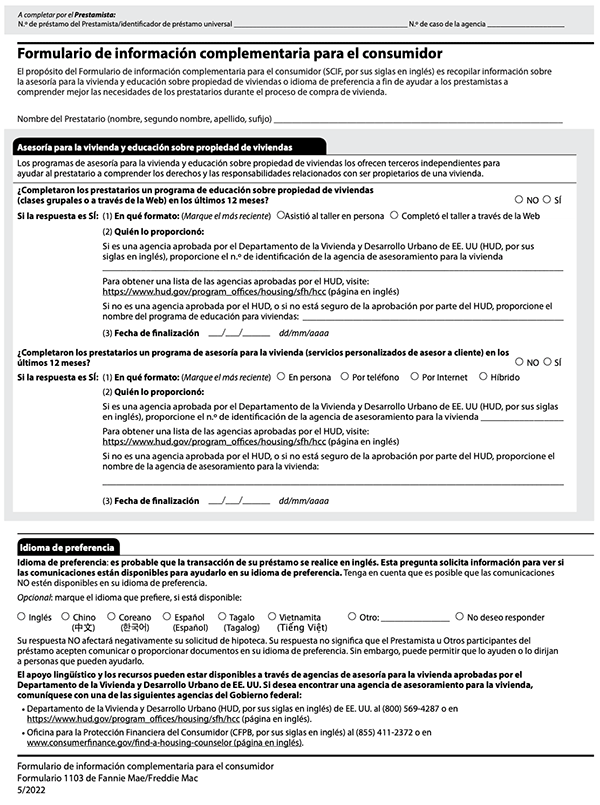

SCIF Spanish Version

Why Haven’t Loan Officers Been Told These Facts?

Don’t Forget – Mandatory Supplemental Consumer Information Form (SCIF) is required for all FHLMC/FNMA loans applications taken on or after March 1, 2023

The GSEs provide the SCIF in multiple languages to facilitate applicant comprehension. However, the executed and delivered SCIF must be in the English version of the form.

So far, no word on the government loans yet, but with the implementation of the mandatory Limited English Proficiency (LEP) SCIF form, they can’t be far behind.

Be wise, and have the applicants execute the SCIF on all loan applications starting in March. Implementing the new form across the board can’t hurt, and it may benefit both you and your customer.

From the FHFA Announcement

“Collecting language preference and housing counseling information provides mortgage applicants with an additional method to inform lenders of their needs, enabling the industry to more fully respond to the nation’s growing diversity,” said FHFA Acting Director Sandra L. Thompson. “These steps will contribute to an equitable housing finance system that welcomes all qualified borrowers.”

From the CFPB

“The CFPB welcomes the FHFA’s announcement today. As those lenders and financial companies that already collect the language preference of applicants and borrowers know, this information allows lenders to serve their customers better. The collection of applicants’ language preference does not violate the Equal Credit Opportunity Act or its implementing regulations,” said CFPB Director Rohit Chopra. “The CFPB is eager to see advances in broader language access to better serve all borrowers.”

FHFA’s Language Access Multi-Year Plan

Created by FHFA, Fannie Mae, and Freddie Mac, Mortgage Translations provides resources to assist lenders, servicers, housing counselors, and others in helping mortgage borrowers who have limited English proficiency. The site contains documents and resources available in English, Spanish, traditional Chinese, Vietnamese, Korean, and Tagalog. Mortgage Translations is part of FHFA’s Language Access Multi-Year Plan.

From the GSEs

Instructions for Completing the Supplemental Consumer Information Form

(SCIF) The SCIF captures information about the homeownership education or housing counseling program completed by the borrower along with the borrower’s language preference. A copy of this form must be maintained in the loan files for loans sold to the GSEs. The lender or borrower should complete the education and counseling sections of the SCIF if required by the loan program or product for which the borrower has applied. The Language Preference information is collected to help lenders better understand the language needs of borrowers during the mortgage lifecycle. The borrower is not required to select any of the language options.

The lender must provide an opportunity for the borrower to indicate a language preference or that they would prefer not to respond. The lender may inform the borrower that the answer will NOT negatively affect the mortgage application and explain the instructions and other information provided on the form concerning language preference to the consumer. The lender may not require a borrower to select “I do not wish to respond” if the borrower wishes to not answer the question and should accept the form from the borrower as provided.

From the FNMA URLA FAQ page

Q16.

What is required from lenders to comply with the GSE’s updated requirements for completing the SCIF?

For new conventional loans with application received dates on or after March 1, 2023 sold to the GSEs, lenders must ensure one copy of the SCIF with the borrower’s responses is in the loan file and must include the corresponding data in loan application file submissions to the GSEs’ AUSs (DU and LPA).

Q17.

What are the requirements for collecting the borrower(’s) language preference?

The lender must present the SCIF to one borrower on the loan application and ask the borrower to provide a preferred language for completing the loan transaction. The borrower is not required to select any of the language options in the “Language Preference” section, including “I do not wish to respond.” For loans with multiple borrowers, the lender may determine whether to present the SCIF to more than one borrower and include more than one SCIF in the loan file. It is up to the lender to decide when to present the SCIF.

Q18.

What are the requirements for collecting the borrower(’s) homeownership education and housing counseling information?

The GSEs have not changed any of their Guide requirements for homeownership education and housing counseling information collection. If the loan offered to the borrower(s) requires homeownership education or housing counseling information, the lender should complete the applicable SCIF section and fields. If the borrower has taken more than one homeownership education course, provide data for the most recent course within the last 12 months. The requirements are the same for more than one housing counseling session.

Q19.

What if the borrower does not wish to complete the SCIF and the loan has neither homeownership education nor housing counseling requirements?

One copy of the SCIF must always be provided in the loan file. In cases where the language preference question has not been completed by the borrower and homeownership education and housing counseling are not required by the loan program, the SCIF would include only the loan identifier and the borrower’s name.

FNMA/FHLMC Supplemental Consumer Information Form Requirement Reminder

FNMA URLA FAQ page (Updated with SCIF)

BEHIND THE SCENES

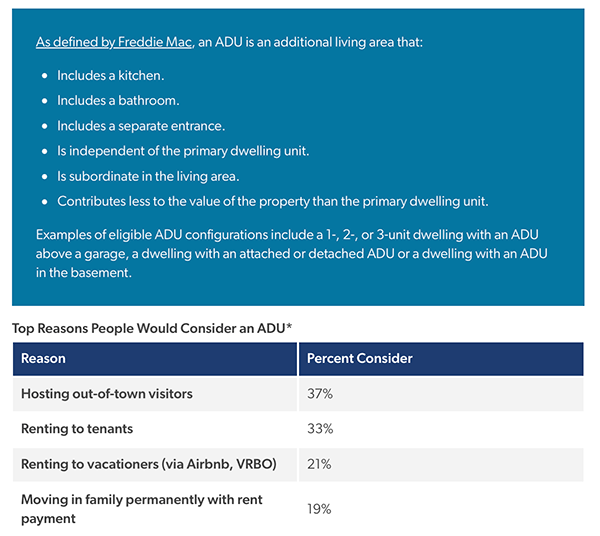

FHLMC Survey Finds Consumers Ill-Informed About Accessory Dwelling Units (ADU)

From FreddieMac

In the past few years, the housing market has seen a rise in accessory dwelling units (ADUs). A recent Freddie Mac consumer survey that gauged familiarity with and interest in ADUs has found 71% of respondents were unfamiliar with the concept.

Despite this lack of familiarity, once respondents were provided with the definition of an ADU, 32% of those who do not currently own one reported interest in having an ADU on their property in the future. Among those interested in having an ADU one day, respondents are most likely to consider using the unit to host family and guests and earn additional rental income.

Consumer concern about ADUs centers around the difficulty and cost of building and maintaining a unit. About half of surveyed homeowners without an ADU think it would be somewhat to very difficult to create or build an ADU on their current property. Among all respondents interested in having an ADU in the future, the most frequently selected ways to finance the costs of building and maintaining an ADU include leveraging personal savings and collecting rent from tenants.

Tip of the Week – ATR and Qualified Mortgage Confusion

Understanding the nexus between ATR and QM

Regulation Z, “minimum standards for transactions secured by a dwelling,” applies equally to loans meeting QM requirements and those that do not.

Regulation Z 12 C.F.R. 1026.43(c) states, “A creditor shall not make a loan that is a covered transaction unless the creditor makes a reasonable and good faith determination at or before consummation that the consumer will have a reasonable ability to repay the loan according to its terms.” The regulatory requirement stems from the ATR section of the TILA 15 U.S.C. §1639c. minimum standards for residential mortgage loans.

The TILA ATR and the implementing Regulation Z “minimum standards” apply to most consumer mortgages. There are a few exemptions.

- Home equity lines of credit

- Reverse mortgages

- Temporary or “bridge” loan with a term of 12 months or less

- HFA mortgages

- Some mortgages by tax-exempt creditors

- Most Community Housing Development Organizations mortgages

The QM distinction concerns the presumption of the lender’s compliance with the TILA ATR requirements. In exchange for making more affordable (APR threshold and fee caps) and less risky loans (limited use of prepayment penalties and balloon payments and no negative amortization or interest-only terms), Regulation Z section 1026.43(e)(1)(i) and (ii) provide a safe harbor or presumption of compliance, respectively, with the repayment ability requirements of § 1026.43(c) (the ATR requirements) for creditors and assignees of covered transactions that satisfy the requirements of a qualified mortgage.

Therefore, the ATR requirements apply equally to QM and Non-QM loans. However, the Regulation Z underwriting requirements for Non-QM loans differ from QM loans. For Non-QM loans, qualifying payment calculations get more conservative. And if you are the lender, you can say goodbye to the ATR presumption of compliance. As a Non-QM lender, you better hope that the borrower makes the payments on time, as that is largely the bar Regulation Z creates to evaluate a lender’s reasonable ATR determination.

Under Regulation Z, the primary QM/Non-QM underwriting difference is how the lender calculates the mortgage payment (principal and interest) when assessing the ratios or residual income. For example, 12 C.F.R. § 1026.43(e)(2)(iv)(A) “For a qualified mortgage, the creditor must underwrite the loan using a periodic payment of principal and interest based on the maximum interest rate that may apply during the first five years after the date on which the first regular periodic payment will be due. Creditors must use the maximum rate that could apply at any time during the first five years after the date on which the first regular periodic payment will be due, regardless of whether the maximum rate is reached at the first or a subsequent adjustment during the initial five-year period.”

This requires the underwriter to consider the worst-case P&I payment that may occur during the 60-month period commencing on the date of the first scheduled payment.

For example, the GSEs SOFR 5/6mo. ARM. The loan has a discounted interest rate of 5.25 percent that is unchanged for an initial five-year period, after which the interest rate will adjust semi-annually based on SOFR plus a margin of 3 percent, subject to a 1 percent semi-annual interest rate adjustment cap.

The index value in effect at consummation is 4.4 percent. The loan closes on March 15, 2023, and the first regular periodic payment is due May 1, 2023. Under the terms of the loan agreement, the first rate change limit is to 6.25 percent (5.25 percent plus 1 percent semi-annual interest rate adjustment cap) on April 1, 2028 (the due date of the 60th monthly payment), which occurs less than five years after the date on which the first regular periodic payment will be due (May 1, 2028). Thus, the maximum interest rate under the loan terms during the first five years after the date on which the first regular periodic payment will be due is 6.25 percent.

The GSEs 5/6mo. ARM requirements reflect the same. See FNMA Seller Guide B3-6-04, Qualifying Payment Requirements. Ask your GSE rep and fulfillment partners if the new LLPA for DTI > 40 applies to actual or qualifying payments: Ditto, any reserve requirement.

For example, to calculate the residual income or debt ratios, the underwriter may calculate the qualifying payment using 6.25% with the original loan amount or 6.25% on the future value of the loan balance after five years of scheduled amortization. Of course, it makes little difference, but it might be worthwhile knowing the calculus.

Compare QM’s substantially equal payment requirement with the rule for Non-QM P&I calculation requirements from 1026.43(c)(5). The lender must use the fully indexed rate or the introductory interest rate, whichever is greater, to calculate the P&I for the capacity test.

A fully indexed rate means the interest rate calculated using the index or formula that will apply after the rate recast, as determined at the time of consummation (closing), and the maximum margin that can apply at any time during the loan term.

Take the same 5/6mo example but with Non-QM underwriting. The underwriter must use the introductory rate or the fully indexed rate, whichever is higher. Based on the 4.4 SOFR index value at consummation and 300 BPS margin, the underwriter must calculate the qualifying P&I at 7.40% instead of the 5.25% introductory rate. Compared with the QM-required qualifying payment based on 6.25%, it is easy to see the Non-QM underwriting calls for a more conservative analysis.

HPML (Including HPML – QM)

Remember that HPML-QM loans do not provide Regulation Z safe harbor as Non-HPML QM loans do. HPML loans subject the lender to a rebuttal (legal challenge) of a lender’s reasonable ATR determination.

To rebut the presumption of compliance on an HPML-QM loan (or any HPML loan), the lender must prove it made a reasonable and good faith determination of the consumer’s repayment ability at the time of consummation.

To do this, the lender must demonstrate that the consumer’s income, debt obligations, alimony, child support, and monthly mortgage debt would leave the consumer with sufficient residual income or assets other than the value of the dwelling to meet living expenses, including any recurring and material non-debt obligations of which the creditor was aware at the time of consummation.

For Non-HPML QM loans, the Regulation Z safe harbor disallows the introduction of evidence against the lender’s reasonable good-faith ATR determination.

Underwriting Risky Features

Regulation Z gets more exacting for loans with balloon payments, interest only, or negative amortization. Where a loan with a balloon payment is an HPML, the creditor must determine the consumer’s repayment ability based on the loan’s payment schedule, including any balloon payment.

For example: Assume a higher-priced covered transaction with a fixed interest rate of 9.50 percent. The loan amount is $200,000 with a ten-year loan term, with payments based on 30 years amortization. The monthly payment for the ten years is $1,682, with a balloon payment of $180,415 at the end of the ten-year term.

The creditor must consider the consumer’s ability to repay the loan based on the payment schedule that fully repays the loan amount. That lender’s consideration must include the balloon payment of $180,415.

Regarding a balloon on an HPML mortgage, the lender’s consideration of the applicant’s ability to refinance or sell the subject does not demonstrate ATR compliance.

One of the more profound Dodd-Frank amendments to the TILA forbids the lender from considering the equity in the subject to satisfy the capacity requirement. 15 U.S.C. 1639c(3) “A determination under this subsection of a consumer’s ability to repay a residential mortgage loan shall include consideration of the consumer’s credit history, current income, expected income the consumer is reasonably assured of receiving, current obligations, debt-to-income ratio or the residual income the consumer will have after paying non-mortgage debt and mortgage-related obligations, employment status, and other financial resources other than the consumer’s equity in the dwelling or real property that secures repayment of the loan.“