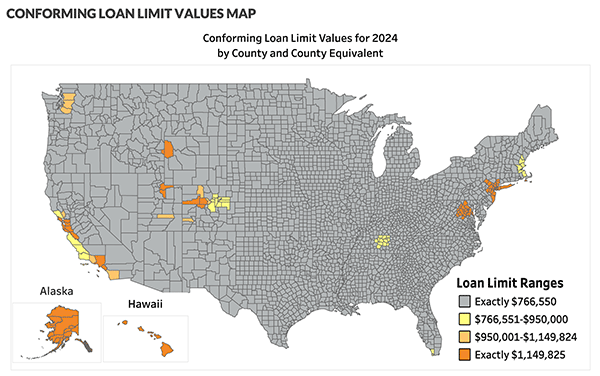

Image courtesy of the FHFA

Why Haven’t Loan Officers Been Told These Facts?

How Federal Agencies Set Maximum Loan Amounts

Year after year, federal agencies dutifully provide loan change information to the public. Yet, how are the maximum loan amounts derived? For those of you who want to get a look under the hood, follow along.

Congress establishes the mechanisms governing the loan amount changes. Section 1322 of the Federal Housing Enterprises Financial Safety and Soundness Act of 1992 (12 U.S.C. 4501 et seq.), or simply the “Safety and Soundness Act,” requires the law’s administrator to “establish and maintain a method of assessing the national average 1-family house price for use in adjusting the conforming loan limitations.”

Years later, Congress passed the Housing and Economic Recovery Act 2008, which created the FHFA and required the regulator to develop a national Housing Price Index (HPI) to adjust the conforming limits based on national average home prices.

Higher Loan Limits for Select Counties

The FHFA creates higher conforming limits for those parts of the country with demonstrably higher housing costs than the national average. The high-cost area limit value is a function of local-area median home values. The local conforming loan limit (CLL) is higher in areas where 115 percent of the local median home value exceeds the national baseline limit. The maximum high-cost loan is up to 50 percent above the national baseline value.

The FHFA calculates the national baseline using the median home values estimated by the Housing and Urban Development (HUD) for the FHA loan program. The FHFA compares county median home values within metropolitan and micropolitan statistical areas (MSAs) and then uses the highest value to determine the local area loan limit value.

HERA TITLE I—FHA MODERNIZATION ACT OF 2008

The FHA is required by the National Housing Act (NHA), as amended by the Housing and Economic Recovery Act of 2008 (HERA), to set Single Family forward mortgage loan limits at 115 percent of area median house prices for a particular jurisdiction, subject to a specified floor and a ceiling. Per the NHA, the FHA calculates forward mortgage limits by MSA and county.

FHA establishes a national county-wide floor (national low-cost area loan limit) based on 65% of the national conforming limit. FHA’s 2024 minimum national loan limit floor of $498,257 for a one-unit property is set at 65 percent of the national conforming loan limit. This floor applies to those areas where 115 percent of the median home price is less than the floor limit.

The NHA requires FHA to set its maximum loan limit ceiling for high-cost areas at $1,149,825, 150 percent of the national conforming loan limit. Forward mortgage limits for the particular exception areas of Alaska, Hawaii, Guam, and the U.S. Virgin Islands are adjusted further by FHA to account for higher construction costs.

The FHA-insured HECM maximum claim amount is 150 percent of the Freddie Mac national conforming limit of $766,550. FHA’s current HECM regulations do not allow the HECM limit to vary by MSA or county; instead, the single HECM limit applies to all HECMs regardless of where the property is located.

VA uses the local conforming loan limits to calculate partial entitlement.

2024 Agency Loan Limits

2024 FNMA/FHLMC

Washington, D.C. – The Federal Housing Finance Agency (FHFA) today announced the conforming loan limit values (CLLs) for mortgages Fannie Mae and Freddie Mac (the Enterprises) will acquire in 2024. In most of the United States, the 2024 CLL value for one-unit properties will be $766,550, an increase of $40,350 from 2023.

Fannie Mae and Freddie Mac are restricted by law to purchasing single-family mortgages with origination balances below a specific amount, known as the “conforming loan limit” (CLL) value. Loans above this amount are known as jumbo loans.

The national conforming loan limit value for mortgages that finance single-family one-unit properties increased from $33,000 in the early 1970s to $417,000 for 2006-2008, with limit values 50 percent higher for four statutorily-designated high cost areas: Alaska, Hawaii, Guam, and the U.S. Virgin Islands.

Since 2008, various legislative acts increased the conforming loan limit values in certain high-cost areas in the United States. While some of the legislative initiatives established temporary limit values for loans originated in select time periods, a permanent formula was established under the Housing and Economic Recovery Act of 2008 (HERA). The 2024 conforming loan limit values have been set under the HERA formula.

USC 12 1717(b) The HERA Adjustment Formula

Each adjustment shall be made by adding to each such amount (as it may have been previously adjusted) a percentage thereof equal to the percentage increase, during the most recent 12-month or 4-quarter period ending before the time of determining such annual adjustment, in the housing price index maintained by the Director of the Federal Housing Finance Agency (pursuant to section 1322 of the Federal Housing Enterprises Financial Safety and Soundness Act of 1992 (12 U.S.C. 4541)). If the change in such house price index during the most recent 12-month or 4-quarter period ending before the time of determining such annual adjustment is a decrease, then no adjustment shall be made for the next year, and the next adjustment shall take into account prior declines in the house price index, so that any adjustment shall reflect the net change in the house price index since the last adjustment. Declines in the house price index shall be accumulated and then reduce increases until subsequent increases exceed prior declines.’’

HUD 2024 Nationwide Forward Mortgage Loan Limits

The Federal Housing Administration (FHA) calculates forward mortgage limits based on the median house prices in accordance with the National Housing Act. FHA’s Single Family forward mortgage limits are set by Metropolitan Statistical Area (MSA) and county and are published periodically. For purposes of conforming high-cost area limits to the indexing of the base Federal Home Loan Mortgage Corporation (Freddie Mac) loan limit required in section 305(a)(2) of the Federal Home Loan Mortgage Corporation Act, HUD uses indexing of county-level prices starting in 2008, the year that current statutory authorities for FHA loan limit determination were enacted. The limits in these areas are set using the county with the highest median price within the MSA. FHA publishes updated limits effective for each calendar year.

The FHA national low-cost area mortgage limits, which are set at 65 percent of the national conforming limit of $766,550 for a one-unit Property, are, by property unit number, as follows:

- One-unit: $498,257

- Two-unit: $637,950

- Three-unit: $771,125

- Four-unit: $958,350

(C) High-Cost Area

The FHA national high-cost area mortgage limits, which are set at 150 percent of the national conforming limit of $766,550 for a one-unit Property, are, by property unit number, as follows:

- One-unit: $1,149,825

- Two-unit: $1,472,250

- Three-unit: $1,779,525

- Four-unit: $2,211,600

FHA HECM

The Federal Housing Administration’s (FHA) HECM Maximum Claim Amount (MCA) limits for Traditional HECM, HECM for Purchase, and HECM-to-HECM refinances are governed by the MCA limitation in sections 255(g) and 255(m) of the National Housing Act . . .

For the period of January 1, 2024, through December 31, 2024, the HECM MCA will be $1,149,825 (150 percent of Federal Home Loan Mortgage Corporation’s (Freddie Mac) national conforming limit of $766,550). The MCA of $1,149,825 is also applicable to the special exception areas:

Alaska, Hawaii, Guam, and the Virgin Islands.

VA

Single and Multi-Unit Properties:

Lenders should note that while a Veteran may use a VA-guaranteed loan to purchase a multi-unit property, the entitlement statute requires the use of the conforming loan limit (CLL) applicable to a single-family residence (i.e., single-unit property).

Interest Rate Reduction Refinancing Loans (IRRRLs):

The Freddie Mac CLL does NOT apply to IRRRLs. For IRRRLs greater than $144,000, VA will guarantee 25 percent of the loan amount, regardless of the Veteran’s entitlement.

VA Effective Date:

The CLL increases are effective for loans closed on or after January 1, 2024.

Helpful Links

Conforming Limits by County

FHA Forward Loan Limits

FHA HECM

FHA Loan Limits Search Engine

VA 26-23-26

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

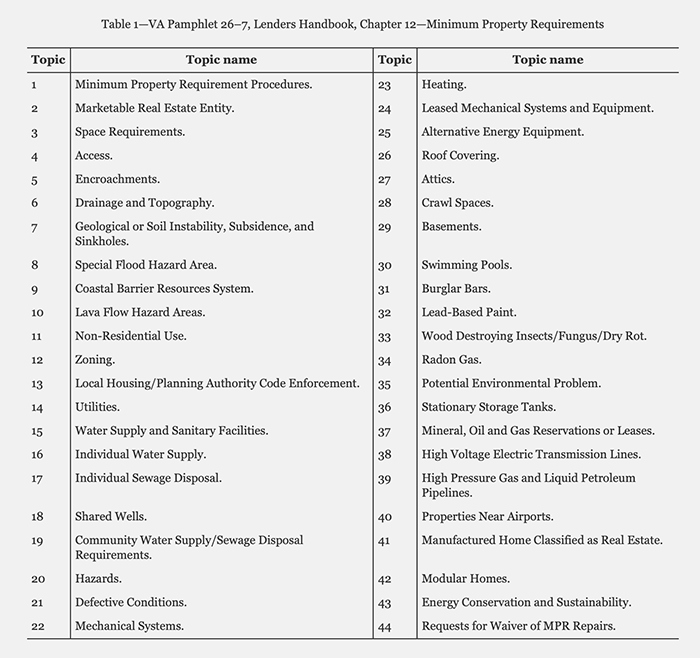

VA MPR Table, Courtesy of the VA

BEHIND THE SCENES – VA Proposes Rules to amend Minimum Property Requirements (MPRs) to align with FNMA/FHLMC

The President signed the Improving Access to the VA Home Loan Benefit Act of 2022 into law in December 2022. The Act requires the VA to consider changing appraisal requirements. The VA proposes adopting an approach that aligns with other industry-wide property standards already in existence. As required by federal rule-making law, the VA is soliciting stakeholders’ comments on the proposed rule changes.

Public Law 117-308 Requires the VA to Act

SEC. 3. UPDATE OF APPRAISAL REQUIREMENTS FOR CERTAIN LOANS GUARANTEED BY THE DEPARTMENT OF VETERANS AFFAIRS.

(b) Waiver of Requirement for Certain Properties.–In prescribing updated regulations or program requirements under subsection (a), the Secretary shall consider making changes applicable to–

(1) certification requirements for appraisers;

(2) minimum property requirements;

(3) the process for selecting and reviewing comparable

sales;

(4) quality control processes;

(5) the Assisted Appraisal Processing Program; and

(6) the use of waivers or other alternatives to existing appraisal processes.

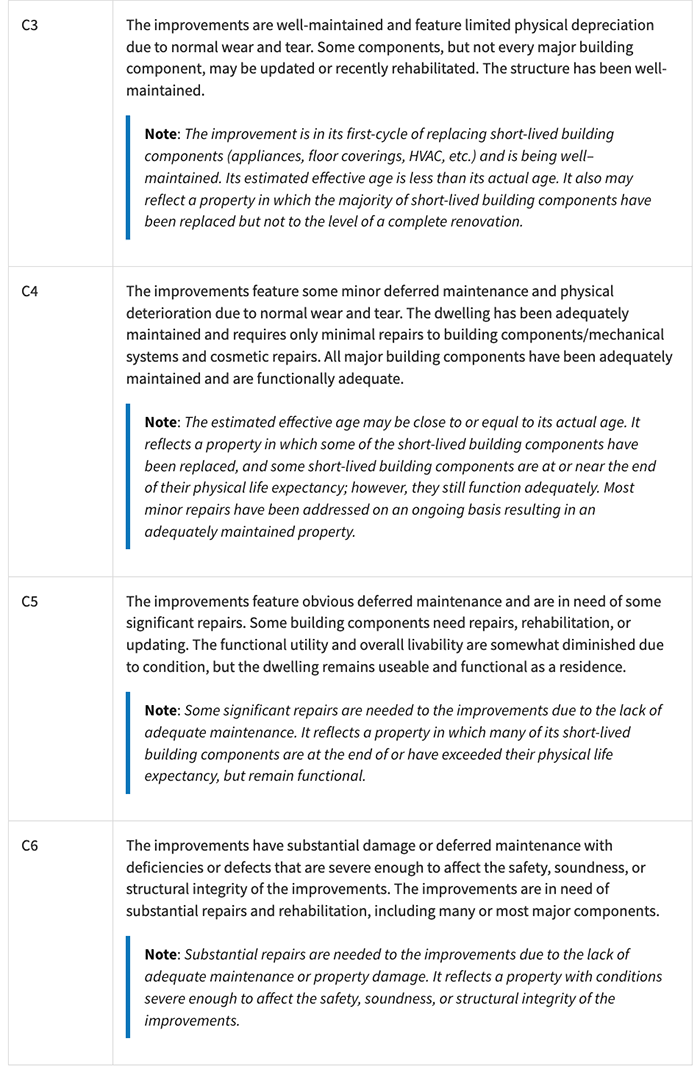

From the VA

By way of background, the Uniform Appraisal Dataset (UAD) defines all fields required for an appraisal submission for specific appraisal forms ( e.g.,Fannie Mae Form 1004) and standardizes definitions and responses for a key subset of fields. When completing an appraisal that conforms to the UAD, the appraiser assigns one of the standardized condition ratings pursuant to the definitions in the Fannie Mae Selling Guide or Freddie Mac Seller/Servicer Guide and presented in [Code screenshot of] Table 2 below. These ratings identify the condition of the improvements for the subject property and comparable sales. VA appraisers utilize industry-standard forms to complete appraisals for VA-guaranteed loans. As such, VA already collects information regarding the UAD property condition rating as part of a VA appraisal. As VA considers how to streamline the appraisal process, one option could be to utilize this existing appraisal information to determine whether a property is suitable for dwelling purposes rather than provide appraisers with a lengthy list of specific MPRs to evaluate. In reviewing the UAD property condition ratings, VA believes that properties rated C1 through C4 would best align with VA’s statutory requirement and existing MPRs, but is open to public feedback on this issue.

From The Congressional Research Service

The Improving Access to the VA Home Loan Benefit Act of 2022 requires the Department of Veterans Affairs (VA) to update regulations, requirements, and guidance related to appraisals for housing loans guaranteed by the VA.

Specifically, such regulations or requirements must specify when an appraisal is required, how an appraisal is to be conducted, and who is eligible to conduct an appraisal for such loans. The bill also requires the VA to submit to Congress recommendations for improving the delivery times for appraisals for VA loans and to take such recommendations into consideration in prescribing its updated regulations or requirements.

The VA must also provide additional guidance for desktop appraisals, which are performed remotely using information gathered by third parties with whom a VA-approved appraiser has entered into an agreement for such appraisal. In updating such guidance, the VA must specifically take into account situations where (1) desktop appraisals provide cost savings for borrowers, and (2) a traditional appraisal requirement could cause time delays and jeopardize the completion of a transaction.

From the VA

Matters Under Consideration

(1)

(a) What are the advantages and/or disadvantages of VA MPRs noted in the above table as compared with similar requirements found in other Federal housing programs and conventional sources of financing ( e.g., property condition requirements)?

(b) What policies or processes specific to VA MPRs could be streamlined, modified, or eliminated to enhance your experience with the VA home loan program?

(c) Please also provide any general suggestions for improvement or comments on the current VA MPRs.

(2)

(a) Should VA replace the above noted VA MPRs with the property condition ratings outlined in Fannie Mae’s Selling Guide or Freddie Mac’s Single-Family Seller/Servicer Guide, and included in the Uniform Appraisal Dataset (UAD)

(b) If VA were to guarantee or make loans only on properties with a condition rating of C1, C2, C3, or C4, either based on the initial appraisal or following repairs, what would be the advantages and/or disadvantages for a borrower? For VA and taxpayers? For lenders and servicers?

(c) Could the below noted property condition ratings be used by VA in another way to determine MPRs?

Partial Condition Ratings List Image Courtesy of FNMA

Tip of the Week – Focus on Jelling, Not Selling

Does a prospect buy their way through the loan manufacture, or is the prospect driven by selling acts that bring about the closing? The question may appear semantical, but is it? Buying originates with the consumer. Selling begins with the provider.

The beliefs surrounding the role and responsibilities in selling or facilitating the buying process significantly affect interactions with the prospect and customer. Selling requires telling. Buying requires jelling. Jelling is a word that describes something taking a good and necessary shape. To become cohesive. When applied to relationships, the term describes behavioral or pattern interactions leading to trust and rapport.

Closing requires many buying decisions. Each buying decision necessitates a provider to supply something to buy to move on to the next buying decision. Skipping the opportunity to satisfy a buying decision diminishes consumer buy-in and rapport. Premature closing happens when the provider misses one or more critical buying steps. Either the provider is ignorant of the need or disvalues it’s import. Premature closing differs from appropriate trial closes. Premature closing may appear incompetent, pushy, and indifferent to the consumer.

Instead of telling the buyer what you think is important, ask them what they need to advance.

Example A-1:

Prospect: My name is Jo Smith. Sammy at XYZ Realty said you can help me with the FHA loan information.

MLO: Hello Jo! I’d be delighted to help. Sammy mentioned you were interested in making an offer to purchase in the coming weeks. How can I help you today?

Prospect: What is your 30-year fixed rate? (Translation – I want a reasonable price; I want to conduct my due diligence but am unsure what I am doing or what to say).

MLO: Jo, shopping for a home and mortgage loan at the same time can be stressful. How are you doing so far?

Prospect: It is between going to the dentist and doing my tax returns! Thanks for asking.

MLO: I get it. Can I provide you with a few different rate options?

Prospect: I do not understand. Don’t you have just a 30-year fixed rate?

MLO: Of course, we offer a 30-year fixed loan. However, comparing single-rate solutions often promotes misconceptions about finding the best loan. Could I give you examples of different fixed-rate terms with the corresponding estimates for the cash to close? The reason for providing more than a single rate is that there is a relationship between the cash to close and the interest rate that becomes clear in comparison.

Prospect: I heard about that. I was surprised to learn about that connection. I am tight on cash to close; anything that helps reduce my cash to close would help. If you can give me an example of the rates with closing cash, that would be great.

MLO: You bet; I’ll prepare two examples of differing fixed rates with the corresponding closing cash. May I also share with you a straightforward means to compare different credit offers?

Prospect: Hell, yeah. Instead of helping, the last lender I talked to appeared more interested in interrogating me or telling me how great they were.

MLO: That must feel like a waste of time. Do you think written estimates providing a comprehensive estimate of all the costs and total loan payment might make your comparisons easier to understand?

Prospect: It would. That is exactly what I need. Sammy also said I needed a preapproval letter.

MLO: Absolutely, we will take care of preapproval for you as well. If it works for you, how about we identify the optimal loan solution first and then attend to the preapproval? Please, may I have your email address and phone number so that I can get those written estimates to you? I’ll call you as soon as I’ve sent it over; please allow about 30 minutes. Will that work for you, Jo?

Powerful Effects

The prospect wants to compare offers competently but may be unaware of the available comparison process. You have fulfilled an essential buying decision by providing the means and substance to do so. Additionally, the prospect has deferred to your leadership and is now ready to make more buying decisions as you present them.

Prospects have little to no interest in loan shopping. They shop because they perceive that lenders and MLOs cannot be trusted to meet their needs. They fear overpaying, making a foolish error, or being taken advantage of. Once the prospect perceives that you meet their needs and can be trusted, they have less or no need to shop with other lenders or MLOs.

What are the essential needs that you must meet?

First, try to reorient the interaction from a focus on your needs to a laser-like focus on the other person’s needs. Humanize the interaction. This is a person with needs, not a loan prospect. They need professional help. Act to conspicuously meet their needs.

The foremost need is trust. Trust is established and maintained with a few essential elements, CDCR.

Competence – Professionalism and know-how.

Dependability – Integrity: you say what you mean and mean what you say.

Care – Empathize with them. Show them that you understand how they feel.

Respect – Listen to them. Use active listening techniques. Appropriately respond to their concerns and questions.

Interweave CDCR within your interactions. In the example labeled A-1, see if you can identify the elements of CDCR at work. Did the MLO miss any CDCR opportunities?

String together a few buying decisions, and even better than having an application underway, your relationship with the buyer is jelling.

Jelling is an art. There is no perfection to attain, only continuous improvements. Be deliberate, be tenacious – infuse CDCR into every exchange.