Why Haven’t Loan Officers Been Told These Facts?

Looming Condo Concerns

Survey Identifies Condo Concerns, What the Data Indicates

Condominium properties and other forms of attached housing differ significantly from detached housing as collateral for mortgage lending. Several factors impact the suitability of condominiums as collateral. The discrete concerns are manifold, although the primary concern is the same: attached housing values can degrade more rapidly and excessively than properties with lesser common interests. As such, these loans present a distinct threat risk to stakeholder interests.

Stakeholders must diligently exercise extra caution regarding market and property downside risk exposure. Overexposure to condo mortgages can exacerbate these risks. Given recent property price gains, some credit tightening, including more significant risk premiums for condo financing, can be anticipated.

The Problem

Too many HOAs get by with minimal reserves and shoddy maintenance, eventually leading to sometimes significant revenue shortfalls and special assessments. If the need for capital improvements arises during a market downturn, that project may become less attractive to potential buyers and their lenders. That can be a problem for condo sellers and other stakeholders. As inventory improves, the competition for home buyers increases. However, unlike detached improvements, condominium projects can lose buyer appeal even in a seller’s market, such as the one at hand, especially if the project units become more challenging to finance.

When coupled with flattening or decreasing values, the reserve/maintenance variable, a crucial factor in condo risk analysis, significantly amplifies condo risks. It is almost unimaginable that there could be a general market downturn soon. More likely, real estate downturns will be more localized. But then, as the poet William Blake said, “What is now proved was once, only imagin’d.” The more experts promise the impossibility of a near downturn, the higher the probability of getting blindsided.

Consider The Emperor’s New Clothes. Experts always want to look like experts. If an expert guesses wrong, but all the other experts get it wrong, too, then the expert who guesses wrong is still an expert.

Is Today’s Real Estate Market A Fairytale?

So off went the Emperor in procession under his splendid canopy. Everyone in the streets and the windows said, “Oh, how fine are the Emperor’s new clothes! Don’t they fit him to perfection? And see his long train!” Nobody would confess that he couldn’t see anything. Such blindness would prove that those who can’t see the Emperor’s new clothes are unfit for his position or a fool. No costume the Emperor had worn before was ever such a complete success.

“But he hasn’t got anything on,” a little child said.

“Did you ever hear such innocent prattle?” said its father. One person whispered to another what the child had said: “He hasn’t anything on. A child says he hasn’t anything on.”

“But he hasn’t got anything on!” the whole town finally cried out.

The Emperor shivered, for he suspected they were right. But he thought, “This procession has got to go on.” So he walked more proudly than ever as his noblemen held high the train that wasn’t there at all.

– Adapted from Hans Christian Andersen’s The Emperor’s New Clothes.

Late last year, FNMA surveyed senior mortgage executives regarding condominium lending concerns. Here are a few excerpts from the collected feedback.

From FNMA’s Mortgage Executive Survey

With the U.S. housing market continuing to confront the significant supply shortage of homes for sale, condos may play an important role in narrowing the supply gap of affordable housing options. While condos represent nearly 10 percent of the mortgage market, they often play a larger role in many metropolitan areas. Condos also present unique risks, as condo owners share financial responsibility for the operation and maintenance of the common areas and shared amenities. The complexities of underwriting condo project eligibility may also increase the costs and timelines for some lenders to approve and close these mortgages.

Condo Risks

On the top risk areas to the condo mortgage market, lenders ranked HOA financial instability (60%) and deferred maintenance (47%) as posing the greatest risk. In particular, lenders’ concern for deferred maintenance grew significantly from 2020 (31%) to 2023 (47%).

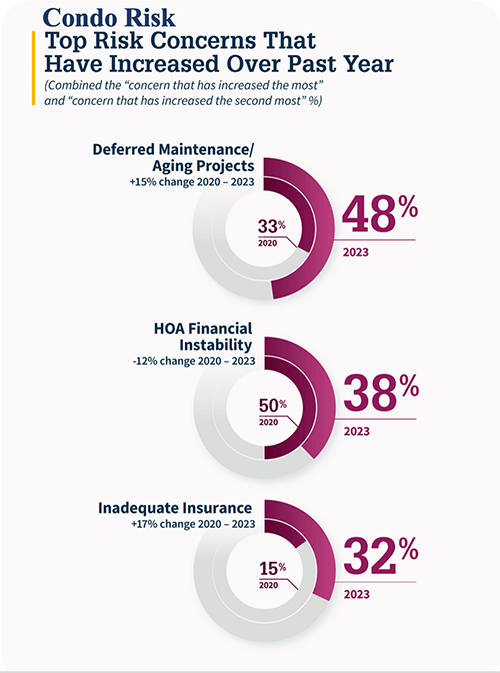

We also asked lenders to identify the risk areas for which their concern levels have increased the most over the past year: The three most commonly cited were:

- Deferred maintenance (48%)

- HOA financial instability (38%)

- Inadequate insurance (32%)

Lenders’ concerns with deferred maintenance and inadequate insurance grew the most from 2020 to 2023.

See the blog in its entirety here: FNMA Blog

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – FHA Removes Branch Registration Requirement

Mortgagee Letter 2024-04, Effective Immediately

Mortgagee Letter (ML) 2024-04 implements the provisions of Final Rule, Changes in Branch Office Registration Requirements, which removed the requirement for Mortgagees to register with HUD all branch offices where FHA business is conducted.

Handbook 4000.1 requires that a Mortgagee register all branch offices where it conducts FHA business, including originating, underwriting, and/or servicing FHA-insured Mortgages. The changes immediately eliminate this requirement and change the applicable fees for branch offices.

All branch offices where a Mortgagee conducts FHA business must continue to meet HUD’s requirements for Office Facilities (I.A.3.c.iii), all applicable licensing requirements (I.A.3.c.vi), Operating Requirements and Restrictions (I.A.6.a), and Staffing (I.A.6.i) addressed in Handbook 4000.1.

Mortgagee Letter 2024-04

Tip of the Week – Post-Closing Consumer Contact

Loss Mitigation, Help Your Customers Know Their Rights

Let Your Customers Know That You Know Servicing

Error Resolution – Qualified Written Request

When borrowers believe a servicing error has occurred with their loan, most reach for the telephone and proceed to call what may be the most unqualified, ignorant, and careless person in power they have ever had the misfortune of meeting. Welcome to the loan servicing call center. The borrowers could be facing a crisis, stressed and out of their minds with worry, and they end up with careless Carina, who, three weeks before her loan servicing onboarding and training, was delivering pizzas. That characterization of the call center is harsh and even unfair to servicers; there are many excellent call center professionals, and if the borrower ends up with one of those folks, it is lovely for them.

However, there is a probability that this unfortunate and untimely meeting with careless Carina may have devastating consequences for an imperiled borrower.

In addition to calling the Servicer, which most borrowers do when a problem arises, Regulation X provides specific protections to the borrower if they make a qualified written request for error resolution and send it to the address identified by the Servicer for such instances.

When the borrower makes a qualified written request for error resolution, the Servicer instantly has an escalated compliance threat. Now, the borrower gets the attention of next-level hotshots. The notice may be mailed or delivered by courier, but certified mail is wise.

Regulation X 12 CFR 1024.35 Error Resolution

Regulation X error resolution procedures describe the responsibilities of Servicers when a borrower thinks the Servicer has made a mistake in servicing the mortgage. 1024.35(b) enumerates specific Servicer errors, but that hardly limits the scope of the consumer’s rights, as Regulation X provides a catch-all, “§ 1024.35(b)(11) Any other error relating to the servicing of a borrower’s mortgage loan.” See the list of Regulation X servicing errors below.

Covered Errors Under Regulation X 12 CFR 1024.35(b)

1) Failure to accept a payment that conforms to any written requirements that the borrower must follow in making payments.

2) Failure to apply an accepted payment to principal, interest, escrow, or other charges under the terms of the mortgage loan and applicable law.

3) Failure to credit a payment to a borrower’s mortgage loan account as of the date of receipt, in violation of the prompt crediting provisions.

4) Failure to pay taxes, insurance premiums, or other charges, including charges that the borrower has voluntarily agreed that you should collect and pay, in a timely manner as required by the escrow provisions.

5) Imposition of a fee or charge that you lack a reasonable basis to impose upon the borrower, which includes, for example, a late fee for a payment that was not late, a charge you imposed for a service that was not provided, a default property-management fee for borrowers who are not in a delinquency status that would justify the charge, or a charge for force-placed insurance in a circumstance not permitted by the force-placed insurance provisions.

6) Failure to provide an accurate payoff balance amount upon a borrower’s request within 7 days in violation of § 1026.36(c)(3).

7) Failure to provide accurate information to a borrower regarding loss mitigation options and foreclosure, as required by the early intervention provisions of this rule.

8) Failure to transfer accurate and timely information relating to the servicing of a borrower’s mortgage loan account to a transferee servicer.

9) Making the first notice or filing required by applicable law for any judicial or non-judicial foreclosure process in violation of the loss mitigation procedures of this rule.

10) Moving for foreclosure judgment or order of sale, or conducting a foreclosure sale in violation of the loss mitigation procedures of this rule.

11) Any other error relating to the servicing of a borrower’s mortgage loan.

RESPA 12 USC 2605(e)(1)(B) Qualified Written Request

The RESPA states that a qualified written request shall be a written correspondence, other than notice on a payment coupon or other payment medium supplied by the Servicer, that includes or otherwise enables the Servicer to identify the borrower’s name and account.

The written request for error resolution shall include a statement of the reasons for the borrower’s belief, to the extent applicable, that the account is in error or provide sufficient detail to the Servicer regarding other information sought by the borrower.

The Servicer must promptly respond to a qualified written request.

Regulation X § 1024.35(e)(1)(i) States that a servicer must respond to a notice of error by either:

Correcting the error or errors identified by the borrower and providing the borrower with a written notification of the correction, the effective date of the correction, and contact information, including a telephone number, for further assistance.

OR

The Servicer must Conduct a reasonable investigation and provide the borrower with a written notification that includes a statement that the Servicer has determined that no error occurred, a statement of the reason or reasons for this determination, a statement of the borrower’s right to request documents relied upon by the Servicer in reaching its determination, information regarding how the borrower can request such documents, and contact information, including a telephone number, for further assistance.

No Hogwash Provision § 1024.35(g)(1)(ii)

The Servicer is not obliged to respond to an “Overbroad notice of error.” A notice of error is overbroad if the Servicer cannot reasonably determine from the notice of error the specific error that the borrower asserts has occurred on the borrower’s account.

Add to Your Value Proposition

Let your customers know you are there to help them. Chances are, 95% of these folks will never experience a significant servicing issue. But knowing that they have you in their corner is a win 100% of the time.