Why Haven’t Loan Officers Been Told These Facts?

Technology Innovations Continue to Emerge

The New FNMA Income Calculator Tool Affords Lenders A New Risk Management and Efficiency Tool for Underwriting Self-Employed Borrowers

Self-employment income is one of the primary sources of defects in loan manufacturing. The uncertainty surrounding some self-employment calculations may lead underwriters to overly conservative and costly conclusions. Furthermore, defects resulting in overstated income and inflated debt ratios can lead to indemnity demands and other negative consequences involving investors.

FNMA’s new Income Calculator Tool went live in December 2023 and promises to streamline loan manufacturing while reducing defects and improving risk management.

Unlike DU validation, which uses tax transcripts, the Income Calculator Tool uses optical character recognition (OCR) technology and allows for an automated analysis of tax returns. Tax returns contain data that transcripts do not. Thus, the promise is that the OCR-based automated analysis can count income that is omitted by automated transcript analysis alone.

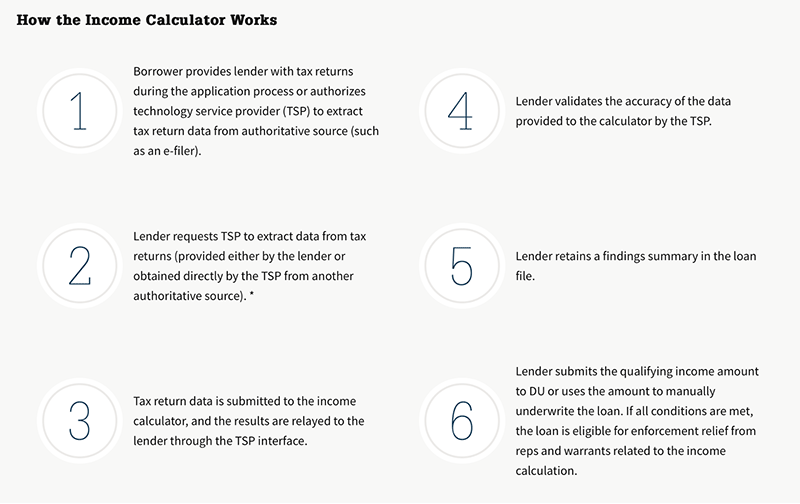

Like many other technology innovations, currently, it is available only through approved technology service providers (TSPs). According to FNMA, the process takes approximately two hours, depending on the technology service provider.

Unfortunately, the Income Calculator Tool does not analyze rental income yet.

FNMA is working on hosting an online version of the Income Calculator Tool that obviates the need for TSPs when using the Tool. However, the proposed no-cost Income Calculator Web Interface tool differs from the TSP service. Rather than using optical character recognition to automate the data retrieval from the applicant’s tax returns, the online tool requires the lender to enter tax return data manually. Still, it beats a stick in the eye. The online tools’ availability is yet to be announced.

From FNMA – Increase certainty of loan quality for homebuyers with self-employed income

Calculating income for self-employed borrowers is not easy and can be time consuming and complicated for even the most seasoned originators. With a growing workforce of self-employed borrowers, and multiple options available, lenders need a clear way to calculate income that’s both accurate and efficient. With Fannie Mae’s latest solution, we offer a new way to calculate income that increases the certainty of the calculation and helps reduce cycle time.

Available initially through authorized technology service providers, the income calculator helps lenders:

- Easily calculate income for self-employed borrowers.

- Maximize the borrower’s income by utilizing allowable add-backs not found in 4506-C tax return transcript data, which may result in better pricing/lower DTI due to higher income being calculated.

- Determine the qualifying monthly income before submitting to DU.

- Be eligible for enforcement relief of rep and warrant on the income calculation.

Income Calculator Announcement

Income Calculator graphic courtesy of FNMA

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – CFPB and DOJ File Novel Discrimination Complaint Against Lender

Complaint Alleges Exploitation of Consumer’s Limited English Proficiency

A potential blockbuster lawsuit with significant fair lending ramifications against a Texas developer and mortgage lender was filed on December 20 by the CFPB and the Justice Department.

Two of the eleven counts against the parties include the lender. The counts against the lender enumerate violations of the ECOA and Fair Housing Act (FHA). Specifically, the thrust of the lender counts alleges discriminatory practices based on race or national origin stemming from predatory seller financing. Both the ECOA and FHA prohibit discrimination based on race or national origin.

The second count is noteworthy in alleging that the lender was “exploiting applicants’ limited English proficiency (LEP), in violation of the FHA.” This LEP complaint might be a first when prosecuting a fair lending complaint against a mortgage lender. The administration of the FHA is the responsibility of HUD. 24 CFR § 100.120 prohibits discrimination in the making of loans and in the provision of other financial assistance.

The complaint alleges “discrimination on the basis of race and national origin in making available residential real estate-related transactions. . .” and discrimination on the basis of race and national origin in the terms, conditions, or privileges of the sale . . .”

Federal agencies have been promulgating the LEP-FHA-ECOA nexus for some years. The origins of the argument are complex and beyond the scope of this article. However, in 2016, the then HUD General Counsel provided thoughtful guidance on the matter of discrimination related to LEP. Excerpted remarks below:

September 15, 2016

Office of General Counsel

Guidance on Fair Housing Act Protections for Persons with Limited English Proficiency

Helen R. Kanovsky, General Counsel, HUD

“A person’s accent and his or her national origin are “inextricably intertwined.” It is thus inconceivable that a housing decision that treats someone differently because he or she speaks English fluently but with an accent is anything but intentional discrimination because of national origin in violation of the Act. The same is true for housing-related policies or practices that treat persons with certain accents differently than persons with other accents.”

“[Refusing] to allow an LEP borrower to have mortgage documents translated, or refusing to provide the borrower with translated documents that the lender or mortgage broker has readily available, is likely not necessary to achieve a substantial, legitimate, nondiscriminatory interest. Likewise, restricting a borrower’s use of an interpreter, or requiring that an English speaker cosign a mortgage, likely will not prove justifiable.”

“The Fair Housing Act prohibits both intentional housing discrimination and housing practices that have an unjustified discriminatory effect because of race, national origin or other protected characteristics. Selective application of a language-related policy, or use of LEP as a pretext for unequal treatment of individuals based on race, national origin, or other protected characteristics, violates the Act. Moreover, because of the close link between LEP and certain racial and national origin groups, restrictions on access to housing based on LEP are likely disproportionately to burden certain protected classes and, if not legally justified, may violate the Act under a discriminatory effects theory.”

Find the entire guidance document at the HUD link below.

Damned if You Do, Damned If You Don’t

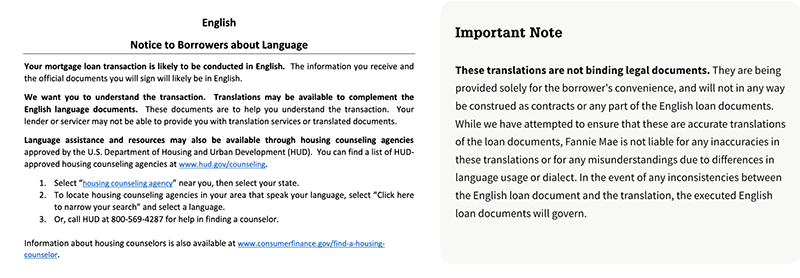

Allegedly, the lender and seller-provided abundant Spanish-language sales and marketing assistance, but the salient written disclosures and legal instruments were in English. It is unknown if the Texas lender provided a language disclosure such as what the FHFA makes available (see image below).

Interestingly, while the lawsuit alleges violations of the Consumer Financial Protection Act (CFPA) against the developer, no such charges were filed against the lender. The CFPA is violated when a covered person violates a consumer protection law such as ECOA and FHA.

Another allegation is that the lender “fails to assess borrowers’ ability to repay and does not request proof of income or liabilities from borrowers.” This one is curious. The facilitation of lot sales financing would not appear to fall under the ATR provisions of the TILA. Perhaps the government’s concern is with some other ATR rule. Perhaps the ATR allegation may be without merit. Unfortunately, these allegations are rarely fully litigated in a way that provides any precedential clarity. Rather, we shall more likely see a host of legal motions and arguments that will fail to resolve this issue for the rest of us.

All Hat, No Cattle?

Lawsuits often contain allegations that are an admixture of merit, supportable facts, and, as said in Texas, bullsh**.

Firstly, and this goes to the notion of predation, the government insinuates that the subject land loan terms are relatively costly. However, the complaint ham-handedly juxtaposes the subject financing against what appears to be an agency mortgage product. Land loans are not home loans, and this is an apples-to-oranges comparison. Furthermore, this incendiary but hollow government observation more than misses the mark. Is the subject financing, when compared against similar types of available financing, in any way usurious? 10.9-12.9 percent is high for agency products, but for land loans, is that a relatively high rate?

While limited English proficiency (LEP) is not expressly a protected class under the FHA or ECOA, as mentioned earlier, the government will argue that language and national origin are inseparably linked. This means that discrimination in connection with LEP is to discriminate based on national origin or race. On its face, that is not an unreasonable assertion.

Stay tuned for developments.

Key Regulations Cited in the Complaint

(FHA) 24 CFR § 100.110(b) Discriminatory practices in residential real estate-related transactions.

It shall be unlawful for any person or other entity whose business includes engaging in residential real estate-related transactions to discriminate against any person in making available such a transaction, or in the terms or conditions of such a transaction, because of race, color, religion, sex, handicap, familial status, or national origin.

(ECOA) 12 C.F.R. § 1002.4(a) Discrimination. A creditor shall not discriminate against an applicant on a prohibited basis regarding any aspect of a credit transaction.

(ECOA) 12 CFR § 1002.2(n) Discriminate against an applicant means to treat an applicant less favorably than other applicants.

(ECOA) 12 CFR § 1002.2(z) Prohibited basis means race, color, religion, national origin, sex, marital status, or age (provided that the applicant has the capacity to enter into a binding contract); the fact that all or part of the applicant’s income derives from any public assistance program; or the fact that the applicant has in good faith exercised any right under the Consumer Credit Protection Act or any state law upon which an exemption has been granted by the Bureau.

(FHA) 24 CFR § 100.120 Discrimination in the making of loans and in the provision of other financial assistance.

(FHA) 24 CFR 100.50(b)(2) Real estate practices prohibited.

Discriminate in the terms, conditions or privileges of sale or rental of a dwelling, or in the provision of services or facilities in connection with sales or rentals, because of race, color, religion, sex, handicap, familial status, or national origin.

(FHA) 24 CFR 100.65(a) Discrimination in terms, conditions and privileges and in services and facilities.

(a) It shall be unlawful, because of race, color, religion, sex, handicap, familial status, or national origin, to impose different terms, conditions or privileges relating to the sale or rental of a dwelling or to deny or limit services or facilities in connection with the sale or rental of a dwelling.

Prepared Remarks of CFPB Director Rohit Chopra at the Press Event for Colony Ridge

FHFA LANGUAGE TRANSLATION DISCLOSURE

Tip of the Week – More Reasons To Accelerate Loan Processing Automation

From the United States Attorney’s Office for the Southern District of Texas

LAREDO, Texas – A 38-year-old man was sentenced for his role in a complex mortgage fraud scheme, announced U.S. Attorney Alamdar S. Hamdani.

Edmundo De La Torre pleaded guilty April 19 to orchestrating a mortgage fraud scheme in which he altered hundreds of documents to get otherwise unqualified buyers’ approval for government-backed mortgages.

U.S. District Judge Marina Marmalejo has now ordered De La Torre to serve 36 months in federal prison to be immediately followed by three years of supervised release. De La Torre was also ordered to pay restitution in the amount of $1.17 million. In handing down the sentence, Judge Marmolejo noted the sophistication and persistence of De La Torre’s crime and remarked on the profound effects it has on potential first-time and low-income homebuyers seeking homes, and instead ending up entangled in legal and finances issues.

From 2018 to 2020, De La Torre admitted he was working as a salesman for a Laredo area homebuilder. De La Torre used his position to attempt to get potential customers approved for Department of Housing and Urban Development (HUD)-backed mortgages. He forged various documents, including financial statements, bank statements, paycheck stubs and letters of reference for at least 38 otherwise unqualified homebuyers.

De La Torre then submitted these fake and forged documents to a Laredo area bank on behalf of the potential homebuyers. He admitted he was receiving a commission for each sale and personally profiting over $200,000 from the scheme. In addition, more than three dozen known loans in this scheme ultimately defaulted or had to be restructured, costing HUD roughly $971,310.10 at the time of his plea in April.

De La Torre was permitted to remain on bond and voluntarily surrender to a U.S. Bureau of Prisons facility to be determined in the near future.

HUD – Office of Inspector General conducted the investigation with assistance from the FBI. Assistant U.S. Attorney Thomas Carter prosecuted the case.