Image courtesy of Southeast Texas Housing Finance Corporation (SETH)

Why Haven’t Loan Officers Been Told These Facts? The FHLMC “DPA One®.”

Bridging The DPA Divide.

If you are new to Low-Moderate-Income lending (LMI), DPA stands for “down payment assistance.” Alternatively, you can also find the acronym DAP in use, which stands for, you guessed it, “down payment assistance program.” These programs are administered primarily by state housing agencies, but hundreds of local and national nonprofits also offer DPA.

Why Down Payment Assistance?

One of the more persistent impediments to entry-level homeownership is the challenge of saving for the down payment. In many markets, rents consume an inordinate percentage of the consumer’s net income, leaving prospective home buyers short of the means to meet traditional down payment requirements.

There are variants of DPA solutions, but the fundamental construct is similar: simultaneously closing a first and second mortgage. The primary financing, or first mortgage, is often an FHA first. A second lien secures the DPA money. Generally, these programs provide for the borrower’s required cash contribution and an amount that covers closing costs. Allowable CLTV/TLTV typically exceeds 100%. The GSEs allow for DPA from nonprofits and employers with no pricing adjustments.

In some cases, the DPA lien is forgivable. You might ask why more home buyers fail to leverage DPA. In a word, complexity. Like anything you do for the first time, with no experience to guide you, it is uncomfortable not knowing what you do not know. In a seller’s market, stakeholders will eschew “unnecessary complexity.”

DPA credit administration has restrictions, requirements, and exceptions like any other loan program. However, the scope of the requirements can substantially differ from agency products. As a result, MLOs or lenders who need to become more familiar with the program requirements and limitations encounter complexity. In most cases, to qualify, the applicant’s household income must meet the program’s definition of low or moderate income, similar to the USDA guaranteed loan program income tests. Additionally, there may also be first-time buyer requirements.

As any MLO can tell you, one of the more costly and cumbersome aspects of arranging a third-party origination is the lenders’ failure to articulate their requirements clearly and at the right time. If the MLO isn’t careful, discovering how the program works in underwriting is a real possibility.

Therefore, MLOs new to DPA must exercise appropriate diligence in uncovering lender requirements for unfamiliar financing solutions. Alternatively, partnering with the right lending team works too. Regrettably, too many MLOs are not that sort of MLO, either needing more support or know-how or both. That can make for a painful learning curve. Consequently, stakeholders sometimes unfairly view these programs as problematic and unreliable.

The FHLMC hopes to address these issues with timely data. FHLMC is providing a new DPA database promising current and relevant data for loan officers seeking to identify DPA solutions for their customers. As of this writing, the LOSJ’s editor could not register for a peek. I’m probably on a list of banned persons, but try it out for yourself at the link below.

From FHLMC

“You would think in this age of information, it would be easy to get your message out there, but it’s not,” says Rhonda Mitchell. “There’s still so much noise.” Rhonda is Homeownership Director at Southeast Texas Housing Finance Corporation, or SETH, a housing finance agency (HFA) based in Houston. SETH promotes affordable housing in the Southeast Texas community.

HFAs across the country are all different. As part of their purpose, they provide down payment assistance (DPA) programs at the state, local and municipal level. Each DPA program has its own distinct requirements to qualify a borrower for a home loan, such as income, debt-to-income, credit, property location and other factors.

Disparate guidelines and requirements can be hard to navigate for loan officers, housing counselors, realtors and other housing professionals. Sometimes information is outdated, so they may be unintentionally working with – and sharing – misinformation. That’s the noise Rhonda notes.

HFAs like SETH are always looking for ways to help borrowers qualify for down payment assistance. While there are hundreds of DPA programs in the market, there hasn’t been a consistent way to match the right DPA program and resources to the needs of a particular borrower.

“It’s been an incredible challenge to provide lender partners access to real-time information,” says Rhonda, “not just for us, but for DPA programs across the U.S.”

That’s why she and her colleagues at SETH jumped at the chance to engage with Freddie Mac during the development of DPA One®, a searchable database of DPA programs that helps housing professionals quickly find, understand and match eligible DPA programs to their low- to moderate-income borrowers in search of financial assistance.

“Last year was a challenging one, with interest rates up and more barriers to affordability. I didn’t expect to see an overall loan registration volume increase of 34% over 2022. DPA One helps our lenders to be more confident connecting DPA programs that help their borrower get into a home.”

Through DPA One, program providers like SETH can manage, edit and publish their program information through a standardized data entry format and process – at any time and at no cost. There are over 500 DPA programs in DPA One today.

“There are a lot of different requirements that an HFA has to manage,” Rhonda says, “and as DPA One was in development, we shared with Freddie Mac what our programs look and feel like to help identify the uniqueness and quirks of different DPA programs. Those differences can work to the homebuyer’s advantage, so we wanted to show them off.”

HFAs frequently make changes to their programs. A loan officer may contact an HFA and note conflicting information – the lender’s internal guidelines say one thing, while the HFA’s guidelines say another. If a loan officer is unaware that the information they’re referring to is out of date, a borrower could get into a mortgage offering unsuited to their situation or could miss out on a homeownership opportunity entirely.

DPA One helps lenders keep up with program changes so they can select the best fit for the homebuyer. “I know that when I go into DPA One and change my information, the system will reflect accurate data,” says Rhonda.

SETH looks to DPA One as the trusted source for their housing professionals to better understand down payment assistance offerings and more confidently support their borrowers. “When our lender partners use DPA One, they’re less likely to get that noise and misinformation,” says Rhonda.

For example, HFAs like SETH still get the myth that a homebuyer needs to put 20% down. But with some mortgage offerings, a borrower can put down much less. “When a lender finds a DPA match, it can make all the difference in getting their borrower into a home,” adds Rhonda. “DPA One makes the search much easier.”

Rhonda believes that educated lenders are stronger lenders. “Some say that it doesn’t matter what lender you work with because you literally have the exact same rate on the exact same day,” she adds. “But it does matter that the lender you work with is experienced and knowledgeable.”

By using DPA One, Rhonda feels more confident when talking to lenders. And by having access to up-to-date DPA information, lenders can deliver a better experience to their homebuyers. “I’m excited that there’s one place my lenders are going to find the most current information,” she says. “It’s critical that they have a resource they can trust.”

“The value of DPA One is that it contributes to partnership,” Rhonda adds. “That’s why we threw our support behind DPA One. I see it working.”

Are you a DPA program provider who would like to include your programs on DPA One at no cost to you?

Our platform partners with HFA programs as well as local and municipal providers. By providing a standardized, central location, your programs will be seen by housing professionals, such as loan officers, housing counselors and other affordable housing advocates.

To date, over 3,200 loan officers have accessed the platform to match DPA programs to borrowers and expand their book of business. DPA One is currently optimized for lenders, loan officers, housing counselors, real estate professionals and DPA providers. We welcome other housing professionals from across the ecosystem to explore the programs and consider joining.

Visit the DPA One website to learn more.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

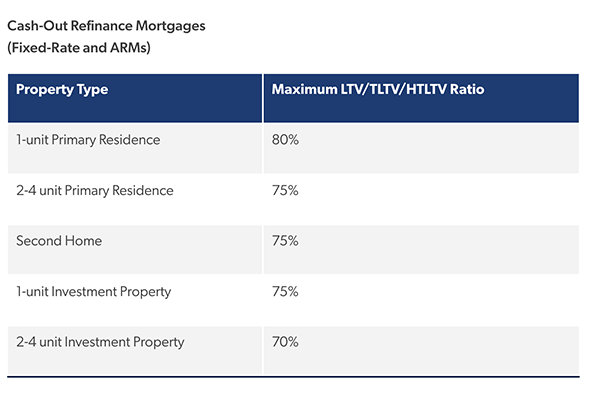

Cash-Out Graphic Courtesy of the FHLMC

BEHIND THE SCENES – FHFA Frankenstein Monster

FHFA To Destroy Cash-Out Refi Market

Well, puppeteer-in-chief FHFA Director Thompson is back at it again. In the category of “what are they thinking,” the FHFA has signaled its intent to greenlight a short-sighted and possibly destructive proposal (if FNMA joins the party) reminiscent of the FHFA DTI price adjustment fiasco. The FHFA thinks it a good idea for the FHLMC to begin purchasing closed-end second mortgages.

You may recall last year, Director Thompson instituted an unpopular pricing adjustment for DTIs exceeding 40%. After several broadsides from concerned stakeholders, Director Thompson relented and rescinded the pricing hit. In her May My Bad statement, she stated, “I appreciate the “feedback” FHFA has received from the mortgage industry and other market participants about the challenges of implementing the DTI ratio-based fee,” said Director Sandra L. Thompson. “To continue this “valuable dialogue,” FHFA will provide additional transparency on the process for setting the Enterprises’ single-family guarantee fees and will request public input on this issue.”

Well, this is not exactly a pricing issue. It is far more significant.

The Birth of Baby Frankenstein

It’s alive! High fives all around. The government had freed the taxpayer from the dependent housing beast, FNMA. It was all good until someone left the basement door unlocked, freeing the beast and its sibling to run amok over the American taxpayer. The beast was born in 1968. After 40 years, the middle-aged derelict ran off with a sleaze, leaving the nation on the verge of disaster.

What a mess. The FHFA agency could do with a walk down memory lane. The federal interventions that launched these FHLMC-type agencies aimed to facilitate affordable and sustainable homes for Americans. The over-arching driver behind these agencies is not improved liquidity and risk management, which is required to keep the beast running. But as Peter Drucker famously stated about leadership, “Management is doing things right; leadership is doing the right things.”

These federal housing interventions came at a time of extraordinary national need. What business does the federal government have in encouraging and facilitating middle-class spending like drunken sailors? No offense to drunken sailors. Is America running low on unsecured credit? Like Uncle Sam’s, middle-class borrowing and spending are out of control.

Observe what the Fed has done to housing and consequently to the hopes of affordable homeownership for an entire generation. Not for younger people anymore. Bankrupt dreams and busted opportunities. Now, another unwise notion from another bureaucratic federal monster-maker. The move to tap home equity will exacerbate the lock-in effect and, at the same time, further enslave middle-class borrowers to debt. It’s like the homeownership dream is getting tag-teamed by professional wrestlers.

Eventually, where this move may lead, everyone, including lenders and third-party originators, will suffer, but in different ways. One would think the banks should lead the charge against this proposal, making strange bedfellows indeed with third-party originators. HELOCs are almost as good as credit cards for these 21st-century Mr. Potter’s. However, don’t expect anyone to sympathize with the struggling mortgage industry. Remember, just like the banks took advantage of 2008 to diminish competition, expanding closed-end equity borrowing will eventually help them move ahead. Thanks to the Fed, third-party originators are on their heels, and the banks may have another opportunity to get in a solid right hook with the FHFA equity lending push.

Competition from third-party originators is the only thing keeping mortgage lending safe from banking dominance. The demise of competition is plain to see in other industries, such as with the rise of Walmart, Amazon, and Microsoft. Consumers suffer when competition is diminished, and ultimately, an unhealthy mortgage industry will hurt the nation as a whole. As has been said before, if a nuclear war breaks out, only two will be left standing: Banks and cockroaches.

The FHFA’s novel foray into secondary lending products does not reverse the lock-in effect or promote responsible borrowing but instead encourages nouveau-riche homeowners to borrow foolishly. When is enough enough? Haven’t we been down this path of government-sponsored foolishness already?

You might say, “Is this not a wee overreaction, a single mortgage product offered by the B team?” Granted, if this is where it ends, no big deal. However, progressive legislation or, worse, progressive regulation is how interested parties transform innocuous and incremental changes into the Frankenstein monster. Many small steps add up to substantive changes. Keep the beast in the basement or unplug it.

There is no silver bullet to fix the lock-in effect. A return to extremely low rates might improve the inventory but might also flood the market with overzealous buyers. The net result won’t improve affordability. Reducing the lock-in effect requires a return to more normative and balanced market forces. For starters, fewer options to borrow against the home equity. House poor with no means to access the equity is an incentive to sell. Ditto for investors using single-family equity as a cash cow to fund further competition with middle-class home buyers.

In the past, a homeowner took out a second mortgage because of financial hardship or personal mismanagement. The terms for seconds were hard. Today, no stigma is attached to draining the equity out of your home. Seductively low initial mortgage payments will sucker many homeowners into treating their home equity as a grab bag. Consumers are increasingly becoming slaves to debt, just like the federal government or rather, the nation. It’s time to slow the debt accumulation down.

A few Details About the New Product Offering

The filing indicates that Freddie Mac “would only purchase a closed-end second mortgage if it has purchased the first mortgage” (Page 11). It is curious why FHLMC is promoting this new product but not FNMA. Of course, limiting the purchases to FHLMC firsts will diminish the number of potential homeowners that could reap this “benefit.” Maybe that is the plan. To test the waters.

A few details about the product:

- Initially, the Seller would manually underwrite the mortgage.

- The proposed maximum TLTV <= 80%.

- Manufactured Home <= 65%.

- Not to exceed the current policy of maximum LTV/TLTV for cash-out refinance mortgage.

The FHFA has opened the floor for public comments because the federal law (The Safety and Soundness Act) requires it to do so.

The FHFA will accept written comments on the proposed new product up to 30 days after the notice is published in the Federal Register. That could mean that by May, FHLMC will be open for seconds.

From The FHFA

“Freddie Mac proposes to purchase certain closed-end second mortgage loans from primary market lenders who are approved to sell mortgage loans to Freddie Mac (Sellers). In a closed-end second mortgage loan, the borrower’s funds are fully disbursed when the loan closes, the borrower repays over a set time schedule, and the mortgage is recorded in a junior lien position in the land records. Freddie Mac has indicated that the primary goal of this proposed new product is to provide borrowers a lower cost alternative to a cash-out refinance in higher interest rate environments. Purchase parameters would seek to minimize credit risk to Freddie Mac while balancing with potential cost saving to existing homeowners.”

“In recognition of the significant impact that the activities of the Enterprises have on the U.S. housing finance system, market participants, and the broader economy, section 1321 of the Safety and Soundness Act requires the FHFA Director to review new Enterprise activities and to approve new Enterprise products before these activities and products are offered to the market.4 Under the Safety and Soundness Act, for any new activity, an Enterprise must seek a determination from the Director as to whether the new activity is a new product that is subject to FHFA prior approval. Before taking a decision on a new product proposal, the Safety and Soundness Act requires the Director to provide the public with notice and an opportunity to comment on the proposal and prescribes a 30-day public notice period. The Safety and Soundness Act also specifies the standards that must be considered by the Director in acting on a new product proposal. Those standards specifically require the Director to make a determination that the proposed new product is in the public interest. FHFA implements these statutory requirements through its regulation on Prior Approval for Enterprise Products.”

See the Notice Here: FHFA Publishes New Product Notice for Freddie Mac Second Mortgage Proposal

Tip of the Week – Managing Stakeholder Expectations

Disappointments, specifically unmet expectations, lead to stakeholder dissatisfaction, which is antithetical to your business growth. You must know these stakeholder expectations, or they become mines, floating just under the water’s surface—undetected, unseen, and out-of-mind until they aren’t, and then the boom that sinks your ship.

The best thing that can happen when you inadvertently slam into one of these mines is that the stakeholder lets you know how they feel. At that point, there is hope for a relational recovery. But the other 90% of the time, the stakeholder says nothing because folks prefer to avoid open conflict. Or folks say nothing because they relish having their pound of flesh. They will badmouth you or seek payback in some other way. In any event, your attempts at a relationship with a dissatisfied stakeholder likely goes nowhere. Forget referrals from these parties.

How do you uncover these mines? With a minesweeper, of course. Questions are your minesweeper. One of the more critical questions you must ask an applicant or prospective applicant is their past homebuying experience and, even more importantly, their mortgage shopping and loan manufacturing experiences.

The mind often seeks to comprehend things by identifying patterns representing threats. The prospect’s comparisons, judgments, and conclusions can occur in a nanosecond without deeper cognitive processing. In many cases, there is little or no critical assessment. They just like you, or they don’t. When you hit the mine, the stakeholder’s mindless, knee-jerk reaction may occur. From that moment forward, everything you do and say passes through this distorted filter.

I Hate Wheatgrass Juice

I was on a health kick some years back. I thought wheatgrass juice was the elixir to a better life. It’s a long story. I invested in an indoor greenhouse, humidifier, and irrigation. The perfect fertilizer, top-notch juicer, the works. I scoured the internet looking for the best organic heirloom wheatgrass seed strain. Patiently, I cultivated my precious crop until it was ready for juicing perfection.

Since childhood, I have loved the smell of fresh-cut grass in the summertime. However, after two weeks of force-feeding myself wheatgrass juice three times a day, I could not stomach another drop. To this day, 20 years later, I still feel nauseous when I smell fresh-cut grass.

I don’t like wheatgrass juice. But to illustrate the point about the undetected mine, my feelings about the smell of grass are so strong that not only does the thought of wheatgrass juice and fresh-cut lawns turn my stomach, but I don’t like anything I might associate lawn cutting or wheatgrass. To this day, I have an aversion to hippies, lawns, landscapers, Home Depot, and lawn tractors. Go figure!

Communication, The Magic Sauce

Most people require an artful elicitation to uncover the mines. Folks will speak in vague or general terms. You validate what they want through careful listening and leveraging active listening techniques.

Translating vague requirements into well-understood and agreed-upon stakeholder deliverables requires appropriate specificity. For example, “If I can limit the cash to close to less than $16,500, is that what you mean by you want a low down payment?” “Mrs. Applicant, if I return your phone call the same day before 6:00 PM, would that be what you mean by responsive communication?” Mr. Applicant, if the actual PITIA payment is lower than what I’ve calculated on this LE, is that what you mean by no surprises at closing, or do you mean something else?” “Mr. Real Estate Broker, if I co-sponsor and conduct your first-time buyer class once a month at your 4th Street location, is that what you mean by more support from lenders?”

Your ability to establish rapport and credibility with the prospect is critical to the sales effort and loan presentation. The prospect’s experiences deeply color the lens through which they see and interact with you. Carefully listening to the stakeholder’s answers lets them know you care about them. Most folks will also interpret your sincere care for them with respect for them, too. Everyone needs respect.

Consider the range of relational experiences people have over a lifetime. Imagine the effect of getting burned or experiencing disappointment or anger due to a past mortgage dustup. What if something you say or do is like wheatgrass juice to a prospect or applicant? Do what you can to locate, identify and defuse the mines in your path.