Why Haven’t Loan Officers Been Told These Facts?

FHA – How to Underwrite A Temporary Reduction In Employment Income

A temporary reduction in employment income due to family leave, temporary disability, or even a government shutdown can leave loan officers and underwriters unsure how to calculate stable monthly income. Getting this calculation wrong can result in serious indemnity issues or even a TILA, ECOA, Fair Housing Act, or UDAAP complaint. An unreasonable credit decision may result if the lender fails to include or exclude certain income under specific circumstances. Should the lender fail to properly consider certain types of income or income under atypical circumstances, that may be unlawful discrimination and, as such, violate fair lending laws. For lenders, failing to correctly consider stable income results in financial loss, lost business, reputational damages, and consumer harm.

Remember that the HUD regulations applicable to the QM ATR compliance safe harbor only apply if the lender complies with the HUD underwriting requirements. Consequently, when the lender originates the loan outside the FHA requirements, you have FHA noncompliance liabilities and a possible loss of the QM-ATR safe harbor.

A Brief on the QM Safe Harbor

As is widely understood, the CFPB-administered TILA prescribes the QM rules under 12 CFR § 1026.43(e)(1)(i), § 1026.43(e)(2), Regulation Z, including the general definition of QM. What also needs to be understood is that the Dodd-Frank Act charges HUD and other government guarantors with prescribing regulations defining the types of loans under their administration that are qualified mortgages with the safe harbor presumption of ATR compliance.

The HUD QM Regulations are similar to Regulation Z but differ in a few key areas. For example, in most cases, the HUD’s 24 CFR § 203.19 QM APR threshold is higher than the CFPB’s 12 CFR 1026.43 QM APR threshold. Regulation Z has higher APR thresholds (up to 650 BPS over APOR for low balance, subordinate financing, and manufactured housing) for certain transactions.

Regulation Z provides the ATR safe harbor for non-HPML QM loans (HPML conforming loan amount limit is 150 BPS over APOR, 250 BPS for Jumbo, 350 BPS for subordinate financing). While the general presumption of compliance afforded QM loans permits APRs up to 2.25 over APOR, for all intents and purposes, due to the intersection with HPML rules, the safe harbor ends at 150 BP over APOR for non-government conforming loan amounts. HUD is far more generous with the QM safe harbor. The HUD QM safe harbor formula is 1.15 + (UMIP 1.75), currently 2.90 over APOR. Almost double the APR safe harbor threshold of Regulation Z for conforming loan amounts. Not all HUD programs fall under the QM rubric; manufactured housing and HECMs are exempt.

HUD will insure loans over the APR threshold. However, while these loans still have a presumption of ATR compliance, under HUD regulations, over the APR threshold means a loss of the safe harbor. FHA loans that are over the APR threshold or noncompliant are subject to an ATR challenge.

According to Black’s law dictionary, a safe harbor is “The provision in a law or agreement [that] will protect from any liability or penalty as long as set conditions have been met.”

HUD specifies that the QM safe harbor provision may be lost when the lender fails to conform to the underwriting requirements. The lender’s advantage in making a HUD-compliant QM loan is a nonrebuttable presumption of compliance with the TILA ATR requirements, which makes HUD happy, too.

24 CFR § 203.19(b)(4) Effect of indemnification on qualified mortgage status.

Good Bye Safe Harbor, Hello Suffering

“§ 203.19(b)(4) An indemnification demand or resolution of a demand that relates to whether the loan satisfied relevant eligibility and underwriting requirements at the time of consummation may result from facts that could allow a change to qualified mortgage status, but the existence of an indemnification does not per se remove qualified mortgage status.”

Brokers might think they have no exposure in this area. This is false. Read your loan agreements and fulfillment requirements. If a broker originates a non-compliant loan, the lender has recourse, including indemnities or other relief through litigation.

Apart from External Audits, How Do Issues With ATR Arise?

Any attorney worth their salt would discover the existence of an indemnity or other technical exception effectively nullifying the QM safe harbor. From there, the lender’s reasonable determination of the borrower’s repayment capacity at consummation is fair game. It won’t take long for that borrower’s lawyer to make the errant lender look like a bloodsucking hellish goon, the embodiment of reckless or careless predatory lending. A contested foreclosure proceeding or regulatory complaint uncovering material noncompliance could become a very costly mistake.

To rebut or challenge means that the lender is subject to legal proceedings, whereby it must justify its reasonable determination of the applicant’s ATR with evidence. The other side can introduce evidence and testimony that the lender was nuts in making the loan. If the lender cannot justify its credit decision regarding the applicant’s repayment capacity at the time of consummation, the effective ATR rebuttal not only may cost the lender the foreclosure action but exposes the lender to adjudication as a TILA, UDAAP, and even fair lending violator.

“Nonrebuttable” means that the lender is not subject to any evidentiary proceedings, whereby it must defend that it made a reasonable credit decision. No evidence of an unreasonable decision, no argument from the plaintiff.

If you overstate the income, you clearly have potential problems. On the other hand, suppose the lender goes the other direction, like in the case study below, and fails to account for certain income types correctly or otherwise mishandles, misinforms, or misleads the applicant. That lender can find itself looking at a HUD Fair Housing Act or CFPB ECOA complaint. By the way, unlawful discrimination is also “unfair” and violates the UDAAP provisions of Title X, The Consumer Financial Protection Act.

FHA Familial Status (Children Under the Age of 18, Including Those In Utero – (Pregnant))

Familial Status and Sex Discrimination Is Bad Lender Juju

(The Fair Housing Act Regulation) 24 CFR § 100.120 Discrimination in the making of loans and in the provision of other financial assistance.

Providing, failing to provide, or discouraging the receipt of loans or other financial assistance in a manner that discriminates in their denial rate or otherwise discriminates in their availability because of race, color, religion, sex, handicap, familial status, or national origin.

(The Fair Housing Act Regulation) 24 CFR § 100.130 Discrimination in the terms and conditions for making available loans or other financial assistance.

It shall be unlawful for any person or entity engaged in the making of loans or in the provision of other financial assistance relating to the purchase, construction, improvement, repair or maintenance of dwellings or which are secured by residential real estate to impose different terms or conditions for the availability of such loans or other financial assistance because of race, color, religion, sex, handicap, familial status, or national origin.

Living Dangerously, A Case Study

The loan officer informed Ann, “That after you have your baby and return to work (from an email),” she would qualify for up to a $575,000 loan. But (from the same email) “You can’t qualify for that amount [575K] while on maternity leave.” The loan officer clumsily added, “You said you would work up to the week you delivered the baby. I told you you had to be working when we closed.”

That did not sound right to Ann. Just recently, the loan officer had preapproved them for $575,000. She had no recollection of the bizarre caveat that she had to be “at work” as of the day of closing. Ann had clearly explained her intent to take several months maternity leave to which the MLO replied, “No problem.”

Now, they were under contract for a $515,000 home. Ann had mentioned to the MLO that she intended to work right up to the delivery, but she developed pregnancy complications and was required to take leave under her physician’s advice.

She had worked with this employer for over five years, and the employer had a well-defined family and medical leave policy, including a liberal maternity leave policy and strict adherence to the Family and Medical Leave Act. Ann explained to the MLO that she intended to return to work and that her employer guaranteed her return to the job. She even had a letter from HR confirming the terms. Her employer benefits package provided 90% base pay for 12 weeks and 50% base pay for up to six months of additional paid leave. Ann planned on returning to work full-time within three months of giving birth. The purchase was scheduled to close in three weeks, about a month before her due date.

It is excellent for Ann and the lender that she called her big brother, who happened to be a person in the know and a practicing litigator. Ann’s brother called his expert loan officer associate, who provided the low-down on FHA temporary leave. The HUD policies were nothing like Ann’s loan officer described.

Ann’s brother’s call to the lender’s local branch manager was all it took to get the immediate attention of the Regional Manager, who smartly passed the application on to a senior underwriter. The underwriter approved the credit package within the day, subject to the HR letter confirming that Ann has the right to return to work and confirming her leave income.

The underwriter determined that, based on 50% of Ann’s pre-leave income (worst-case income) and the applicant’s cash reserves, sufficient income and liquid assets were available to cover the reduced income for the planned leave period per the 4000.1.

Throwing MLOs Under the Bus

By failing to adequately support MLOs, lenders set themselves up to fail the LOs and tee themselves up for serious enforcement action. This lender lacked appropriate MLO training and support but had an excellent escalation policy and quickly resolved the matter to Ann’s satisfaction.

It Is Written – Where Are These Policies Articulated?

Through the 24 Code of Federal Regulations (CFR), HUD complies with the National Housing Act statutory directive for the single-family residential loans that HUD insures, guarantees, or administers. HUD then provides the Handbooks, such as the 4000.1, to implement the regulation by providing a more user-friendly artifact.

FHA Temporary Reduction In Income, About A 50-Minute Training

FHA 4000.1

II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT

A. Title II Insured Housing Programs Forward Mortgages

4. Underwriting the Borrower Using the TOTAL Mortgage Scorecard (TOTAL)

II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT

A. Title II Insured Housing Programs Forward Mortgages

5. Manual Underwriting of the Borrower

The same provisions apply to manual and TOTAL underwriting.

(C) Addressing Temporary Reduction in Income

For Borrowers with a temporary reduction of income due to a short-term disability or similar temporary leave, the Mortgagee may consider the Borrower’s current income as Effective Income, if it can verify and document that:

- The Borrower intends to return to work

- The Borrower has the right to return to work

- The Borrower qualifies for the Mortgage taking into account any reduction of income due to the circumstance.

For federal, state, tribal, or local government employees temporarily out of work due to a government shutdown or other similar, temporary events (where lost income is anticipated to be recovered), income preceding the shutdown can be considered as Effective Income.

For Borrowers returning to work before or at the time of the first Mortgage Payment due date, the Mortgagee may use the Borrower’s pre-leave income as Effective Income.

For Borrowers returning to work after the first Mortgage Payment due date, the Mortgagee may use the Borrower’s current income plus available surplus liquid asset Reserves, above and beyond any required Reserves, as an income supplement up to the amount of the Borrower’s pre-leave income as Effective Income.

The amount of the monthly income supplement is the total amount of surplus Reserves divided by the number of months between the first payment due date and the Borrower’s intended date of return to work.

Required Documentation

- The Mortgagee must provide the following documentation for Borrowers on temporary leave:

- A written statement from the Borrower confirming the Borrower’s intent to return to work, and the intended date of return

- Documentation generated by current employer confirming the Borrower’s eligibility to return to current employer after temporary leave

- Documentation of sufficient liquid assets, in accordance with “Sources of Funds,” used to supplement the Borrower’s income through intended date of return to work with current employer.

Next week, the Journal reviews the FNMA and FHLMC Employee Temporary Leave Income policy.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

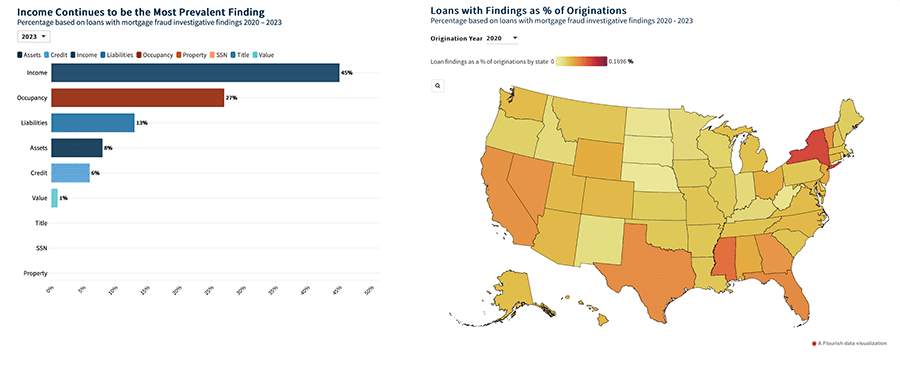

Mortgage Fraud Graphics Courtesy of FNMA

BEHIND THE SCENES

FNMA Fraud Reports, Income and Occupancy Still Tops

A Cautionary Tale from FHLMC

An Inside Peek at A GSE Fraud Investigation

From FHLMC

Liars will go to great lengths to deny wrongdoing. So what do you do when someone claims innocence, yet your suspicions remain?

That’s what one of our Single-Family Fraud Risk (SFFR) investigators experienced in a case in which the denials were so convincing, the perpetrator got away with the crime. But not for long.

Discovered

We discussed the origins of this case in a previous True Lies article. At that time, we knew that it involved the fabrication of CPA letters intended to establish credible borrower income and assets.

One of our Seller/Servicers had observed suspicious behavior coming from a mortgage brokerage. They followed Freddie Mac’s requirements for suspected fraud and reported their concerns to our Single-Family Fraud Risk (SFFR) team.

Our initial investigation confirmed that many of those letters contained forged signatures and unsubstantiated information; but who was responsible for these misrepresentations aimed at qualifying borrowers for loans owned by Freddie Mac?

The investigator turned to the borrowers, who were not aware of the information contained in the letters and had never requested that the letters be created.

Implicated

After further investigation, we found evidence that the loan officer (LO) and loan officer assistant (LOA) at the brokerage had fabricated CPA letters and other business documents to fraudulently satisfy underwriting requirements.

When he admitted his guilt, the LO implicated the LOA, explaining that the LOA was not only aware of what he was doing, but participated in it.

When separately confronted by her employer, the LOA reluctantly admitted her role, adding that she did so only because she knew the LO was going to confess. However, she later changed her story, insisting that she was coerced by her employer into signing an admission of guilt.

She strongly denied any involvement and convinced the state regulator to conclude that she was innocent. They declined to move the case forward.

But Freddie Mac’s SFFR investigator still had her suspicions.

Appealed

In a letter to Freddie Mac, the LOA denied everything she had previously admitted, including statements of guilt made to her employer.

The LOA vehemently insisted that she had no knowledge of anything the LO was doing. She further protested that she didn’t even work at the same branch as the LO and therefore could not have participated with him in this fraudulent activity.

Following her instincts, our investigator continued digging. She learned that the LOA did, in fact, work at the same branch as the LO – at least some of the time – and still had access to the LO’s files, even after she moved to a different location.

Revealed

Based on the investigator’s further digging, Freddie Mac concluded that both the LO and the LOA were culpable. We placed them on the Exclusionary List. Following that, law enforcement pursued their own investigation.

Eventually, when presented with all the facts again, the LOA finally told the truth: She had aided in document falsification to get the loans approved. Her actions – as well as her initial denials – jeopardized her credentials and her reputation.

Resolved

In the mortgage industry, otherwise decent people may see an opportunity to cut corners, bend the rules or even break the law to get a loan done. They may rationalize their actions and their words may not always match their behavior.

As soon as the mortgage brokerage was notified by the lender client about their suspicions, they took the right steps to look into this situation. And our SFFR investigator focused on the facts, not the LOA’s words of protest.

If an individual is truly innocent, we should be able to verify the facts that resolve the concerns. But if you suspect that a player in the loan origination process is lying, report your suspicion to Freddie Mac.

Excerpted From The FNMA Red Flag Page

Fannie Mae is committed to working with our industry partners to help combat fraud by offering the following list of common red flags that may indicate mortgage fraud. Inconsistencies in the loan file are often a tip-off that the file contains misrepresentations. The presence of one or more red flags in a file does not necessarily mean that there was fraudulent intent. However, several red flags in a file may signal a fraudulent transaction.

Some of the FNMA Red Flags

Mortgage application

- Significant or contradictory changes from handwritten to typed application.

- Unsigned or undated application.

- Employer’s address shown only as a post office box.

- Loan purpose is cash-out refinance on a recently acquired property.

- Buyer currently resides in subject property.

- Same telephone number for applicant and employer.

- Extreme payment shock (may signal straw buyer and/or or inflated income).

- Purchaser of investment property does not own residence.

Sales Contract

- Non-arm’s length transaction: seller is real estate broker, relative, employer, etc.

- Seller is not currently reflected on title.

- Purchaser is not the applicant.

- Purchaser(s) deleted from/added to sales contract.

- No real estate agent is involved.

- Power of attorney is used.

- Second mortgage is indicated, but not disclosed on the application.

- Earnest money deposit equals the entire down payment or is an odd amount for the local market.

- Multiple deposit checks have inconsistent dates, e.g., #303 dated 10/1, #299 dated 11/1.

- Name and/or address on earnest money deposit check differ from buyers.

- Real estate commission is excessive.

- Contract dated after credit documents.

- Contract is “boiler plate” with limited fill-in-the-blank terms, not reflective of a true negotiation.

Asset documentation

- Down payment source is other than deposits (gift, sale of personal property).

- Applicant’s salary does not support savings on deposit.

- Applicant does not use traditional banking institutions.

- Pattern of loyalty to financial institutions other than the subject lender.

- Balances are greater than the FDIC or SIPC insured limits.

- High-asset applicant’s investments are not diversified.

- Excessive balance maintained in checking account.

- Dates of bank statements are unusual or out of sequence.

- Recently deposited funds without a plausible paper-trail or explanation.

- Bank account ownership includes unknown parties.

- Balances verified as even dollar amounts.

- Two-month average balance is equal to present balance.

- Source of earnest money is not apparent.

- Earnest money is not reflected in account withdrawals.

- Earnest money is from a bank or account with no relationship to the applicant.

- Bank statements do not reflect deposits consistent with income.

- Reasonableness test: assets appear to be out of line with type of employment, applicant age, education, and/or lifestyle.

See the entire list of FNMA mortgage fraud red flags at the link below.

FNMA Fraud Prevention

FNMA Quality Insider – Reviewing your fraud controls

Tip of the Week – Avoid Any Appearance of Wrongdoing

Excerpted from the DOJ Press Announcement (The defendant’s names have been altered while adjudication is pending)

April 24, 2024

Dick and Jane were previously employed by a New Jersey-based, privately owned licensed residential mortgage lending business. Dick was employed as a senior loan officer and Jane was a mortgage loan officer and Dick’s assistant. From 2018 through October 2023, Dick and Jane used their positions to conspire and engage in a fraudulent scheme to falsify loan origination documents sent to mortgage lenders in New Jersey and elsewhere, including their former employer, to fraudulently obtain mortgage loans. Dick and Jane routinely mislead mortgage lenders about the intended use of properties to fraudulently secure lower mortgage interest rates. Dick and Jane often submitted loan applications falsely stating that the listed borrowers were the primary residents of certain proprieties when, in fact, those properties were intended to be used as rental or investment properties.

By fraudulently misleading lenders about the true intended use of the properties, Dick and Jane secured and profited from mortgage loans that were approved at lower interest rates. The conspiracy also included falsifying property records, including building safety and financial information of prospective borrowers to facilitate mortgage loan approval. Between 2018 through October 2023, Dick originated more than $1.4 billion in loans.

The conspiracy to commit bank fraud charge carries a maximum potential penalty of 30 years in prison and a $1 million fine, or twice the gross gain or loss from the offense, whichever is greatest.

U.S. Attorney Sellinger credited special agents of the FBI, under the direction of Special Agent in Charge James E. Dennehy in Newark, and special agents of the Federal Housing Finance Agency, Office of Inspector General, under the direction of Special Agent in Charge Robert Manchak, with the investigation leading to today’s arrests.

The government is represented by Assistant U.S. Attorney Shontae D. Gray of the Economic Crimes Unit in Newark.

The charges and allegations contained in the complaint are merely accusations, and the defendants are presumed innocent unless and until proven guilty.

Excerpted from DOJ complaint

Overview of the Conspiracy

5. At all times relevant to this complaint, DICK, JANE, and others worked on “Team DICK” at the Financial Institution. DICK led the team and was the senior loan officer responsible for loan origination. Approximately four employees worked as loan processors on Team DICK under DICK. From between in and around 2018 through in and around October 2023, DICK originated more than $1.4 billion in loans for the Financial Institution.

6. At various times since at least 2018, DICK, JANE, and others known and unknown, used their positions at the Financial Institution to conspire and engage in a fraudulent scheme to falsify loan origination documents sent to mortgage lenders located in New Jersey and elsewhere to obtain mortgage loans based on false and fraudulent pretenses, representations, and promises.

7. It was further part of the conspiracy that DICK and JANE routinely misled mortgage lenders about the intended use of particular properties to fraudulently secure lower mortgage interest rates from mortgage lenders.

8. It was further part of the conspiracy that DICK and JANE routinely misled mortgage lenders about the intended use of particular properties to fraudulently secure lower mortgage interest rates from mortgage lenders.

9. Specifically, DICK and JANE submitted loan applications falsely stating that the listed borrowers were the primary residents of certain proprieties when, in fact, those properties were intended to be used as rental or investment properties. Those misrepresentations materially affected the interest rates the mortgage lenders offered on the mortgage loans for those properties because lenders typically charged higher rates on homes that were not owner-occupied due to risks associated with investment properties. However, when a home was owner-occupied, borrowers offered lower mortgage rates, more favorable terms, and less stringent approval qualifications.

10. By fraudulently misleading mortgage lenders about the true intended use of the properties, DICK and JANE secured and profited from mortgage loans that were approved at lower rates.

11. As part of the scheme, DICK and JANE also falsified property records, including building safety information, and prospective borrowers’ financial information to facilitate mortgage loan approval.

Representative Fraudulent Transaction

12. For example, in or around August 2022, a prospective borrower (the “Borrower”) engaged the Financial Institution and worked with DICK and JANE to acquire an approximately $353,000 mortgage for a condominium located in Secaucus, New Jersey (the “Property”).

13. DICK served as the Borrower’s broker, and a member of Team Dick (“Employee-1”) assisted DICK and JANE by processing the loan application for the Property.

14. As part of the loan application process, the Financial Institution required the homeowners’ association (“HOA”) at the Property to provide information about the Property, including building safety and financial information, so that it may determine eligibility of the Property for mortgage financing. Accordingly, Employee-1 asked the treasurer of the HOA (“Individual- 1”) to provide certain documents, including audited financial statements, a 2022 final condominium complex budget, and a completed Fannie Mae Form 1076 Condominium Project Questionnaire (“Form 1076”).

15. Individual-1 returned the Form 1076 and indicated on the form that the HOA did not maintain a capital reserve account. Employee-1 asked Individual-1 to provide a final budget that showed a 10% capital reserve, which was required for loan approval. In response, Individual-1 stated that the HOA did not have a reserve account.

16. On or about August 3, 2022, Employee-1 told JANE that the HOA did not maintain a capital reserve, which created a loan-to-value issue for loan application approval.

17. On or about the same date, DICK emailed a high-ranking employee of the Financial Institution (“Employee-2″), copying JANE, advising Employee- 2 that the HOA did not have a budget but “was willing to do one.” DICK inquired whether Employee-2 “would be ok with [the HOA] producing a new budget after they said to [Employee-1] they didn’t do one but after my call they are willing to do one?”

18. Employee-2 responded and authorized DICK and JANE to move forward with the loan application on that basis. On or about August 4, 2022, JANE sent Employee-1 a revised HOA budget, which showed the requisite capital reserve required for loan approval.

19. DICK and JANE then prepared or caused to be prepared a false and fraudulent loan application falsely stating that the HOA had the necessary capital reserve for loan approval, which they submitted to the Financial Institution for approval. Unbeknownst to Employee-2, the HOA did not have a reserve account. On or about August 25, 2022, the Financial Institution approved the mortgage loan based on the false and fraudulent representations DICK and JANE made.

20. As part of the investigation, law enforcement spoke to Individual-1, who confirmed that the HOA budget JANE provided to Employee-1 was fabricated and that the HOA did not have a capital reserve budget in more than 25 years. Individual-1 also confirmed that at no time did Individual-1 speak to DICK or JANE throughout the loan application process.

One can only hope it’s all a big misunderstanding for these individuals’ sake.