Why Haven’t Loan Officers Been Told These Facts?

The Safety and Soundness Act

12 U.S.C 4501(7) The Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation have an affirmative obligation to facilitate the financing of affordable housing for low- and moderate-income families in a manner consistent with their overall public purposes, while maintaining a strong financial condition and a reasonable economic return.

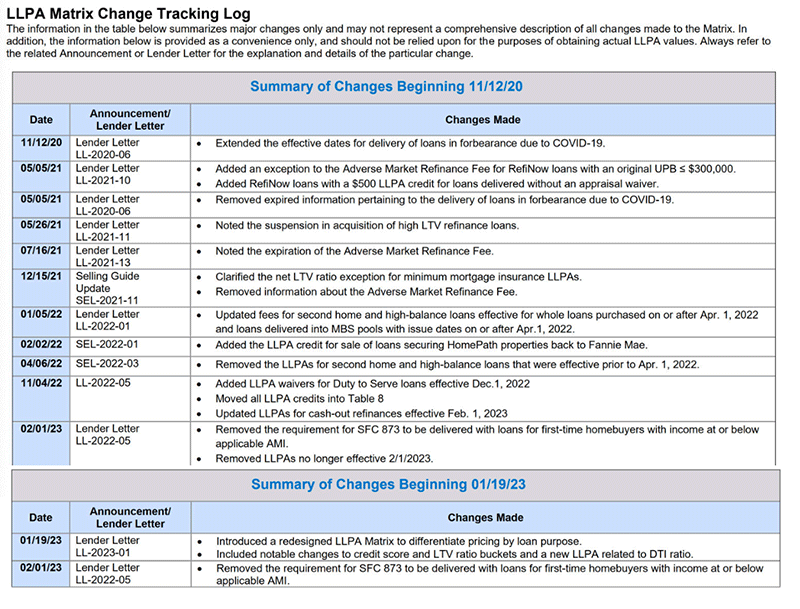

The FHFA Making More Pricing Changes for the GSEs

FNMA/FHLMC Making Significant LLPA and Credit Fee Changes

The finance elves have been busy in the Duty-To-Serve kitchen, whipping up a fresh dish of GSE compliance with federal laws about financing for the underserved. The Journal has written extensively in the past about the inadequate FHFA and GSE efforts to comply with applicable duty-to-serve federal laws (e.g., the GSEs chartering legislation, The Safety and Soundness Act, and the HERA) and reasonably meet the duty to serve LMI households and other underserved communities.

Admittedly, it is fun to bash public institutions, but it is fair to give credit when credit is due. Indeed, something has lit a candle under the FHFAs’ rear end. The FHFA is getting more feasible solutions for the affordable housing challenge.

Someone has to pay for these LMI credit enhancements. Time to soak the “haves!” The haves are those households that exceed the AMI. Recall that the GSEs announced there would be no more pricing adjustments for LMI programs commencing in December. A month later, time for the other shoe to drop. On top of the underlying rate increases, the GSEs are making financing more expensive for many households.

Expanding homeownership opportunities to the underserved has a cost. But honestly, this is a bill that must be paid. Improvements to housing affordability require substantial commitments, and significant changes are required to expand homeownership opportunities.

More entry-level buyers in the housing arena may translate to more consistent housing demands. More consistent housing demands translate to more long-sighted and practicable housing solutions. Every little bit helps. Housing affordability is a complex problem, so more complex solutions with more moving parts are what it will take to improve homeownership opportunities.

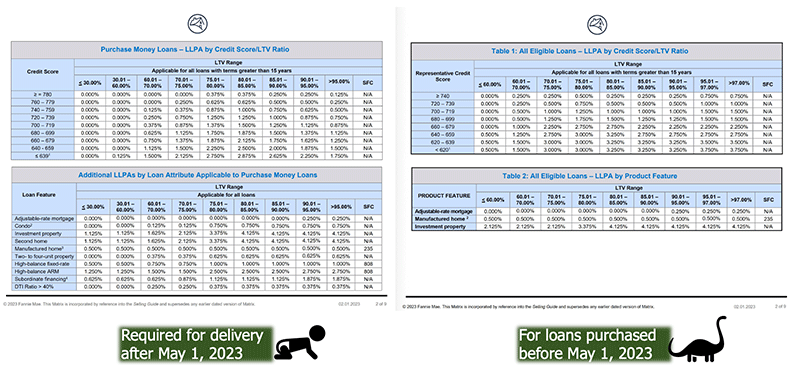

Tricky Pricing

Pay careful attention to the new and improved LLPA charts (see an example in the snippet below). It’s not merely a reorganization of the GSE’s pricing matrix. There are substantive changes to delivery loan pricing after May 1, 2023. That means applications originating in February, March, or April may be subject to the changes.

The Journal has not found an excellent executive summation of the critical pricing changes. Noteworthy is the additional price of 25 – 37.5 BPS required for DTIs over 40% on LTVs over 60% is standard across most transactions.

Various stakeholders have complained about the DTI pricing hit because MLOs and underwriters don’t know how to do the DTI calculus. For example, is the DTI based on the qualifying or actual payments (e.g., buydowns and ARMs qualifying payments)?

Another example. Suppose DU or the lender calculates the DTI north of 40%, and the MLO quoted and priced the loan with a DTI under 40%. Is that a change of circumstance? It could be a nasty change of circumstance in your relationship with the applicant.

Clearly, this is a grand opportunity for MLOs to learn how to compete on price and service.

Don’t forget most or all LLPA and Credit Fees are waived for any duty-to-serve implementation, which includes households at and under 100% of the AMI.

A few notable changes:

From FHLMC (FNMA makes the same adjustment)

- Debt-to-Income Ratio > 40%

- This Credit Fee applies to all loan purpose types

- May be subject to a Credit Fee cap when applicable

- Freddie Mac uses system-calculated total debt expense ratio percent in Loan Selling Advisor® to determine when this Credit Fee is assessed

Taken From

The Federal Register

August 4, 2009

The Enterprises are government-sponsored enterprises (GSEs) chartered by Congress for the purpose of establishing secondary market facilities for residential mortgages. See 12 U.S.C. 1451, 1716. Specifically, Congress established the Enterprises to provide stability in the secondary market for residential mortgages, respond appropriately to the private capital market, provide ongoing assistance to the secondary market for residential mortgages (including activities relating to mortgages on housing for low- and moderate-income families involving a reasonable economic return that may provide less of a return than the Enterprises’ other activities), and promote access to mortgage credit throughout the nation.

The Safety and Soundness Act provides that the Enterprises “have an affirmative obligation to facilitate the financing of affordable housing for low- and moderate-income families.” 12 U.S.C. 4501(7). Section 1129 of HERA amended section 1335 of the Safety and Soundness Act to establish a duty for the Enterprises to serve three specified underserved markets, in order to increase the liquidity of mortgage investments and improve the distribution of investment capital available for mortgage financing for certain categories of borrowers in those markets. 12 U.S.C. 4565. Specifically, the Enterprises are required to provide leadership to the market in developing loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families with respect to manufactured housing, affordable housing preservation, and rural markets.

In addition, section 1335 requires FHFA to establish, by regulation effective for 2010 and each subsequent year, a method for evaluating and rating the Enterprises’ performance of the duty to serve underserved markets sec. 4565(d). Furthermore, FHFA is required to report annually to Congress on the Enterprises’ performance of the duty to serve underserved markets.

From the FHFA Announcement

FHFA Announces Updates to the Enterprises’ Single-Family Pricing Framework

FOR IMMEDIATE RELEASE

1/19/2023

Washington, D.C. – The Federal Housing Finance Agency (FHFA) today announced further changes to Fannie Mae’s and Freddie Mac’s (the Enterprises) single-family pricing framework by introducing redesigned and recalibrated upfront fee matrices for purchase, rate-term refinance, and cash-out refinance loans.

“These changes to upfront fees will strengthen the safety and soundness of the Enterprises by enhancing their ability to improve their capital position over time,” said Director Sandra L. Thompson. “By locking in the upfront fee eliminations announced last October, FHFA is taking another step to ensure that the Enterprises advance their mission of facilitating equitable and sustainable access to homeownership.”

The priorities outlined in the 2022 and 2023 Scorecards for the Enterprises include developing a pricing framework to maintain support for single-family purchase borrowers limited by wealth or income, while also ensuring a level playing field for large and small sellers, fostering capital accumulation, and achieving commercially viable returns on capital.

Today’s pricing changes broadly impact purchase and rate-term refinance loans and build on upfront fee changes announced by FHFA in January and October 2022, which have been integrated into the new grids. The new fee matrices consist of three base grids by loan purpose for purchase, rate-term refinance, and cash-out refinance loans—recalibrated to new credit score and loan-to-value ratio categories—along with associated loan attributes for each.

The updated fees will take effect for deliveries and acquisitions beginning May 1, 2023, to minimize the potential for market or pipeline disruption.

BEHIND THE SCENES

Judge Rules Against the CFPB’s ECOA Complaint

The CFPB suffered another setback similar to the ass-whooping they received back in a 2018 federal appeals court RESPA ruling. However, this was a federal district court. It is hardly imaginable the CFPB will take the ruling sitting down. They will most likely appeal the district court ruling if they do not have a better case in the works with appropriate precedential ramifications. They and other stakeholders have a lot riding on the particular ECOA regulatory precept the district court chose to strike down.

The Honorable Federal Judge Franklin U. Valderrama for the Northern District of Illinois granted a mortgage broker’s motion to dismiss the CFPB complaint.

The case stemmed from CFPB allegations about the brokers’ alleged use of racially offensive language on its regular radio mortgage program. The CFPB complaint alleged an ECOA violation on the basis of discouragement. The CFPB argued that allegedly racially inappropriate comments would discourage African American prospects from applying to the broker for a mortgage.

12 CFR 1002.4(b) (b) Discouragement. A creditor shall not make any oral or written statement, in advertising or otherwise, to applicants or prospective applicants that would discourage on a prohibited basis a reasonable person from making or pursuing an application. The CFPB promulgates the prohibitions in its official commentary

1002.4(b)-1. Prospective applicants.

“Generally, the regulation’s protections apply only to persons who have requested or received an extension of credit. In keeping with the purpose of the Act – to promote the availability of credit on a nondiscriminatory basis – § 1002.4(b) covers acts or practices directed at prospective applicants that could discourage a reasonable person, on a prohibited basis, from applying for credit.”

Additionally, the CFPB brought a Consumer Financial Protection Act violation against the broker. “Section 1036(a)(1)(A) of the CFPA prohibits a covered person from offering or providing to a consumer any financial product or service not in conformity with “Federal consumer financial law” or otherwise committing any act or omission in violation of a “Federal consumer financial law.” 12 U.S.C. § 5536(a)(1)(A).”

However, in the blockbuster decision, Judge Valderrama disagreed with the CFPB’s regulatory interpretation of the ECOA and granted the defendant’s motion for dismissal. The court stated that “the plain text of the ECOA thus clearly and unambiguously prohibits discrimination against applicants, which the ECOA clearly and unambiguously defines as a person who applies to a creditor for credit. . . The Court therefore finds that Congress has directly and unambiguously spoken on the issue at hand and only prohibits discrimination against applicants.”

From the ECOA 15 USC §1691. Scope of prohibition

(a) Activities constituting discrimination

It shall be unlawful for any creditor to discriminate against any applicant, with respect to any aspect of a credit transaction.”

15 USC §1691(a) Definitions; rules of construction

(b) The term “applicant” means any person who applies to a creditor directly for an extension, renewal, or continuation of credit, or applies to a creditor indirectly by use of an existing credit plan for an amount exceeding a previously established credit limit.

However, the CFPB and its allies are not without resources. Stay tuned for more on this important case.

Tip of the Week

Caution With Associates – RESPA

Most MLOs and managers are familiar with RESPA/Regulation X rules about an Affiliated Business Arrangement (ABA). However, many stakeholders are unfamiliar with the ABA requirements, which apply to those making referrals to “associates” with affiliate relationships.

Suppose you have an associate relationship with someone sending you referrals, such as a real estate company or the agent of a real estate company. That real estate company is responsible for disclosing the associate or affiliate relationship before making the referral. That disclosure requires the use of a written ABA Disclosure. As the person receiving the referral, you can be a counterparty to a Section 8 violation if the real estate company fails to disclose the ABA.

As an MLO or business owner, you are a lender or an affiliate of a lender. The term “associate” requires some explanation.

So, what is an “associate?” An associate could be a family member such as a spouse or parent. Another type of associate is a person with whom the referring person has marketing agreements. Formal or informal agreements establish an associate relationship. Under Regulation X, agreements can be established by a pattern or practice.

12 C.F.R. § 1024.14(e) Agreement or understanding. An agreement or understanding for the referral of business incident to or part of a settlement service need not be written or verbalized but may be established by a practice, pattern or course of conduct. When a thing of value is received repeatedly and is connected in any way with the volume or value of the business referred, the receipt of the thing of value is evidence that it is made pursuant to an agreement or understanding for the referral of business.

For example, suppose a mortgage company arranges with a real estate company to provide complimentary refreshments at public open houses. In exchange for the open house goodies (a thing of value), the open house hosts market the mortgage company by distributing the mortgage company’s marketing materials and introducing prospective buyers to the mortgage company’s loan officers attending open houses.

Under RESPA and Regulation X, the real estate company should disclose the nature of its relationship with the mortgage company to the prospective buyer BEFORE the referral occurs. This disclosure must be in writing to satisfy Regulation X.

RESPA 12 U.S.C. 2602(7,8)) the term “affiliated business arrangement” means an arrangement in which (A) a person who is in a position to refer business incident to or a part of a real estate settlement service involving a federally related mortgage loan, or an associate of such person, has either an affiliate relationship with or a direct or beneficial ownership interest of more than 1 percent in a provider of settlement services (8) the term “associate” means one who has one or more of the following relationships with a person in a position to refer settlement business: (A) a spouse, parent, or child of such person; (B) a corporation or business entity that controls, is controlled by, or is under common control with such person; (C) an employer, officer, director, partner, franchisor, or franchisee of such person; or (D) anyone who has an agreement, arrangement, or understanding, with such person, the purpose or substantial effect of which is to enable the person in a position to refer settlement business to benefit financially from the referrals of such business.

Regulation B 12 CFR § 1024.15(b) An affiliated business arrangement is not a violation of section 8 of RESPA if the conditions set forth in this section are satisfied.

The person making each referral has provided to each person whose business is referred a written disclosure, in the format of the Affiliated Business Arrangement Disclosure Statement.