporate Finance and Bankers, but is SOFR a Good Index for Consumer Finance?

Because of its range of coverage, SOFR is a good representation of general funding conditions in the overnight Treasury repo market. As such, it reflects an economic cost of lending and borrowing relevant to the vast array of capital market participants.

In addition to producing SOFR, the Federal Reserve Bank of New York also publishes 30-day, 90-day, and 180-day averages of SOFR and a SOFR Index. The GSEs use the 30-day compounded average of SOFR for ARMs. Historically, there is little difference in compound versus simple interest calculations for the 30-day SOFR average.

There are two essential reasons why financial products like mortgages use an average of the overnight rate:

- First, an average of daily overnight rates will accurately reflect movements in interest rates over a given period of time

- Second, an average overnight rate smooths out idiosyncratic, day-to-day fluctuations in market rates, making it more appropriate for use

What Happened to the SOFR in September 2019?

The Chicago Fed on the September 19, 2019, SOFR Anomaly

“Two developments in mid-September put stress on overnight funding markets. First, quarterly tax payments for corporations and some individuals were due on September 16. Over a period of a few days, these taxpayers took more than $100 billion out of bank and money market mutual fund accounts and sent the money to the U.S. Treasury. Second, the Treasury increased its long-term debt by $54 billion by paying off maturing securities and issuing a larger quantity of new ones. (A reduction in short-term Treasury bills outstanding partly offset the increase in long-term debt.) Buyers of the new debt paid for it by withdrawing money from bank and money market accounts. Combined with the tax payments, the debt issuance reduced the amount of cash in the financial system.

At the same time as liquidity was diminishing, the Treasury debt issuance caused financial institutions to need more liquidity. A substantial share of newly issued Treasury debt is typically purchased by securities dealers, who then gradually sell the bonds to their customers. Dealers finance their bond inventories by using the bonds as collateral for overnight loans in the repo market. The major lenders of cash in that market include banks and money market funds—the very institutions that had less cash on hand as a result of taxpayers’ and bond buyers’ payments to the Treasury.

With more borrowers chasing a reduced supply of funding in the repo market, repo interest rates began to rise on September 16 and then soared on the morning of September 17, reaching as high as 9% in some transactions—on a day when the FOMC was targeting a range of 2% to 2.25% for the fed funds rate.”

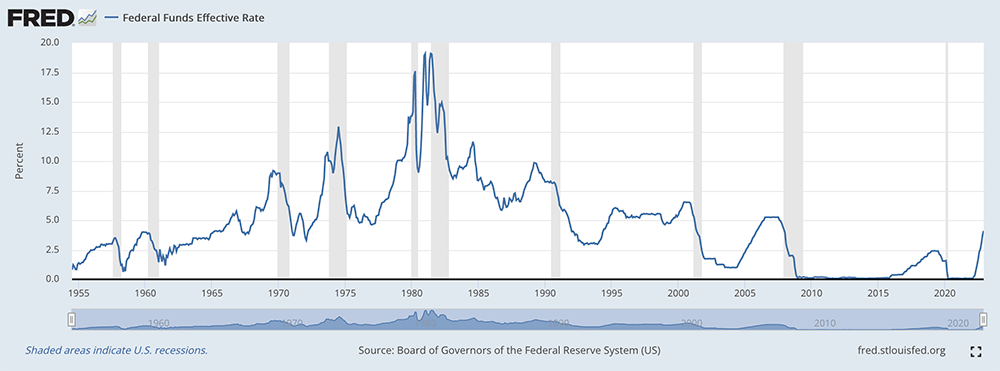

What is the Federal Funds Rate? (Figure 2 below)

The Federal Funds rate (fed funds) are reserves held in a bank’s Federal Reserve Bank account. Federal banking laws govern the reserves necessary for capital management and risk policy compliance. Suppose a bank holds more fed funds than is required to cover its regulatory reserve requirement. Those excess reserves may be lent to another financial institution with a Federal Reserve Bank account. To the borrowing institution, these funds are fed funds purchased. To the lending institution, they are fed funds sold. The Fed sets a “target” for these rates, but the actual rate is subject to negotiation between borrowers and lenders.

Is the SOFR a Perfect Mortgage Index

As a mortgage index, applicants may have some concerns with the SOFR. While September 2019 is a fascinating finance study and makes for good fake news and conspiracy stories, it is of some concern to mortgagors because the September 2019 event underscores the SOFR’s susceptibility to extra-capital market concerns.

Formerly used indices such as US Treasury-derived and Cost of Funds values have always been subject to political and monetary policies. But perhaps not to the same extent as the daily SOFR values.

Do bankers and political hacks control SOFR? Yes and no. First, the Fed is supposed to be independent of politics. However, they are not entirely neutral. The Federal Reserve, like many other central banks, is an independent government agency but also one that is ultimately accountable to the public and Congress. However, you get a job as a Fed governor through politics – just like any other political appointment. Second, SOFR and the Federal Funds rate track closely. Should inflation pressures continue, expect SOFR to mirror the Federal Funds rates. However, unlike the Federal Funds rates, the SOFR rates are secured by solid collateral – US Treasury Securities. That makes the loans that comprise SOFR marginally safer than unsecured loans between banks. Therefore, SOFR yields should be lower than the target Federal Funds rate.

Therefore, the Fed’s action to rein in inflation and tighten the money supply could unintentionally punish ARM mortgagors. Especially if future Fed Governors take a more aggressive stance when facing perceived inflation pressures. But that would be the case for any money market index.

In exchange for spreading the interest rate risk more evenly between borrowers and lenders, consumers get a hefty discount compared to the long-term fixed rates. It works for some, not for others.

Now that you know more about SOFR and finance, how do you translate that to the consumer loan presentation? Stay tuned for a few suggestions!

Figure 2 – Courtesy of the St. Louis Fed