Why Haven’t Loan Officers Been Told These Facts?

“Another 3-day Waiting Period!”

Yes, Virginia, There will be another 3-day waiting period before closing even though there were no changes to the loan terms or APR. The lender’s CD failed to describe the loan product accurately according to Regulation Z, and we can’t have any material changes sprung on the vulnerable consumer at closing, even if the change is in a word alone. Sorry for any inconvenience.

Have you been surprised by this misunderstood requirement?

Three instances of a corrected CD require another 3-day waiting period before consummation.

12 CFR § 1026.19(f)(2)(ii) Changes before consummation requiring a new waiting period.

If the CD becomes inaccurate in the following manner before consummation, the creditor shall ensure that the consumer receives corrected disclosures containing all changed terms no later than three business days before consummation.

(1) The annual percentage rate becomes inaccurate (CD pg 5, Loan Calculations) as defined in § 1026.22.

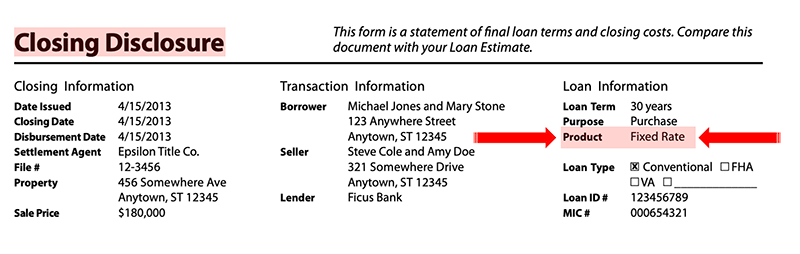

(2) The loan product is changed, causing the information disclosed under § 1026.38(a)(5)(iii) (CD pg 1, Loan Information) to become inaccurate.

(3) A prepayment penalty is added, making the (CD pg 1, Loan Terms) statement of whether the transaction includes a prepayment penalty, labeled “Prepayment Penalty,” inaccurate.

1) What is an Inaccurate APR? Who knows?

Ҥ 1026.22(a)(2) Generally, the annual percentage rate shall be considered accurate if it is not more than 1/8 of 1 percentage point above or below the APR last disclosed.

In an irregular transaction, the annual percentage rate shall be considered accurate if it is not more than 1/4 of 1 percentage point above or below the annual percentage rate determined in accordance with paragraph (a)(1) of this section. For purposes of this paragraph (a)(3), an irregular transaction is one that includes one or more of the following features: multiple advances, irregular payment periods, or irregular payment amounts (other than an irregular first period or an irregular first or final payment).”

Because it is difficult to interpret what constitutes an irregular transaction, most lenders stick to the safe bet and impose another waiting period for APR changes greater than 1/8th. Irregular transactions are not necessarily what comes to mind. Irregular transactions may include fixed-rate and discounted adjustable-rate loans. Some compliance experts believe loans with cancellable MI/PMI could also be irregular.

2) Product

Notice that a change to the product description, not necessarily a change to the product, renders the CD inaccurate. That should be straightforward enough. If the loan terms change, the product description must reflect the change, right? For example, the product changes from a fixed rate to an adjustable rate, which is a change in the product type, and the product description must reflect the change.

However, the product description could change without a corresponding change to the loan terms. How might this occur? Easily. In preparing the initial CD, should the lender fail to describe the product accurately and subsequently corrects the product description, the lender must do so no less than three days before consummation.

Reg Z has very exact product description requirements

Regulation Z product description requirements enumerate three loan “types.” Loan product descriptions may also include applicable loan features. The product description is fairly idiot-proof for a fixed-rate loan without features. Features are not a loan type but a term that alters the monthly payments, such as step-payment, or subprime features, such as interest-only or balloon payment.

Product description errors are not difficult to make and could include mistakenly describing the introductory or first adjustment period. Heck, the lender could screw up the abbreviation for months (the correct abbreviation is “mo“). The product description is either correct or it is not. In a prefunding audit, the accuracy of the product description is one of the things the auditor must evaluate.

Ensure you know how the product should be described, especially if the transaction has a step-payment feature or is an adjustable-rate product. Extra vigilance is appropriate if you are doing a subprime product. Review the pre-publication CD for product description errors.

Regulation Z CD product description requirements are the same as those for the Loan Estimate preparation.

Reg Z product description requirements sample:

12 CFR § 1026.37(a)(10)(i) The description of the loan product shall include one of the following terms:

(I) Adjustable rate. If the interest rate may increase after consummation, but the rates that will apply or the periods for which they will apply are not known at consummation, the creditor shall disclose the loan product as an “Adjustable Rate.”

Comment 37(a)(10)-3. Periods not in whole years.

i. Terms of 24 months or more. For product types and features that have introductory periods or adjustment periods that do not equate to a number of whole years, if the period is a number of months that is 24 or greater and does not equate to a whole number of years, § 1026.37(a)(10) requires disclosure of the whole number of years followed by a decimal point with the remaining months rounded to two places. For example, if the loan product is an adjustable rate with an introductory period of 30 months that adjusts every year thereafter, the creditor would be required to disclose “2.5/1 Adjustable Rate.” If the introductory period were 31 months, the required disclosure would be 2.58/1 Adjustable Rate.”

ii. Terms of less than 24 months. For product types and features that have introductory periods or adjustment periods that do not equate to a number of whole years, if the period is less than 24 months, § 1026.37(a)(10) requires disclosure of the number of months, followed by the designation “mo.” For example, if the product type is an adjustable rate with an 18-month introductory period that adjusts every 18 months starting in the 19th month, the required disclosure would be “18 mo./18mo. Adjustable Rate.”

(II) Step rate. If the interest rate will change after consummation, and the rates that will apply and the periods for which they will apply are known at consummation, the creditor shall disclose the loan product as a “Step Rate.” [This includes Lender or borrower-funded subsidies for temporary buydowns]

(III) Fixed rate. If the loan product is not an Adjustable Rate or a Step Rate, as described in paragraphs (a)(10)(i)(A) and (B) of this section, respectively, the creditor shall disclose the loan product as a “Fixed Rate.”

If Applicable, Loan Features

(ii) The description of the loan product shall include the features that may change the periodic payment using the following terms, subject to paragraph (a)(10)(iii) of this section, as applicable:

(A) Negative amortization. If the principal balance may increase due to the addition of accrued interest to the principal balance, the creditor shall disclose that the loan product has a “Negative Amortization” feature.

(B) Interest only. If one or more regular periodic payments may be applied only to interest accrued and not to the loan principal, the creditor shall disclose that the loan product has an “Interest Only” feature.

(C) Step payment. If scheduled variations in regular periodic payment amounts occur that are not caused by changes to the interest rate during the loan term, the creditor shall disclose that the loan product has a “Step Payment” feature.

(D) Balloon payment. If the terms of the legal obligation include a “balloon payment,” as that term is defined in paragraph (b)(5) of this section, the creditor shall disclose that the loan has a “Balloon Payment” feature.

3) Prepayment Penalty

Adding a prepayment penalty makes the Loan Terms section inaccurate. Since prepayment penalties are potentially significant costs, another waiting period is required to give Virginia time to consider the change and make an informed decision.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

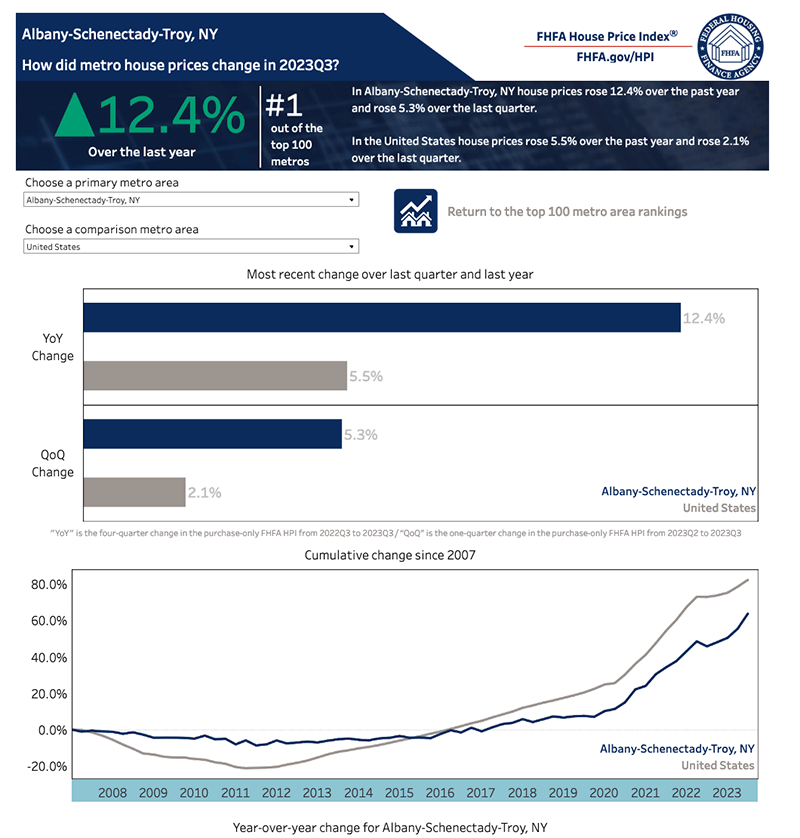

BEHIND THE SCENES – The Nation’s Hottest Housing Market, Schenectady, NY???

What does Schenectady have in common with Akron, OH, Camden, NJ, and Elgin, IL? According to the latest data from the FHFA, all three were among the nation’s top ten hottest housing markets.

As housing prices continue to squeeze the middle class, affordability’s last bastions are becoming less affordable. In the third quarter of 2023, Schenectady leads the nation’s hottest markets.

Check the FHFA webpage for insights into the ever-changing housing market.

FHFA HPI® Top 100 Metro Area Rankings

Tip of the Week – Create a Post Closing Checklist

Most originators have some form of loan manufacturing checklists—those lovely catalogs of all the mistakes, things to avoid, and what to do to ensure we close on time. But how many originators put equal effort into a great post-closing customer experience?

There is a place for non-mortgage-related things of interest. But when the customer thinks about you, do you want to be considered an expert on moister turkeys and safely carving a pumpkin or mortgage lending? Your professional relevance is on display.

Does your value proposition expire at the closing table? As a marketing objective, you must remain top-of-mind as often and as long as possible. Your customer may still be thinking about mortgages weeks or months after the closing, which is one of the best times to maximize referrals.

But how do you connect or stay connected with your customers over the long run? Recipes for moist Turkeys and all that are good, but you want them to recognize your mortgage relevance. You’ve got to add post-closing and loan servicing value propositions.

Start with five values you can bring your post-closing customers

For example:

1) Post-closing checkup within one week of closing.

Remind the customer that they may get mortgage artifacts they don’t understand in the mail, and even a new Closing Disclosure is not that unusual. Ensure they contact you should they receive any correspondence from the servicer.

2) Post-closing checkup within two weeks of closing.

Reinforce the proposition from last week and add something new, such as a gift or something meaningful for the new home. Along with the gift, ask the customers if they have an attorney, financial planner, or accountant they can refer you to, as you provide specialized loan services for professionals.

3) Post-closing checkup within four weeks of closing.

Provide them with a “How to keep your homeowner’s insurance premium manageable” handout. In some parts of the country, homeowners insurance is a significant expense. Along with the handout, ask the customer if they know any first responders or educators, as you offer special financing for community servants.

4) Post-closing checkup within eight weeks of closing.

Provide them with the Borrower’s Bill of Rights. Get or create a digest of the federal loss mitigation programs, including error resolution steps, FHA partial claims, forbearance, etc. Borrowers should always know they can contact you about anything. Call you if they disagree with the Servicer on matters pertaining to payments, fees, escrows, or anything else. Along with the handout, ask if the customer knows anyone who doesn’t own a home, and if so, please have them call you. Give them a $500 coupon they can pass on to a first-time buyer.

5) Post-closing checkup within sixteen weeks of closing.

Provide the customer with the “Everything You Need to Know About Credit Scores” handout. Ask the customer if they know anyone serving or who has served in the military, as you have specialized financing for those who serve the nation.

Be creative, have fun, and, above all else, be professionally relevant.