Why Haven’t Loan Officers Been Told These Facts?

HPA and Non-HPA PMI Cancellation: Don’t Conflate or Confuse the Two

Despite the recent run-up in real estate values, consumers paying for PMI coverage are often unpleasantly surprised that, in many instances, the loan servicer is under no obligation to drop the PMI solely based on the home’s market value. The oft-asserted MLO refrain that servicers drop the PMI when the LTV falls to 80% of the home value is specious at best and a material misrepresentation at worst.

The federal law titled the “Homeowners Protection Act (HPA),” informally known as the PMI Cancellation Law, requires servicers to cancel PMI under specific circumstances.

Generally, there are three different PMI cancellation paths. Two fall under the HPA. Those being borrower requested and automatic cancellation. The third exists apart from the HPA and is sometimes called Non-HPA cancellation. Non-HPA PMI cancellation policies are derived from investor policy.

Non-HPA PMI cancellation at an 80% LTV is a myth perpetuated all too often by well-meaning but ill-informed MLOs. At origination, an accurate representation of PMI cancellation possibilities may be critical to a consumer’s mortgage selection and informed use of credit. Consequently, misrepresentations surrounding PMI cancellation are not only injurious to relationships with borrowers but could have additional negative repercussions.

Cancellation Path Number 1

HPA “Borrower Requested Cancellation,” 12 USC 4901 & 4902 (“That is not what the loan officer told me” cancellation type)

From FNMA

The servicer is authorized to identify a mortgage loan that is close to or has reached the LTV requirements for MI termination based on original value and notify the borrower of the actions required to terminate MI. The servicer must terminate MI based on the original value of the property only after receiving a direct response from the borrower to do so.

HPA “Borrower Requested Cancellation” (Based on Original Value)

The borrowers may request PMI cancellation when the loan balance reaches 80% of the home’s original value. It goes without saying that, especially in the present market, there may be a significant gulf between the market value of the home and the original value.

Instead of using the current value of the home, the HPA requires servicers to use the property’s appraised value or sales price when the subject financing originated (original value) as the baseline for PMI cancellation. The lender must obtain an appraisal to determine that the property’s current value is not less than the original value.

Cancellation Path Number 2

HPA “Automatic Cancellation” (The “This is outrageous, I’m getting a lawyer” cancellation type)

Based on the original value, the servicer must cancel the PMI at 78% LTV with a few conditions.

For automatic cancellation, when the principal balance of the mortgage is first scheduled to reach 78 percent of the original value of the secured property (based solely on the initial amortization schedule in the case of a fixed rate loan or on the amortization schedule then in effect in the case of an adjustable rate loan, irrespective of the outstanding balance) if the borrower is current, or if the borrower is not current on that date, on the first day of the first month following the date that the borrower becomes current (12 U.S.C. 4902(b)).

Unlike the borrower-requested cancellation, for fixed-rate loans, the automatic cancellation is based solely on the scheduled amortization at origination, not the actual loan balance. In other words, had the borrower accelerated the amortization, under the HPA, the lender may ignore the actual loan balance in calculating the LTV.

There is no provision in the automatic termination section of the Act, as there is with the borrower-requested PMI cancellation section, that protects the lender against declines in property value or subordinate liens. The automatic termination provisions do not refer to

good payment history (as prescribed in the borrower-requested provisions), but state only that the borrower must be current on mortgage payments (12 U.S.C. 4902(b)).

Cancellation Path Number 3

Non-HPA Borrower Requested Cancellation (The “I’m going to sue you and file a complaint” cancellation type)

The third path discussion is limited in scope to the current FNMA policy. Different investors may have unique Non-HPA cancellation policies that differ from FNMA’s.

Unnecessary Discussions of Non-HPA Cancellation, A Fools Errand

For MLOs, in general, explaining non-HPA cancellation at origination may be a fool’s errand. As the MLO in our case study found, borrowers will probably fail to understand or recall the dynamics of non-HPA cancellation. Best practice: accurately describe the HPA and avoid discussing non-HPA cancellation with applicants. HPA disclosure is a requirement under the Act, but non-HPA cancellation is not.

For transactions or circumstances that are not subject to the HPA, FNMA, and FHLMC have discrete policies related to borrower-requested PMI cancellation. Below is a partial list of the current FNMA non-HPA PMI cancellation requirements. The FHLMC policies are similar but differ.

Bear in mind that non-HPA cancellation is investor policy, not law. This means that the agency’s business needs dictate non-HPA cancellation. By law and in conformity with prudent risk management practices, the GSE’s non-HPA cancellation policies must adapt to the market and applicable directives from the FHFA.

For many consumers, comprehending the malleable nature of non-HPA cancellation at origination is truly a bridge too far.

FNMA non-HPA PMI cancellation for loans secured by a one-unit principal residence or second home:

The satisfaction that the mortgage loan meets the applicable LTV ratio eligibility criterion must be evidenced by obtaining a property valuation based on an inspection of the property’s interior and exterior.

Cancellation LTV’s must be:

-

- 75% or less if the seasoning of the mortgage loan is between two and five years.

- 80% or less if the mortgage loan seasoning is over five years.

(Loans Not Subject to HPA) For loans secured by a one to four-unit investment property or a two-to-four-unit principal residence:

The LTV ratio must be 70% or less, and the mortgage loan seasoning must be over two years. If Fannie Mae’s minimum two-year seasoning requirement is waived because the property improvements made by the borrower increased the property value, the LTV ratio must be 80% or less.

[Regarding property improvements,] the borrower must provide details to the Servicer on the property improvements since the mortgage loan’s origination. Improvements that increase value are typically renovations that substantially improve marketability and extend the useful life of the property (e.g., kitchen and bathroom renovations or the addition of square footage). However, repairs that are made to keep the property maintained and fully functional are not considered improvements.

Remember, FNMA does not want servicers to solicit their borrowers for non-HPA cancellation. “The servicer must not solicit a borrower for MI termination based on current value of the property.”

Case Study: HPA Compared to Non-HPA PMI Cancellation

Morgan is an exemplary MLO in every way. If Morgan has a fault, it is over-informing applicants. Morgan originated a conventional 95% loan for Harry Homeowner, and as is her practice, she carefully explained the HPA disclosure.

At the same time, Morgan also informed Harry that when the LTV “gets down to 80%,” the servicer will cancel the PMI. Or that is what Harry heard. In Morgan’s recollection, as she was always careful to do, she had further explained to Harry that the PMI cancellation based on current value was an industry practice, not the HPA requirement.

As Harry recalled, Morgan’s PMI discourse was a little overwhelming, but he clearly remembered she said he could cancel the PMI when he got to an 80% LTV.

Q4 2023, Harry Contacts the Servicer to Cancel the PMI

Harry bought the home for $300,000 in 2022 with a 95% LTV mortgage. The original loan amount was $285,000. Terms: 30-year fixed-rate mortgage at 4.25%. The home’s current market value is estimated at $355,000. After 20 months of loan payments, the borrower owed about $276,900. Using the home’s current value relative to the outstanding balance, the borrower calculated the LTV at 78% and requested the servicer to cancel the PMI.

However, as required by the HPA, the servicer correctly calculates the cancellation LTV (based on the original value of $300,000) at 92%. The servicer’s calculated 92% LTV is higher than the HPA borrower-requested cancellation threshold of 80%. The servicer was not obligated under the HPA to cancel the PMI and denied Harry’s cancellation request. Furthermore, were the servicer to oblige Harry, it would be in violation of its servicing agreement with FNMA.

The Non-HPA Cancellation Hoops

The helpful servicer asked Harry if he had improved the home, but he had not.

The servicer correctly explained to the now fuming borrower that the investor’s non-HPA cancellation policy would only permit the servicer to cancel the PMI using the current home value once the loan is at least two years old.

The borrower asked that if he waited four months until the loan was two years old, assuming a current market value of $355,000, would the servicer then cancel the PMI? The servicer calculated the ending loan balance after four more payments at $275,200 and correctly explained that if the loan is over two but less than five years old, the investor’s non-HPA cancellation threshold when using the current home value is 75% LTV. Assuming a current market value of $355,000, the borrower’s LTV in four months would be 78%, still too high for PMI cancellation.

The consumer was livid and produced an email from the originating MLO that stated that at any time the borrower could establish that the loan balance was under an 80% LTV based on a current appraisal, the Servicer had to cancel the PMI under the HPA.

The borrower then asked the representative if, once past the two-year mark, he would pay the loan down to $266,250, bringing the LTV down to 75% based on the market value of $355,000, could the PMI be cancelled. The servicer stated, based on another request for cancellation and assuming a 75% LTV as evidenced by an appropriate interior/exterior appraisal, once past the two-year mark, assuming no late payments, and absent any investor policy changes, the servicer would reevaluate the borrowers PMI cancellation request and commence termination of the PMI in accord with the then current investor policy.

Somewhat mollified, Harry asked whom he should complain to as he felt misled by the lender. The servicing representative suggested that the borrower contact the lender that originated the loan to discuss the matter (brilliant). The borrower did just that. Harry called and talked to a manager, who immediately involved senior management (brilliant). The lender is working with the borrower on a satisfactory solution and intends to reimburse some of the borrower’s PMI premiums (brilliant). The lender is providing the MLOs with a new job aid and disclosure to minimize the risks of miscommunications surrounding PMI cancellation (better late than never).

Harry’s recollections differed from what was described in the MLO’s email. However, the email was vague and open to interpretation, as was the case with Harry.

Borrower Requested Cancellation Under the HPA

The HPA states that a borrower may initiate cancellation of PMI coverage by submitting a written request to the servicer. The servicer must take action to cancel PMI when the cancellation date occurs, which is when the principal balance of the loan reaches (based on actual payments) or is first scheduled to reach 80 percent of the “original value,” irrespective of the outstanding balance, based upon the initial amortization schedule (in the case of a fixed rate loan) or amortization schedule then in effect (in the case of an adjustable rate loan), or any date after that that the borrower submits a written cancellation request.

The borrower must have a good payment history and satisfy any requirement of the mortgage holder for evidence of a type established in advance [valuation report] that the value of the property has not declined below the original value and certification that the borrower’s equity in the property is not subject to a subordinate lien (12 U.S.C. 4902(a)(4)).

Consumer Financial Protection Act Violations

Material misrepresentations of the HPA or PMI cancellation may violate the Consumer Financial Protection Act. Be circumspect if you must discuss non-HPA PMI cancellation with the applicant.

12 USC 5531(c)(1)(A) the act or practice causes or is likely to cause substantial injury to consumers which is not reasonably avoidable by consumers.

12 USC 5531 (d)(1) et seq. materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service; or (2) takes unreasonable advantage of-

(A) a lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service;

(B) the inability of the consumer to protect the interests of the consumer in selecting or using a consumer financial product or service; or

(C) the reasonable reliance by the consumer on a covered person to act in the interests of the consumer.

The CFPA is enforceable by state agencies as well as the federal government. The relief (fines and remediation) can be substantial. In extreme cases, the CFPA allows for fines of up to

$1,406,728 per day of violation. Generally, enforcement actions must commence no more than 3 years after the date of discovery of the violation.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

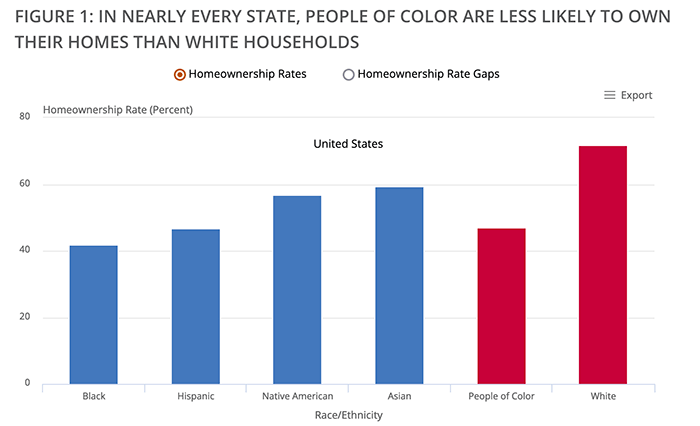

Bar chart courtesy of the Joint Center For Housing Studies of Harvard University

BEHIND THE SCENES – A Federal Reserve Bank Of St.Louis Report Underscores the Persistent Challenge of Wealth Inequalities

Key Takeaways from the Report

For the second quarter of 2023 (through June 30):

How much wealth inequality is there in the U.S.?

-

- The top 10% of households by wealth had $7.0 million on average. As a group, they held 69% of total household wealth.

- The bottom 50% of households by wealth had $51,000 on average. As a group, they held only 2.5% of total household wealth.

What is the current generational wealth gap?

-

- Younger Americans (millennials and Gen Zers) owned 70 cents for every $1 of wealth owned by Gen Xers at the same age.

- Younger Americans (millennials and Gen Zers) owned 74 cents for every $1 of wealth owned by baby boomers at the same age.

What is the current racial wealth gap?

-

- Black families owned about 24 cents for every $1 of white family wealth, on average.

- Hispanic families owned about 24 cents for every $1 of white family wealth, on average.

What is the current wealth gap by household education?

-

- Families headed by someone with some college education (but no four-year degree) had 30 cents for every $1 of wealth held by families headed by a four-year college graduate.

- Families headed by someone with a high school diploma had 23 cents for every $1 of wealth held by families headed by a four-year college graduate.

- Families headed by someone with less than a high school diploma had 10 cents for every $1 of wealth held by families headed by a four-year college graduate.

See the report here. The Institute for Economic Equity Report

Tip of the Week – Don’t Let Post-Consummation Closing Disclosure Corrections Spoil A Job Well Done

Did you know that if the lender detects certain inaccuracies in the Closing Disclosure within 30 days of consummation, it will distribute a new CD to your customer?

Did you also know that some creditors fail to distribute the corrected CD to the mortgage broker when publishing post-consummation CDs? Imagine how customers feel about getting a new CD three weeks after closing. Do you think this sort of thing could harm your relationship with that customer? Why leave it to chance?

For Example

Two weeks after closing, the creditor gets a revised billing for your customer’s credit report. It appears to correct an error for a last-minute supplement that was counted twice in the billing. The credit report vendor issues a $25 adjustment to the creditor.

Regulation Z does not permit the creditor to keep that refund. Furthermore, the CD must reflect the actual fee charged by the vendor. Because the error was detected within 30 days of consummation, the creditor must act to correct the CD to reflect the correct credit report fee and the $25 lender credit/refund to the borrower.

Do you think the creditor will call your customer to explain this inconsequential paper shuffling? Unlikely. Will the creditor let you know about the revised CD? Perhaps, but maybe after the borrower receives their copy, if at all.

Some folks will get the $25 check and be happy for the beer money. And then some other folks might not be happy about getting a new CD they do not comprehend.

Regulation Z

Regulation Z requires corrected CDs if, within thirty days of consummation, an event in connection with the transaction settlement occurs, which causes the disclosure to become inaccurate.

If the inaccuracy results in a change to an amount paid by the consumer from what the creditor disclosed at consummation, the creditor shall deliver or mail a corrected disclosure no later than thirty days after determining that such event has occurred.

Risk Mitigation

Exercise a little risk management. First, avoid the errant CD altogether. Carefully review the preclosing CD for errors. Most MLOs do this to some degree.

Secondly, after closing, let your customers know that it is not unusual for the creditor to catch minor errors that occur in the closing paperwork. Inform your customer should there be one of these paperwork errors; the corrections occur within 60 days of closing (30-day post-consummation correction period plus the lender’s 30-day distribution requirement). Let them know not to worry. Be sure to mention that the lender won’t try to collect any money from them due to CD errors, but they might get a small check if there are overcharges. Encourage the customer to call you should they receive another CD.

The 60-day post-closing period is a unique opportunity to galvanize your customer relationship and value. During this time, you can demonstrate ongoing relevance, professionalism, and care.