Why Haven’t Loan Officers Been Told These Facts?

VA Joins Effort to Defang Medical Collections

Effective Immediately, Mandatory Implementation Date, January 1, 2024

VA Lenders Handbook M26-7

Chapter 4: Credit Underwriting

Topic 7: Credit History – Required Documentation and Analysis

(b)Medical Collection and Charge-off Accounts (See pages 4-37 et seq.)

Identifiable medical collections are collection accounts that are established when an overdue medical bill is referred to a collection agency. Charge-offs may occur when a creditor is no longer pursuing repayment of the medical debt. Lenders may disregard all identifiable medical collections, including charge-off accounts, that have not been reduced to a judgment or lien.

Identifiable medical collection accounts that have not been reduced to a judgment or lien do not have to be paid off as a condition for loan approval and should not impact the overall acceptability of a borrower’s credit.

Lenders do not need to obtain explanations for medical collections or charge-offs and do not need to otherwise address such accounts.

Non-medical Collection Accounts

Isolated non-medical collection accounts do not necessarily have to be paid off as a condition for loan approval. A credit report may show numerous satisfactory accounts and one or two unpaid collections. In such instances, while it would be preferable to have collections paid, it would not necessarily be a requirement for loan approval.

However, non-medical collection accounts must be considered part of the borrower’s overall credit history and such accounts should be considered open, recent credit. These unpaid accounts must therefore be considered in the debt-to-income ratio and residual income calculation on VA Form 26-6393, Loan Analysis, and when using an Automated Underwriting System (AUS). If such accounts are listed on the credit report with a minimum payment, then the debt should be recognized at the minimum payment amount.

Non-medical collection accounts without established payment arrangements are to be included with a calculated monthly payment using 5% of the outstanding balance of the collection. Borrowers with a history of such accounts should have re-established satisfactory credit in order to be considered a satisfactory credit risk.

While VA does not require such accounts be paid-off prior to closing if the borrower’s overall credit is acceptable, an underwriter must address the existence of the account(s) with an explanation on VA Form 26- 6393, Loan Analysis, and justify why positive factors outweigh the negative credit history such accounts represent.

Charge-off Accounts

These accounts are typically collections in which the creditor is no longer pursuing collection of the account. The underwriter must address the circumstances regarding the negative credit history when reviewing the overall credit of the borrower(s). This does not apply to identifiable medical charge-offs, as described above.

See the updated Chapter 4 at the link below.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – FNMAs’ Revealing White Paper

Theoretically, FNMA’s November DU changes improve credit access for people of color and women

One catch: Approval for the enhanced LTVs on multifamily is hard to get

Excerpted from the FNMA White Paper “Responsibly Increasing Affordable Housing Supply & Access to Credit”

Regarding FNMA’s Enhanced LTV/CLTV for Multifamily and Single Borrower Transactions

We have carefully considered the potential credit risks and business impacts of this expansion. We arrived at this decision based on a comprehensive analysis of application data disclosed pursuant to the Consumer Financial Protection Bureau’s Home Mortgage Disclosure Act (HMDA) and various sources of loan performance data beyond our own data. These data allow us to estimate not only the impact of making these changes on potential mortgage origination volume, but also on various credit risk and financial metrics such as capital costs or delinquency rates. Certainly, mortgages on multi-unit properties do carry a higher credit risk than those on 1-unit homes, even when controlling for other risk factors. In their 2016 study, the Urban Institute found that GSE loans on 2-4-unit structures had a 30% higher risk of default compared to 1-unit properties, with owner-occupants posing less risk than investors. This risk difference is also recognized in the GSE capital requirements under the Enterprise Regulatory Capital Framework (ERCF), which impose a 40% risk premium on 2-4-unit mortgages.

The risk assessment within Desktop Underwriter also takes the number of units into account when evaluating the overall risk of the mortgage application. This means that, regardless of where the LTV ratio eligibility limits are set, a mortgage application on a multi-unit property will need stronger compensating factors than for a similar 1-unit property. Based on our assessment of both internal and external loan performance data, we find the risk assessment in DU’s evaluation of loan performance is accurate on these higher LTV ratio transactions for 2-to-4-unit properties.

The 2016 Urban Institute report recommended that the GSEs increase the eligibility limits on owner-occupied 2-4-unit loans, in the interest of expanding credit to underserved populations, and because of the benefit to affordable rental housing. The last two administrations have expressed interest in addressing affordable housing supply challenges, including re-evaluating existing regulatory barriers that reduce density. We hope that this eligibility update, along with other reforms, will support renewed construction and renovation investment for this important part of the nation’s housing supply.

Changes to Number of Borrowers

For over two decades, DU’s risk assessment has considered the Number of Borrowers as a risk factor given its historic predictiveness of mortgage default. During that time, two or more borrowers were considered less risky than one sole borrower.

However, we are removing this attribute as a risk factor in the November 18, 2023 release. This is because we have advanced our risk assessment over the years, including a broader view of an applicant’s credit profile, loan application information, and property value attributes. These enhancements decrease the relative predictiveness of the Number of Borrowers risk factor such that the impact to model performance without this attribute is minimal (less than a 2% relative decrease in our main model-performance metrics).

This change is consistent with FHFA’s update to the capital framework in late 2020, where FHFA removed Number of Borrowers as a factor that could unduly restrict access to credit for sole borrowers.

Broadly speaking, we believe this change will positively affect access to mortgage credit for single-individual households and households with children headed by a single parent or guardian. For US households with children, the proportion with two parents has been decreasing – from about 85% of households in the late 1960’s to about 70% of households in 2020. And today, women are by far the most common single head of households with children – approximately 70% of single head of households with children were maintained by a mother.

Across all US households, the proportion of households that are a single individual has increased from 13.3% in the 1960’s Census to 27.6% in the 2020 Census. Similar to the trends above in single-parent households, this trend is not even across the US. From a geographic perspective, the counties with the highest percentage of single-person households are in the Midwest and the Mississippi River Delta area and other rural areas throughout the US. The percentage of Black households with a single person living alone was 36.3% in 2022 (58% of whom were single women), for white (non-Hispanic/Latino) households this was 30% (55% of whom were single women). Asian and Hispanic/Latino households with a single person living alone were rarer at about 20% (and split more evenly by gender at about 50% being single women or single men).

Additionally, the average age of households consisting of a single member was 57.3 years, versus 55 for two members, and 44.5 for households of three or more.

By changing the risk assessment in Desktop Underwriter to no longer consider Number of Borrowers, but instead rely on other predictive factors about the potential borrower(s) creditworthiness and the financial aspects of the mortgage application, we can increase access to credit for these households, which may serve as a catalyst for building wealth or aging in place.

See the entire paper below.

Responsibly Increasing Affordable Housing Supply & Access to Credit

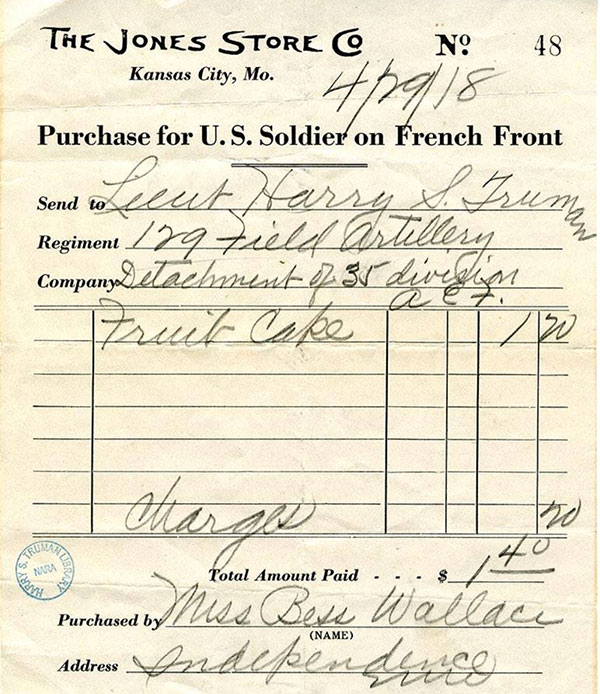

Receipt for the oldest fruitcake still in circulation. Fruitcakes were often used in place of sandbags during WWI. Courtesy of the National Archives

Tip of the Week – Holiday Gift Giving and Section 8

Yes, In Addition to Violating Standards of Decency, Gifting Fruitcake May Violate RESPA Section 8(a)

RESPA Section 8(a) and Regulation X, 12 CFR § 1024.14(b) prohibits giving or accepting a fee, kickback, or thing of value pursuant to an agreement or understanding (oral or otherwise) for referrals of business incident to or part of a settlement service involving a federally related mortgage loan.

Pursuant to an agreement or understanding, oral or otherwise.

An agreement or understanding need not be written or verbalized. It may be established by practice, pattern, or course of conduct. For example, when a thing of value is received repeatedly and connected in anyway, with the volume or value of business referred, receipt of the thing of value is evidence that it is made pursuant to an agreement or understanding. 12 CFR § 1024.14(e).

For example, at Christmas, an MLO gifted fruitcakes to persons who made at least one referral to her last year. When questioned, the MLO explained that the fruitcakes were under $25 and only sent to borrowers, not regular referral partners.

RESPA Section 8 prohibitions generally apply to any person, which RESPA defines as individuals, corporations, associations, partnerships, and trusts. 12 USC § 2602(5).

There is no exception to RESPA Section 8 solely based on the gift or promotion’s value (or lack thereof).

The MLO managed a remarkable twofer. She pulled off a gauche and despicably tasteless act in gifting fruitcakes for referrals while simultaneously violating Section 8(a). That takes some talent.

Understandably and expectedly, a thing of value for referrals includes exchanging epicurean delights such as Peruvian roast pig or New Delhi whole goat for referrals. But violate RESPA with a fruitcake? Yes, Virginia, there is a law. After a Section 8 flogging, the MLO might enjoy a Martha Stewart marathon for the new year.

By any stretch of the imagination, most people would not consider fruitcake a thing of value.

Yet, this subjective thing-of-value test gets tricky. The law allows settlement service providers to conduct normal promotions. However, normal promotions must not involve defraying expenses that otherwise would be incurred by persons in a position to refer covered business.

In the case of the gifted fruitcake, generally, you may be safe from the appearance of defraying the beneficiary’s expenses. Fruitcakes are primarily purchased for gifts. Reliable estimates suggest that almost 99% of fruitcakes are gifted, re-gifted, or used by the recipient as a doorstop or paperweight. Making fruitcake the gift that keeps on giving.

Had the hapless MLO sent fruitcakes to all her customers rather than only those who sent her a referral, she may have offended many more customers. However, she would have avoided the Section 8 inquiry. Furthermore, she would receive many more referrals by broadly giving despite the ham-handed holiday gift.

Spirit! are they yours?” Scrooge could say no more.

“They are Man’s,” said the Spirit, looking down upon them. “And they cling to me, appealing from their fathers. This boy is Ignorance. This girl is Want. Beware them both, and all of their degree, but most of all beware this boy, for on his brow I see that written which is Doom, unless the writing be erased. Deny it!” cried the Spirit, stretching out its hand towards the city.

– A Christmas Carol, Charles Dickens

Happy Holidays from the LOSJ.